How Long After Federal Do You Get Your State Taxes As a general rule you can expect your state tax refund within 30 days of the electronic filing date or the postmark date To get the current status

WASHINGTON The IRS today provided guidance PDF on the federal tax status of refunds of state or local taxes and certain other payments made by state or local Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive

How Long After Federal Do You Get Your State Taxes

How Long After Federal Do You Get Your State Taxes

https://www.graystoneadvisors.com/wp-content/uploads/2021/10/getting-your-boss-to-yes.jpg

Which States Pay The Most Federal Taxes A Look At The Numbers

https://dyernews.com/wp-content/uploads/taxmap-1.png

I Live In One State Work In Another Where Do I Pay Taxes Picnic Tax

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

Depending on when taxpayers file their returns they can often receive their federal tax refund payment direct deposit within only 2 3 weeks Paper check refunds can take a How long you wait for your state tax refund depends on multiple factors Here s a list of resources you can use to check your refund status in your state

You can file your state return after your federal return as long as it is filed before your state tax return deadline on or before the last day for taxes 2021 However you will not be able to e file your state return if you Get answers to commonly asked questions about your tax refund and its status Why is my refund different than the amount on the tax return I filed updated December 22 2023

Download How Long After Federal Do You Get Your State Taxes

More picture related to How Long After Federal Do You Get Your State Taxes

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

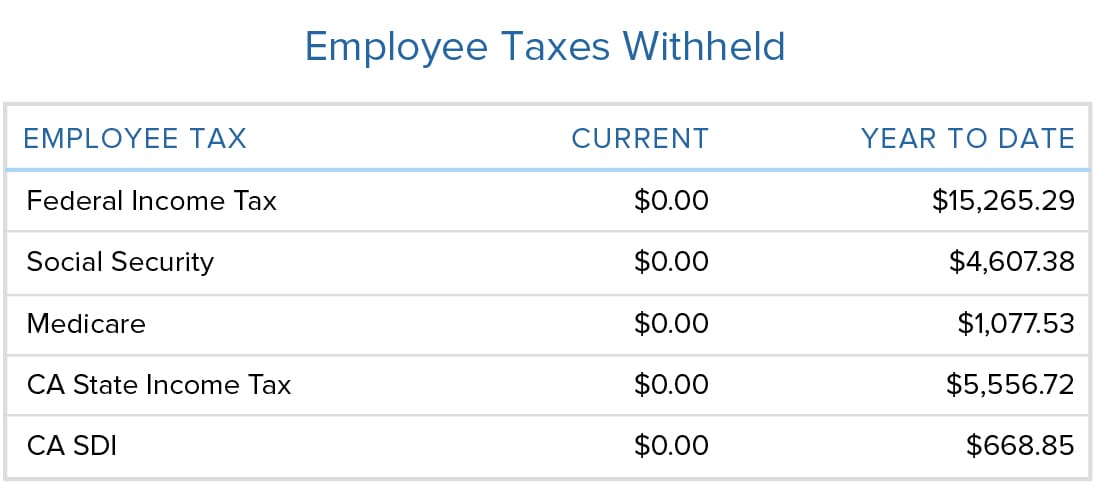

Where Can I Find My Year to date Federal And State Withholding Amount

https://support.joinheard.com/hc/article_attachments/4788931701143/Paystub-employee-taxes-withheld.jpeg

When You Bail Someone Out Of Jail Do You Get Your Money Back

https://delaughterbailbonds.com/blog/wp-content/uploads/2022/10/Picture4.png

How long will my state refund take The IRS says it sends most federal tax refunds in 21 days but every state processes returns at its own pace For example refunds generally take up to two weeks to process in California Where s My Tax Refund a step by step guide on how to find the status of your IRS or state tax refund Use TurboTax IRS and state resources to track your tax refund check return status and learn about common

The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks Unfortunately a 21 day delivery of your tax refund isn t guaranteed There are a number of factors In some states you ll get your refund within a couple of days while other states will take weeks or months to process Learn how to check your state tax refund status If you find

How To Get More Listings And Triple Your Income

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/sites/2147505394/images/trht3P5ScOT8PWeTlCF6_TudRFeRjWmyTtuYVzQAY_how-to-get-more-listings-and-triple-your-income.png

How Do Big Lots Rewards Work

https://koopy.com/wp-content/uploads/2021/11/how-to-get-big-lots-rewards-2048x1946.png

https://savingtoinvest.com/average-irs-and-st…

As a general rule you can expect your state tax refund within 30 days of the electronic filing date or the postmark date To get the current status

https://www.irs.gov/newsroom/irs-issues-guidance-on-state-tax-payments

WASHINGTON The IRS today provided guidance PDF on the federal tax status of refunds of state or local taxes and certain other payments made by state or local

