How Long Do Hmrc Appeals Take What to do when you disagree with a tax decision HMRC1 appealing against a decision getting a review by HMRC and reasonable excuses

Find out how to appeal an individual or partnership Self Assessment penalty For example either online or by post using forms SA370 or SA371 HMRC will send you a penalty If you disagree with an HMRC decision and you have a right of appeal see below under the heading When you can appeal an HMRC decision you can appeal in writing to HMRC You must normally make an appeal within

How Long Do Hmrc Appeals Take

How Long Do Hmrc Appeals Take

https://www.shouselaw.com/wp-content/uploads/2020/12/wc2_ss.jpg

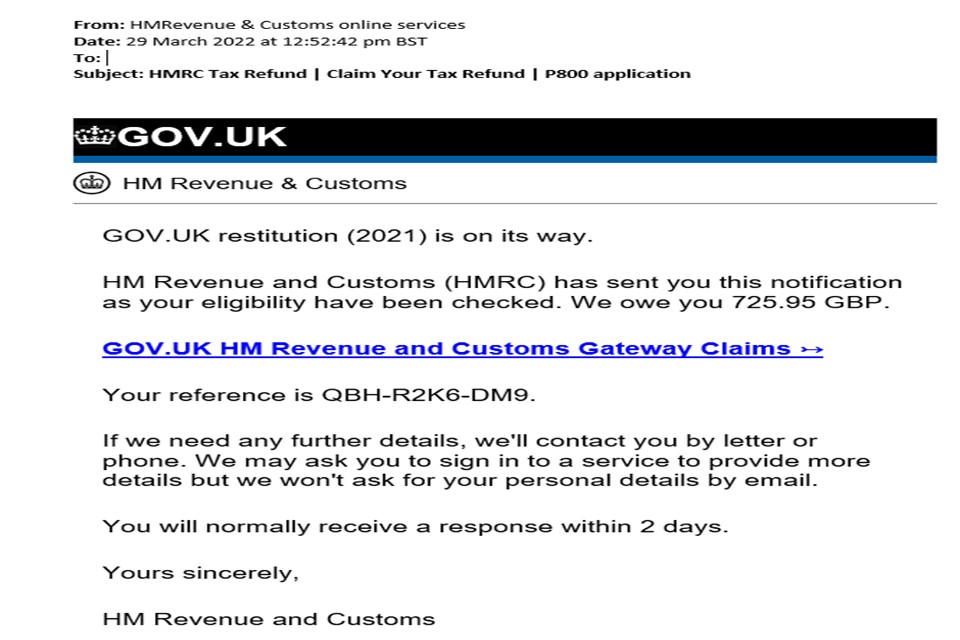

HMRC MarvicBladyn

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/149506/Example_of_a_scam_email.jpg

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

This guide provides a comprehensive overview of the appeal process including the types of penalties you can appeal how to make an appeal and what to do if you disagree with HMRC s response We ll also discuss Generally the review process takes around 45 days although it may end up being longer If you do not agree with the decision made following the review process then you can submit an appeal to the tax tribunal You should do this

HMRC must give permission for the late appeal to be heard if it is satisfied that there was a reasonable excuse for failing to meet the deadline and the request for a late appeal was made without unreasonable delay as soon Whatever option the taxpayer decides to follow they have 30 days from the date of the letter to either accept the review request or notify the appeal to the tribunal If the taxpayer does not take any action within the 30 day

Download How Long Do Hmrc Appeals Take

More picture related to How Long Do Hmrc Appeals Take

How Long Does The VA Appeals Process Take Tax N Duty

https://www.taxnduty.com/wp-content/uploads/2021/06/How-Long-Does-the-VA-Appeals-Process-Take.jpg

How Long Do You Stay In Jail If You Can t Make Bail All N One

https://allnonebailbonds.com/wp-content/uploads/2022/08/how-long-do-you-stay-in-jail-if-you-cant-make-bail_compressed.jpg

How Long Do Admissions Officers Read Applications College Money Tips

https://collegemoneytips.com/wp-content/uploads/2022/11/how-long-do-college-admissions-officers-read-applications.png

How long does the appeals process take The time it takes for an appeal to be resolved varies depending on how complex the case is whether you agree with HMRC s initial decision and even Whatever option the taxpayer decides to follow they have 30 days from the date of the letter to either accept the review request or notify the appeal to the tribunal If the taxpayer does not

HMRC expects you to file the tax return as soon as you are able to do so within 14 days of the end of the special circumstances which caused you to file late If HMRC rejects Guidance for HMRC complaints and appeals Including how to complain and how to disagree with or appeal a decision

How To Spot The Biggest HMRC Tax Scam Tactics Which News

https://media.product.which.co.uk/prod/images/original/gm-1f834b79-22cf-4fef-8a82-196212cde999-hmrc-offices-in-whitehall-london.jpeg

What Happens If The HMRC Made A Mistake

https://fmpglobal.co.uk/wp-content/uploads/2020/09/HMRC.jpg

https://www.gov.uk › tax-appeals

What to do when you disagree with a tax decision HMRC1 appealing against a decision getting a review by HMRC and reasonable excuses

https://www.gov.uk › guidance › check-when-to-appeal-a...

Find out how to appeal an individual or partnership Self Assessment penalty For example either online or by post using forms SA370 or SA371 HMRC will send you a penalty

How Long Does It Take For HMRC To Pay My VAT Refund

How To Spot The Biggest HMRC Tax Scam Tactics Which News

VA Loan Requirements How Long Do You Have To Live In A House

Can I Appeal An HMRC Penalty

HMRC Appeals How To Challenge HMRC

Letter From HMRC About Overseas Assets Income Or Gains

Letter From HMRC About Overseas Assets Income Or Gains

How Long Do I Have To File My Workers Compensation Claim YouTube

Roblox Appeal Copy And Paste AlfinTech Computer

How Long Do You Have To Go To A Doctor After A Motorcycle Accident

How Long Do Hmrc Appeals Take - HMRC must give permission for the late appeal to be heard if it is satisfied that there was a reasonable excuse for failing to meet the deadline and the request for a late appeal was made without unreasonable delay as soon