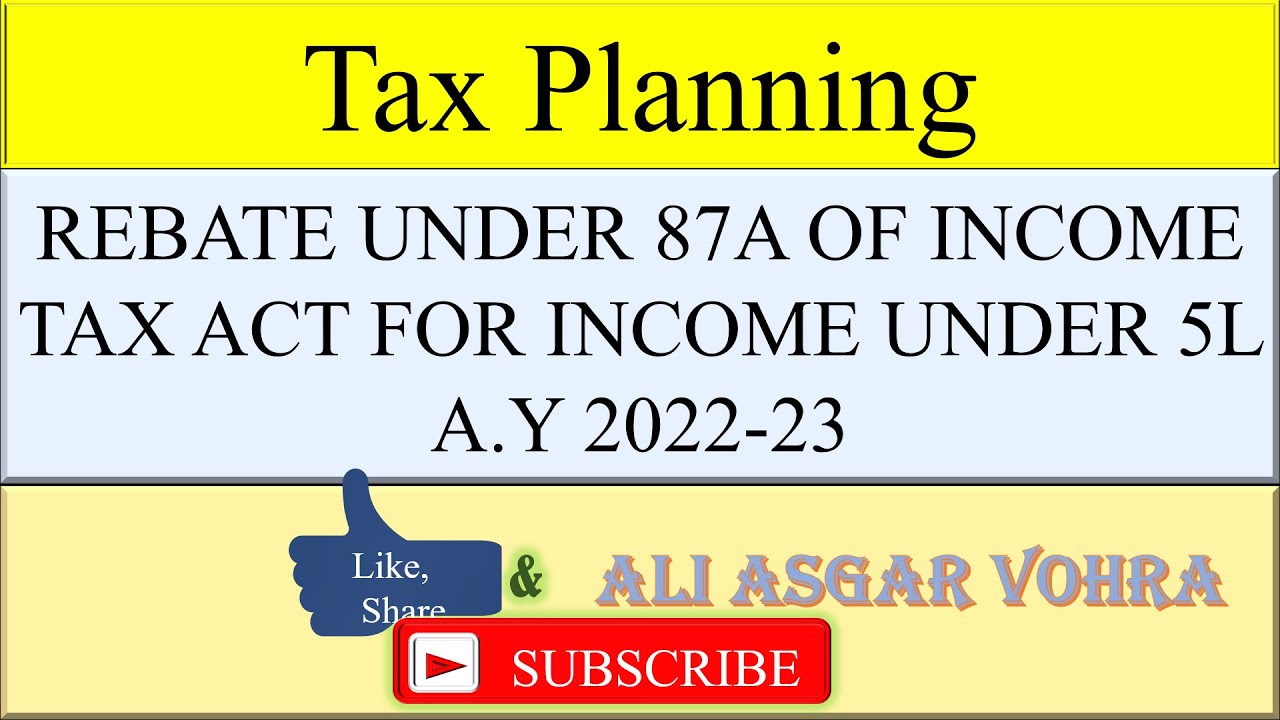

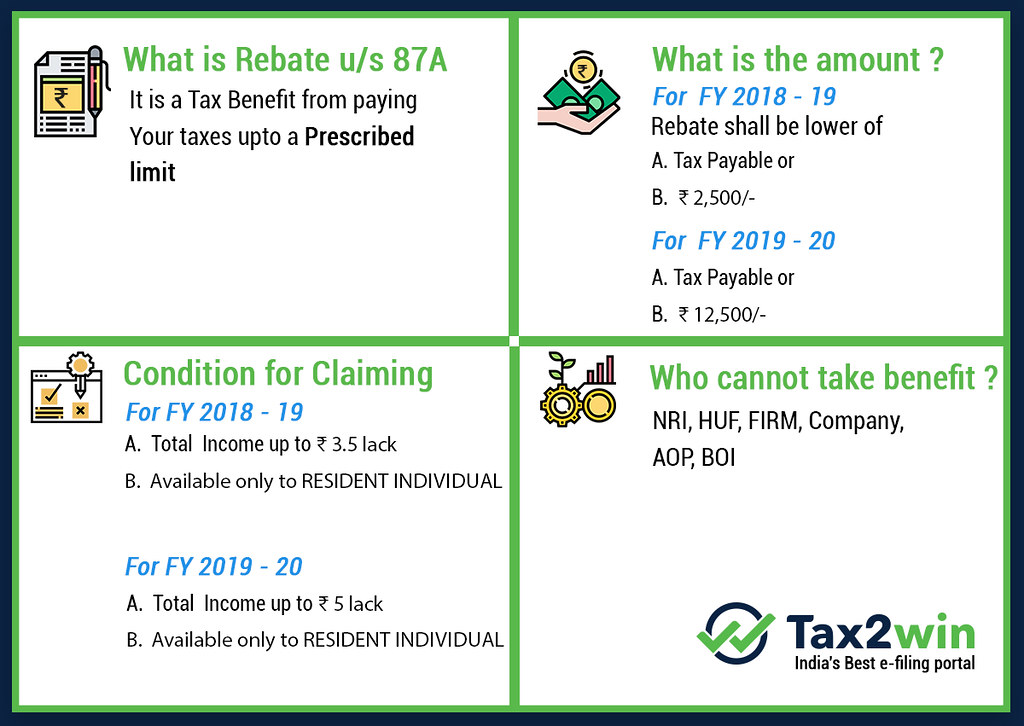

How Is Rebate Calculated Under 87a Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

