How Does The California Solar Tax Credit Work If you are a California resident looking to install solar panels there are multiple incentives you can take advantage of to lower the cost of your system including a property tax exclusion

On this page we cover all of the solar and battery incentives rebates and tax credits available for your California home solar installation We also provide guidance on how low income solar power programs work Use the California solar tax credit and federal rebates to make your solar panel purchase much more affordable Invest in renewable energy and thus fund the remodeling of your generator and reduce your electricity bills contributing to a clean environment and benefiting financially

How Does The California Solar Tax Credit Work

How Does The California Solar Tax Credit Work

https://www.cagreen.org/wp-content/uploads/2020/05/SERVICES-PAGE-6b.jpg

Your Guide To Solar Tax Credits

https://www.usersadvice.com/wp-content/uploads/2023/03/Screenshot_15-1024x655.png

Solar In California Ultimate Guide Solar Panels In California How You

https://sunwork.org/wp-content/uploads/2021/01/Solar-Tax-Credit-Timeline-2.jpg

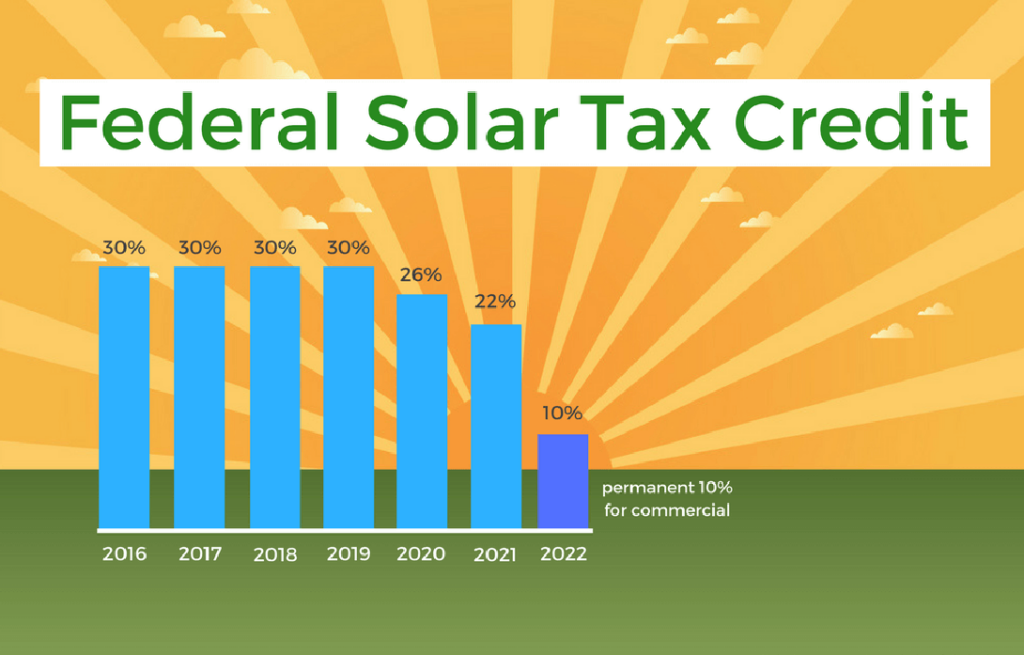

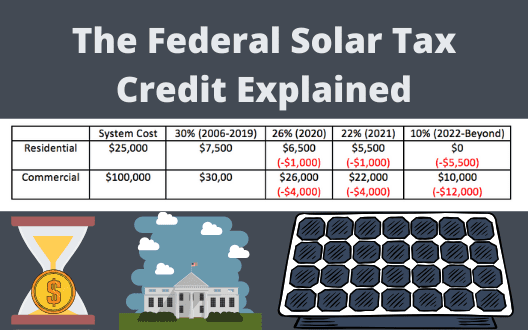

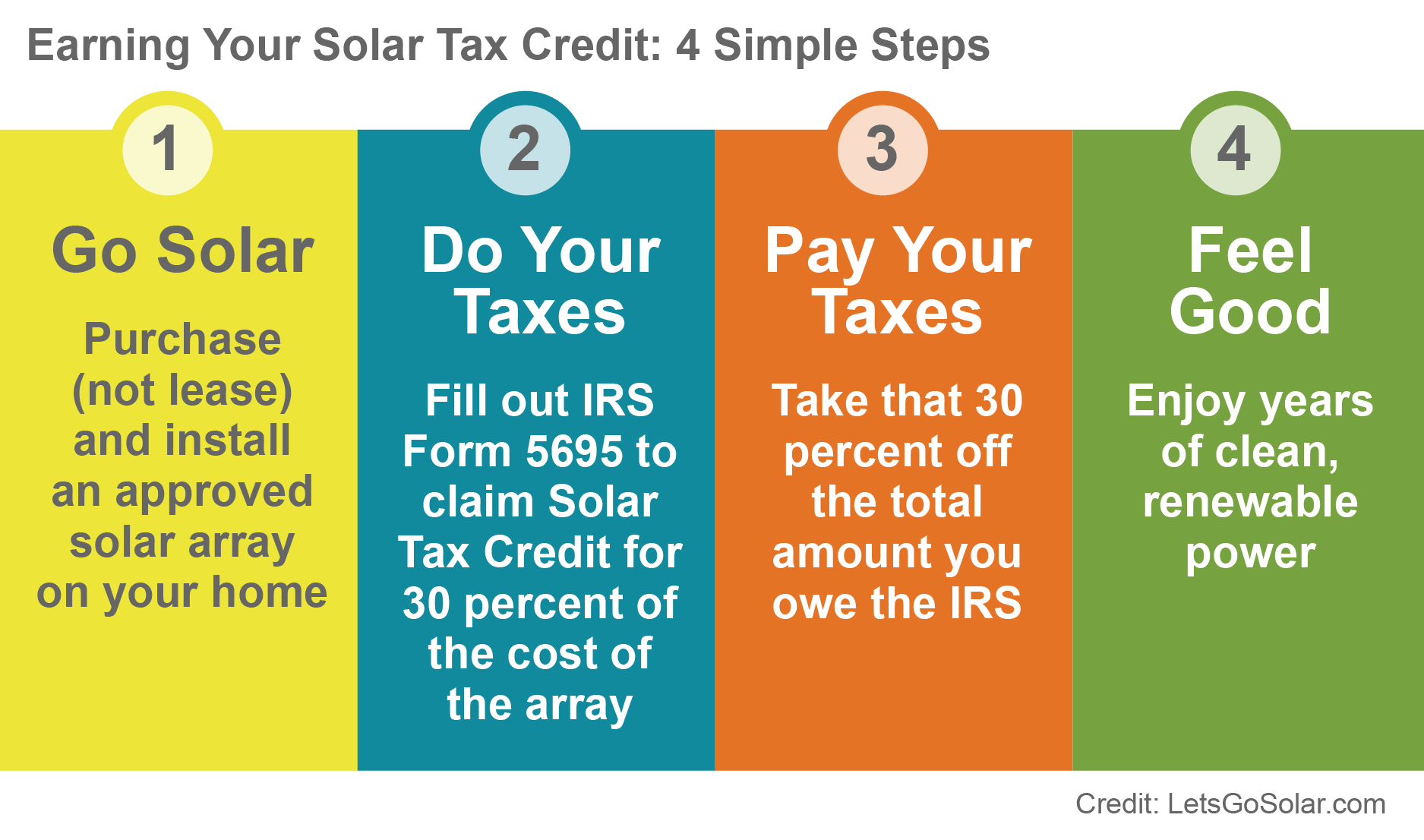

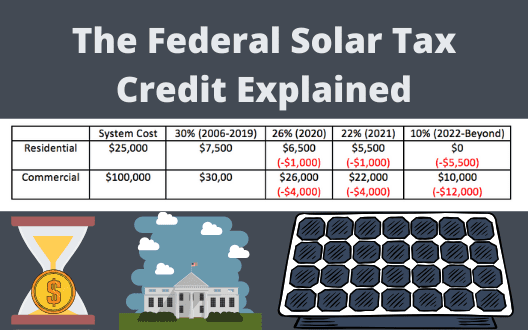

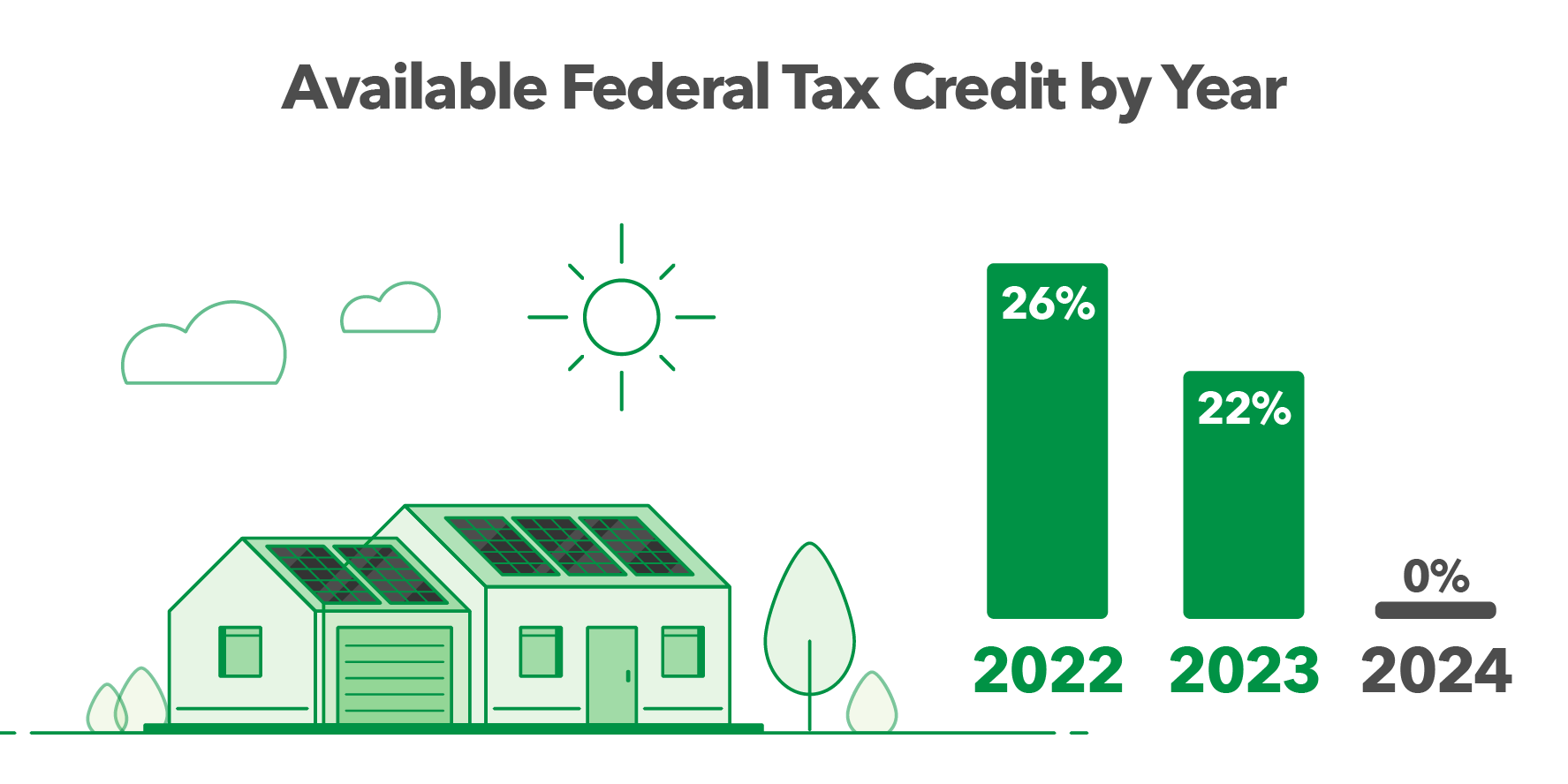

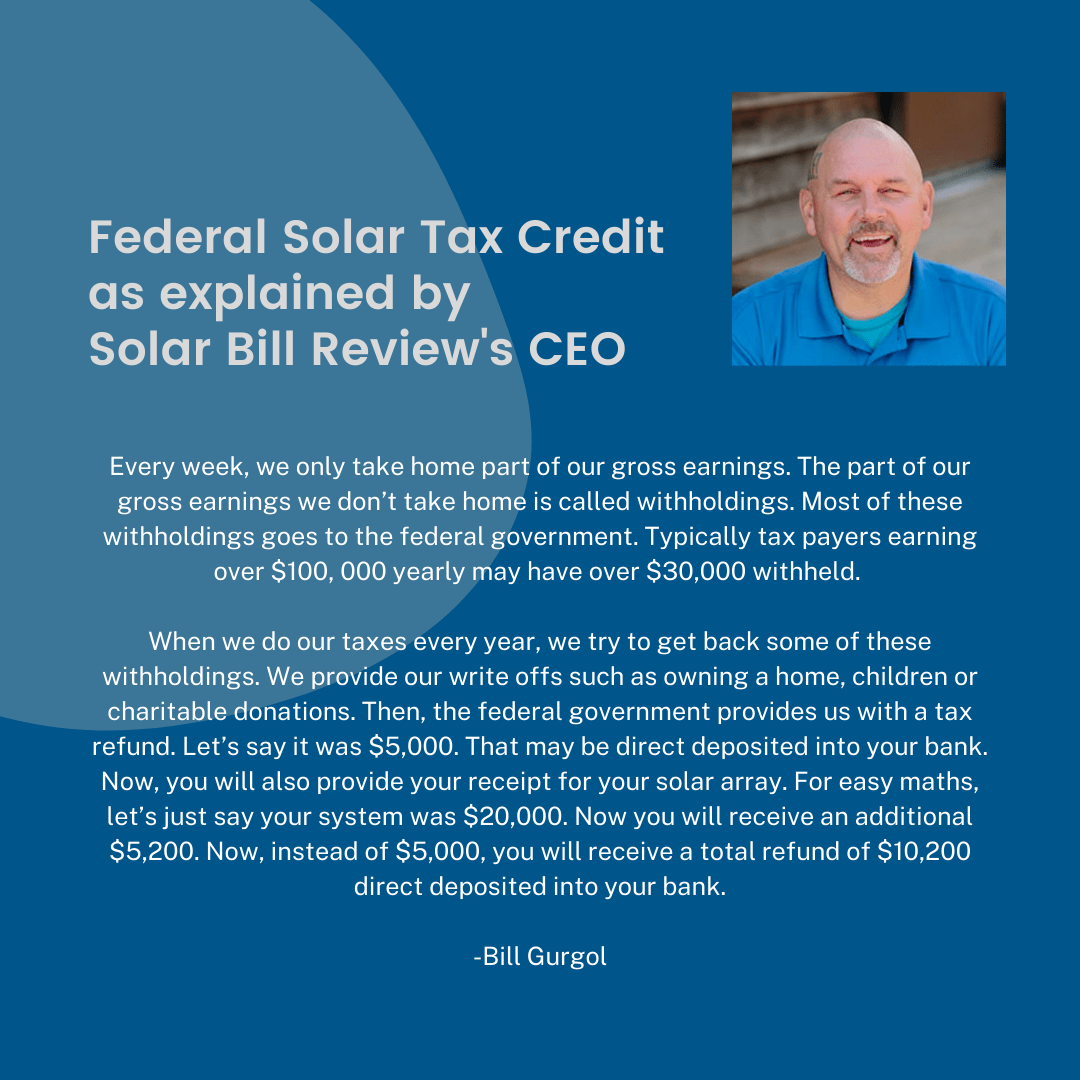

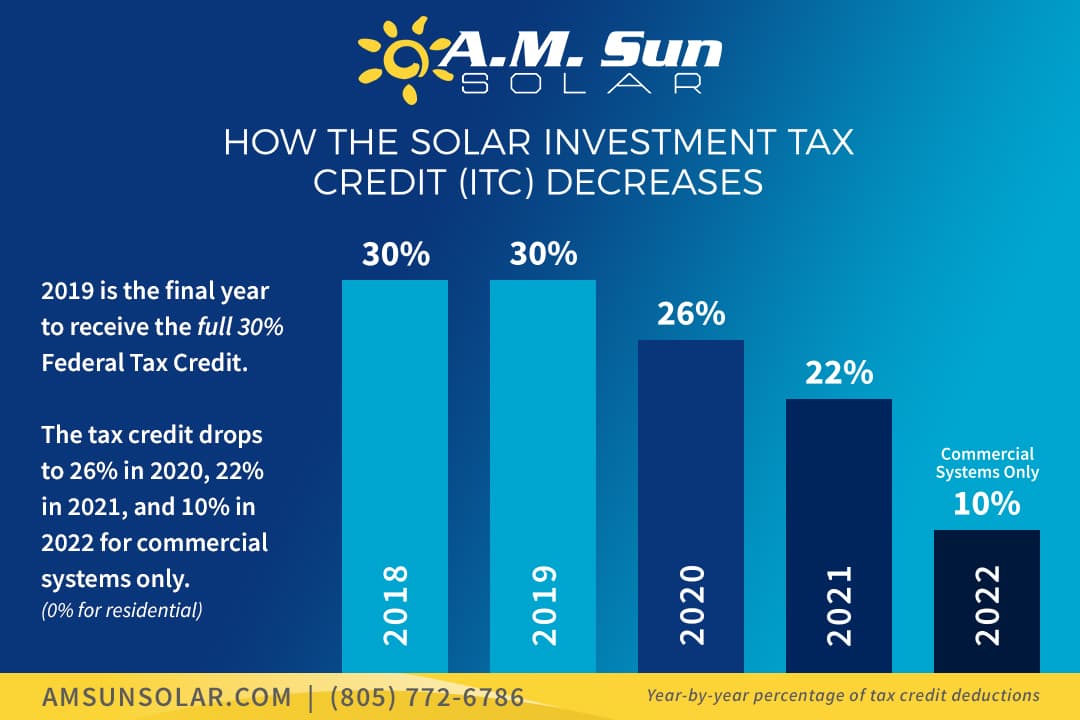

How does the California solar tax credit work California no longer has a state solar tax credit However the federal solar tax credit is worth 30 of the installed cost of a solar and or battery system This credit can be used to decrease your federal tax liability and increase your tax refund The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

The federal solar tax credit is one of the most valuable incentives in California and it s available to all residents It s designed to help reduce the effective cost of converting to solar and incentivize residents to adopt renewable energy How does the California solar tax credit work Although California does not have a state solar tax credit