How Does Buying A Home Affect Tax Return If you itemize deductions on your federal return you can claim a deduction for your mortgage interest paid on a home bought in 2023 along with state and local taxes paid in 2023 Will my tax return be higher if I bought a house

Types of Tax Breaks for Buying a House The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or Homefinity can help There s no way around it buying a home is expensive Mortgage debt and interest payments not to mention saving for a down payment can be daunting But by taking advantage of these tax benefits when you file your tax return you can put some of that money back in your bank account

How Does Buying A Home Affect Tax Return

How Does Buying A Home Affect Tax Return

https://media.hswstatic.com/eyJidWNrZXQiOiJjb250ZW50Lmhzd3N0YXRpYy5jb20iLCJrZXkiOiJnaWZcL2JhbmtydXB0Y3ktdGF4ZXMtb3JpZy5qcGciLCJlZGl0cyI6eyJyZXNpemUiOnsid2lkdGgiOiIxMjAwIn19fQ==

How To Approach A Multi Offer Situation When Buying A Home In 2021

https://i.pinimg.com/originals/4c/e5/67/4ce567ade0598c70d352a219e37e2387.jpg

Breakfast Learn Using A FHA 203K Loan To Purchase Your Home On

https://i.pinimg.com/originals/66/57/fe/6657fe6c29a8242e0e780bf8e21844e8.png

Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct home ownership expenses However taxpayers can t take the standard deduction if they itemize Non deductible payments and expenses Homeowners can t deduct any of the following items Tax Implications of Buying or Selling a House 3 min read Whether you are buying or selling a house the process can be quite stressful especially when thinking about potential tax implications Let s look at the documents you need to save and the tax issues you will need to consider

Key Takeaways For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to buy build or improve your home For tax years after 2017 the limit is reduced to 750 000 of debt for binding contracts or Key Takeaways The Internal Revenue Service IRS provides several tax breaks to make homeownership more affordable Common tax deductions include those for mortgage interest mortgage points

Download How Does Buying A Home Affect Tax Return

More picture related to How Does Buying A Home Affect Tax Return

Buying A Home Will Likely Be One Of The Biggest Financial Transactions

https://i.pinimg.com/originals/42/65/5a/42655ac1430dc08744c79cd3111784ed.jpg

How Does Erc Affect Tax Return

https://www.theemployeeretentioncredit2022.org/img/026feff17561d1f394fc4575e6abc3a8.jpg?03

Renting Versus Buying A Home Bankers Trust Mortgage Payment Mortgage

https://i.pinimg.com/originals/25/d3/f1/25d3f1d88e739dda60f637a1bc23a9f5.jpg

Does buying a home help with taxes Yes in some ways you ll see that buying a home will help with taxes However taxes as a homeowner are a bit more complicated than what you may be used to as a past renter If you sold your home to buy this one you won t pay taxes on the first 250 000 also known as a gain as long as you owned the home and it was your main home for at least two years within the five years leading up to the sale If you file jointly you won t pay taxes on the first 500 000 I bought a house what can I deduct

In this article we ll break down how much money you can get back in taxes for buying a house based on a hypothetical homeowner to see if they ll get the most tax benefit from itemizing their taxes or taking the standard deduction Here are some details about our hypothetical homeowner Married Filing jointly How Does Buying a House Help With Taxes The Internal Revenue Service IRS extends several tax benefits to homeowners that can reduce what they owe or potentially result in a larger refund These tax breaks take the form of deductions So what good are tax deductions A tax deduction reduces your taxable income for the year

How Does Buying A Home Affect Your Credit Score Credit Innovation

https://creditinnovationgroup.com/wp-content/uploads/2021/08/How-Does-Buying-a-Home-Affect-Your-Credit-Score.jpg

Pin On Buying A Home

https://i.pinimg.com/736x/55/db/44/55db44a101d395f141a858820b42151b.jpg

https://www.sofi.com/learn/content/how-does-buying-a-house-affect-taxes

If you itemize deductions on your federal return you can claim a deduction for your mortgage interest paid on a home bought in 2023 along with state and local taxes paid in 2023 Will my tax return be higher if I bought a house

https://www.forbes.com/advisor/mortgages/tax...

