How Does Solar Credit Work On Taxes The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

Key takeaways In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax

How Does Solar Credit Work On Taxes

How Does Solar Credit Work On Taxes

https://www.credit.com/blog/wp-content/uploads/2019/02/solar-tax-credit1.jpg

How Does The Solar Tax Credit Work Solar Energy Solutions

https://www.sesre.com/wp-content/uploads/2023/09/how-does-the-solar-tax-credit-work.webp

How Does The Solar Tax Credit Work In Maui

https://www.maui-solar.com/wp-content/uploads/2019/07/How-Does-the-Solar-Tax-Credit-Work-in-Maui.jpg

How does the solar tax credit work The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means that if the gross system cost is 20 000 your tax Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a

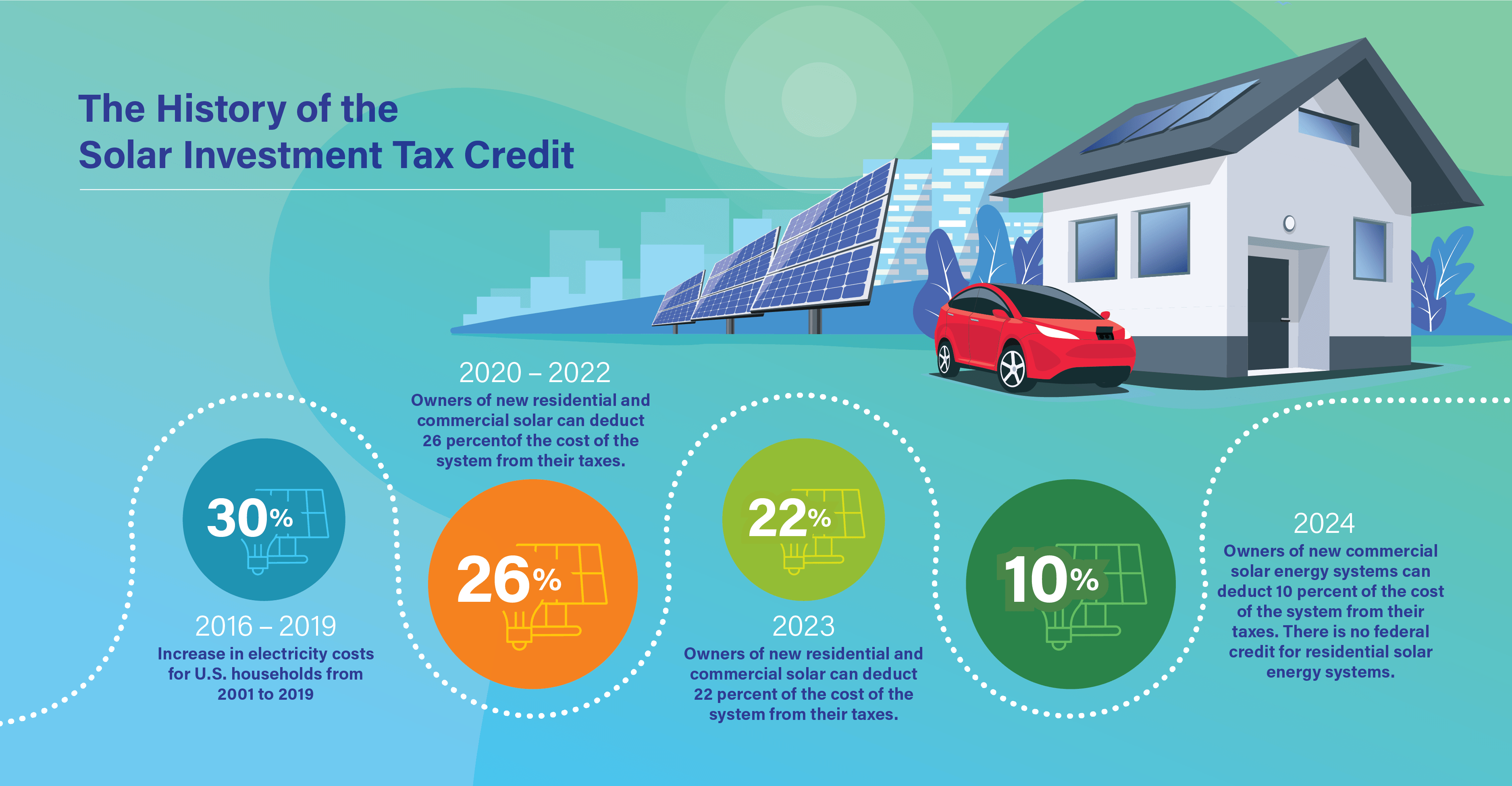

For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs The solar tax credit lets homeowners subtract 30 of a solar purchase and installation off their federal taxes Here s how it works and who it works best for

Download How Does Solar Credit Work On Taxes

More picture related to How Does Solar Credit Work On Taxes

/filters:quality(60)/2021-04-01-How-Does-The-Federal-Solar-Credit-Work-CDN.png)

How Does The Federal Solar Tax Credit Work Ownerly

https://own-content.ownerly.com/fit-in/980x0/filters:format(jpeg)/filters:quality(60)/2021-04-01-How-Does-The-Federal-Solar-Credit-Work-CDN.png

