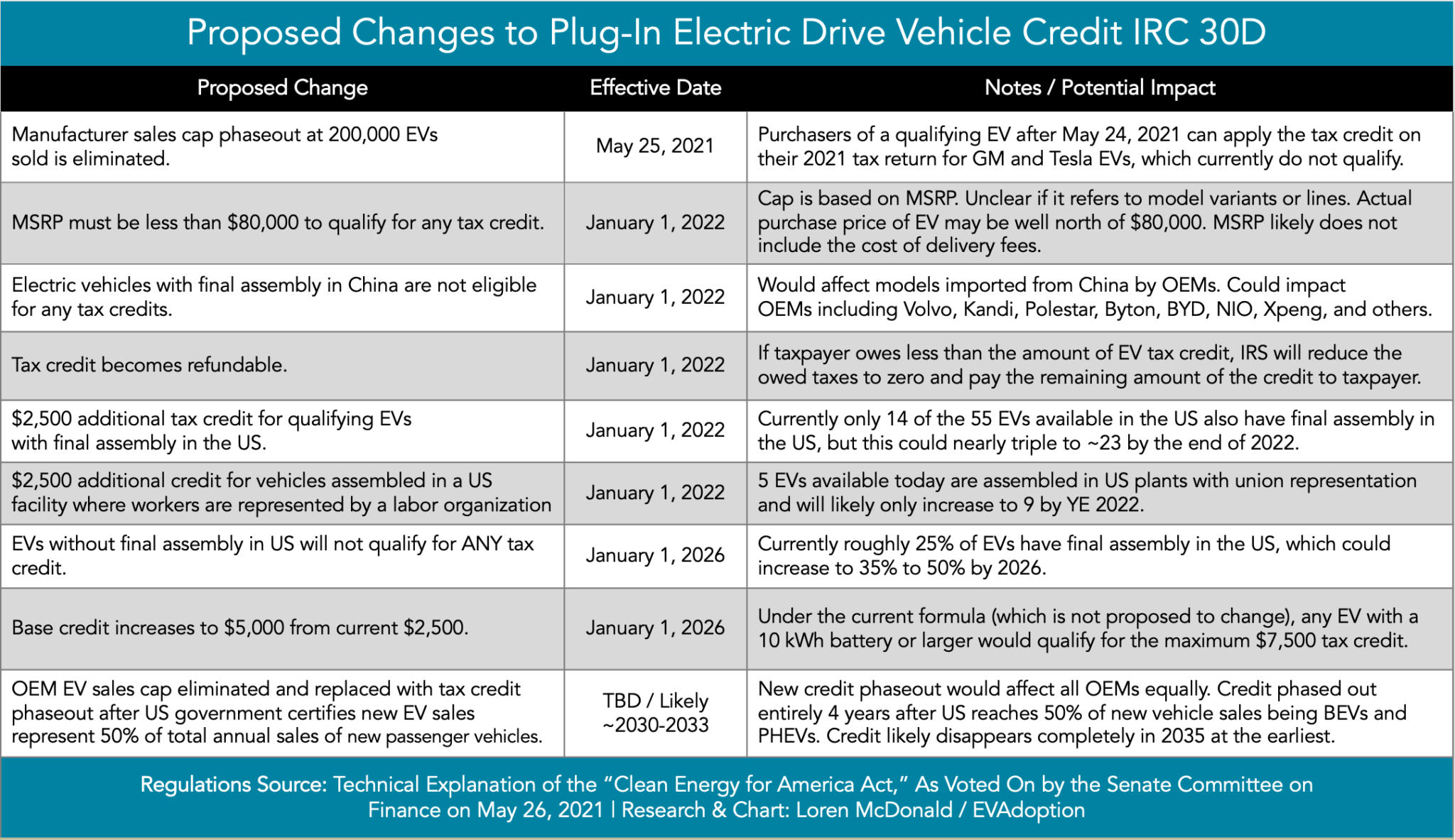

How Does Ev Tax Credit Work Example Since 2008 the federal government has offered federal tax credits of up to 7 500 when you purchase an electric vehicle EV or plug in hybrid electric vehicle PHEV With the Inflation

