How Does Homestead Exemption Work In Minnesota Homestead Classification Having a homestead classification may qualify your property for a Homestead Market Value Exclusion or one of the following Property Tax Refund Market

Owners and occupants must be Minnesota residents to qualify for homestead Verification of income tax returns would assure the assessor that a property owner does at a minimum pay This article highlights several important features of the Minnesota homestead laws which everyone who owns or plans to buy a home in Minnesota should be aware of 1 The homestead exemption area grew out of the

How Does Homestead Exemption Work In Minnesota

How Does Homestead Exemption Work In Minnesota

https://img1.wsimg.com/isteam/ip/b34afe40-e69a-482c-a211-a2c20f7660e7/NCRE 01-ec0f5c3.jpg/:/

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption-663x1024.png

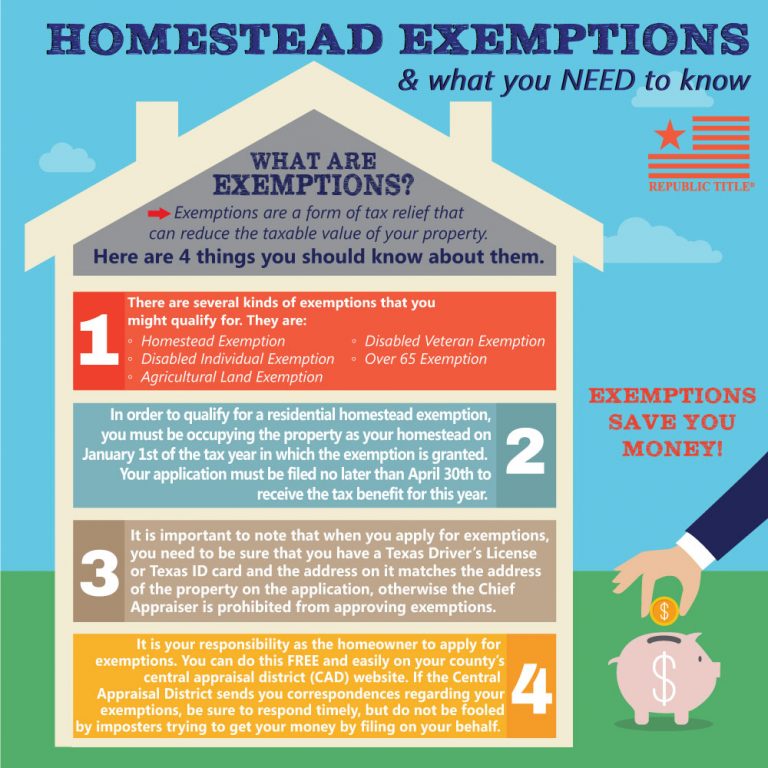

Filing For Homestead Exemption In Georgia

https://www.heathermurphygroup.com/wp-content/uploads/2023/03/HMG-Filing-for-Homestead-Exemption-in-Georgia.png

A homestead classification qualifies your property for a classification rate of 1 00 on up to 500 000 in taxable market value Homesteads are also eligible for a market value The following chart provides a snapshot of Minnesota homestead law See Prevent and Manage Foreclosure FAQs for more details Code Section 510 01 et seq Max

Individual taxpayer identification numbers now qualify property owners for homestead exclusion You may qualify for homestead status if You or one of your relatives lives in the home You The market value homestead credit was eliminated during the 2011 Minnesota legislative session However qualifying homeowners will still receive a tax benefit through the homestead

Download How Does Homestead Exemption Work In Minnesota

More picture related to How Does Homestead Exemption Work In Minnesota

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

What Is A Homestead Exemption And Do You Qualify WalletGenius

https://cdn2.system1.com/eyJidWNrZXQiOiJvbS1wdWItc3RvcmFnZSIsImtleSI6IndhbGxldGdlbml1cy93cC1jb250ZW50L3VwbG9hZHMvMjAyMS8xMi9zaHV0dGVyc3RvY2tfMjAzNjk2OTAwMy5qcGciLCJlZGl0cyI6eyJ3ZWJwIjp7InF1YWxpdHkiOjQwfX19

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

The Homestead Market Value Exclusion HMVE program replaced the Market Value Homestead Credit program for taxes payable in 2012 and beyond Learn more about The residential homestead classification provides a property tax exclusion for property that is owned and occupied by the owner or a qualified relative The amount of the exclusion is shown on your property tax statement and is

Minnesota lets filers use either the federal exemption system or Minnesota s state exemption system so you ll have two homestead amounts to choose between What is the Homestead Exclusion Homestead is a program to reduce property taxes for owners or relatives of owners who also occupy their homes CR H 2023 Homestead

