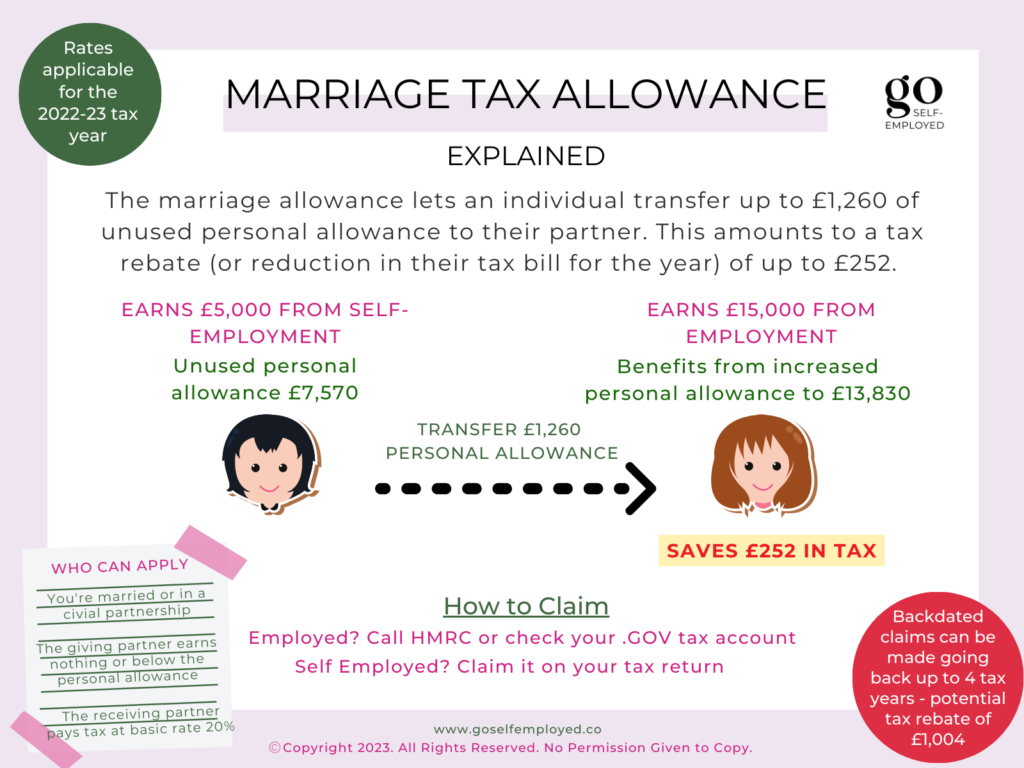

How Far Back Can I Claim Marriage Tax Allowance Verkko Yes Widows and widowers are able to claim backdated marriage tax allowance though only as far back as 2019 So if you and your

Verkko 6 huhtik 2023 nbsp 0183 32 In order to claim back to 2019 20 couples have until 5 April 2024 For 2023 24 you have until 5 April 2028 to submit a claim You can read more about time limits for claiming tax refunds on our Verkko You can backdate your claim to include any tax year since 5 April 2019 that you were eligible for Marriage Allowance If your partner has since died you can still claim

How Far Back Can I Claim Marriage Tax Allowance

How Far Back Can I Claim Marriage Tax Allowance

https://media.product.which.co.uk/prod/images/original/gm-b791b79f-3fe9-4662-aec8-d3b60742e0c3-tax-allowance-copycat-websitelead.jpeg

Am I Eligible For The Marriage Tax Allowance Times Money Mentor

https://www.thetimes.co.uk/money-mentor/wp-content/uploads/2021/07/marriage.jpg?resize=800

Marriage Tax Allowance In 2020 Get A Tax Refund Of Up To 1 188 YouTube

https://i.ytimg.com/vi/dxgVxxnqAas/maxresdefault.jpg

Verkko 19 lokak 2023 nbsp 0183 32 Remember you can only claim marriage allowance for previous years if you met the eligibility criteria in that year So you will not be eligible to backdate the Verkko 11 helmik 2022 nbsp 0183 32 Couples can apply any time backdate their claims for any of the 4 previous tax years and receive a payment of up to 163 1 220 at a time when they need it

Verkko Overview Married Couple s Allowance could reduce your tax bill by between 163 401 and 163 1 037 50 a year You can claim Married Couple s Allowance if all the following Verkko 30 maalisk 2023 nbsp 0183 32 If you re claiming Marriage Tax Allowance for the first time you could be due a whopping 163 1 242 windfall as you can claim as far back as the 2018 19 tax year But after 5 April you may no

Download How Far Back Can I Claim Marriage Tax Allowance

More picture related to How Far Back Can I Claim Marriage Tax Allowance

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Marriage Tax Allowance What Is It Kirk Rice

https://www.kirkrice.co.uk/wp-content/uploads/2016/03/Married-Couples.jpg

Benefit From Marriage Tax Allowance

https://files.websitebuilder.prositehosting.co.uk/60/36/60363dc4-5636-47d5-a094-6faaad3747d6.png

Verkko 5 huhtik 2023 nbsp 0183 32 Not sure how the marriage allowance works or how it applies to your situation Find answers to commonly asked questions about the marriage allowance and how it applies Can the marriage Verkko 14 helmik 2023 nbsp 0183 32 Better still you can claim back for the previous 4 tax years As a result the total tax rebate can be as high as 163 1 241 This total is explained later We will

Verkko 20 helmik 2015 nbsp 0183 32 If your partner s earnings are much closer to 163 10 600 they can still share the leftover bit of their allowance Say they earn 163 10 000 they can give you the Verkko 17 toukok 2023 nbsp 0183 32 There are upper and lower limits for how much can be earned and the amount of tax that can be claimed For 2021 22 married couples allowance could

How Far Back Can You Claim VAT On Expenses In UK Intertax Tax

https://polishtax.com/wp-content/uploads/2023/01/How-far-back-can-you-claim-VAT-on-expenses-in-UK-768x509.jpg

Can Pensioners Claim Marriage Tax Allowance Money Back Helpdesk

https://moneybackhelpdesk.co.uk/images/articles/Marriage/_articleHero/Tax-Accounts-Vector.webp

https://www.moneysavingexpert.com/family/m…

Verkko Yes Widows and widowers are able to claim backdated marriage tax allowance though only as far back as 2019 So if you and your

https://www.litrg.org.uk/tax-guides/tax-basics/…

Verkko 6 huhtik 2023 nbsp 0183 32 In order to claim back to 2019 20 couples have until 5 April 2024 For 2023 24 you have until 5 April 2028 to submit a claim You can read more about time limits for claiming tax refunds on our

Marriage Tax Allowance UK Accountants North Wales Hale

How Far Back Can You Claim VAT On Expenses In UK Intertax Tax

Travelling Allowance To The Officials Deployed For Election Duty

Married Tax Allowance 2024 Ashil Calypso

Tax Claimer Tax Claimer

Marriage Allowance Should I Claim Alpha Business Services

Marriage Allowance Should I Claim Alpha Business Services

How Far Back Can I Claim Underpayment Of Wages 2024 Updated

Can Pensioners Claim Marriage Tax Allowance Money Back Helpdesk

Let Property Campaign Landlords With Unpaid Tax Lindsay Henson

How Far Back Can I Claim Marriage Tax Allowance - Verkko In a marriage tax allowance claim you could be refunded up to 163 1 150 How Long Does It Take If My Claim Is To Be A Success It can take up to two months for any