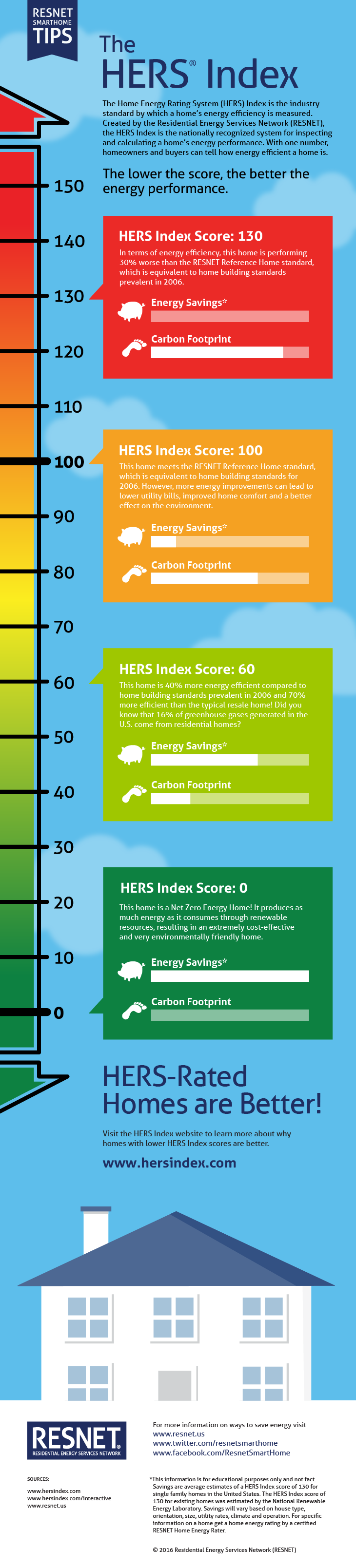

How Does The Energy Star Tax Credit Work An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more energy efficient utilize clean energy sources and lower greenhouse gas emissions that contribute to climate change and global warming If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

How Does The Energy Star Tax Credit Work

How Does The Energy Star Tax Credit Work

https://jaxbuildingscience.com/_wp/wp-content/uploads/2014/06/6815_RES_Infographic_May_v6-01.png

Top 3 Reasons To Use Energy Star Appliances

http://speedyrefrigeratorservice.com/blog/wp-content/uploads/2014/12/energy-star.jpg

How Does The Federal Solar Tax Credit Work PB Roofing Co

https://pbroofingco.com/wp-content/uploads/2021/06/GettyImages-1182411756.jpg

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star

Under the Residential Clean Energy Property Credit a taxpayer may carry forward the unused amount of the credit to reduce tax liability in future tax years Related Energy Efficient Home Improvement Qualifying Expenditures and Credit Amount Upgrading to ENERGY STAR certified systems can make homeowners eligible for up to 3 200 in tax credits annually to lower the cost of energy efficient home upgrades Accountants should guide clients through the documentation required to claim these credits for energy efficient HVAC systems ensuring compliance with the eligibility requirements

Download How Does The Energy Star Tax Credit Work

More picture related to How Does The Energy Star Tax Credit Work

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Energy Star Tax Credit Energy Efficient Product HomeRite

https://www.homeriteharrisburg.com/wp-content/uploads/2023/05/EnergyTaxCredit-Web_2-1024x1024.jpg

West Michigan s First Energy Star Version 3 Certified Home GreenHome

https://greenhomeinstitute.org/wp-content/uploads/2013/09/LEED_TM_gold_13.jpg

Two home energy tax credits that were revamped by Biden s Inflation Reduction act could save those who have made energy efficient updates to their home quite a bit on their tax bill What Some of the biggest credits available are HVAC tax credits to help you heat and cool your home more efficiently You can qualify for these credits as long as the products you install are qualified through ENERGY STAR and meet certain energy efficiency and performance requirements

Energy Star is a joint program of the U S Environmental Protection Agency and the U S Department of Energy See the Energy Star Federal Income Tax Credits and Other Incentives for Energy Efficiency website for information regarding the credits available for 2022 tax returns The Bipartisan Budget Act of 2018 extended the credits in Part I of Form 5695 Residential Energy The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to

About Us Bimbo Bakeries USA

https://bimbobakeriesusa.com/sites/default/files/inline-images/energy-star-2020.png

ENERGY STAR Labels 101 What They Mean How To Read Them

https://cdn-ww.trimarkdigital.com/wp-content/uploads/2021/05/ww-connecticut-blog-label-windows.jpg

https://www.investopedia.com/terms/e/energy-tax-credit.asp

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources

https://www.energystar.gov/.../tax-credit-information

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more energy efficient utilize clean energy sources and lower greenhouse gas emissions that contribute to climate change and global warming

The Importance Of ENERGY STAR International Laboratory Freezer Challenge

About Us Bimbo Bakeries USA

Understanding The NFRC And Energy Star Labels All Seasons Blog

HP Receives Energy Star Partner Of The Year Wirth Consulting

Energy Conservation Renewables La Mesa CA Official Website

CRC Office Obtains Energy Star Certification Christian Reformed Church

CRC Office Obtains Energy Star Certification Christian Reformed Church

Is The Energy Star Mark Becoming Meaningless TechRadar

Energy Tax Credits For 2024

FL Residents Solar Federal Tax Credit Guide SunVena Solar

How Does The Energy Star Tax Credit Work - Energy tax credits are government incentives to provide tax savings to individuals and businesses when investing in certain energy technologies Energy credits can lower the net cost of purchasing certain qualifying equipment upgrades or improvements