How Long After Winning The Lottery Do You Get The Money

How To Get More Listings And Triple Your Income

Do You Get Your Earnest Money Back If You Can t Get A Mortgage

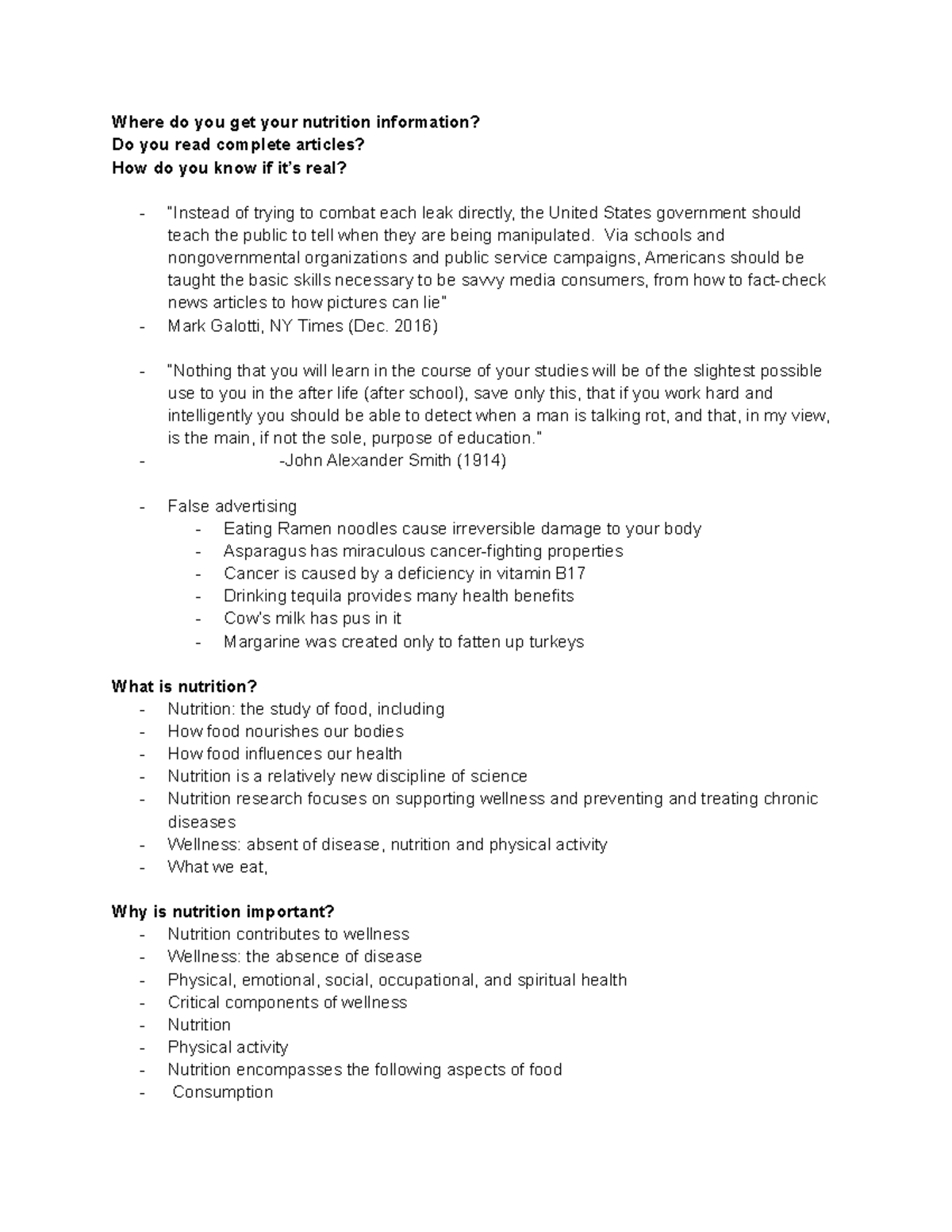

Chap 1 Notes Where Do You Get Your Nutrition Information Do You

How High Are Property Taxes In Your State American Property Owners

How Do You Get Your Money Back If Your Su Apple Community

How Do You Get Your Money Back If Your Su Apple Community

Bonus Assignment Where Do You Get Your Information About Crime A I

Do You Get Money Back After Paying A Bail Bondsman Simply Bail

STUMP Articles Taxing Tuesday The Governor Of Illinois Talks Taxes

How Long After Federal Do You Get Your State Taxes - How long you wait for your state tax refund depends on multiple factors Here s a list of resources you can use to check your refund status in your state