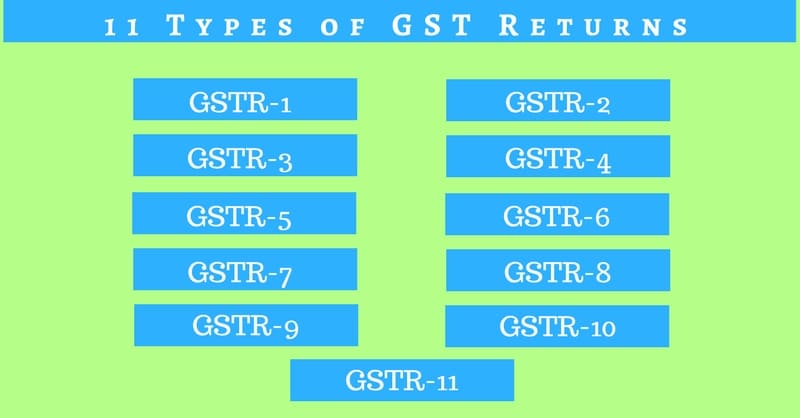

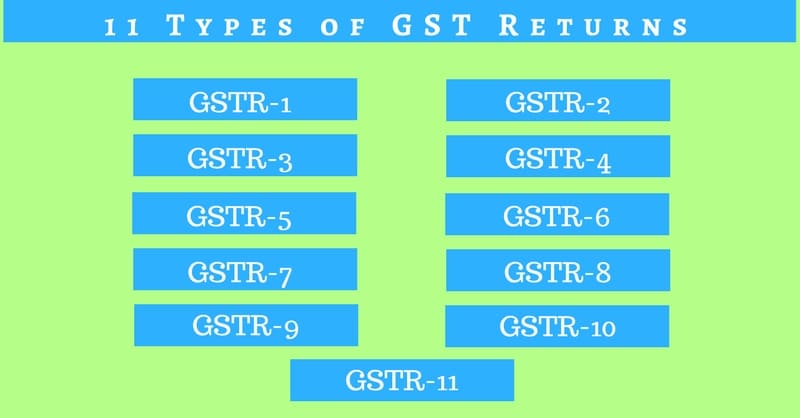

How Many Gst Returns To Be Filed There are a total of 13 returns under the Goods and Services Tax GST regime These returns serve to capture different aspects of a taxpayer s financial transactions and obligations within the GST

14 rowsFor every GSTIN registered a taxpayer is mandated to file a Everything you need to know about GST returns including who is required to file them and the types of returns Stay updated with the due dates for filing your GST returns

How Many Gst Returns To Be Filed

How Many Gst Returns To Be Filed

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202112/gst-graphic.jpg?itok=n1QrvzGi

GST Return How To File GST Returns Online Duet Date Types Of GSTR

https://www.betterplace.co.in/blog/wp-content/uploads/2020/03/GST-Return-1.jpg

GST Return Types Of GST Returns IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2023/10/GST-Return.jpg

