How Long Does It Take To Process A Self Assessment Tax Return The refund request confirmation states that Paraphrase HMRC aim to refund in 2 weeks or if additional security procedures are used upto 4 weeks Do not

You can correct a tax return within 12 months of the Self Assessment deadline online or by sending another paper return Example For the 2022 to 2023 tax year you ll usually Currently HMRC are not reporting any delay to the processing of paper Self Assessment tax returns on their service dashboard At the moment the service

How Long Does It Take To Process A Self Assessment Tax Return

How Long Does It Take To Process A Self Assessment Tax Return

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/image_data/file/193411/s960_10316_Self_Assessment_asset_GOV.UK__1_.jpg

How To File Self Assessment Tax Return YouTube

https://i.ytimg.com/vi/hjcuCUBZxxs/maxresdefault.jpg

What Is A Self Assessment Tax Return YouTube

https://i.ytimg.com/vi/-00s3HsDxbM/maxresdefault.jpg

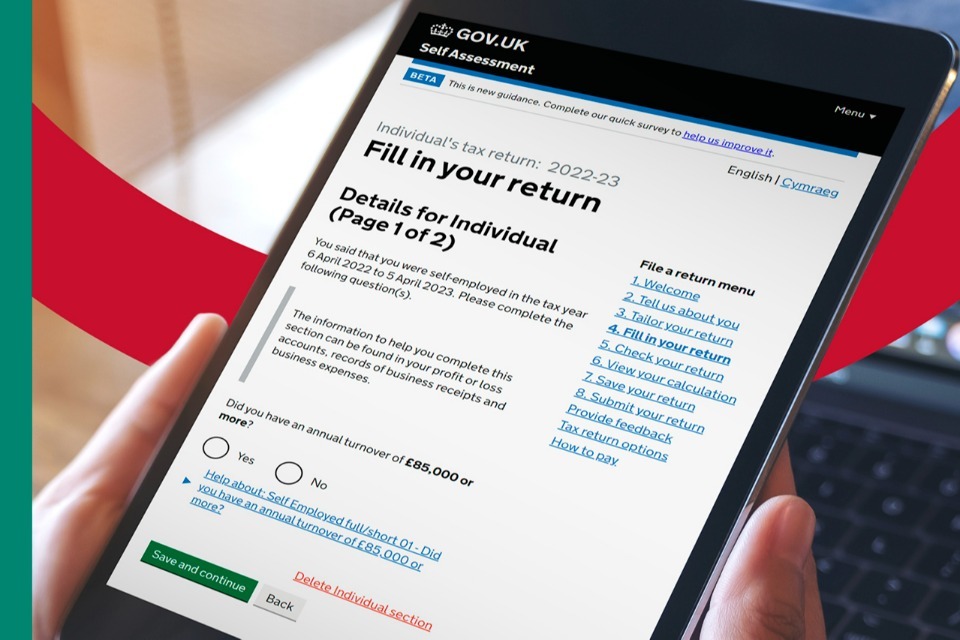

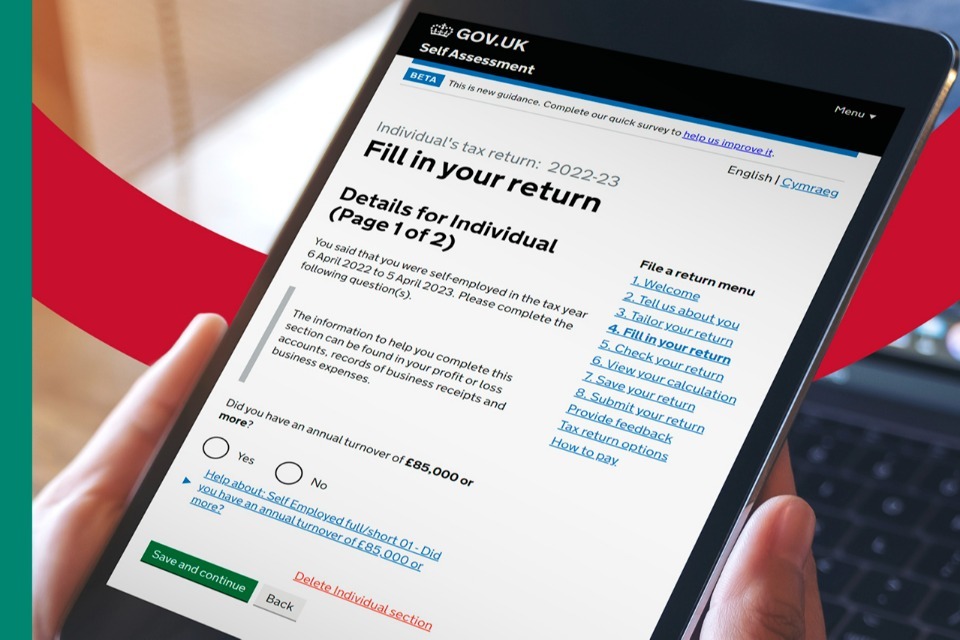

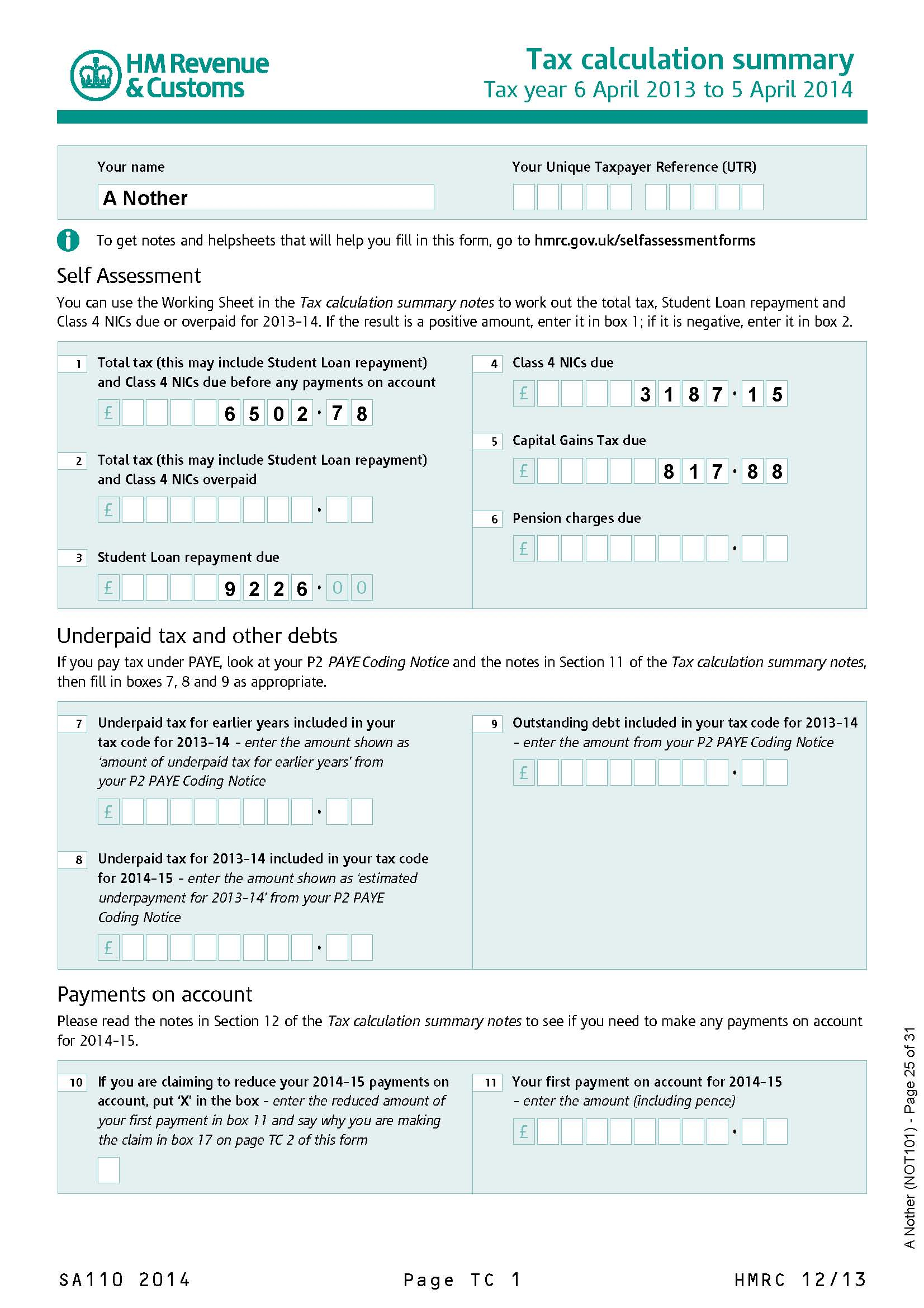

Self assessment tax returns must be submitted each year by the self employed and people who owe tax on income they ve received Find out how to complete a tax return for the 2023 24 tax year and what Tax return deadlines Tax returns are submitted for tax years rather than calendar years and you do this in arrears The self assessment deadlines for the

