How Is Business Personal Property Tax Calculated In Texas Business Personal Property Cost Schedules Below are some examples of personal property cost schedules developed by different appraisal districts around the statement

Property Taxation of Business Personal Property Evaluate the property tax as it applies to business personal property and the current 500 exemption Quantify the Neglecting business personal property tax can lead to compliance issues tax penalties and missed planning opportunities This guide defines business personal

How Is Business Personal Property Tax Calculated In Texas

How Is Business Personal Property Tax Calculated In Texas

https://derickjameshome.files.wordpress.com/2021/03/understanding-business-personal-property-tax.jpg

2024

https://img.cs-finance.com/img/the-basics/how-to-calculate-income-tax-expense.jpg

Property Tax Notice Statement Mackenzie Gartside Associates

https://i2.wp.com/www.comoxmortgages.com/wp-content/uploads/2021/09/Property-Tax-Notice-example.png?ssl=1

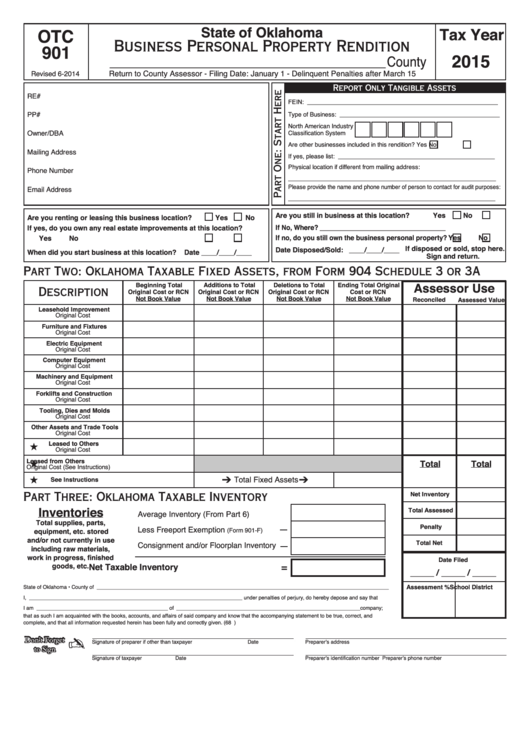

Texas law requires property values used in determining taxes to be equal and uniform It establishes the process for local officials to follow in determining property values setting Texas requires filing an annual business personal property tax return that lists all assessable personal property owned by a business as of January 1 The

Owners of business personal property worth more than 20 000 must file a rendition with 1 the owner s name and address 2 a description of the property for inventory 3 a Per Section 22 01 a of the Texas Property Tax Code general information regarding the busi ness shall be provided including the business name owner name location and

Download How Is Business Personal Property Tax Calculated In Texas

More picture related to How Is Business Personal Property Tax Calculated In Texas

What Is Business Personal Property Insurance Small Business Trends

https://media.smallbiztrends.com/2022/04/what-is-business-personal-property-insurance-850x476.png

Property Tax Bill Examples

https://www.tax.state.ny.us/images/orpts/proptaxbills/upstate-2.jpg

Difference Between Sa302 And Tax Year Overview What You Provide Your

https://www.spondoo.co.uk/wp-content/uploads/2022/04/How-to-view-download-and-print-SA032-Tax-Calculation-and-Tax-overview-3.png

Business Personal Property tax is an ad valorem tax on the tangible personal property that is used for the production of income The State of Texas has jurisdiction to tax Handbook of Texas Property Tax Rules 19 Stratification Stratification divides the range of information for property in a district or property category into intervals and lists the

