How Does A Federal Tax Credit Work For Solar The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

Your federal tax credit For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit State tax credits for installing solar Calculating the amount of your federal solar tax credit is very simple Take the total cost your system and multiply it by 0 30 For example if you spent 25 000 all in on going solar parts labor permits etc then your tax credit would be worth 7 500 25 000 gross cost x 0 30 30 tax credit 7 500 Residential Clean Energy Credit

How Does A Federal Tax Credit Work For Solar

How Does A Federal Tax Credit Work For Solar

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

The Complete Federal Solar Tax Credit Guide Greater Solar Texas

https://greatertexassolar.com/wp-content/uploads/2022/11/The-Complete-Federal-Solar-Tax-Credit-Guide-Mason-Kerrville-Llano-Marble-Falls-Fredericksburg-TX-2.jpeg

How Does The Federal Solar Tax Credit Work For Businesses

https://blog.geoscapesolar.com/hubfs/how-does-the-federal-solar-tax-credit-work-for-businesses.jpg

How does the solar tax credit work The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax credit would be 6 000 20 000 x 30 6 000 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill

Download How Does A Federal Tax Credit Work For Solar

More picture related to How Does A Federal Tax Credit Work For Solar

Taxes And Solar How Does The Federal Tax Credit Work For Solar

https://i.ytimg.com/vi/LbH4Y8TQRJ4/maxresdefault.jpg

How Does The Solar Tax Credit Work In Maui

https://www.maui-solar.com/wp-content/uploads/2019/07/How-Does-the-Solar-Tax-Credit-Work-in-Maui-1000x600.jpg

How Does The Solar Tax Credit Work A1A Solar

https://a1asolar.com/wp-content/uploads/2021/09/Solar_Tax_Credit_Work.jpg

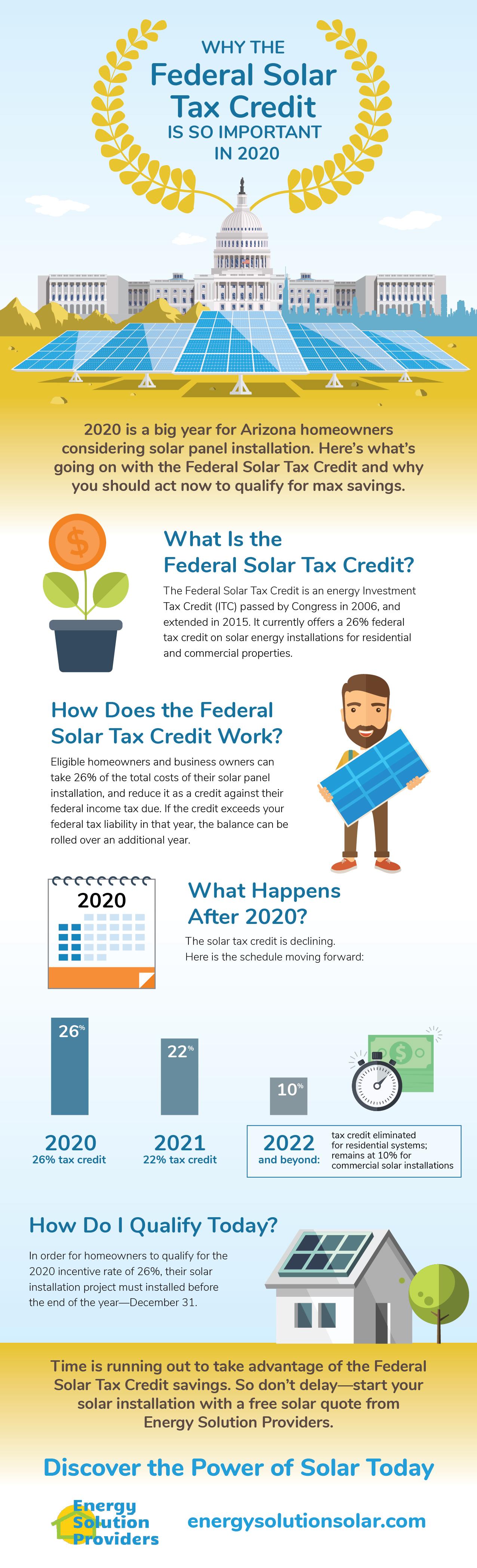

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor The only requirements to use this incentive are You own the system by going solar via cash or a solar loan lease or PPA financing cannot claim the tax credit You have income tax liability which is what this incentive reduces We ll cover how to claim your federal solar tax credit later on

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of Key takeaways The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035

Find Out How Much You Can Save With The Solar Tax Credit ACT Blogs

https://www.actblogs.com/wp-content/uploads/2022/12/Solar-Tax-Credit.webp

How Does The Federal Tax Credit Work For Solar

https://www.gosunward.com/wp-content/uploads/2024/01/Go-Sunward-Solar-tax-credit.webp

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

https://www.energy.gov/sites/default/files/2023-03/...

Your federal tax credit For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit State tax credits for installing solar

How Does The Federal Solar Tax Credit Work PB Roofing Co

Find Out How Much You Can Save With The Solar Tax Credit ACT Blogs

Solar Tax Credit Everything You Need To Know About The Utah And

How Does The Solar Tax Credit Work How To Claim Solar Tax Credit

How Does The Federal Tax Credit Work For Solar

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

At 30 Solar Panel Tax Credits Are At A High Point For Now The New

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How Does The Federal Solar Tax Credit Work

How Does A Federal Tax Credit Work For Solar - Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also