How Long Does It Take Your State Income Tax To Come Back The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may

The deadline to file returns in 2024 is April 15 this sometimes varies based on weekends or state holidays This article includes a handy reference chart taxpayers If you sent a paper tax return through the mail it will take longer to receive your refund than if you filed electronically How long does a state refund take The amount of time it takes to receive your state refund can vary

How Long Does It Take Your State Income Tax To Come Back

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

How Long Does It Take Your State Income Tax To Come Back

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

The Pros And Cons Of Residing In A State With No State Income Tax The

https://theamericanretiree.com/wp-content/uploads/2022/12/shutterstock_1914941572.jpg

How Long Does It Take To File Taxes

https://www.freshbooks.com/wp-content/uploads/2022/03/duration-to-file-taxes.jpg

To track your state refund select the link for your state below If you re looking for your federal refund instead the IRS can help you Important To help The IRS starts tracking your tax refund within 24 hours after e filing and updates the tool daily If you filed your tax return by mail expect longer processing times and delays

The agency updates the tracker once per day usually overnight You can start checking your tax refund status 24 hours after e filing your return and four weeks after mailing a paper return How long will it take for my status to change from return received to refund approved updated May 16 2023 Processing times vary depending on the information

Download How Long Does It Take Your State Income Tax To Come Back

More picture related to How Long Does It Take Your State Income Tax To Come Back

How To Find Out If You Owe Irs Informationwave17

https://i.insider.com/5f721b9074fe5b0018a8dc86?width=1000&format=jpeg&auto=webp

Planning A Roth IRA Conversion Check Your State Income Tax

https://image.cnbcfm.com/api/v1/image/101297520-172184086r.jpg?v=1532564561&w=1920&h=1080

How Long Does It Take To Transfer Money Between Banks

https://blog.sanatransfer.com/content/images/size/w2000/2023/05/Duration-for-Money-Transfer-between-banks--1-.jpg

Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive

Use the Where s My Refund tool to check your return status within 24 hours after the IRS receives your e filed return or 4 weeks after mailing a paper return Learn Welcome to the Money blog a hub of personal finance and consumer news tips Today s posts include a look at the discounts available to students and local

States With The Lowest Corporate Income Tax Rates Infographic

https://assets.entrepreneur.com/article/1398974418-states-lowest-corporate-income-tax-rates-infographic.jpg

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

https://files.taxfoundation.org/20210303101855/2021-combined-federal-and-state-corporate-income-tax-rates.-Do-corporataions-pay-state-and-federal-taxes.png

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg?w=186)

https://www.usa.gov/check-tax-status

The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may

https://www.cpapracticeadvisor.com/2024/02/07/2024...

The deadline to file returns in 2024 is April 15 this sometimes varies based on weekends or state holidays This article includes a handy reference chart taxpayers