Electronically filed Form 1040 returns are generally processed within 21 days We re currently processing paper returns received during the months below Form 1040 You have until 11 59pm on Wednesday 31 January 2024 to send HMRC an online tax return for the 2022 2023 tax year which ended on 5 April 2023 The same

Download How Long Does It Take To Process A Self Assessment Tax Return

More picture related to How Long Does It Take To Process A Self Assessment Tax Return

The Ultimate Self Assessment Tax Return Guide I Bar2

https://bar2.co.uk/media/zsyhbutj/self-assessment-tax-return-blog-card.jpg?anchor=center&mode=crop&width=1200&height=627&rnd=132814414362900000

When Do You Have To Fill In A Self Assessment Tax Form Printable Form

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/guides/self-assessment/Self_Assessment_4_avoid_these_common_mistakes.png

Filing A Self Assessment Tax Return A Complete Guide

https://cloudcogroup.com/wp-content/uploads/2020/01/guide-to-filling-in-self-assessment-tax-returns.jpg

File a complete self assessment tax return for the 2018 19 tax year You ll need to do this online as the deadline for filing a paper return was 31 October 2019 and paper returns are no longer being accepted Expect the IRS to acknowledge your return within 24 to 48 hours IRS Refund Timetable Post acceptance the processing time typically unfolds on an IRS

The process can take longer if you have made a query in relation to your self assessment The amount of time you should expect to hear back on your query can vary depending Step 3 Fill in your self employed tax return If you re filing a paper return you ll need to complete form SA100 and the self employed supplement form SA103 But

