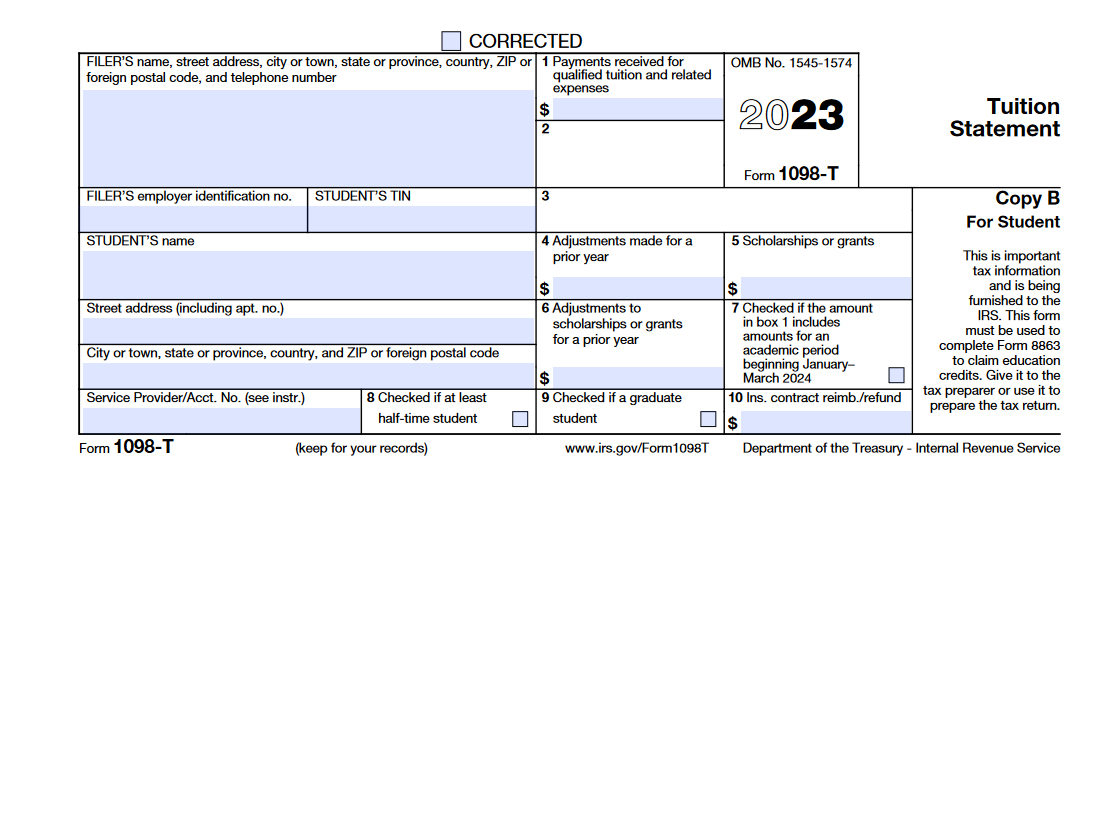

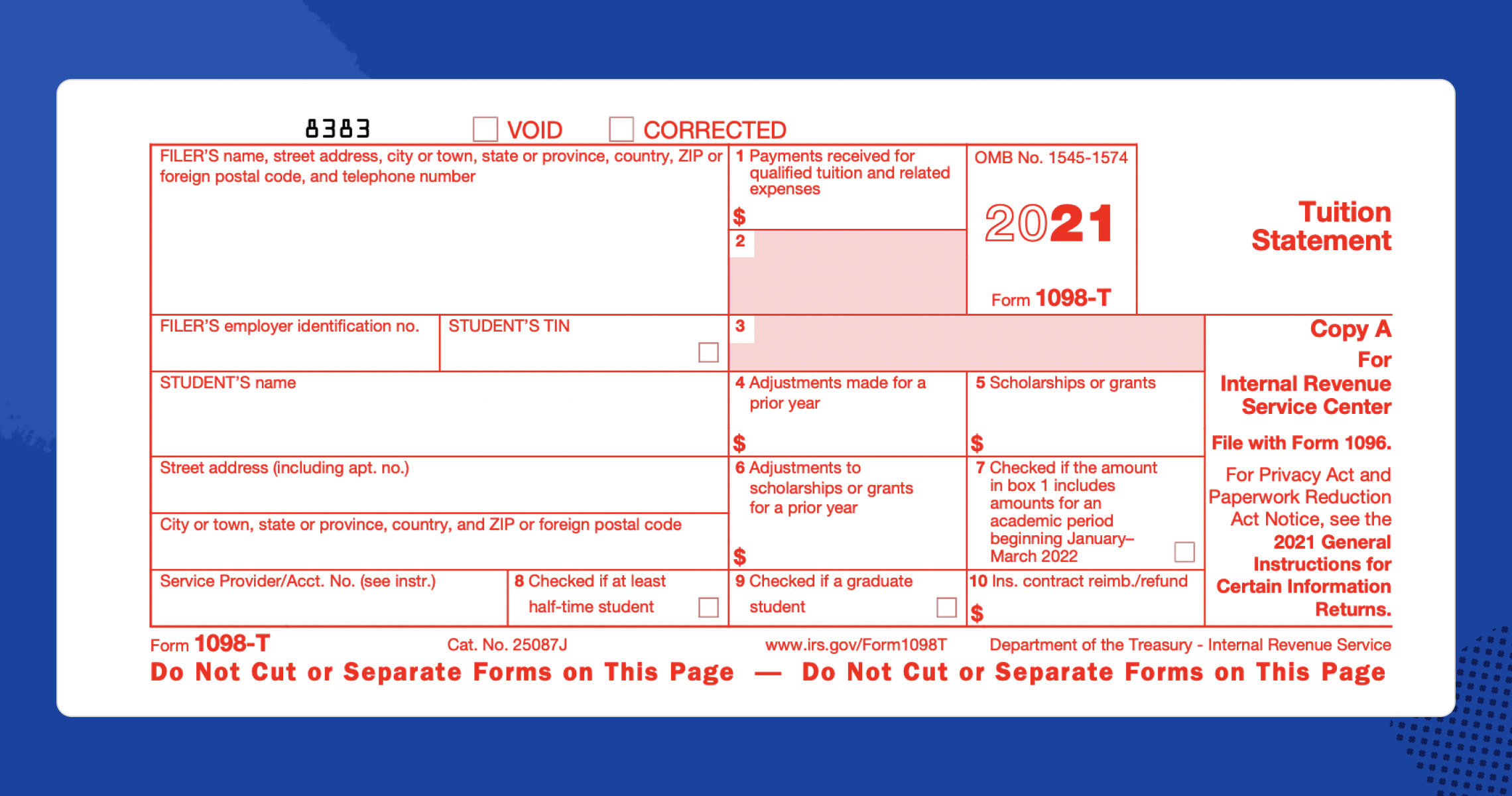

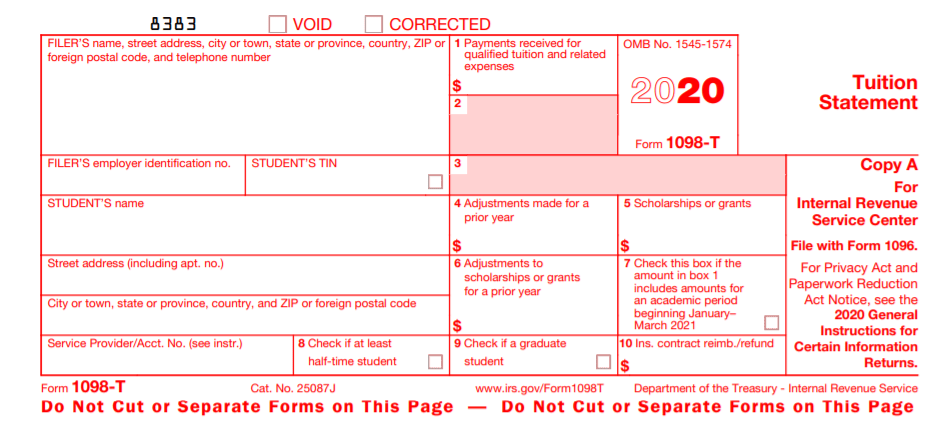

How Does Tuition Statement Affect Taxes A form 1098 T Tuition Statement is used to help figure education credits and potentially the tuition and fees deduction for qualified tuition and related expenses paid during the tax