Personal Income Tax For Foreigners In Vietnam Reductions And

States With The Lowest Corporate Income Tax Rates Infographic

How Long Will It Take To Get Credit From 500 To 700 Leia Aqui How

Realtor How Long Does It Take To Improve Your Credit Score Enough

Section 143 1 Of The Income Tax Act 1961 IPleaders

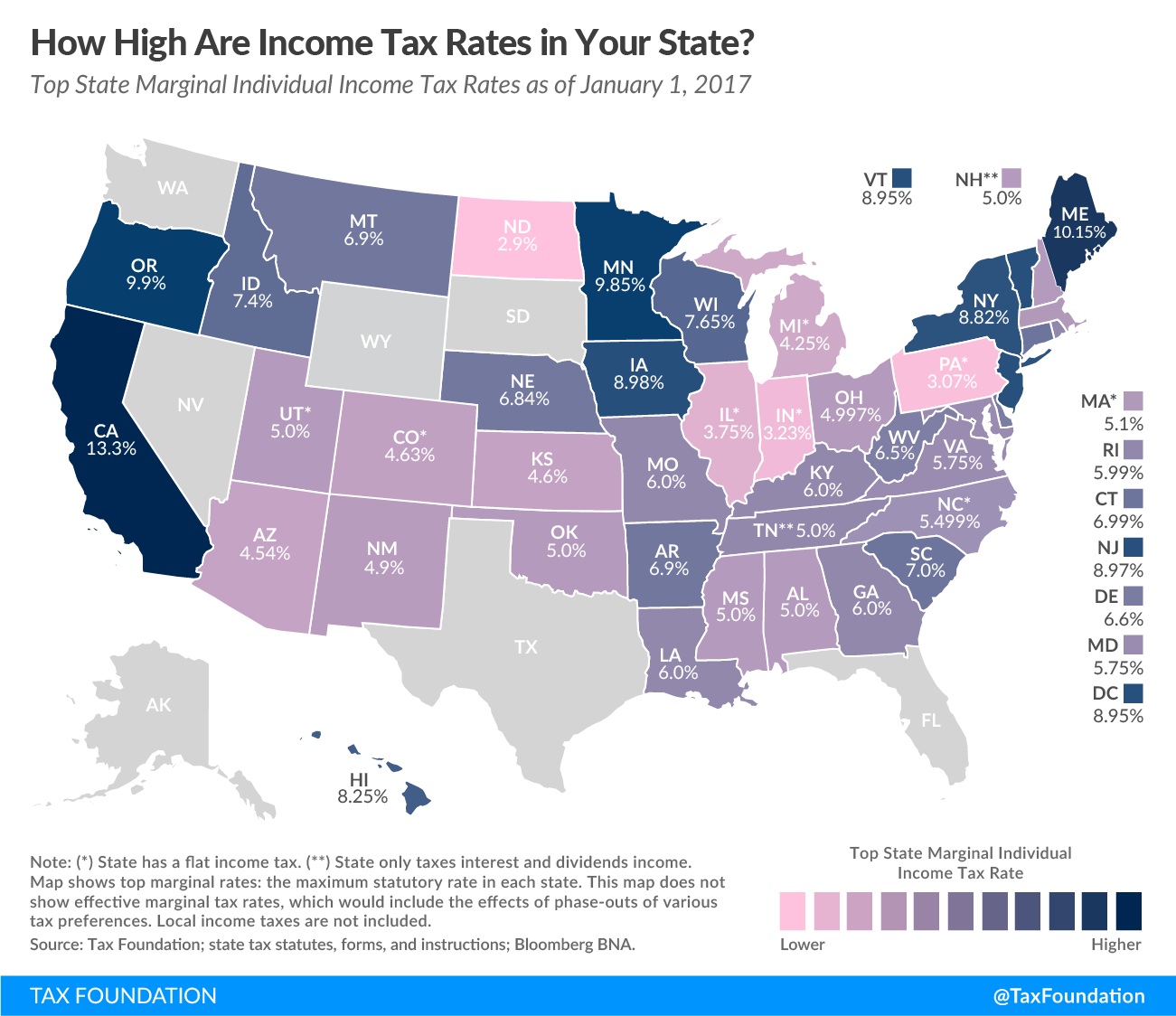

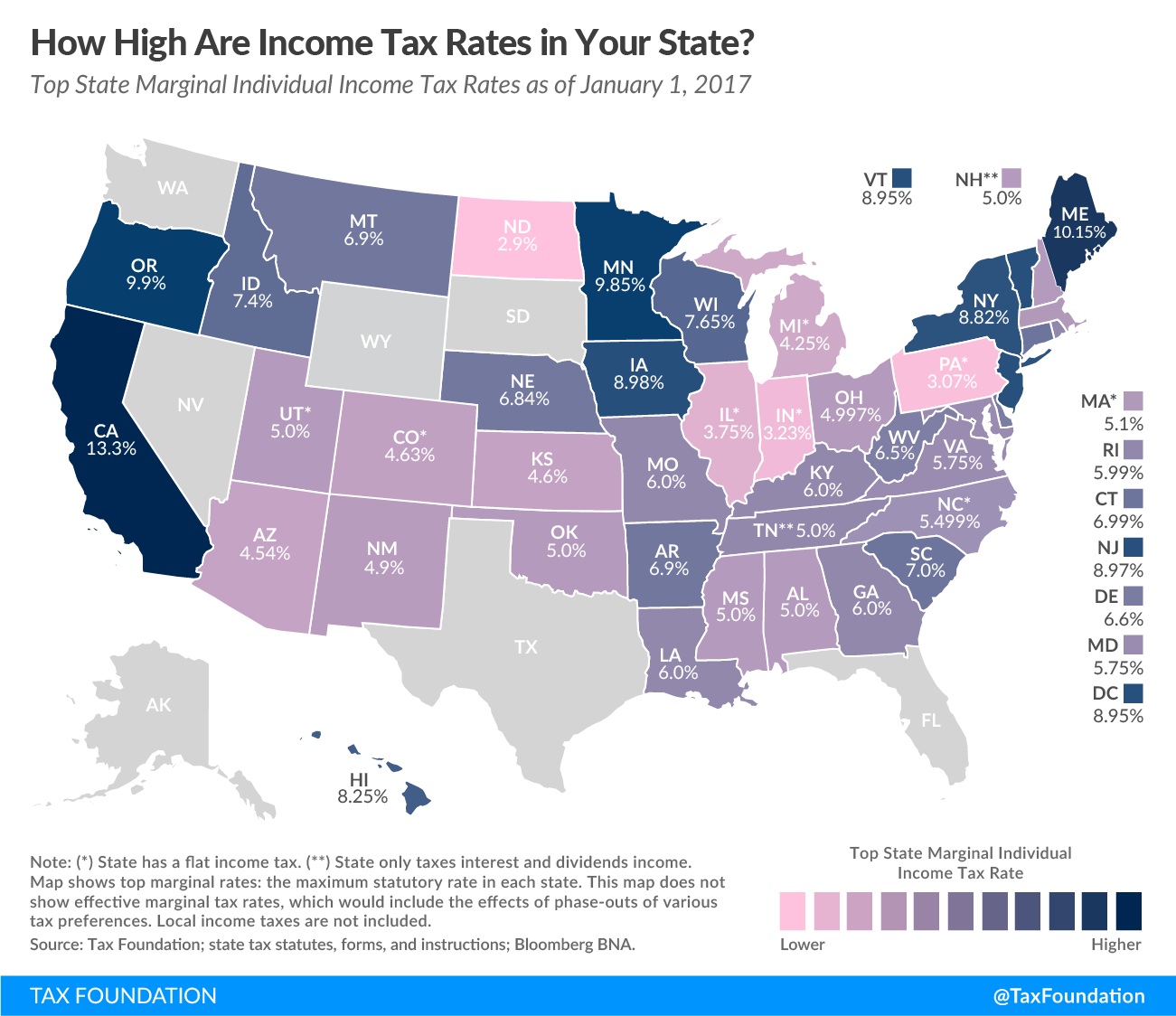

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

