How Does Depreciation Affect The Tax Basis Of An Asset Quizlet How does depreciation affect the tax basis of an asset The tax basis is reduced by the depreciation allowed or allowable on the asset each year Which of the following costs

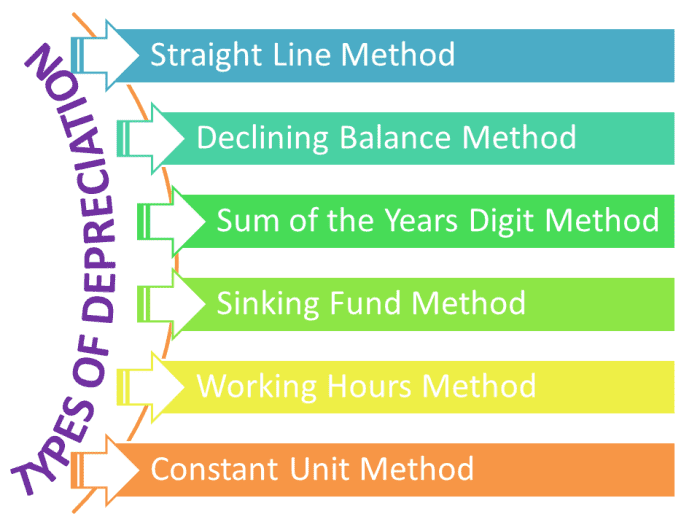

A company s depreciation expense reduces the amount of taxable earnings thus reducing the taxes owed Several methods of calculating depreciation can be The depreciable basis is equal to the asset s purchase price minus any discounts and plus any sales taxes delivery charges and installation fees For real

How Does Depreciation Affect The Tax Basis Of An Asset Quizlet

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

How Does Depreciation Affect The Tax Basis Of An Asset Quizlet

https://www.investopedia.com/thmb/avXNjl4fcBx8fPLI8gGFJ6Oyxss=/3000x2000/filters:no_upscale():max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png

How Does Depreciation Affect Tax Returns YouTube

https://i.ytimg.com/vi/4V83RkXffiQ/maxresdefault.jpg

Calculation Of Depreciation On Rental Property InnesLockie

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

How does depreciation affect the tax basis of an asset Multiple choice question The original basis is increased by the depreciation expense deducted on the tax return Depreciation allows businesses to spread the cost of physical assets such as a piece of machinery or a fleet of cars over a period of years for accounting and tax purposes There are

Topic No 703 Basis of Assets Basis is generally the amount of your capital investment in property for tax purposes Use your basis to figure depreciation Depreciation places the cost as an asset on the balance sheet and that value is reduced over the useful life of the asset Depreciation can be calculated using

Download How Does Depreciation Affect The Tax Basis Of An Asset Quizlet

More picture related to How Does Depreciation Affect The Tax Basis Of An Asset Quizlet

How Does Depreciation Affect Cash Flow RSM 2000

https://www.rsm2000.co.uk/birsezob/2021/12/iStock-163851379.jpg

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

What Is Depreciation And How Is It Calculated

https://www.investopedia.com/thmb/QspUXL9xHu-XOBdyeWOLIzQxjt8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg

How To Calculate Depreciation Adjustment Haiper

https://betterthisworld.com/wp-content/uploads/2021/07/Why-does-accumulated-depreciation-have-a-credit-balance-on-the.png

