How Is Property Tax Calculated In Nj County municipal and school budget costs determine the amount of property tax to be paid A town s general tax rate is calculated by dividing the total dollar amount it needs to

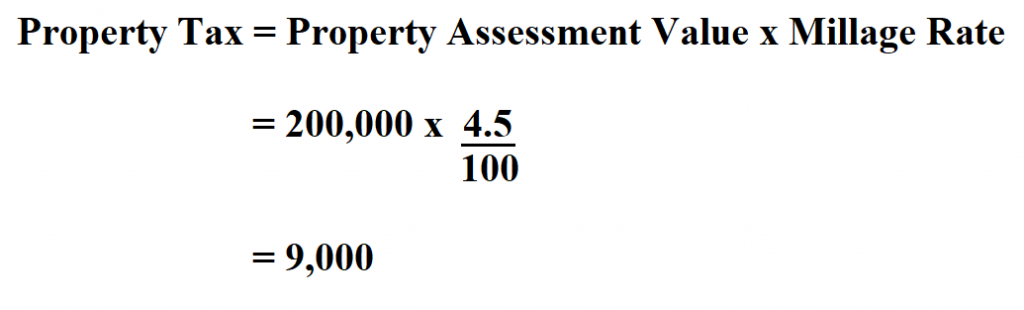

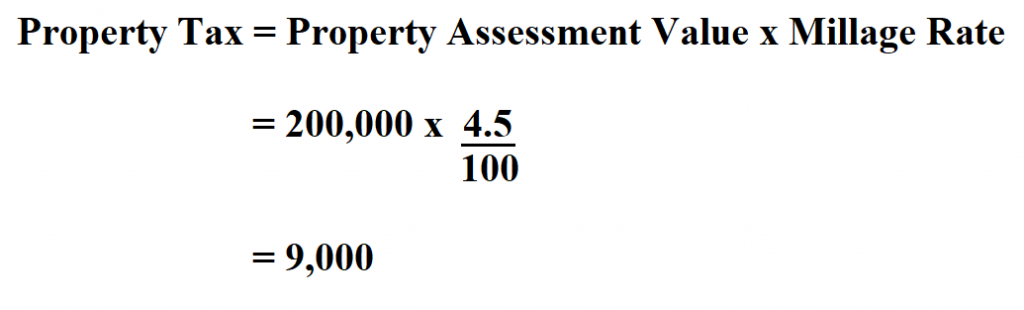

New Jersey s real property tax is ad valorem meaning that each person pays tax based on the value of the property they own New Jersey courts have determined full and fair value In other words Tax Levy Ratables Tax Rate New Jersey practice is to calculate the rate per 100 of value This allows tax rates to be shown in pennies Sample Calculation Once the tax

How Is Property Tax Calculated In Nj

/filters:quality(60)/2020-04-14-How-to-Calculate-Property-Tax-CDN.png)

How Is Property Tax Calculated In Nj

https://own-content.ownerly.com/fit-in/750x0/filters:format(jpeg)/filters:quality(60)/2020-04-14-How-to-Calculate-Property-Tax-CDN.png

How Is Property Tax Calculated YouTube

https://i.ytimg.com/vi/YRmpytcoP1U/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGBcgPih_MA8=&rs=AOn4CLCAASccTJPZ8RyZoX3DzblnYEirBQ

Property Tax Calculator And Complete Guide

https://rethority.com/wp-content/uploads/2020/12/910459_Property-Tax-Calculator_4_120820.jpg

