How Is Fuel Tax Credit Calculated Updated September 28 2021 Reviewed by Margaret James Fact checked by Suzanne Kvilhaug What Is the Fuel Tax Credit The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a

Work out the amount of your fuel tax credits in dollars Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the Finance Taxation Claim fuel tax credits Last Updated 18 January 2024 If your business uses fuel you may be able to claim credits for the fuel tax included in the

How Is Fuel Tax Credit Calculated

How Is Fuel Tax Credit Calculated

https://www.accountancygroup.com.au/wp-content/uploads/fuel-tax.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

Fuel Tax Credit Changes HTA

https://www.hta.com.au/wp-content/uploads/2022/05/Fuel-tax-credit-changes-1.png

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits through What do you get Credit for fuel tax Who is this for Businesses who use fuel in their operations Overview Fuel tax credits provides a credit for the fuel tax

Last updated 5 December 2023 If your business is registered for fuel tax credits you can use the fuel tax credit calculator to check the fuel tax credits for the fuel acquired for The calculation of excise duty and customs duty is based on the cents per litre rate CPL rate The fuel excise tax applies to all types of fuel which include diesel

Download How Is Fuel Tax Credit Calculated

More picture related to How Is Fuel Tax Credit Calculated

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

https://www.investopedia.com/thmb/3sJEd4MIrb_d4zhZSOvSwD0vw6I=/750x0/filters:no_upscale():max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png

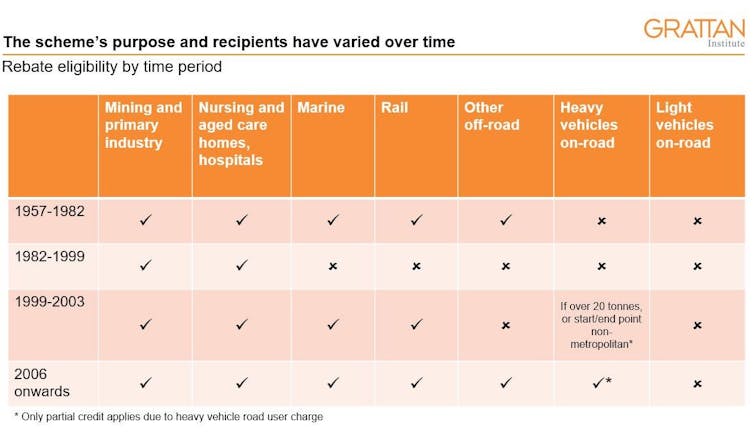

Reform A Fuel Tax Credit Scheme With No Real Rationale

https://images.theconversation.com/files/508032/original/file-20230203-2044-mgwnqd.JPG?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

Fuel And Fuel Taxes Trucking Blogs ExpeditersOnline

https://www.expeditersonline.com/cms/uploads/2022-3rd-quarter-ifta-fuel-tax-rates-4-august-2022_001.png

Contents What is the fuel tax credit Eligibility criteria for fuel tax credits Fuels ineligible for tax credit What are the fuel tax credit rates in 2023 for businesses How to calculate You ll need to accurately report the type and amount of fuel used and calculate the credit based on current tax rates for each fuel type It s also important to

Tax credits calculated on Form 4136 directly reduce your tax obligations How to use Form 4136 The form lists dozens of uses in which fuel taxes either don t apply or are reduced The credit is calculated based on the amount of eligible fuel consumed during a specific period and it allows for a refund or reduction of the fuel excise

Fuel Tax Credit Calculator CairenAbsalat

https://i.pinimg.com/736x/89/79/57/89795702af255dbba2d134a53e547353.jpg

How To Calculate My Credit Score The Fancy Accountant

https://fancyaccountant.com/wp-content/uploads/2020/06/calculate-credit-score.png

https://www.investopedia.com/terms/f/f…

Updated September 28 2021 Reviewed by Margaret James Fact checked by Suzanne Kvilhaug What Is the Fuel Tax Credit The Credit for Federal Tax Paid on Fuels Fuel Tax Credit is a

https://www.ato.gov.au/businesses-and...

Work out the amount of your fuel tax credits in dollars Do this by multiplying the eligible quantity of fuel by the relevant fuel tax credit rate when you acquired the

Fuel Tax Credit Confusion Cause For Regional Angst Prime Mover Magazine

Fuel Tax Credit Calculator CairenAbsalat

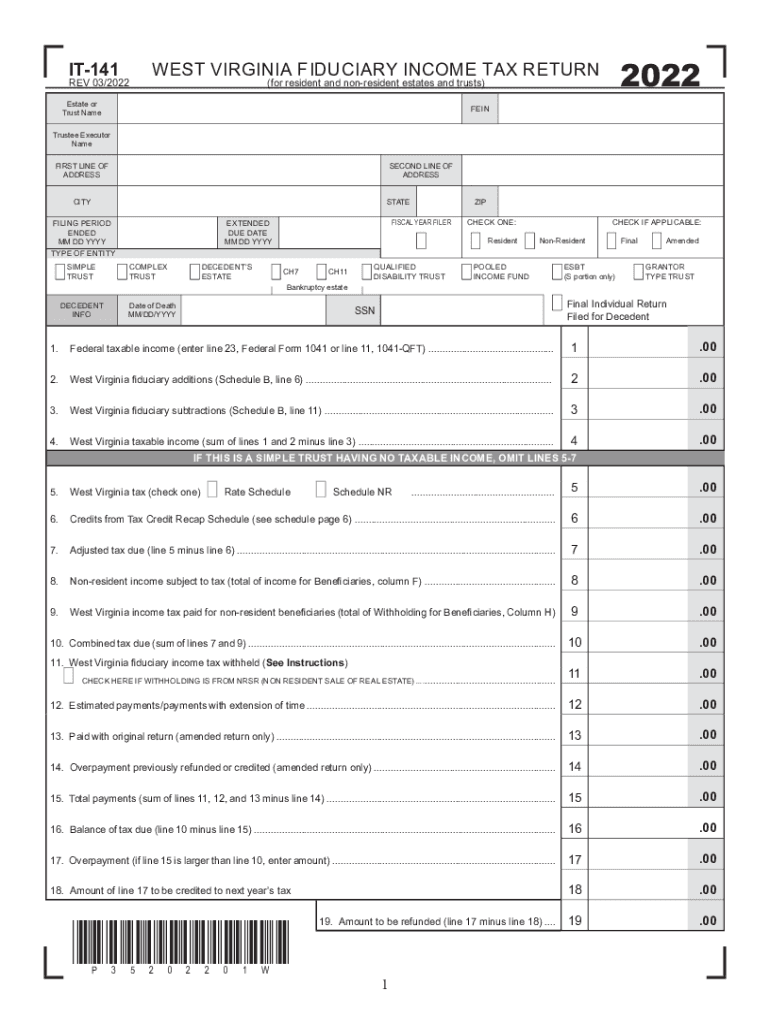

Income Tax Virginia 2022 2024 Form Fill Out And Sign Printable PDF

What Is The Fuel Tax Credit LiveWell

Add A New Fuel Tax Rate Agrimaster

Opinion Before We Invest Billions In This Clean Fuel Let s Make Sure

Opinion Before We Invest Billions In This Clean Fuel Let s Make Sure

Fuel Tax Credit Calculation

Fuel Tax Credit Calculation Worksheet

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

How Is Fuel Tax Credit Calculated - Fuel tax credits are assessable income and should be disclosed in the tax return as assessable government industry payments They are also treated as installment