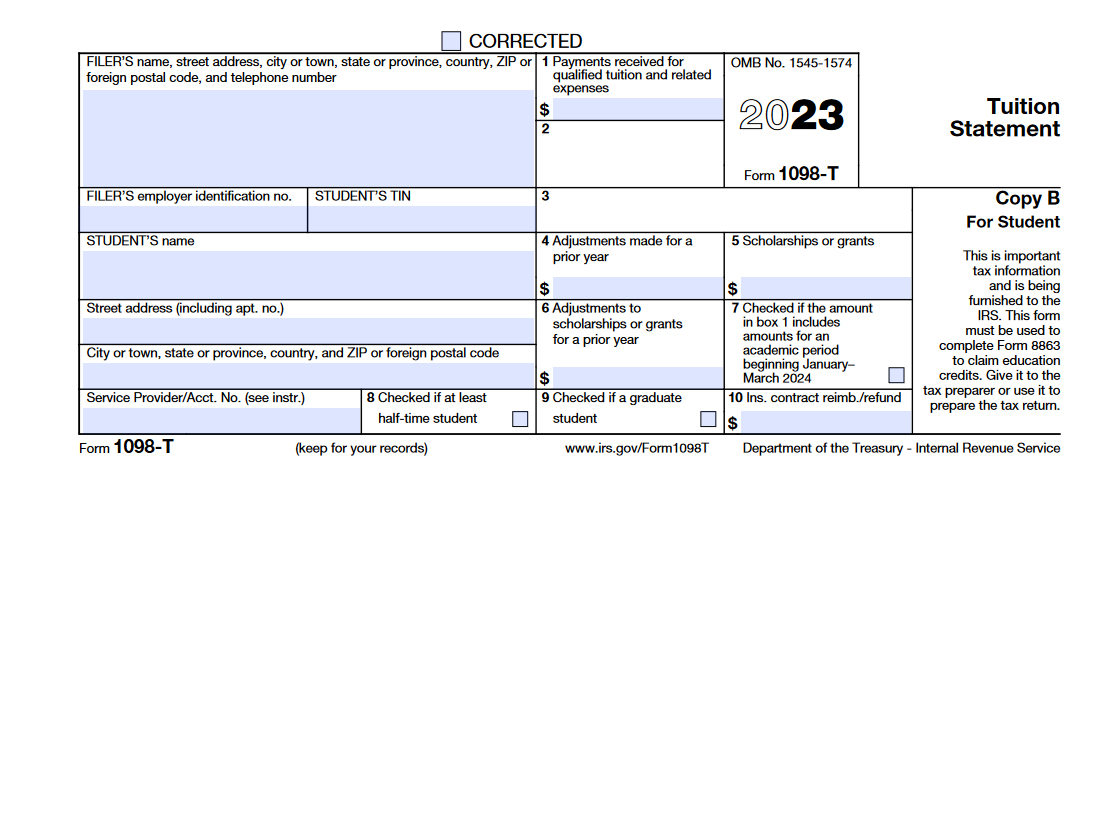

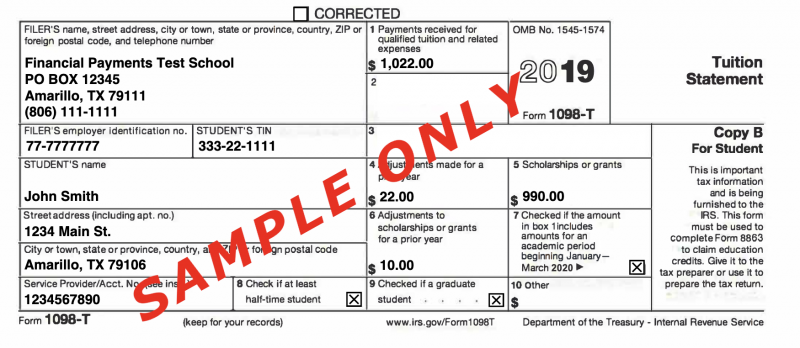

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the amounts paid for qualified tuition and related expenses which are essential for calculating potential education tax credits Forms and Instructions About Form 1098 T Tuition Statement Eligible educational institutions file Form 1098 T for each student they enroll and for whom a reportable transaction is made Insurers file this form for each individual to whom they made reimbursements or refunds of qualified tuition and related