Sources Of U S Tax Revenue By Tax Type Tax Unfiltered

Visualizing Taxes By State

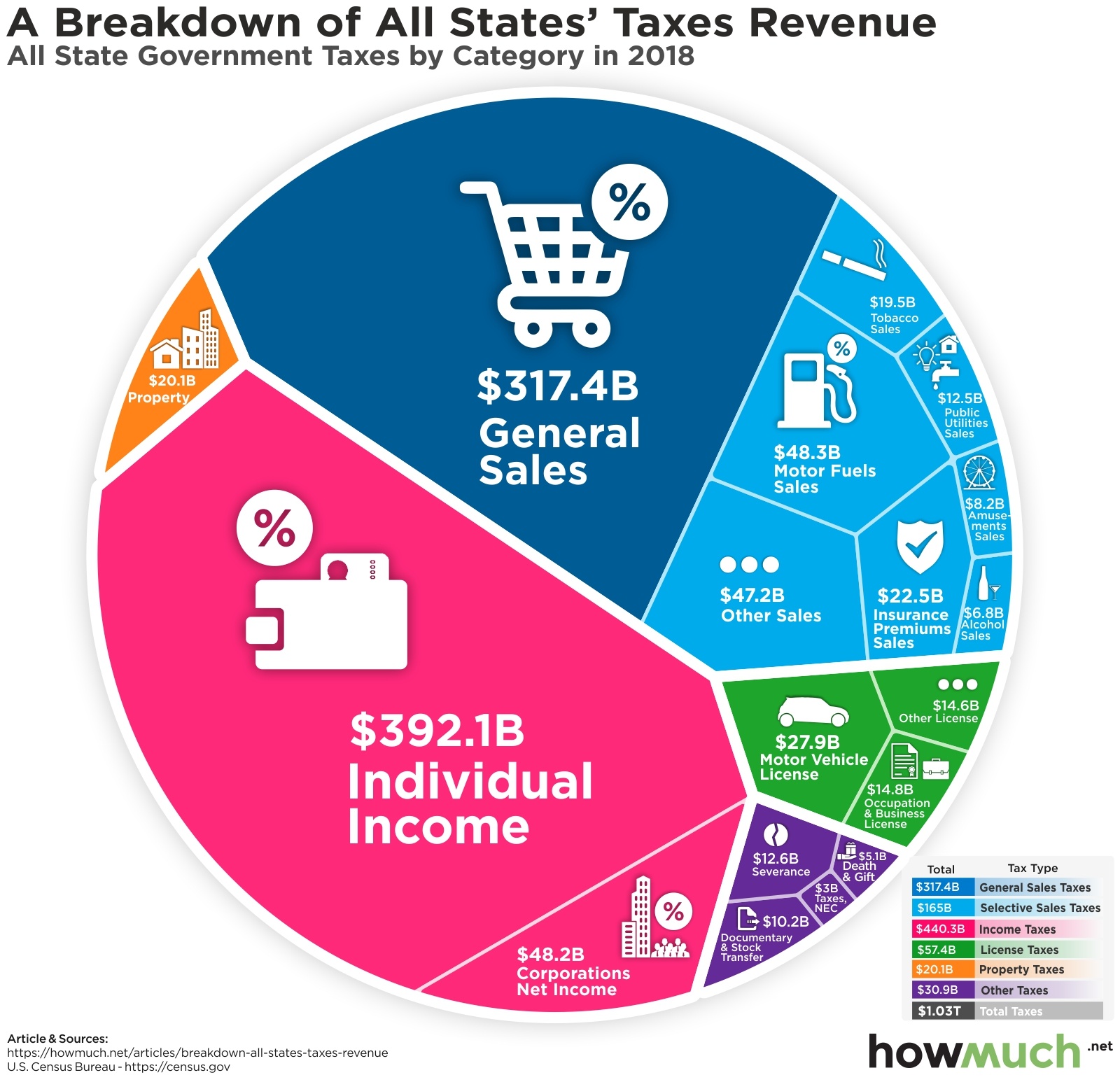

In One Chart State Tax Revenue By Source

How Long Does It Take Your State Income Tax To Come Back - The agency updates the tracker once per day usually overnight You can start checking your tax refund status 24 hours after e filing your return and four weeks after mailing a paper return