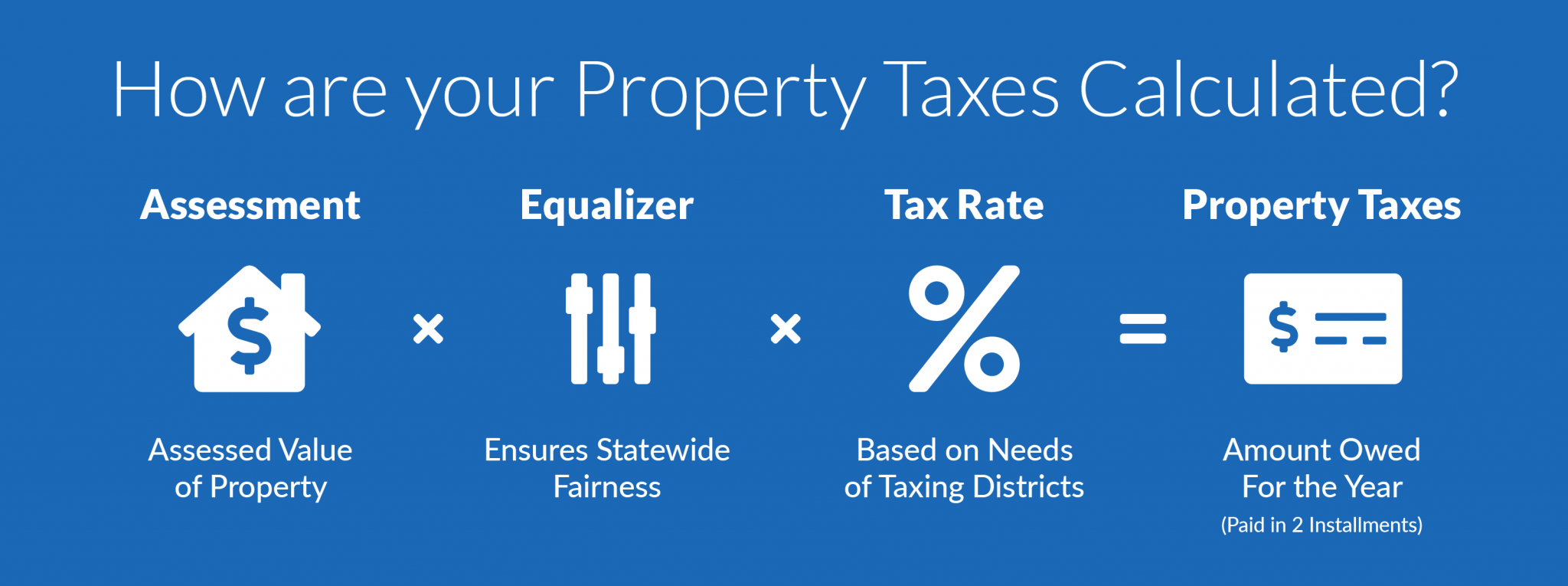

While the way each state defines personal property is different the final steps are fairly universal First you identify the total value of your taxable personal property in a given How is Business Personal Property Tax Calculated The amount of business personal property tax that you owe in Texas is based on the value of your property The county

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

What Is Business Personal Property Tax KE Andrews Since 1978

https://www.keatax.com/wp-content/uploads/2023/06/BuildingPhoto-11-5.jpg

https://comptroller.texas.gov/taxes/property-tax/personal-schedules

Business Personal Property Cost Schedules Below are some examples of personal property cost schedules developed by different appraisal districts around the statement

https://ttara.org/wp-content/uploads/2018/09/TTARA...

Property Taxation of Business Personal Property Evaluate the property tax as it applies to business personal property and the current 500 exemption Quantify the

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

How High Are Property Taxes In Your State American Property Owners

Fillable Business Personal Property Tax Return Form Printable Pdf

How Is Commercial Property Tax Calculated

Fillable Business Personal Property Tax Return Form Printable Pdf

How Is Property Tax Calculated Use An Example To Teach You How Much

How Is Property Tax Calculated Use An Example To Teach You How Much

FAQs HouseAppeal

What Is Business Personal Property Tax POConnor

What Is A Taxpayer Identification Number 5 Types Of Tins Images And

How Is Business Personal Property Tax Calculated In Texas - Per Section 22 01 a of the Texas Property Tax Code general information regarding the busi ness shall be provided including the business name owner name location and