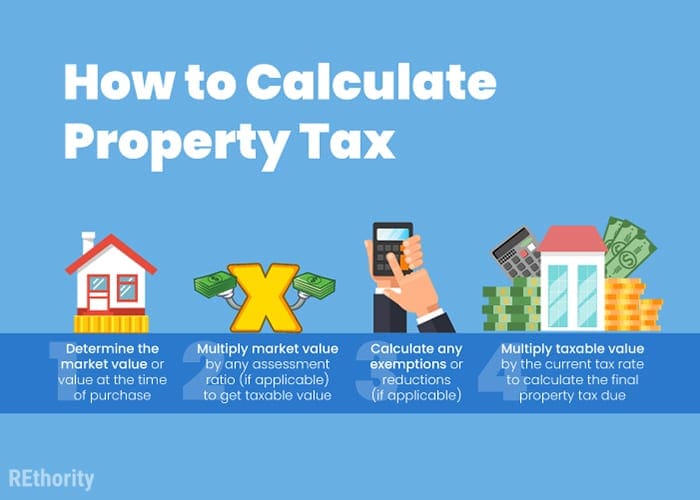

To calculate your New Jersey property tax for 2024 follow these steps Step 1 Determine the assessed value of your property which is the value assigned to your property by the local tax assessor Step 2 Find the current The tax levy is divided by the total assessed value of all taxable property within the municipality or the tax base to determine the general tax rate The general tax rate is then applied to the assessed value of each individual parcel of

How Are NJ Property Taxes Calculated The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs A town s general tax The New Jersey Homeowner s Guide to Property Taxes is a comprehensive resource answering homeowners everyday questions about how their home s value is assessed how their property tax bill is created and where their

Download How Is Property Tax Calculated In Nj

More picture related to How Is Property Tax Calculated In Nj

Who Pays The Least Property Tax In Ontario The Answer May Surprise You

https://media.alexirish.com/wp-content/uploads/2020/09/16194209/greater-toronto-property-tax-rates.jpg

Understand How The Federal Income Tax Is Calculated

https://fas-accountingsolutions.com/wp-content/uploads/2022/05/BLOG-BANNER-33.png

Property Tax Calculator And Complete Guide

https://rethority.com/wp-content/uploads/2020/12/910459_Property-Tax-Calculator_1_120720.jpg

Property taxes in NJ is calculated using the formula Assessed Value x General Tax Rate 100 Property Tax Below is a town by town list of NJ Property tax rates in Atlantic County Egg Harbor City has the highest property tax rate in NEW JERSEY HOMEOWNER S GUIDE TO PROPERTY TAXES A NEW RESOURCE THAT ANSWERS HOMEOWNERS EVERYDAY QUESTIONS Knowing how your property taxes

Calculating property taxes requires some basic math Residential property taxes are calculated annually for the purpose of raising tax revenue for New Jersey s local governments including the county municipality and school district New Jersey statute N J S A 54 4 2 25 defines the standard of value as the true value of property N J S A Taxable assessed value is that percentage of true value established by each county

How To Calculate Property Tax

https://www.learntocalculate.com/wp-content/uploads/2020/06/propertyy-tax-2-1024x310.png

Property Tax Receipt November 30 1896 UNT Digital Library

https://digital.library.unt.edu/ark:/67531/metapth198866/m1/1/high_res/

/filters:quality(60)/2020-04-14-How-to-Calculate-Property-Tax-CDN.png?w=186)

https://www.nj.gov › treasury › taxation › lpt › genlpt.shtml

County municipal and school budget costs determine the amount of property tax to be paid A town s general tax rate is calculated by dividing the total dollar amount it needs to

https://www.nj.gov › treasury › taxation › pdf › lpt › pt...

New Jersey s real property tax is ad valorem meaning that each person pays tax based on the value of the property they own New Jersey courts have determined full and fair value

