How Does Tax Deduction Work In South Africa If you contribute to a pension provident or retirement annuity fund you ll qualify for a tax deduction up to 27 5 of your annual income limited to no more than the actual

Get an expert to advise you about what can be claimed as a deduction on your income tax allowable deductions will vary according to your job and personal circumstances and they are deducted from your income In South Africa everyone who receives income from working must pay taxes Understanding income tax and mandated deductions is an excellent way to ensure taxpayers

How Does Tax Deduction Work In South Africa

How Does Tax Deduction Work In South Africa

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

How Does An NC 529 Tax Deduction Work CFNC

https://www.cfnc.org/media/gkrhpy1n/tax-deduction-money.jpg

Tax Deduction What Is It And How Does It Work OK Save Money

https://oksavemoney.com/wp-content/uploads/2023/03/AdobeStock_249973140-scaled.jpeg

PAYE is income tax deducted from your salary before you receive it There are several ways for calculating PAYE in South Africa Although SARS professionals use all techniques an employee should learn how to calculate All it really means is that you are paying the tax you owe to SARS on a monthly basis instead of all at once at the end of the tax year hence PAYE means Paye As You Earn This is a good thing as it saves the taxpayer from

As a general rule allowances subject to certain limits granted to an employee by an employer to meet business expenditure are taxable in South Africa but only to the extent Tax consultants Vincent Radebe Phumla Taho and tax attorney Darren Britz from Tax Consulting South Africa share five ways that tax payers can maximise their refunds from SARS 1 Medical credits Taxpayers can claim deductions for