calculating the value of a federal solar tax credit is easy For example let s say that you purchased a solar energy and battery system for a total investment of 30 000

Download How Does The California Solar Tax Credit Work

More picture related to How Does The California Solar Tax Credit Work

What Is Solar Tax Credit How Does It Work Supreme Solar Electric

https://supreme.solar/wp-content/uploads/2022/07/solar-tax-credit.jpg

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Solar-Tax-Credit-California.jpg

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2021/10/What-is-a-Solar-Tax-Credit-R01-1089x1536.jpg

Solar tax credits encourage investments in solar energy by giving you money back at tax time The amount of tax benefit will usually be a percentage of the amount invested in solar Between the federal tax credit and other state specific incentives you can save thousands on solar panels making them well worth the investment Here s how you can lower the cost of solar if you live in California

How do California solar tax credits work There are a few different tax incentives that California residents can benefit from when they install solar However most commonly these incentives allow homeowners and businesses to deduct a portion of the costs associated with the installation of solar panels from their tax obligations The biggest solar incentive California residents can take advantage of is the federal solar tax credit also called the Investment Tax Credit ITC According to our 2024 survey of 1 000 recent solar buyers 64 took advantage of the ITC as a way to get money back

The Federal Solar Tax Credit Explained Sunshine Plus Solar

https://sunshineplussolar.com/wp-content/uploads/2020/05/The-Federal-Solar-Tax-Credit-Explained-2.png

For Homeowners

https://gasolar.memberclicks.net/assets/images/Charts/chart900width_earningsolartaxcredit.png

https://www.marketwatch.com/guides/solar/...

If you are a California resident looking to install solar panels there are multiple incentives you can take advantage of to lower the cost of your system including a property tax exclusion

https://www.solarreviews.com/solar-incentives/california

On this page we cover all of the solar and battery incentives rebates and tax credits available for your California home solar installation We also provide guidance on how low income solar power programs work

How Do I Claim The Solar Tax Credit EnergySage

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Federal Investment Solar Tax Credit Guide Learn How To Claim The

What To Know About The Solar Federal Tax Credit Toplead

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

What Is The Solar Tax Credit

What Is The Solar Tax Credit

Your Guide To Solar Federal Tax Credit

Everything You Need To Know About Federal And State Solar Tax Credits

Benefits Of The Solar Investment Tax Credit For The Everyday Consumer

How Does The California Solar Tax Credit Work - All homeowners who purchase their own solar installation are eligible to receive the 30 federal Renewable Energy Tax Credit As you can probably deduce from the name it s a tax credit not a deduction and as such is equal to a dollar for dollar rebate on your solar installation