Property Taxes By State County Median Property Tax Bills

How To Calculate Property Tax

An Overview Of Property Taxes Optima Tax Relief

How Is Your Property Tax Calculated In Ontario YouTube

My Property Taxes Are What Understanding New Hampshire s Property

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example

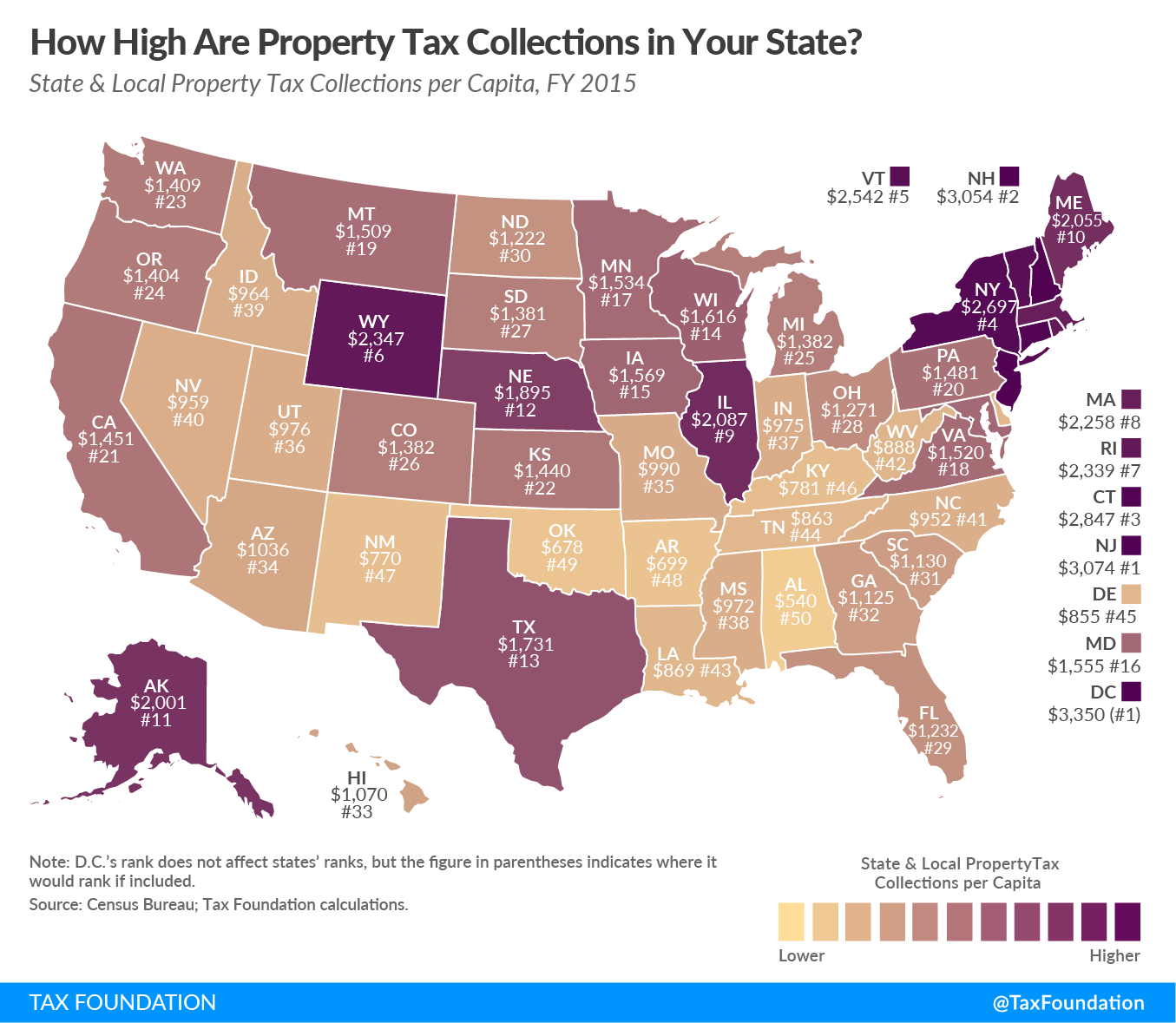

How High Are Property Tax Collections In Your State Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

How Is Property Tax Calculated In California The Tech Edvocate

How Is Property Tax Calculated In Nj - To calculate your New Jersey property tax for 2024 follow these steps Step 1 Determine the assessed value of your property which is the value assigned to your property by the local tax assessor Step 2 Find the current