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500

How Does Ev Tax Credit Work Example

How Does Ev Tax Credit Work Example

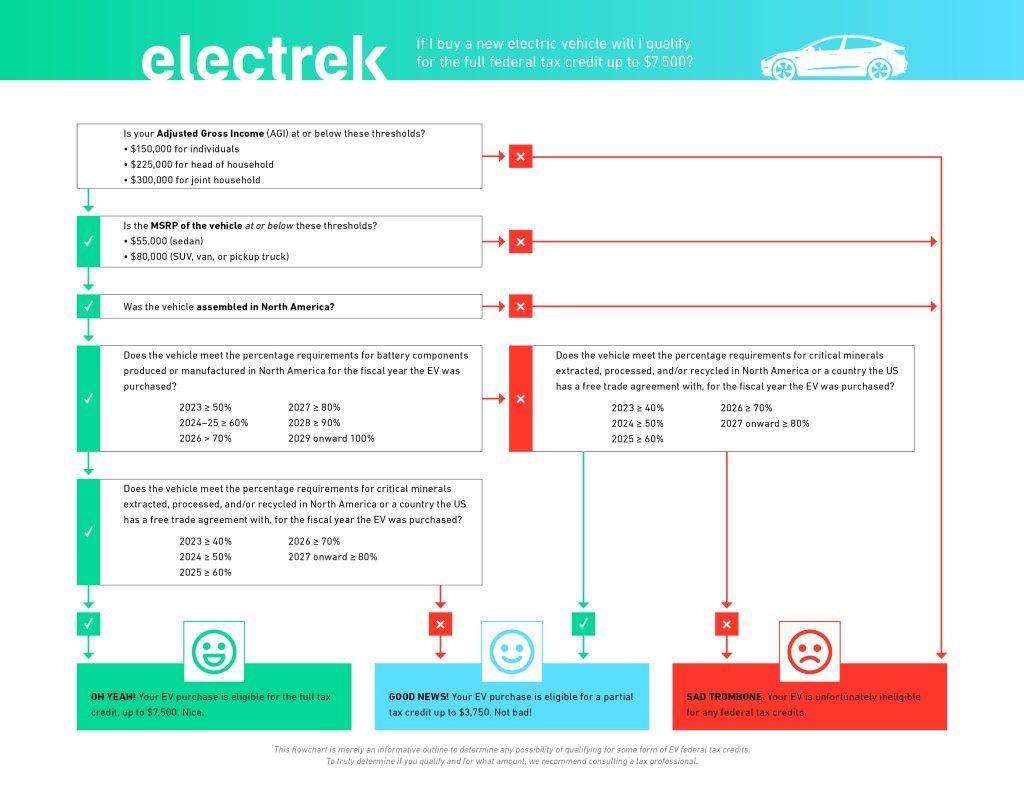

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

Federal EV Tax Credit Explained YouTube

https://i.ytimg.com/vi/CB6B0PfJdRc/maxresdefault.jpg

Main Post Image

https://blog.1800accountant.com/wp-content/uploads/2022/09/EV-Tax-Credits-Explained_blog-header.jpg

A new electric vehicle EV can help you reduce your carbon footprint and access a tax credit of up to 7 500 As of 2024 the federal government expanded the How Do Federal EV Tax Credits Work The credits reduce a filer s federal income tax for the year subject to price and income caps EV tax credits are

How does the used EV credit work Consumers can receive tax credits of up to 4 000 or 30 of the vehicle price whichever is less for buying EVs that are at least two years old You can claim the federal electric vehicle tax credit for your 2023 and 2024 taxes Here s what you need to know before you buy an electric car SUV or truck