Types of Tax Breaks for Buying a House The IRS offers many tax breaks that can help offset the substantial costs of buying and owning a home Most states offer tax breaks similar or

Reasons Buying A Home Is Less Risky Intuitive Finance

How Does Buying A Home Affect Your Credit Score Credit Innovation

Does Buying A Home Help With Taxes Incite Tax

How To Prep Your Bank Account To Buy A Home Money Matters Trulia

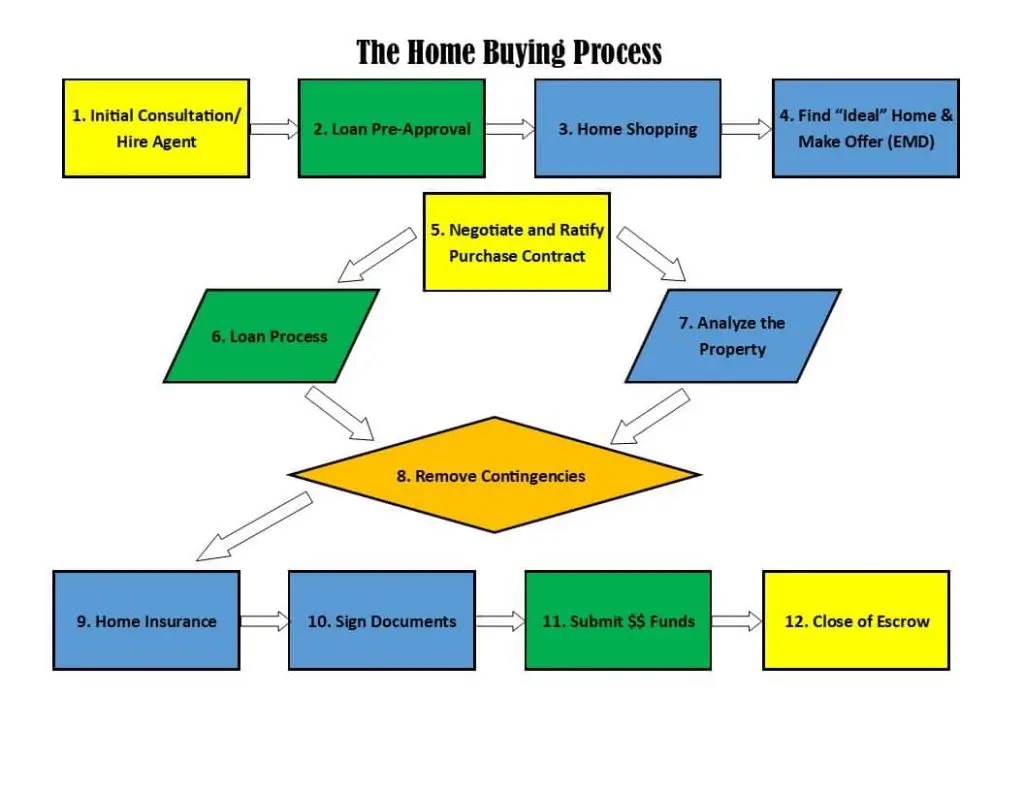

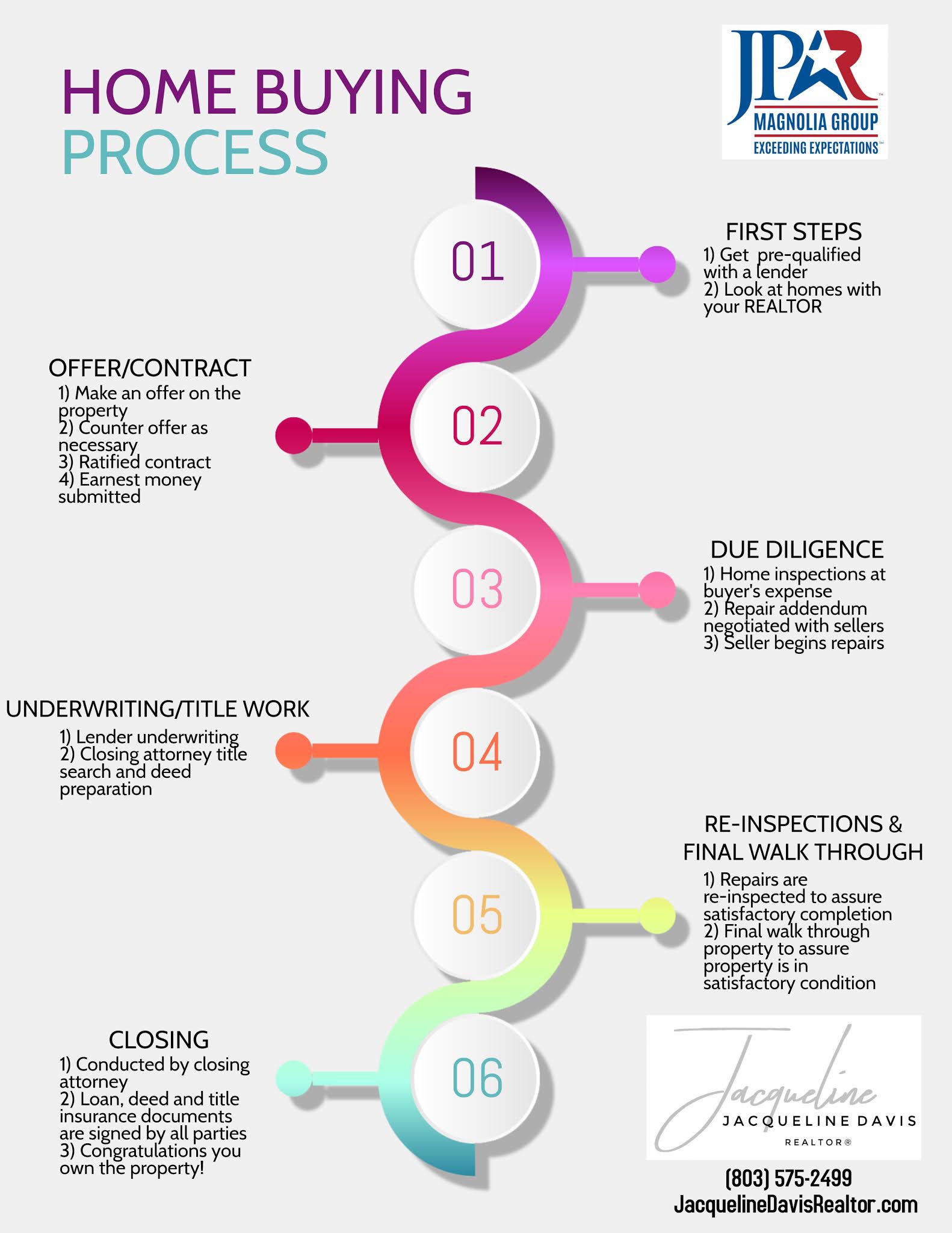

Buying A House Checklist Home Buying Process Flowchart

How Long Does It Take To Buy A House

How Long Does It Take To Buy A House

The Cost Of Renting Vs Buying A Home In Every State Renting Vs

Biweekly Mortgage Payments Vs Monthly Why You Should Consider Making

The Home Buying Process

How Does Buying A Home Affect Tax Return - Tax Implications of Buying or Selling a House 3 min read Whether you are buying or selling a house the process can be quite stressful especially when thinking about potential tax implications Let s look at the documents you need to save and the tax issues you will need to consider