How Is Nys Star Credit Calculated Follow these steps to calculate the STAR savings amount Find your Maximum Enhanced STAR exemption savings Determine the total amount of school

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program If you are a STAR recipient you receive the benefit in one of two ways The STAR credit program open to any eligible homeowner whose income is 500 000

How Is Nys Star Credit Calculated

How Is Nys Star Credit Calculated

https://www.tax.ny.gov/images/press/addtchildeiccheck.jpg

How To Calculate My Credit Score The Fancy Accountant

https://fancyaccountant.com/wp-content/uploads/2020/06/calculate-credit-score-1024x629.png

Changes To The NYS STAR Program

https://static.wixstatic.com/media/74c4f9_d3d933188d8a4ccf85c311e761b3dc64~mv2_d_8118_5412_s_4_2.jpeg/v1/fill/w_1000,h_667,al_c,q_85,usm_0.66_1.00_0.01/74c4f9_d3d933188d8a4ccf85c311e761b3dc64~mv2_d_8118_5412_s_4_2.jpeg

How it Works STAR helps lower the property taxes for eligible homeowners who live in New York State If you apply and are eligible you ll get a STAR credit check STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner occupied primary residences This state financed

The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes 2024 STAR Handout PDF Register The STAR Program takes two forms the Basic STAR and the Enhanced STAR The Basic STAR is open to the primary residence of any New York State resident and exempts

Download How Is Nys Star Credit Calculated

More picture related to How Is Nys Star Credit Calculated

New York s STAR Rebate Program Undergoes Changes

https://i0.wp.com/hellertaxgrievance.com/wp-content/uploads/2019/08/new-york-star-program.png

How Are Credit Scores Calculated YouTube

https://i.ytimg.com/vi/snujslCkQBY/maxresdefault.jpg

How To Calculate My Credit Score The Fancy Accountant

https://fancyaccountant.com/wp-content/uploads/2020/06/calculate-credit-score.png

Calculate your income for STAR by doing the following IRS Form 1040 Federal Adjusted Gross Income Line 11 minus the taxable portion of IRA distributions Line 4b NYS It is important to plan accordingly and understand your eligibility for the STAR program Additionally if your income is 250 000 00 or less and you currently

Homeowners may be eligible for a School Tax Relief STAR credit or exemption The STAR Credit is offered by New York State in the form of a rebate check The STAR New applicants who qualify for STAR will register with New York State instead of applying with their assessor If they qualify they will receive a STAR credit in the form of a

NEW YORK STATE DEPARTMENT OF LABOR RELEASES SURVEY FINDINGS ON STATE OF

https://dol.ny.gov/profiles/custom/webny/themes/custom/webny_theme/images/nys-default.png

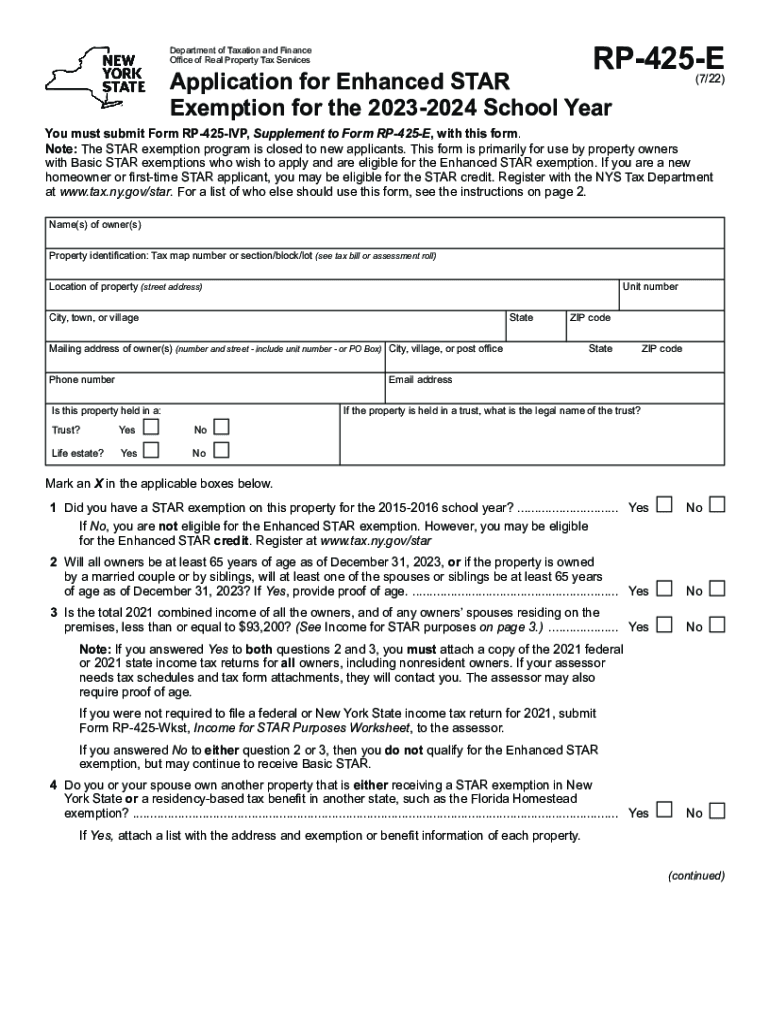

2022 Form NY RP 425 E Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/624/625/624625208/large.png

https://www.tax.ny.gov/pit/property/star/enhanced...

Follow these steps to calculate the STAR savings amount Find your Maximum Enhanced STAR exemption savings Determine the total amount of school

https://www.tax.ny.gov/star

The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners If you are eligible and enrolled in the STAR program

The Finn Mindset Inflation Protection

NEW YORK STATE DEPARTMENT OF LABOR RELEASES SURVEY FINDINGS ON STATE OF

Calculate Credit Score Pie Chart Leah Ingram

NY Sends Tiny Checks To Pay Interest On Last Year s Tax Refund

How Does Your Credit Score Stack Up

How Is A Credit Score Calculated YouTube

How Is A Credit Score Calculated YouTube

Tips For Managing Your Credit Score AwardWallet Blog

How Much Is The Nys Star Exemption

NY Sends Tiny Checks To Pay Interest On Last Year s Tax Refund

How Is Nys Star Credit Calculated - The School Tax Relief STAR program provides eligible homeowners in New York State with relief on their property taxes 2024 STAR Handout PDF Register