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

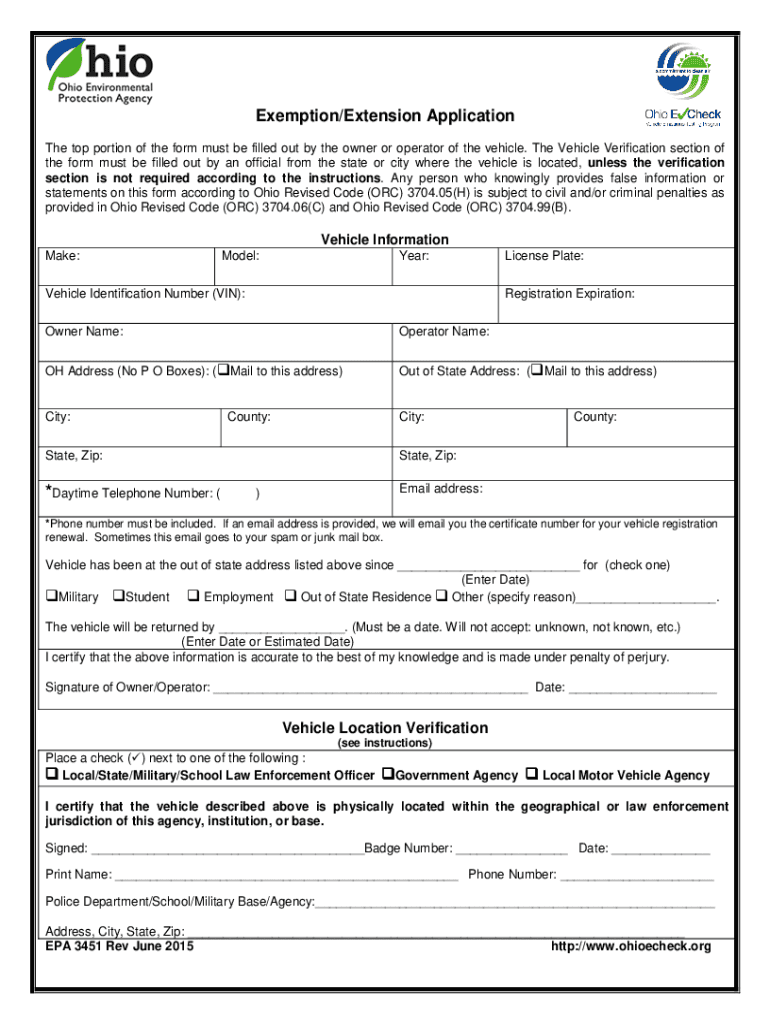

For The Tax Exempt In Ohio 2015 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/468/833/468833564/large.png

https://www.revenue.state.mn.us/homestead-classification

Homestead Classification Having a homestead classification may qualify your property for a Homestead Market Value Exclusion or one of the following Property Tax Refund Market

https://www.revenue.state.mn.us/sites/default/...

Owners and occupants must be Minnesota residents to qualify for homestead Verification of income tax returns would assure the assessor that a property owner does at a minimum pay

California Bankruptcy Homestead Exemptions Increase For 2022

York County Sc Residential Tax Forms Homestead Exemption CountyForms

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

How Does The U S Homestead Property Tax Exemption Work Mansion Global

How Much Does Homestead Exemption Save In Texas Square Deal Blog

Iowa Homestead Tax Credit Scott County Lawana Crisp

Iowa Homestead Tax Credit Scott County Lawana Crisp

Homestead Exemption Mojgan JJ Panah

Madison County Indiana Homestead Exemption Form ExemptForm

How Does The Florida Homestead Exemption Work In An Estate YouTube

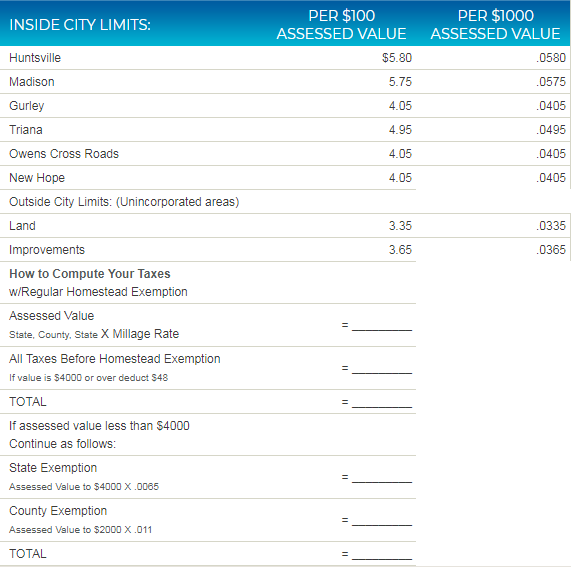

How Does Homestead Exemption Work In Minnesota - The following chart provides a snapshot of Minnesota homestead law See Prevent and Manage Foreclosure FAQs for more details Code Section 510 01 et seq Max