Taxes And Solar How Does The Federal Tax Credit Work For Solar

https://i.ytimg.com/vi/LbH4Y8TQRJ4/maxresdefault.jpg

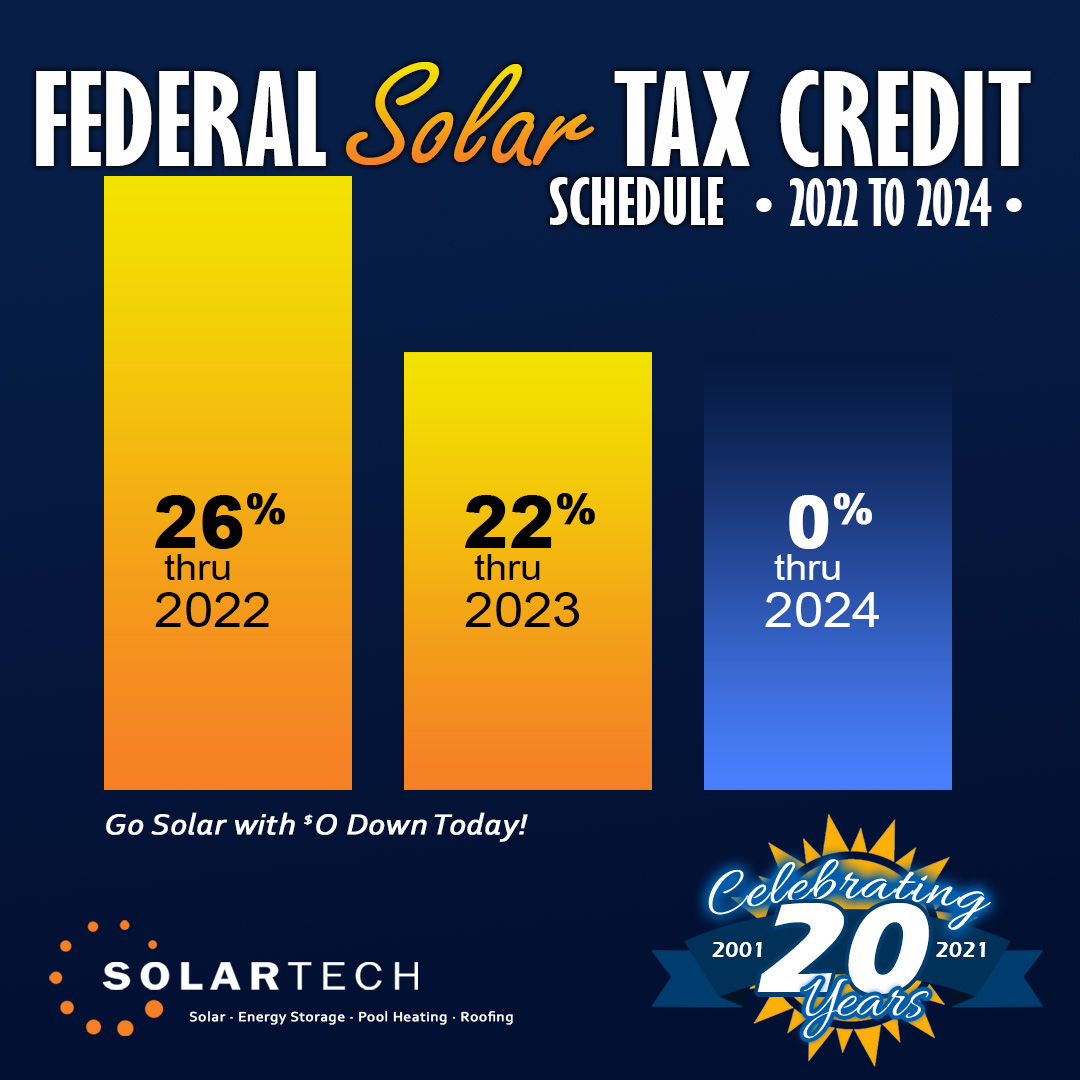

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 How does the solar tax credit work Once you ve completed your eligible solar project you can claim this credit the next time you file your federal income taxes Tax credits give you a dollar for dollar reduction in your

How does the federal solar tax credit work This federal incentive while generous won t come directly in the form of cash in your pocket Instead it ll reduce the amount of The solar tax credit is a dollar for dollar reduction in your tax liability worth up to 30 of the cost of a solar and or battery project This incentive is also known as

