How Is Fuel Benefit Tax Calculated Use form P11D WS2 and P11D WS2b if you re an employer and need to work out the cash equivalent of providing car and fuel benefit to an employee

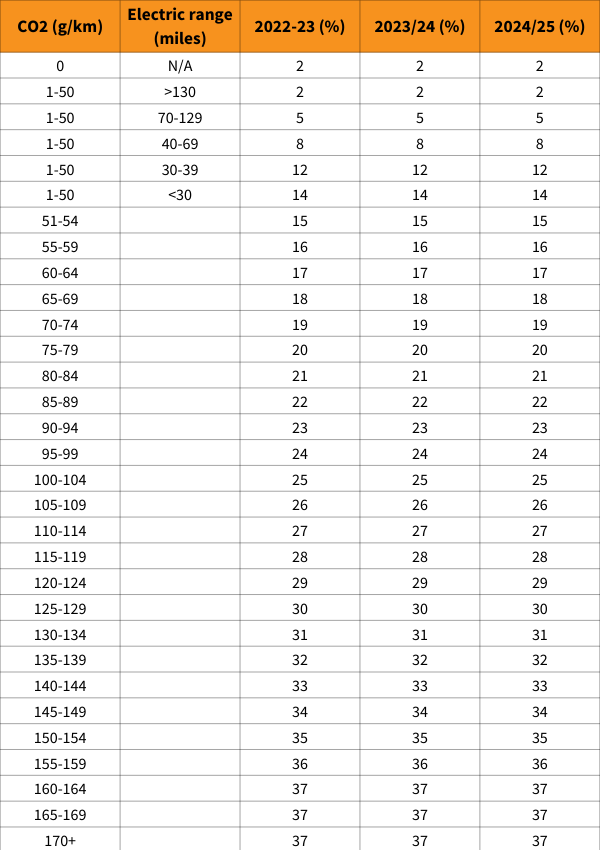

To calculate the fuel benefit tax you ll need to know the benefit in kind BiK banding of your company car You can find this information in the Fleet News Company Car Tax How is the company car fuel benefit calculated Company car fuel benefit is the tax you pay to HMRC on the free for personal use fuel you get from your employer Like all HRMC taxes there is a calculation that is used

How Is Fuel Benefit Tax Calculated

How Is Fuel Benefit Tax Calculated

https://static.toiimg.com/thumb/msid-62634413,width-1070,height-580,imgsize-130310,resizemode-6,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Business Mileage Rates Gateway2Lease Blog

https://images.gateway2lease.com/blog/blog-are-you-using-the-correct-business-rates.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

You can calculate taxable value using commercial payroll software Or you can use HMRC s company car and car fuel benefit calculator Using the HMRC calculator Choose fuel How is fuel benefit calculated At the start of each tax year the government set the Fuel Benefit Multiplier which is roughly based on the cost of an average company car

The benefit in kind or BIK tax is calculated by your car s CO2 emission band and multiply it by the fuel benefit charge multiplier For example 26 x 24 600 Calculate the company car tax and any fuel benefit charge on your actual income Just select your vehicle or enter the P11D value and BIK rate to calculate Instantly compare

Download How Is Fuel Benefit Tax Calculated

More picture related to How Is Fuel Benefit Tax Calculated

Tax Saving Salary Components BetterPlace

https://www.betterplace.co.in/blog/wp-content/uploads/2020/02/19-1.jpg

Fuel And Fuel Taxes Trucking Blogs ExpeditersOnline

https://www.expeditersonline.com/cms/uploads/2022-3rd-quarter-ifta-fuel-tax-rates-4-august-2022_001.png

Government Is Now Eyeing To Suspend Excise Tax On Fuel CarGuide PH

https://4.bp.blogspot.com/-U2cT_mrQd4k/WwZDclGbIRI/AAAAAAAAyDE/CFMgMZH1azAVzqvf6MoDowVjbqdEyWjIgCLcBGAs/s1600/fuel_filling.jpg

Fuel benefit occurs when an employer pays for private fuel such as for travelling to and from work for an employee The value of the benefit and the amount of tax an employee The fuel benefit charge is calculated by multiplying the fuel benefit charge multiplier by the car s appropriate percentage that is the CO emissions derived percentage used to

Fuel benefit tax is based on a flat annual rate that s 27 800 in the 2024 25 financial year The percentage of that figure that you have to pay in tax is tied to your How do you calculate tax on fuel Tax on fuel is calculated based on the value of private fuel benefit which is determined by HMRC fuel benefit charge rates

How Is Company Tax Calculated Lawpath

https://images.lawpath.com/2019/07/tax.jpg

How Is Fuel Consumption Calculated Autodeal

https://www.autodeal.com.ph/custom/blog-post/header/5bff3f7ed2637.jpg

https://www.gov.uk/government/publications/paye...