Download How Does Tax Deduction Work In South Africa

More picture related to How Does Tax Deduction Work In South Africa

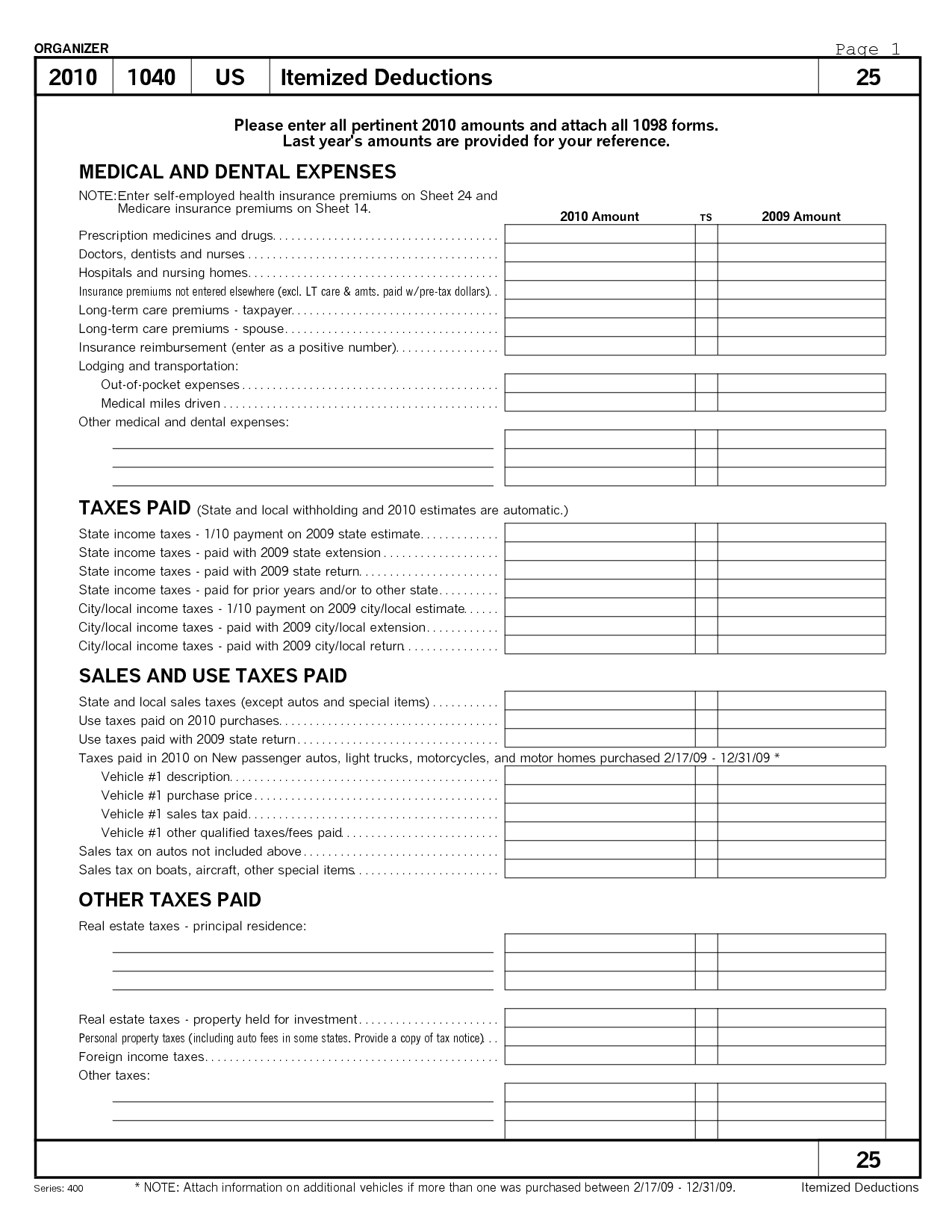

11 Monthly Bill Worksheet Worksheeto

https://www.worksheeto.com/postpic/2014/09/2015-itemized-tax-deduction-worksheet-printable_603011.png

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

To make the most of your tax savings and benefits it s essential that you understand what goes into tax and which deductions you can claim for How does tax in South Africa work If you earn an income whether from a salary or Why is my employee s tax lower than expected after lockdown Why are the UIF and SDL amounts on the payslip different What relief measures are there for employees

In South Africa taxable income includes salaries wages bonuses and capital gains But not all of this income will be taxed several deductions may apply to reduce your taxable income A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below which no tax is payable For