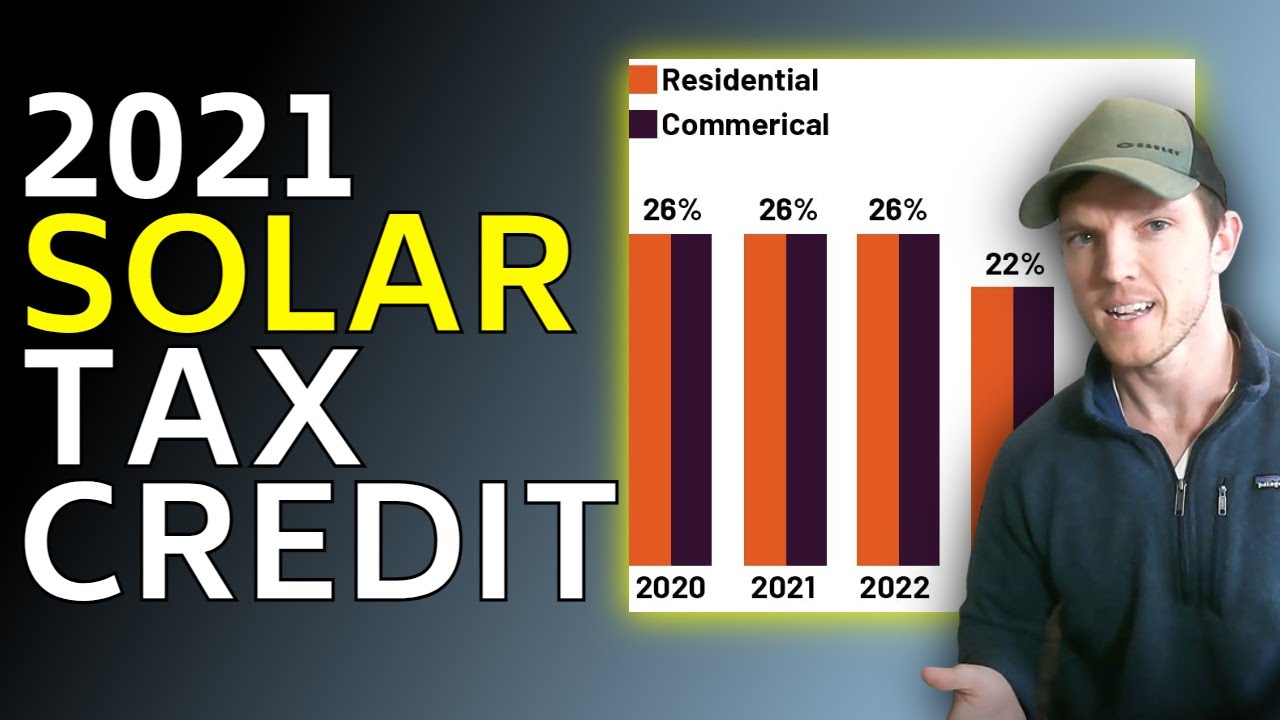

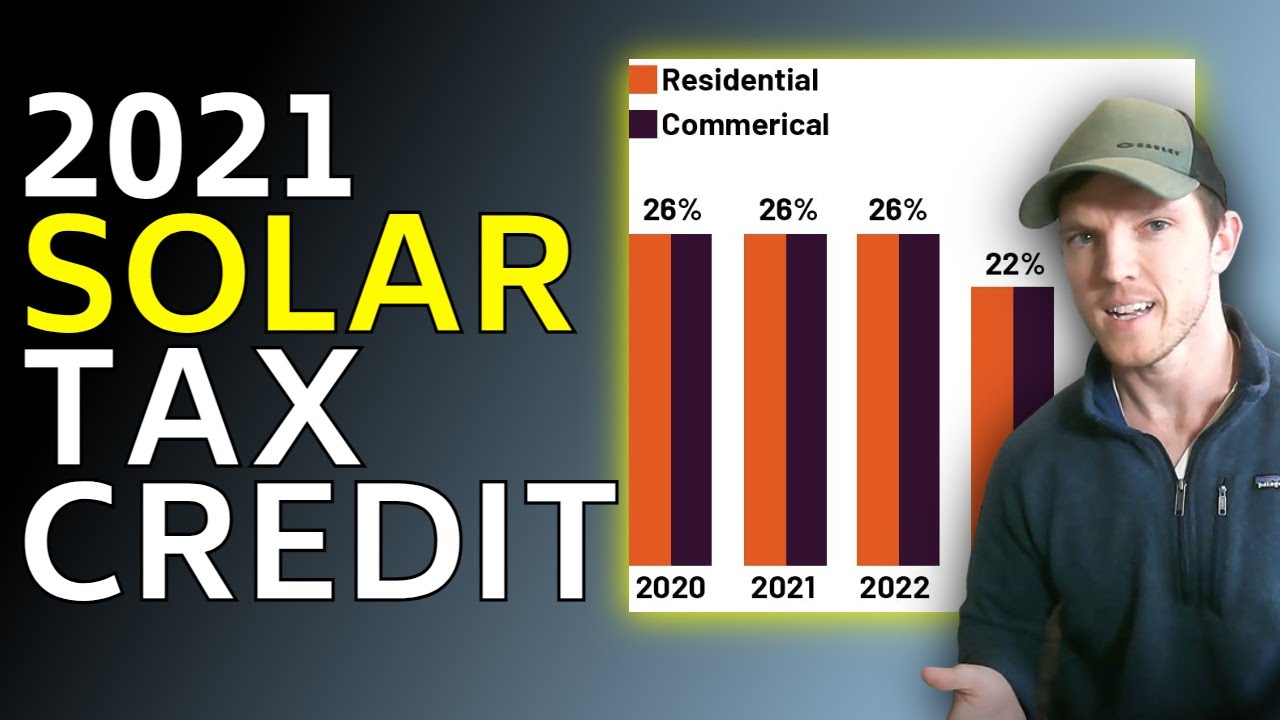

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

https://i.ytimg.com/vi/u143Lcm-QG4/maxresdefault.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

https://www.nerdwallet.com/.../taxes/sola…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

https://www.energysage.com/solar/solar-tax-credit-explained

Key takeaways In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will

California Solar Tax Credit LA Solar Group

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

How Does The Federal Solar Tax Credit Work Nicki Karen

How Does The Federal Solar Tax Credit Work CTR

Your Guide To Solar Federal Tax Credit

Your Guide To Solar Federal Tax Credit

Everything You Need To Know The New 2021 Solar Federal Tax Credit

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Things To Know About Solar Installation Tax Credit

How Does Solar Credit Work On Taxes - Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a