How Does Homestead Exemption Work How does a homestead exemption work Most states offer exemptions that could help you reduce your property tax bill and receive protection from creditors These protections are designed to help you stay in your home and avoid getting priced out of neighborhoods where property value is increasing

Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes They re called homestead exemptions because they apply to primary residences not rental properties or investment properties You must live in the home to qualify for the tax break How Does a Homestead Exemption Work The homestead exemption often works by lowering the assessed value of your house that your property taxes are based on or by protecting some of the value of your home Because homestead exemptions are state laws there are a lot of differences between how a homestead exemption works in one

How Does Homestead Exemption Work

How Does Homestead Exemption Work

https://www.mattcurtisrealestate.com/thumbs/720x1280/q75/uploads/Huntsville.58.jpg

Understanding Homestead Exemption How Does It Work And How Can It Save

https://www.lihpao.com/images/illustration/how-does-homestead-exemption-work-1.jpg

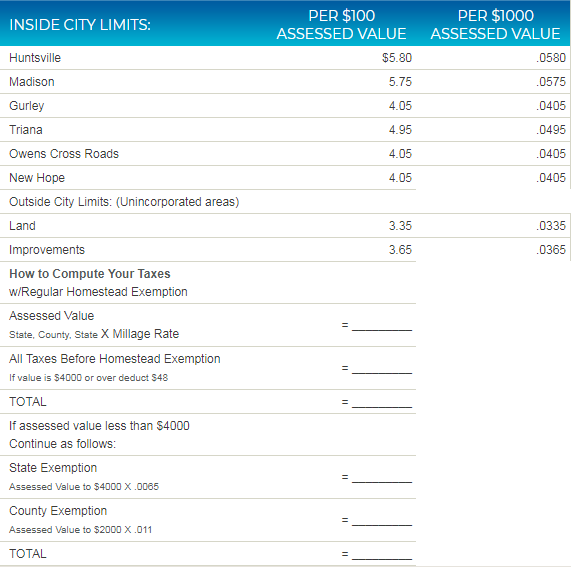

How Does Homestead Exemption Work In Madison County

https://www.mattcurtisrealestate.com/uploads/agent-1/101 Pineoak-5.jpg

Homestead exemptions usually offer a fixed discount on taxes such as exempting the first 50 000 of the assessed value with the remainder of the home s value being taxed at the normal How Does a Homestead Exemption Work Here s how a homestead exemption can translate to savings A homestead valued at 400 000 taxed at 1 is eligible for an exemption of 50 000

If you re a homeowner and filing for bankruptcy the homestead exemption can be used to shield your home s equity from creditors who want it as payment for How Does A Homestead Exemption Work A homestead exemption protects those in financial straits from property taxes by decreasing the taxable value of the home It can provide tax relief to homeowners going through bankruptcy or foreclosure and stop or pause the forced sale of a property

Download How Does Homestead Exemption Work

More picture related to How Does Homestead Exemption Work

Iowa Homestead Tax Credit Scott County Lawana Crisp

https://photos.demandstudios.com/getty/article/56/242/86544241.jpg

Q How Does The Homestead Exemption Work

https://media.licdn.com/dms/image/C5612AQGnXhPplnPvIg/article-cover_image-shrink_720_1280/0/1605126644806?e=2147483647&v=beta&t=QkT_23_GTQRx9ir3kenVfUdGHCv2hnz0zEGMElzBb6E

Madison County Indiana Homestead Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-does-homestead-exemption-work-in-madison-county.png

If you qualify for homestead status you ll be eligible for a homestead exemption This is a state tax law provision that lowers the amount of property taxes you must pay on your home The status and its qualifications varies from state to state but it generally allows you to save money on your annual property taxes How Does Homestead Exemption Work The homestead exemption law protects a portion of the home value from property taxes This exemption applies to primary residences only Other properties such as vacation homes or commercial and investment properties do not qualify for the exemption

[desc-10] [desc-11]

What Is A Homestead Exemption Bankrate

https://www.bankrate.com/2020/11/17092341/homestead-exemption.jpg

Homestead Exemption Explained Clarke County Tribune

https://www.clarkecountytrib.com/sites/default/files/3045584.jpg

https://www.lendingtree.com/home/mortgage/what-is...

How does a homestead exemption work Most states offer exemptions that could help you reduce your property tax bill and receive protection from creditors These protections are designed to help you stay in your home and avoid getting priced out of neighborhoods where property value is increasing

https://smartasset.com/taxes/what-is-a-homestead-tax-exemption

Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes They re called homestead exemptions because they apply to primary residences not rental properties or investment properties You must live in the home to qualify for the tax break

HOMESTEAD EXEMPTION Bushore Church Real Estate

What Is A Homestead Exemption Bankrate

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Harris County Homestead Exemption Form ExemptForm

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

How Does Homestead Exemption Work Should You Apply

How Does Homestead Exemption Work Should You Apply

Filing For Homestead Exemption In Georgia

How Does Homestead Exemption Work In Madison County

What Is A Homestead Exemption

How Does Homestead Exemption Work - [desc-14]