Use form P11D WS2 and P11D WS2b if you re an employer and need to work out the cash equivalent of providing car and fuel benefit to an employee

https://www.fleetnews.co.uk/fleet-faq/how-do-i-calculate-fuel-benefit-tax

To calculate the fuel benefit tax you ll need to know the benefit in kind BiK banding of your company car You can find this information in the Fleet News Company Car Tax

Company Car Fuel Benefits Explained Example GB Vehicle Leasing

How Is Company Tax Calculated Lawpath

Calculating Social Security Taxable Income TaxableSocialSecurity

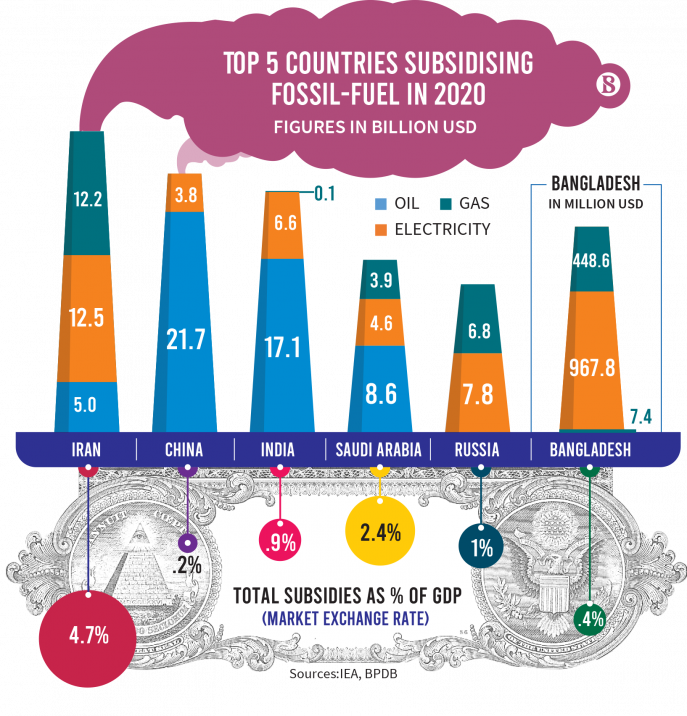

Can We Say no To Fuel Subsidies

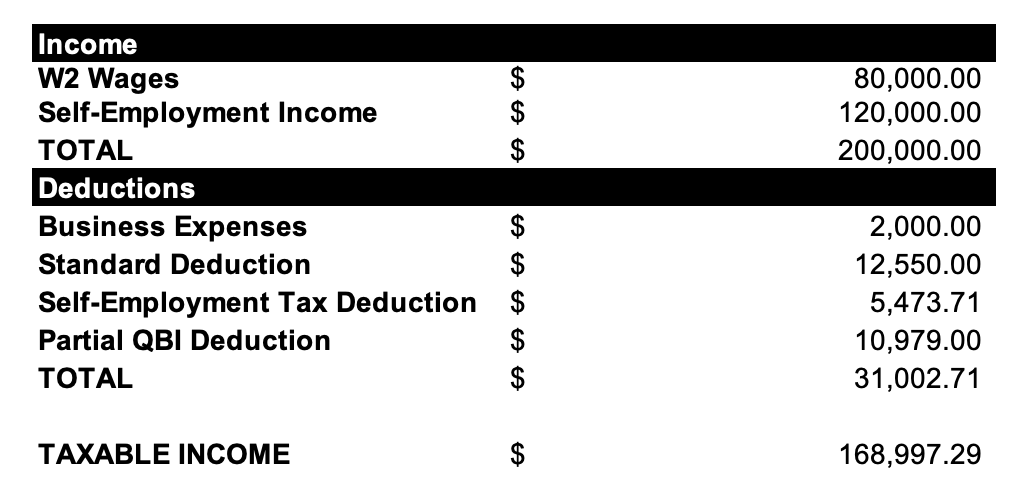

Maximizing Your Tax Benefits As A Self Employed Pro 2023

How Capital Gains Tax Is Calculated DG Institute

How Capital Gains Tax Is Calculated DG Institute

How Is Agricultural Income Tax Calculated With Example Updated 2022

Car Fuel Benefit Charge Pay back To Save Tax Total Accounting

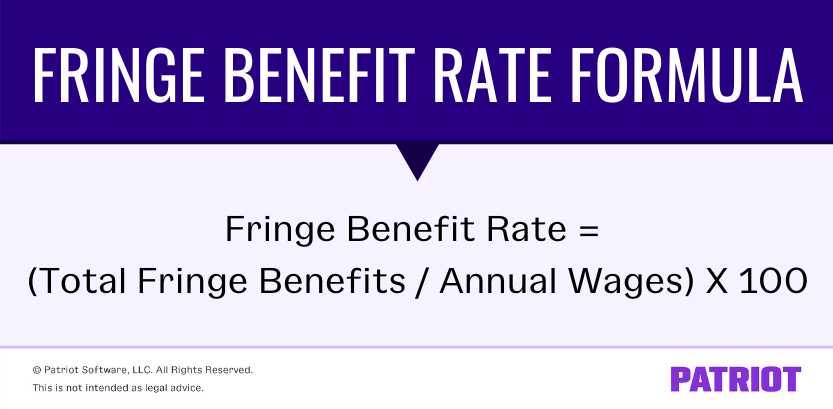

What Is A Fringe Benefit Rate Overview How To Calculate

How Is Fuel Benefit Tax Calculated - You can calculate taxable value using commercial payroll software Or you can use HMRC s company car and car fuel benefit calculator Using the HMRC calculator Choose fuel