How Long For State Tax Refund 2023 The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may not be the amount you expected

The IRS says if you file early and electronically you ll typically receive your tax refund within 21 days after filing However if you file a paper tax return expect delays The vast majority of tax refunds are issued by the IRS in less than 21 days Here s what you need to know to predict how long you ll wait for your refund

How Long For State Tax Refund 2023

How Long For State Tax Refund 2023

https://assets3.cbsnewsstatic.com/hub/i/r/2021/04/16/239cc120-f300-4de2-b409-efa2fd819c99/thumbnail/1200x630/b00b71a4ba29cdebfee63e3b6549d01c/tax-refund-5-509643-640x360.jpg

IRS Tax Refund Chart For 2023 When Will I Get My Tax Refund CPA

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/36056/tax_refund_2_.58ad2540b4575.5e063e880c538.png

/do-i-need-to-file-a-nonresident-state-tax-return-3193323_color2-7b1108deb22e49eeb24d85d2aa5b03b1.gif)

Nj Tax Refund Status 2015 Daserware

https://www.thebalance.com/thmb/upDa7MjciK0JIqU4w7cXKjIUpYc=/1500x1000/filters:fill(auto,1)/do-i-need-to-file-a-nonresident-state-tax-return-3193323_color2-7b1108deb22e49eeb24d85d2aa5b03b1.gif

How quickly will I get my refund updated December 22 2023 We issue most refunds in less than 21 calendar days However if you mailed your return and expect a refund it could take four weeks or more to process your return Where s My Refund has the most up to date information available about your refund The IRS has announced it will start accepting tax returns on January 23 2023 as we predicted as far back as October 2022 So early tax filers who are a due a refund can often see the

Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year return 4 weeks after you file a paper return Sign in to your TurboTax account and open Your tax returns documents on the Tax Home screen Your state return for 2023 should be listed as Filed and your Return Status should say Accepted If it says Started instead you ll need to

Download How Long For State Tax Refund 2023

More picture related to How Long For State Tax Refund 2023

How Long To Get Colorado Tax Refund Coots Nathan

https://i.pinimg.com/originals/25/84/14/258414a9ba63687de99d431af3bce628.png

Arkansas State Tax Withholding Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/594/382/594382499/large.png

Refund Schedule 2023 R IRS

https://preview.redd.it/refund-schedule-2023-v0-i3bi7qw6pfia1.jpg?width=1080&crop=smart&auto=webp&s=f4eb33a25148030a3bd95b47a532675f61f16c80

For 2023 tax returns filed in 2024 the IRS said it planned to issue more than 90 of refunds within 21 days of e filing Some refunds could take as little as 14 days However this was also stated in 2020 during the pandemic but as we all know those returns were often delayed How to track the status of your federal tax refund and state tax refund in 2024 plus tips about timing

When Will the IRS Start Accepting 2023 Tax Returns and Issuing Refunds The IRS has announced it will start accepting tax returns on January 23 2023 as we predicted as far back as October As of about 4 p m Eastern more than 830 Delta flights had been canceled and more than 1 220 had been delayed American was reporting more than 360 flights canceled and more than 1 040 delayed

2024 Tax Due Date Calendar Damara Robinetta

https://thecollegeinvestor.com/wp-content/uploads/2024/01/TCI_-_2024-TAX-REFUND-CALENDAR-Updated-1.png

Mississippi State Tax Refund 2024 Gaynor Gilligan

https://d3f7q2msm2165u.cloudfront.net/aaa-content/user/files/5db1f769dee0197a792f8765.jpeg?1578803697787

https://www.usa.gov/check-tax-status

The IRS generally issues refunds within 21 days of when you electronically filed your tax return and longer for paper returns Find out why your refund may be delayed or may not be the amount you expected

https://www.forbes.com/advisor/taxes/when-will-i...