How Does Tuition Statement Affect Taxes

How Does Tuition Statement Affect Taxes

https://i.etsystatic.com/10352854/r/il/ec9265/3618084393/il_fullxfull.3618084393_ehdc.jpg

Streetfighter 1098 Discount Dealers Save 59 Jlcatj gob mx

https://blog.pdffiller.com/app/uploads/2016/02/1098-T-form-tuition-statement.png

Sample Letter Asking For In State Tuition Doc Template PdfFiller

https://www.pdffiller.com/preview/563/655/563655828/large.png

The 1098 T tuition statement is a tax form that helps you capture one of those great tax perks you don t want to miss out on So take note students you ll get a 1098 T form a tuition statement sent from your college or university by January 31 17 Jan 2024 Are you a student or parent who has paid for college expenses this year If so you may have heard of a tax form called the 1098 T This form is used to report information about qualified tuition and related expenses as well as scholarships and grants that may affect your tax liability

The 1098 T form shows the amount you paid for qualified educational expenses during a tax year The forms are only issued by eligible institutions like colleges universities and vocational Form 1098 T Tuition Statement explained Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any fees that are required for enrollment and course materials the student was required to buy from the school are qualified expenses

Download How Does Tuition Statement Affect Taxes

More picture related to How Does Tuition Statement Affect Taxes

College Fee Receipt Template Trending Customizable Receipt Templates

https://i.pinimg.com/736x/a6/5b/db/a65bdbf0a660505c0257e544c6cae568.jpg

Tuition Assisting 101

https://www.assisting101.com/wp-content/uploads/2018/06/Tuition-1024x311.jpg

Daycare Tax Statement Tuition Receipt Child Care Forms Daycare Studio

http://static1.squarespace.com/static/5e1e35b1de448101b3f06ad3/5e1e3da023fb8c15dc45cb0b/5e49f7708497647c6292db9a/1643635963969/5.png?format=1500w

Expenses Cannot Be Paid with Tax Free Funds You cannot claim a credit for education expenses paid with tax free funds You must reduce the amount of expenses paid with tax free grants scholarships and fellowships and other tax free education help Education credits An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit

Your tuition statement gives you details about the educational expenses and gives you the opportunity to obtain tax credits and deductions Colleges and post secondary educational institutions are required to send these to students each year March 29 2022 Colleges in the United States send Form 1098 T or tuition statements to their students This tax Form is mandatory to file the taxes and it increases the tax refund It qualifies the students for education relevant tax benefits lifetime learning credit deduction on tuition fees etc What is Form 1098 T

IRS Form 1098 T Tuition Statement Forms Docs 2023

https://blanker.org/files/images/form-1098t.png

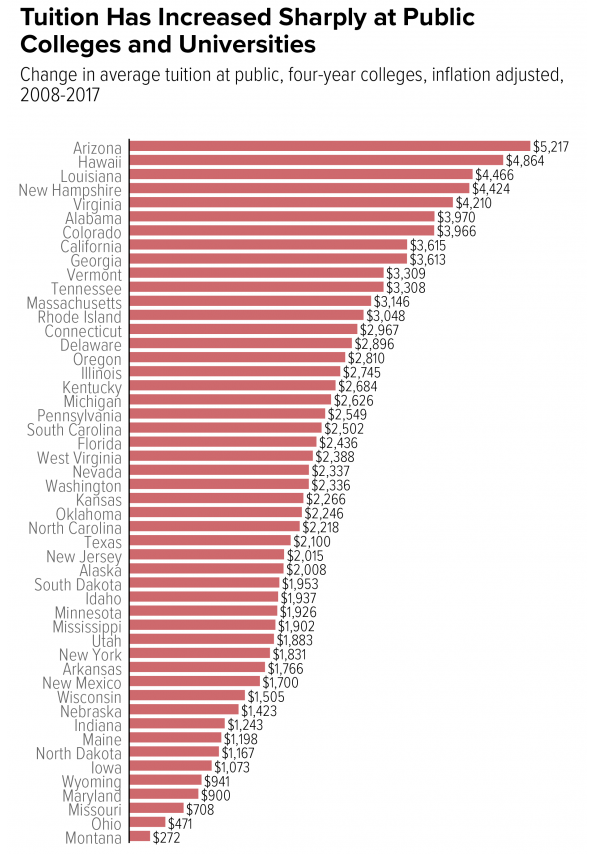

How Much Public College Tuition Costs Have Risen In Each State

https://www.collegefinancinggroup.com/wp-content/uploads/2017/08/tuition-rises-in-each-state.png

https://www.forbes.com/sites/kellyphillipserb/2015/...