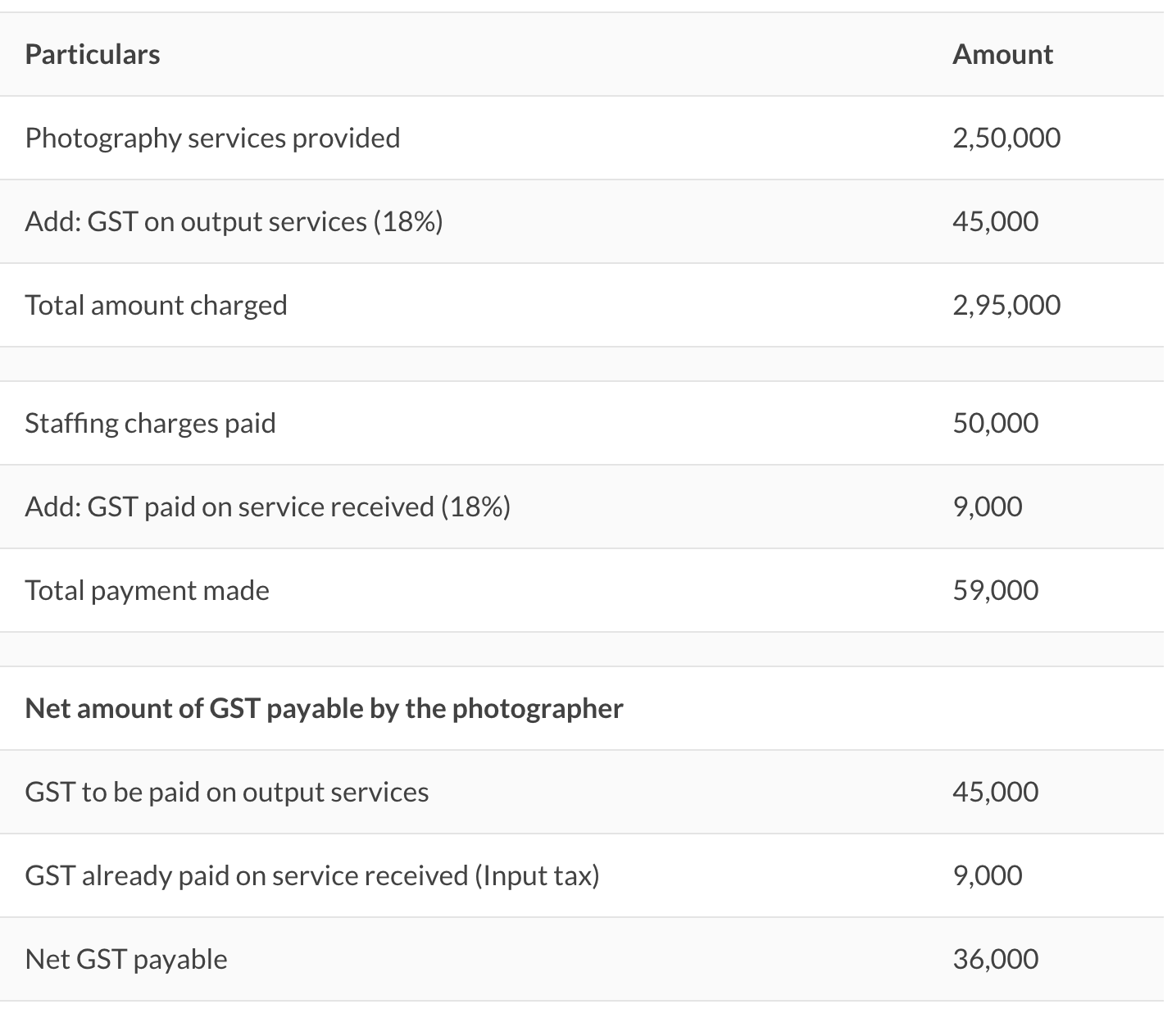

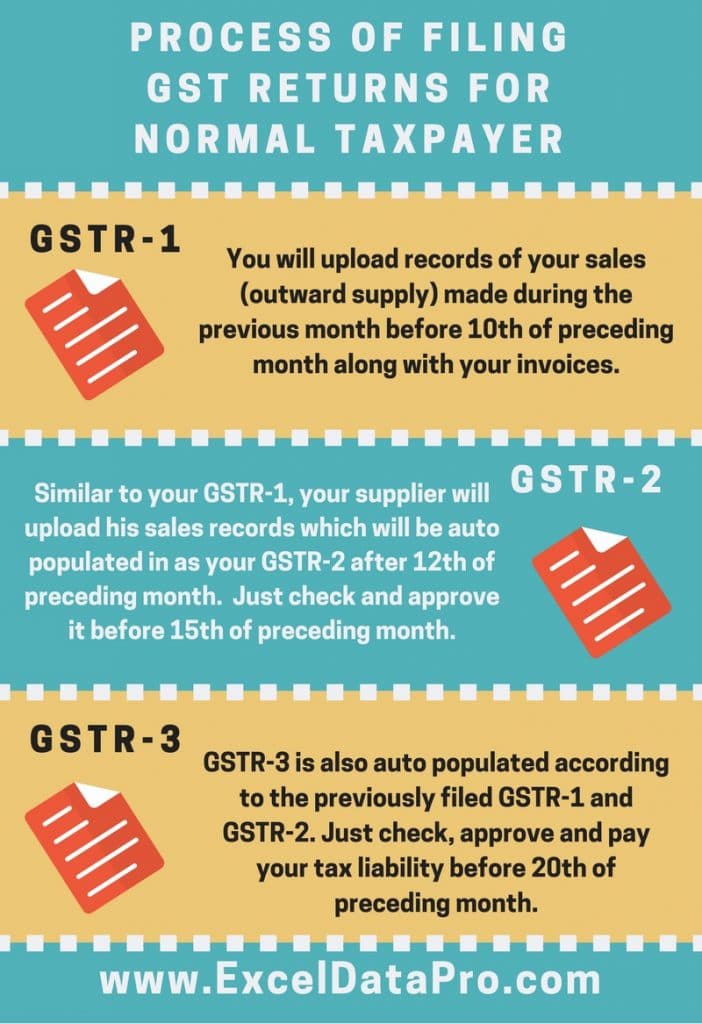

What is the Due date of filing GSTR 1A This return is to be filed or the changes in GSTR 1A can be accepted or rejected between 15th and 17th of next month GSTR 2 In a financial year a registered GST taxpayer is required to file a total of 4 GST returns These returns are filed in various forms such as GSTR 1 GSTR 2A GSTR 3B and

For filing the GST returns one has to file 4 forms that may include the returns for the purchases made returns for the supplies monthly annual returns etc The government GSTR 5A Return to be filed by non resident OIDAR service providers Monthly 20th of the next month GSTR 6 Return for an input service distributor to distribute the eligible

Download How Many Gst Returns To Be Filed

More picture related to How Many Gst Returns To Be Filed

GST Return Who Should File Due Dates Types Of GST Returns

https://assets.dev.khatabook.com/media/uploads/2021/06/06/gst_2-1.webp

How To Know How Many GST Collected From A Particulars Debtors With

https://i.ytimg.com/vi/pM9LbTuf8ho/maxresdefault.jpg

How To File GST Returns A Comprehensive Guide

https://gromonivesh.com/wp-content/uploads/2023/05/PspEFDKLWZ.png

Which GST Returns are required to be filed From 1st January 2021 A registered person is required to file following returns GSTR 3B Quarterly or Monthly This in depth article explains various types of GST Returns format of GST returns process of filing GST returns and important due dates Check out now