The IRS says if you file early and electronically you ll typically receive your tax refund within 21 days after filing However if you file a paper tax return expect delays

2023 Tax Refund Chart Printable Forms Free Online

2024 Tax Due Date Calendar Damara Robinetta

State And Local Tax Refund Worksheet

How To Check Nj Tax Refund Status Typekasap

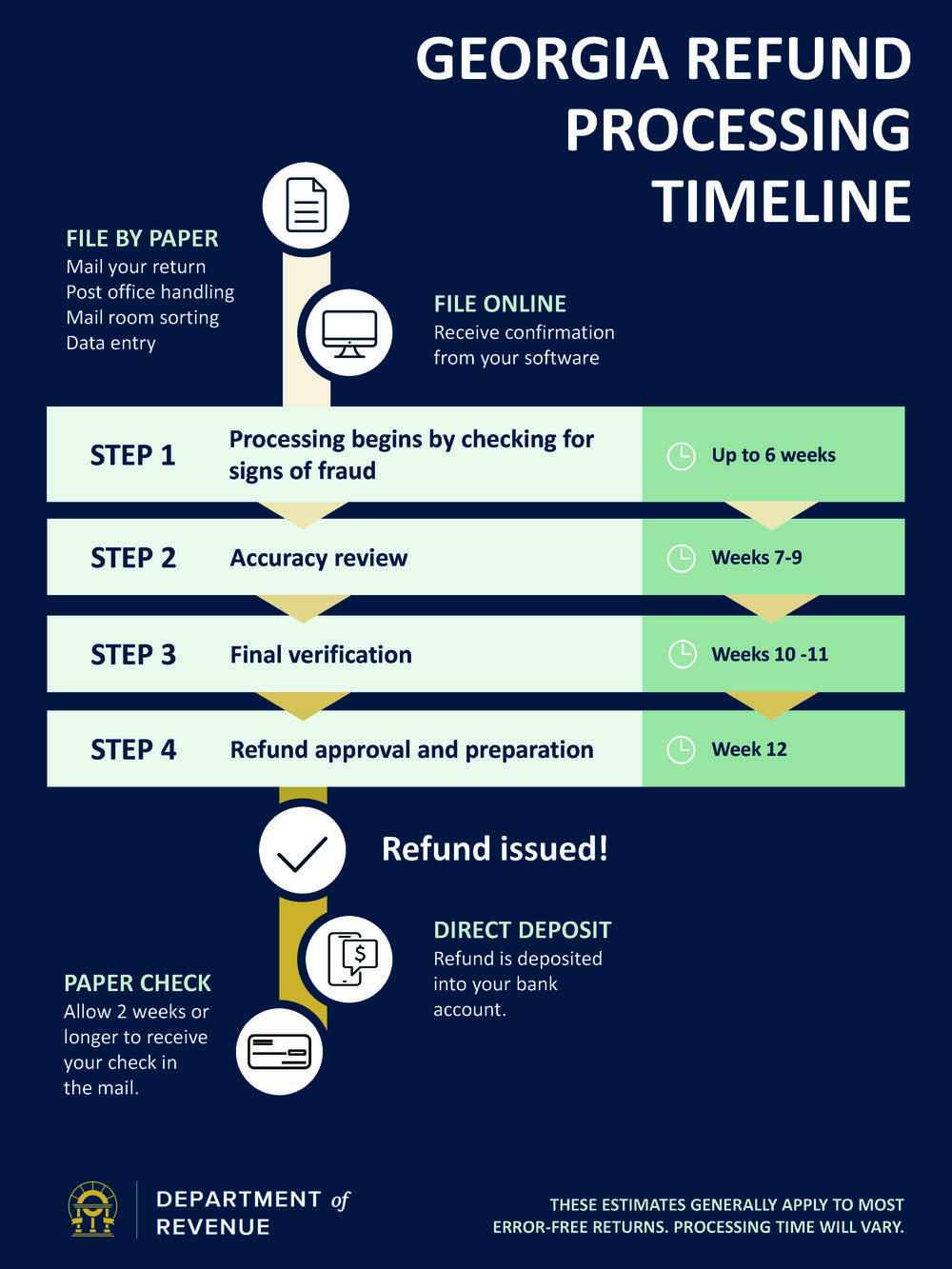

Ga State Tax Refund 2024 Shara Delphine

Local Tax Refunds Must Your Local And State Taxes Be Reported To The IRS

Local Tax Refunds Must Your Local And State Taxes Be Reported To The IRS

Georgia State Tax Refund 2024 Vikki Orelle

Expecting A Tax Refund Donate It Center For Work Education Employment

How To Check State Return Flatdisk24

How Long For State Tax Refund 2023 - Use this tool to check your refund Your refund status will appear around 24 hours after you e file a current year return 3 or 4 days after you e file a prior year return 4 weeks after you file a paper return