The maximum rebate under section 87A for the AY 2024 25 is Rs 25 000 under the new tax regime and Rs 12 500 under the optional tax regime See the example below for rebate calculation under Section 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

How Is Rebate Calculated Under 87a

How Is Rebate Calculated Under 87a

https://i.ytimg.com/vi/Hztq_FdPKLk/maxresdefault.jpg

Calculate A Rebate YouTube

https://i.ytimg.com/vi/Gm-LyXhsTao/maxresdefault.jpg

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

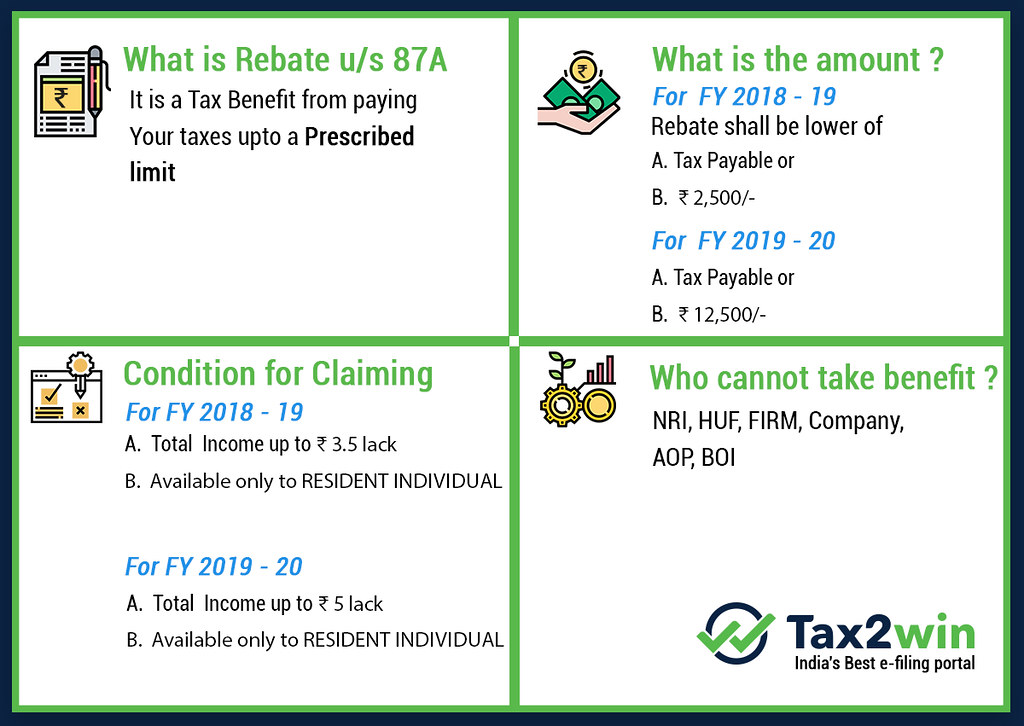

To claim a tax rebate under Section 87A follow these steps Calculate your gross total income for the financial year Reduce your tax deductions for tax savings investments etc Determine your total income after The total taxable income of both Mr C and Mr D is below 7 00 000 This makes them both eligible for the rebate under section 87A Let s calculate the amount of rebate they re

To calculate the rebate under Section 87A determine your gross income and subtract available deductions under Sections 80C to 80U If your net taxable income is less than Rs 5 lakhs you are eligible 2 The reference to Section 115BAC 1A in Section 87A is intended to differentiate the benefits to taxpayers under the OTR vis a vis NTR as under a Under

Download How Is Rebate Calculated Under 87a

More picture related to How Is Rebate Calculated Under 87a

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebates Learn How To Streamline Your Process Rockton Software

https://www.rocktonsoftware.com/wp-content/uploads/2020/05/Rebates1-600x363.png

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

https://i.ytimg.com/vi/KePXPu9nUAQ/maxresdefault.jpg

Claiming a rebate under Section 87A provides significant tax relief to eligible individuals with an annual income up to 5 lakhs Section 87 A s rebate is a valuable provision To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is

Rebate under section 87A is allowed from tax payable before levy of Education cess secondary and higher education cess Surcharge The amount of If your total income doesn t exceed Rs 5 lakh you can claim a tax rebate under section 87A It s important to keep in mind that the maximum rebate under section

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

https://i.ytimg.com/vi/c8x9R1Q-cVQ/maxresdefault.jpg

https://tax2win.in/guide/section-87a

Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

https://taxconcept.net/income-tax/income-ta…

The maximum rebate under section 87A for the AY 2024 25 is Rs 25 000 under the new tax regime and Rs 12 500 under the optional tax regime See the example below for rebate calculation under Section

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Rebate Under 87A Of Income Tax No Tax On Income Upto Rs 727770

Income Tax Rebate Under Section 87A

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

A Guide To Rebates On Discounted Bills

A Guide To Rebates On Discounted Bills

Income Tax Rebate Under Section 87A How It Avail Eligibility

Rebate Calculations 101 How Are Rebates Calculated Enable

Is Section 87A Rebate For Everyone SR Academy India

How Is Rebate Calculated Under 87a - The total taxable income of both Mr C and Mr D is below 7 00 000 This makes them both eligible for the rebate under section 87A Let s calculate the amount of rebate they re