How Does Production Tax Credit Work The Renewable Electricity Production Credit PTC is a per kilowatt hour tax credit for electricity generated by qualified energy resources and sold by the taxpayer to an unrelated person during the taxable year The credit ranges from 2 3 cents kWh for wind geothermal and closed loop biomass to 1 1 cents kWh for open loop biomass landfill

The Production Tax Credit PTC first established under the Energy Policy Act of 1992 is a driving force for constructing otherwise uneconomic industrial wind turbines for electric generation The renewable electricity production tax credit PTC is a per kilowatt hour kWh federal tax credit included under Section 45 of the U S tax code for electricity generated by qualified renewable energy resources

How Does Production Tax Credit Work

How Does Production Tax Credit Work

https://www.olympiabenefits.com/hubfs/How does the Medical Expense Tax Credit work in Canada.png

_-_FI.png#keepProtocol)

Production Tax Credit PTC Program Overview Benefits

https://www.carboncollective.co/hubfs/Production_Tax_Credit_(PTC)_-_FI.png#keepProtocol

How Does The New Tax Credit Work News In France

https://img.lemde.fr/2023/03/10/0/0/5616/3744/1440/960/60/0/469d408_1678445578860-pns-777116022.jpg

The Production Tax Credit PTC allows owners and developers of wind energy facilities land based and offshore to claim a federal income tax credit on every kilowatt hour of electricity sold to an unrelated party for a period of 10 The renewable electricity production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated using qualified energy resources The credit expires at the end of 2020 so that only projects that began construction before

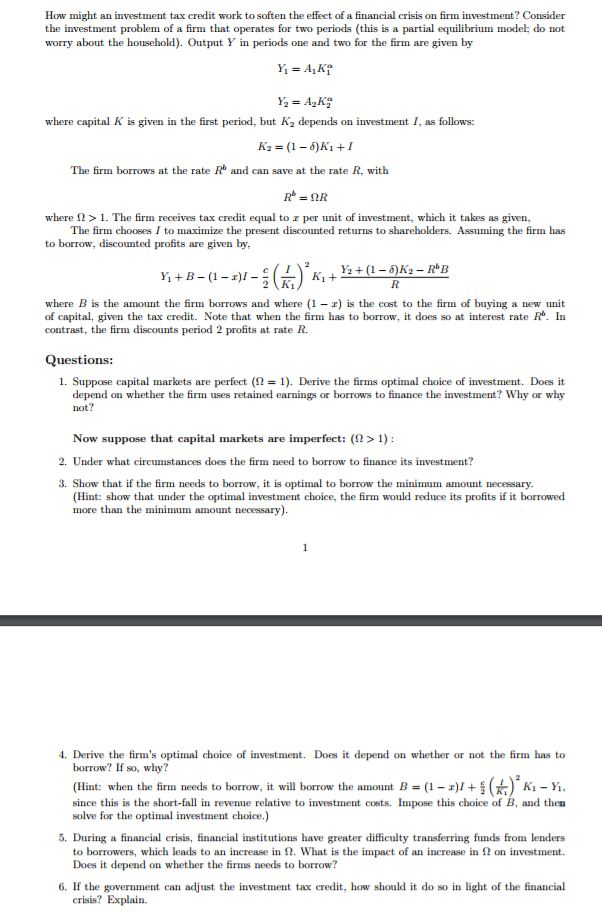

The Federal Production Tax Credit PTC and Investment Tax Credit ITC are incentives for development and deployment of renewable energy technologies This document provides an update on their benefits applicability to specific technologies and expiration dates U S wind projects that use large turbines greater than 100 kilowatts kW are eligible to receive federal tax incentives in the form of production tax credits PTC and accelerated depreciation

Download How Does Production Tax Credit Work

More picture related to How Does Production Tax Credit Work

How Does The EV Tax Credit Work Flipboard

https://ic-cdn.flipboard.com/familyhandyman.com/821f7137539b62b7f33ccb6f49ea5b0160d56eb5/_medium.jpeg

How Does The AZ Tax Credit Work YouTube

https://i.ytimg.com/vi/i0EcgwwPBNI/maxresdefault.jpg

How Does The Federal Solar Tax Credit Work YouTube

https://i.ytimg.com/vi/HoPwzGYYsgM/maxresdefault.jpg

The production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a system s operation It reduces the federal income tax liability and is adjusted annually for inflation 2 The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS

Through at least 2025 the Inflation Reduction Act extends the Investment Tax Credit ITC of 30 and Production Tax Credit PTC of 0 0275 kWh 2023 value as long as projects meet prevailing wage apprenticeship requirements for projects over 1 The Act substantially changes and expands existing federal income tax benefits for renewable energy including the existing Section 45 production tax credit PTC and Section 48 investment

Investment Tax Credit Versus Production Tax Credit McKinstry

https://www.mckinstry.com/wp-content/uploads/2022/04/NW-CO-1-1.jpg

How Might An Investment Tax Credit Work To Soften The Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/ce7/ce757067-5ca2-41a6-9fde-f4ea3d213bee/phpohgGNe.png

https://www.iea.org/policies/4797-renewable...

The Renewable Electricity Production Credit PTC is a per kilowatt hour tax credit for electricity generated by qualified energy resources and sold by the taxpayer to an unrelated person during the taxable year The credit ranges from 2 3 cents kWh for wind geothermal and closed loop biomass to 1 1 cents kWh for open loop biomass landfill

_-_FI.png#keepProtocol?w=186)

https://www.masterresource.org/production-tax...

The Production Tax Credit PTC first established under the Energy Policy Act of 1992 is a driving force for constructing otherwise uneconomic industrial wind turbines for electric generation

How Tax Credits Work YouTube

Investment Tax Credit Versus Production Tax Credit McKinstry

How Does The Earned Income Tax Credit Work 12 Essential EIC Facts

How Does A Property Tax Credit Work YouTube

Production Tax Credit Vs Investment Tax Credit Which Is Better For

How Does The Premium Tax Credit Work YouTube

How Does The Premium Tax Credit Work YouTube

Did The First Child Tax Credit Work Experts Say It Did The National

Production Tax Credit Explained Silver Tax Group

How Does The Federal Solar Tax Credit Work

How Does Production Tax Credit Work - Originally created under the Energy Policy Act of 1992 the PTC is a ten year inflation adjusted US federal income tax credit for each kilowatt hour kWh of electricity generated by certain types of renewable or zero carbon emission projects provided certain conditions are