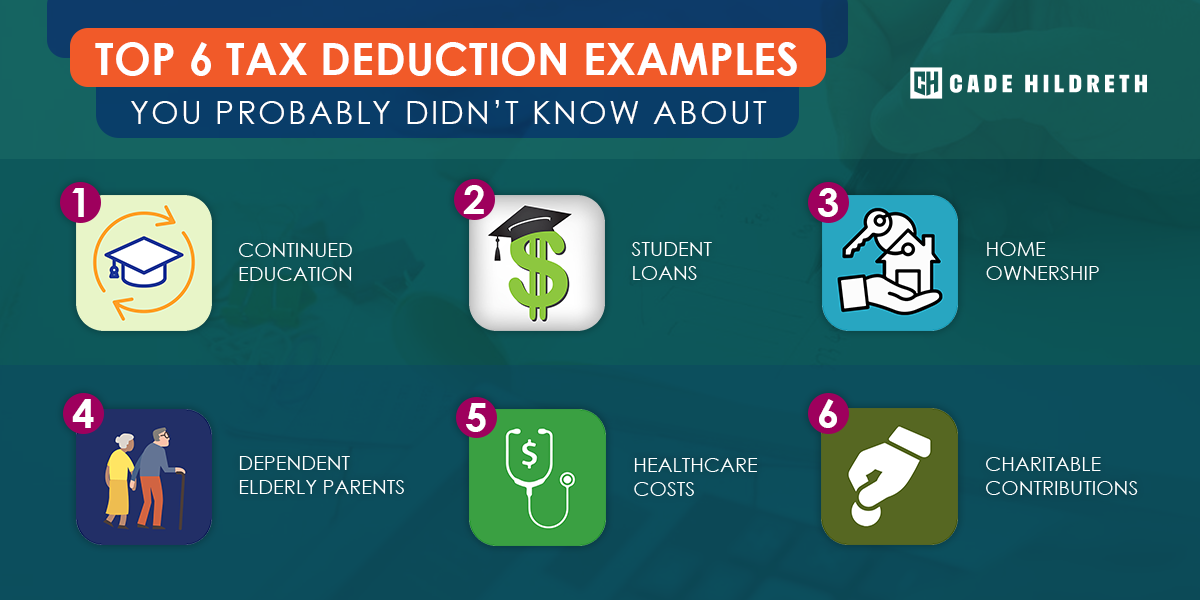

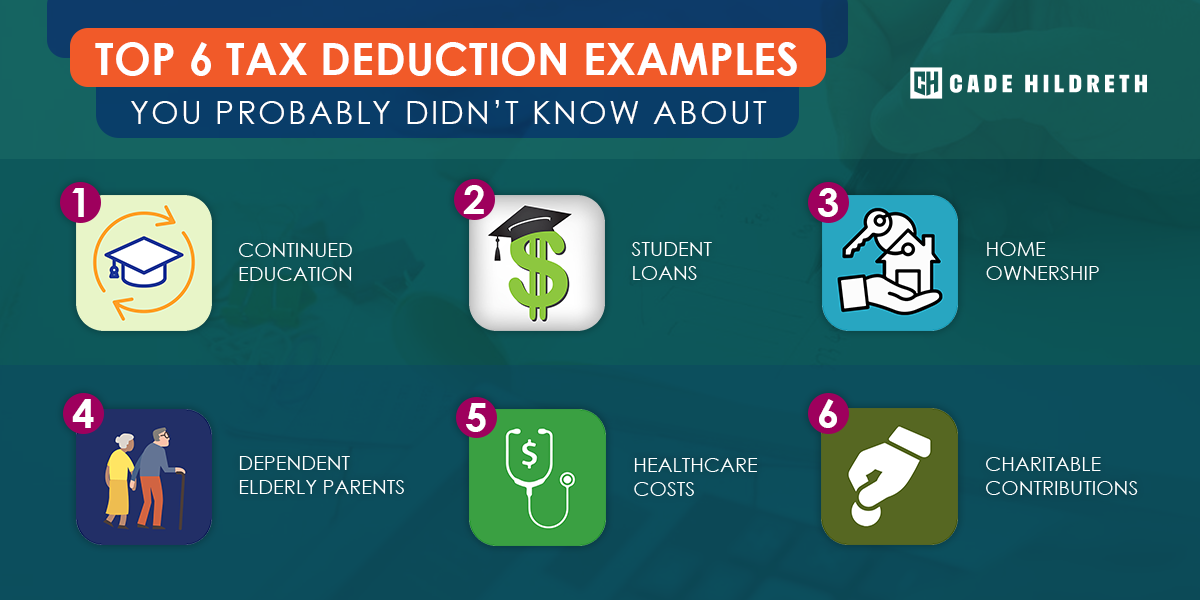

Top 6 Tax Deduction Examples You Probably Didn t Know About

https://cadehildreth.com/wp-content/uploads/2020/01/tax-deduction-examples.png

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

https://www.taxtim.com › za › guides › the-complete-tax...

If you contribute to a pension provident or retirement annuity fund you ll qualify for a tax deduction up to 27 5 of your annual income limited to no more than the actual

https://personal.nedbank.co.za › learn › blo…

Get an expert to advise you about what can be claimed as a deduction on your income tax allowable deductions will vary according to your job and personal circumstances and they are deducted from your income

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Top 6 Tax Deduction Examples You Probably Didn t Know About

How Does Tax Deduction Work In India Tax Walls

The Standard Deduction Vs Itemizing Your Tax Return Which Is Best

How Does Monthly Income Tax Deduction Work In Malaysia

Warning Over Remote Work In South Africa BusinessTech

Warning Over Remote Work In South Africa BusinessTech

How Does Tax Deduction Work In India Tax Walls

Standard Deduction For Fy 2023 24 In New Tax Regime Printable Forms

What Are Tax Deductions Napkin Finance

How Does Tax Deduction Work In South Africa - As a general rule allowances subject to certain limits granted to an employee by an employer to meet business expenditure are taxable in South Africa but only to the extent