A form 1098 T Tuition Statement is used to help figure education credits and potentially the tuition and fees deduction for qualified tuition and related expenses paid during the tax

https://www.taxfyle.com/blog/form-1098-t

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the amounts paid for qualified tuition and related expenses which are essential for calculating potential education tax credits

1098 T Form Printable Printable Forms Free Online

IRS Form 1098 T Tuition Statement Forms Docs 2023

Explore Our Image Of Law Firm Invoice Template Invoice Template Word

2019 Updates 1098 T Forms

You Give Us Your Money Here s What Happens Next MyOCADU Community

What Is The Employee Medicare Tax

What Is The Employee Medicare Tax

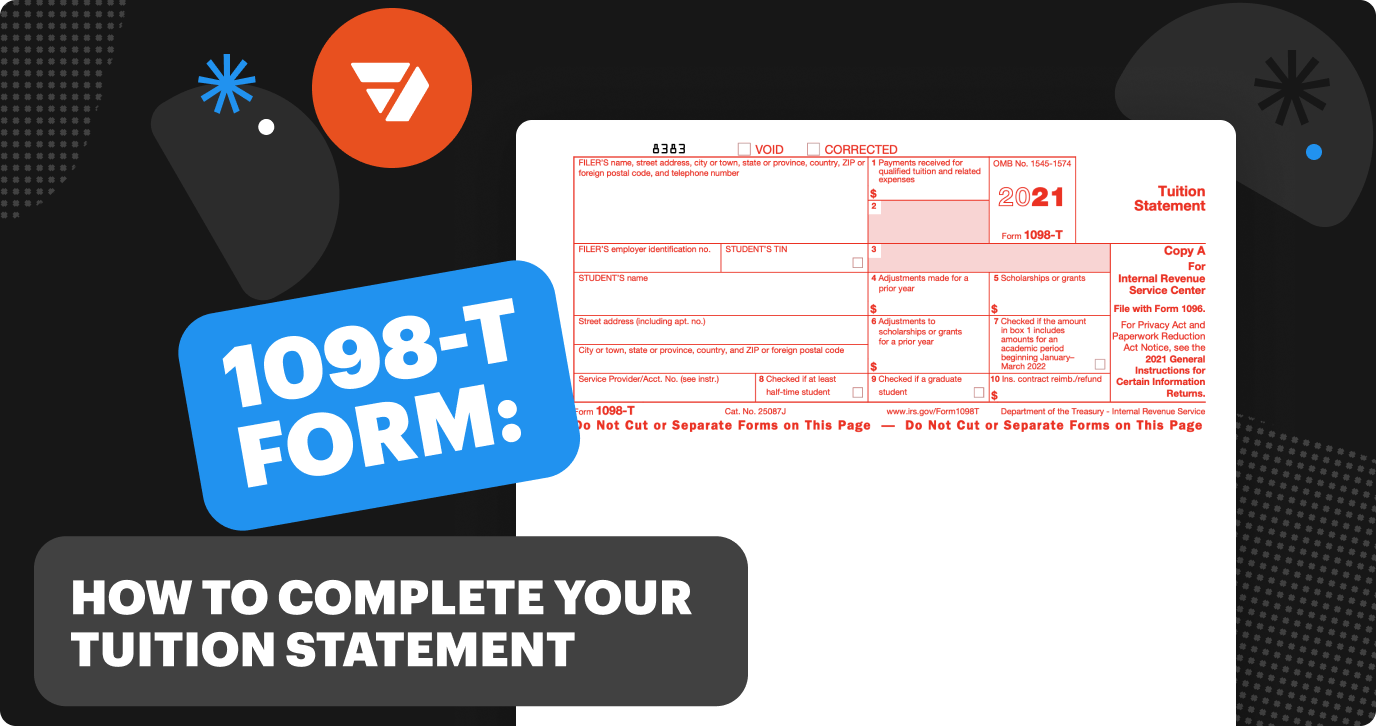

1098 T Form How To Complete And File Your Tuition Statement

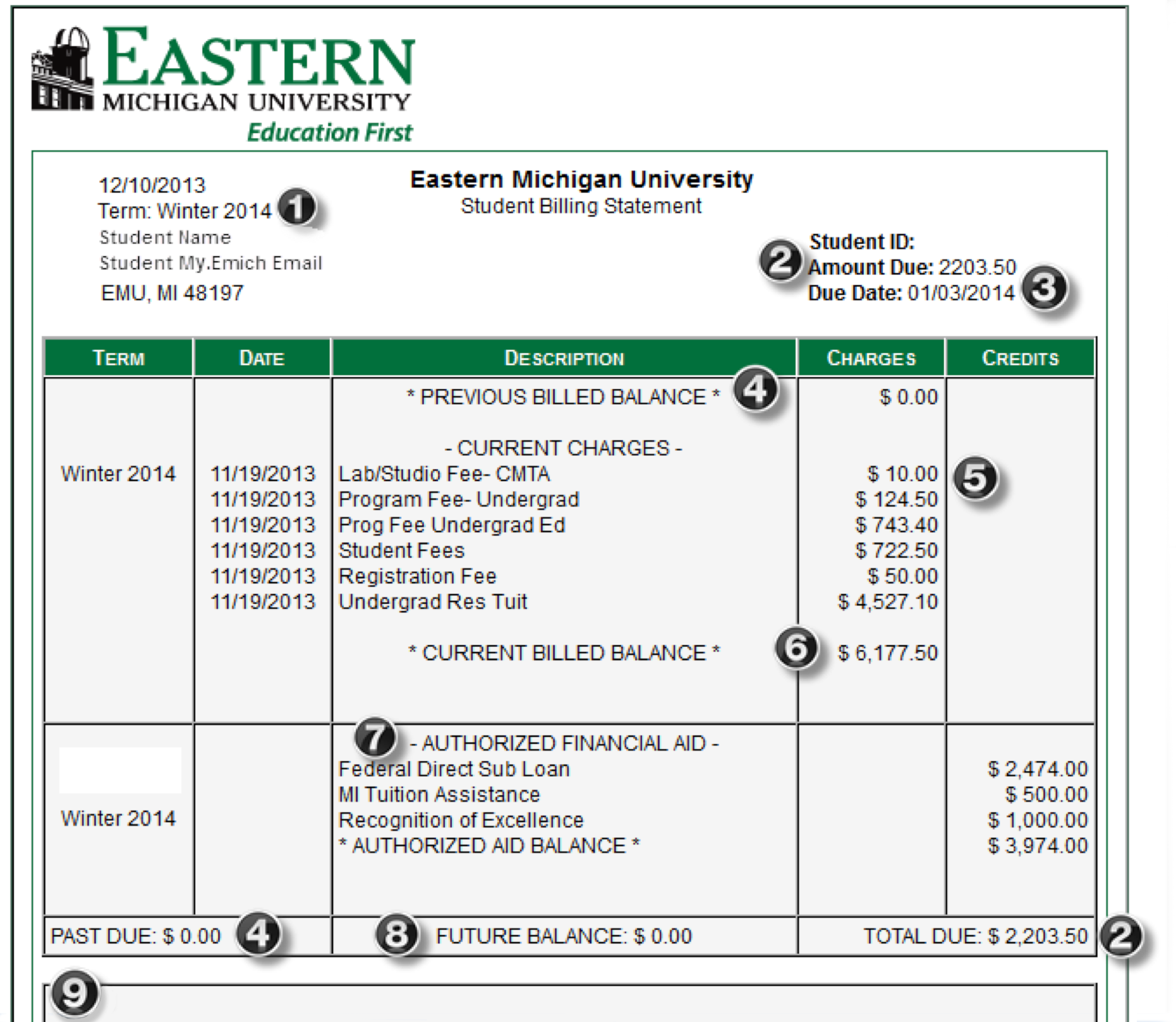

How To Read Your College Bill Or Tuition Statement Get Schooled

Understanding Your EBill Student Business Services

How Does Tuition Statement Affect Taxes - 17 Jan 2024 Are you a student or parent who has paid for college expenses this year If so you may have heard of a tax form called the 1098 T This form is used to report information about qualified tuition and related expenses as well as scholarships and grants that may affect your tax liability