When to file your GST return Your GST return is due by the 28 th of the month after the end of your taxable period For example the GST return for the taxable period ending GSTR 3 is the monthly return which consists of the details of both outward and inward supplies already filed GSTR 1 and GSTR 2 GSTR 3 is to be filed before 20th of the

Types Of GST Returns And Their Due Dates ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/07/Types-of-GST-Returns.jpg

GST For Freelancers A Complete Guide On Registration And Rates

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2020/04/Screenshot-2020-06-02-at-4.57.24-PM.png

https://www.indiafilings.com/learn/gst-re…

There are a total of 13 returns under the Goods and Services Tax GST regime These returns serve to capture different aspects of a taxpayer s financial transactions and obligations within the GST

https://tallysolutions.com/gst/types-of-gst-returns

14 rowsFor every GSTIN registered a taxpayer is mandated to file a

GST Explainer On 4 tier GST Tax Structure In India Jordensky

Types Of GST Returns And Their Due Dates ExcelDataPro

GST Rates In 2023 List Of Goods Service Tax Rates Slabs

UNDERSTAND GST RETURNS

GST For Business GST Registration GST Returns Payment Due Dates

GST Returns

GST Returns

GST Return How To File GST Return Who Should File Types Of GST

How Many Monthly GST Returns Are To Be Filed By A Regular Taxpayer

GST

How Many Gst Returns To Be Filed - 2 Types of GST Return There are many GST return types which a business is required to file at different intervals Here is a list of some of the most common ones GSTR 1