Download How Does Ev Tax Credit Work Example

More picture related to How Does Ev Tax Credit Work Example

Government Electric Vehicle Tax Credit Electric Tax Credits Car

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

Everything To Know About The New EV Tax Credits Virginia Automobile

https://vada.com/wp-content/uploads/2023/04/ev-tax-credits-1024x858.png

Earned Income Tax Credit City Of Detroit

https://detroitmi.gov/sites/detroitmi.localhost/files/2019-01/ETIC-Chart.jpg

Here s how the electric vehicle tax credits work in 2024 as of this writing Discount upfront In 2024 dealerships can offer instant EV tax rebates to qualifying customers on qualifying How Does the Clean Vehicle Tax Credit Work If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle

How does an electric vehicle tax credit work What are the proposed changes in Build Back Better Are EV tax credits retroactive Currently in some cases as much as 7 500 is available as a tax credit to people who want to buy an electric vehicle or a plug in hybrid

New EV Tax Credits Taxed Right

https://taxedright.com/wp-content/uploads/2022/11/EV-Tax-Credit-1-760x505.jpg

Electric Car Tax Credits OsVehicle

https://cdn.osvehicle.com/1666444202247.png

https://cars.usnews.com/cars-trucks/advi…

Since 2008 the federal government has offered federal tax credits of up to 7 500 when you purchase an electric vehicle EV or plug in hybrid electric vehicle PHEV With the Inflation

https://www.theverge.com/23310457/inflati…

Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The

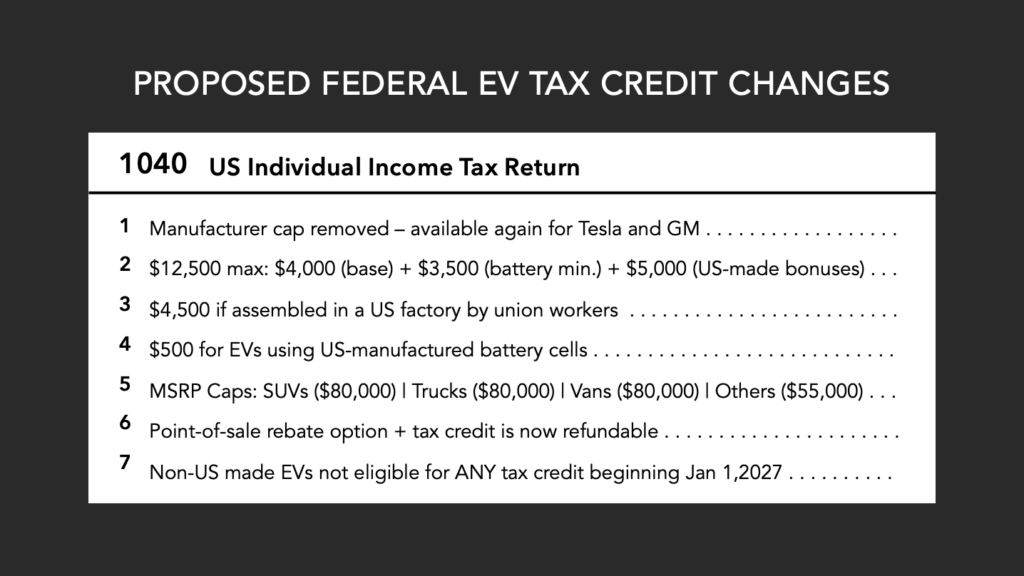

Proposed Federal EV Tax Credit Changes IRC 30D featured Image v3

New EV Tax Credits Taxed Right

How Does New Ev Tax Credit Work Todrivein

How Does The EV Tax Credit Work Commons credit portal

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

Do You Qualify For The EV Tax Credit NextBigFuture

Do You Qualify For The EV Tax Credit NextBigFuture

Do You Qualify For The EV Tax Credit NextBigFuture

Rivian Offers Binding Contract To Maintain 7 500 EV Tax Credit

The New EV Tax Credit In 2023 Everything You Need To Know Updated

How Does Ev Tax Credit Work Example - You can claim the federal electric vehicle tax credit for your 2023 and 2024 taxes Here s what you need to know before you buy an electric car SUV or truck