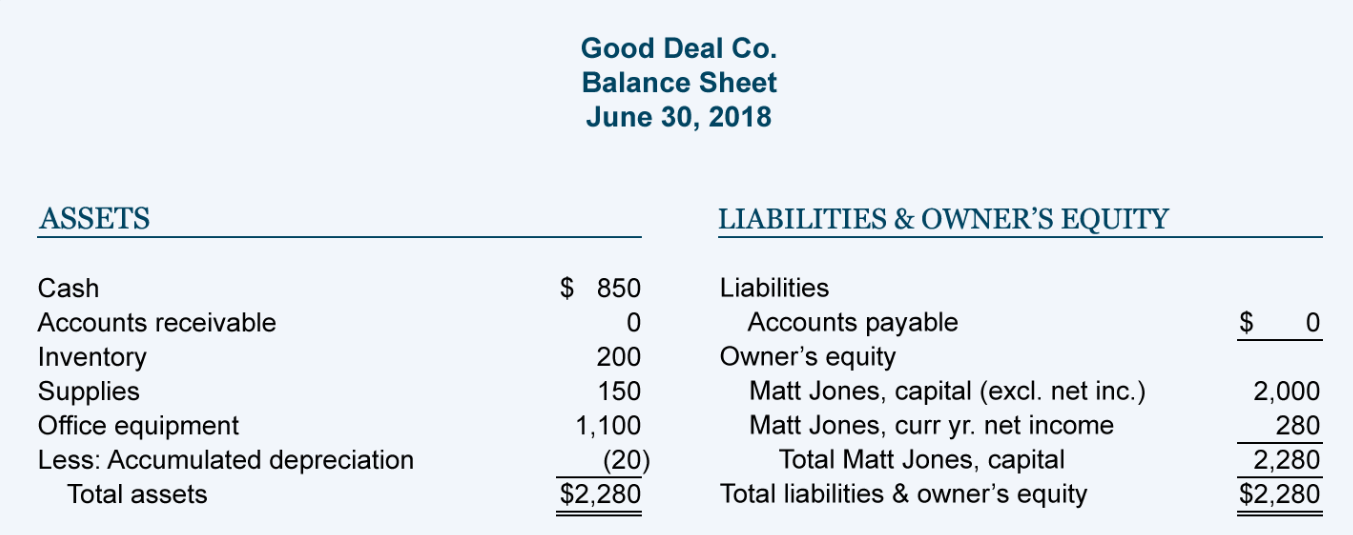

Why It Matters 2 1 Describe the Income Statement Statement of Owner s Equity Balance Sheet and Statement of Cash Flows and How They Interrelate 2 2 Define Explain and How Does Depreciation Work on Taxes Depreciation is a tax deduction that allows you to recover the cost of assets that you purchase and use for your

If you take deductions for depreciation or casualty losses reduce your basis You can t determine your basis in some assets by cost This includes property you receive as a Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income generating

Section 179 For Small Businesses 2021 Shared Economy Tax

https://sharedeconomycpa.com/wp-content/uploads/2022/03/depreciation-schedule-example.jpg

How Does Depreciation Affect Cash Flow RSM 2000

https://www.rsm2000.co.uk/birsezob/2021/12/iStock-1046010272.jpg

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png?w=186)

https://quizlet.com/691961744/ch10-smartbook-flash-cards

How does depreciation affect the tax basis of an asset The tax basis is reduced by the depreciation allowed or allowable on the asset each year Which of the following costs

https://www.investopedia.com/ask/answers/031815/...

A company s depreciation expense reduces the amount of taxable earnings thus reducing the taxes owed Several methods of calculating depreciation can be

Hecht Group The Depreciation Deduction For Commercial Property

Section 179 For Small Businesses 2021 Shared Economy Tax

Appreciation Depreciation Of Currency And Its Impacts Explained Basic

Depreciation Definition Types Of Its Methods With Impact On Net Income

How To Calculate Depreciation Expense On A House Haiper

8 Ways To Calculate Depreciation In Excel 2023

8 Ways To Calculate Depreciation In Excel 2023

Methods Of Depreciation Formulas Problems And Solutions Owlcation

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation In Cash Flow Finance Capital Markets Khan Academy

How Does Depreciation Affect The Tax Basis Of An Asset Quizlet - Topic No 703 Basis of Assets Basis is generally the amount of your capital investment in property for tax purposes Use your basis to figure depreciation