Self assessment Tax HMRC Deadline Looms As Thousands Face 100 Penalty

https://static.independent.co.uk/2023/01/31/02/35691dca550702ca74d38dc648f80c7aY29udGVudHNlYXJjaGFwaSwxNjc1MTc0OTY3-2.9065085.jpg

Self Assessment Countplus Online Accountants

https://www.countplus.co.uk/wp-content/uploads/2021/11/self-assessment-1.png

https://community.hmrc.gov.uk/customerforums/sa/...

The refund request confirmation states that Paraphrase HMRC aim to refund in 2 weeks or if additional security procedures are used upto 4 weeks Do not

https://www.gov.uk/self-assessment-tax-returns/corrections

You can correct a tax return within 12 months of the Self Assessment deadline online or by sending another paper return Example For the 2022 to 2023 tax year you ll usually

How To File Your Self Assessment Tax Return On Time The Cheap Accountants

Self assessment Tax HMRC Deadline Looms As Thousands Face 100 Penalty

How To Fill In A Self assessment Tax Return Which

Self Assessment Tax Return Form Employment Pages Employment Form

Self assessment Tax Returns Everything You Need To Know MSE

Self Employment Tax Return Form Long Employment Form

Self Employment Tax Return Form Long Employment Form

Self Assessment Tax Return Accountants In Brim Naseems

How Do You Complete A Self Assessment Tax Return Cooper Accounting

A Step by Step Guide To Filing Your Self Assessment Tax Return

How Long Does It Take To Process A Self Assessment Tax Return - Overview You ll get a bill when you ve filed your tax return If you filed online you can view this when you ve finished filling in your return but before you submit it in the section