How Much Are State Income Tax In California Use our income tax calculator to find out what your take home pay will be in California for the tax year Enter your details to estimate your salary after tax

Find out how much you ll pay in California state income taxes given your annual income Customize using your filing status deductions exemptions and more Quickly figure your 2023 tax by entering your filing status and income Tax calculator is for 2023 tax year only Do not use the calculator for 540 2EZ or prior tax years

How Much Are State Income Tax In California

How Much Are State Income Tax In California

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-state-of-ca-tax-brackets-1.png

California State Taxes What You Need To Know Russell Investments

https://russellinvestments.com/-/media/images/us/blogs/images/kuhariccajuly20_1.jpg?la=en&hash=717E899384790A3236829815D21264B377FC4FB8

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

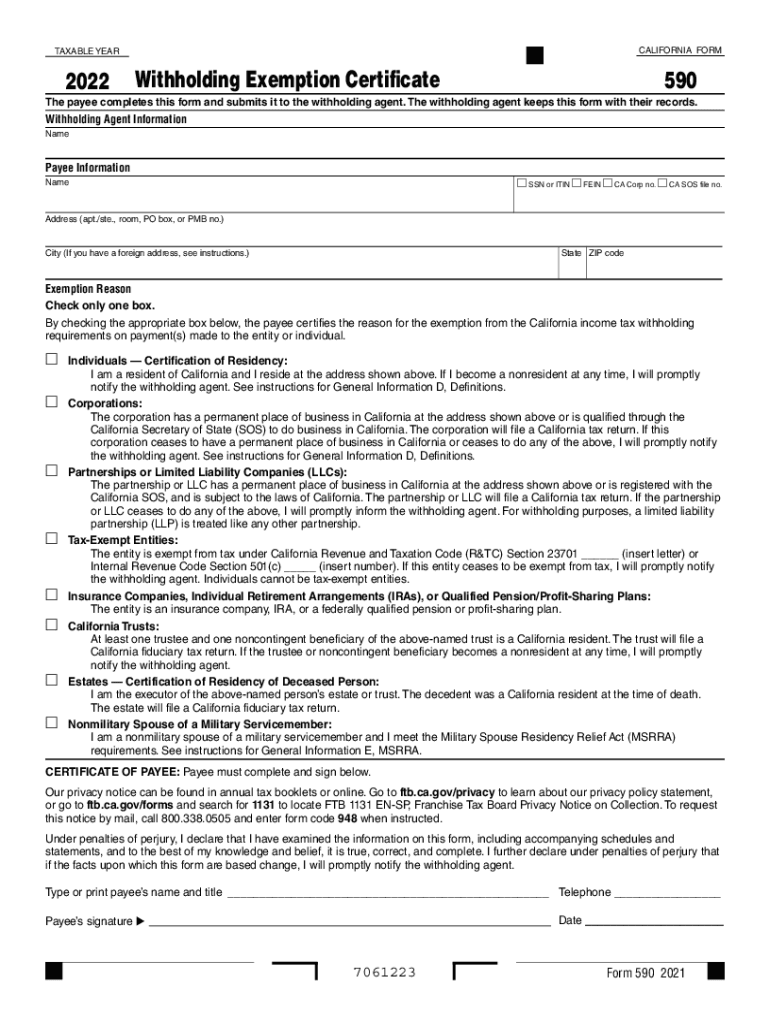

The lowest California income tax rate of 1 applies on income up to 10 099 for single filers up to 20 198 for joint filers California s 2024 income tax ranges from 1 to 13 3 This page has the latest California brackets and tax rates plus a California income tax calculator Income tax tables and other tax information is sourced from the California Franchise Tax Board

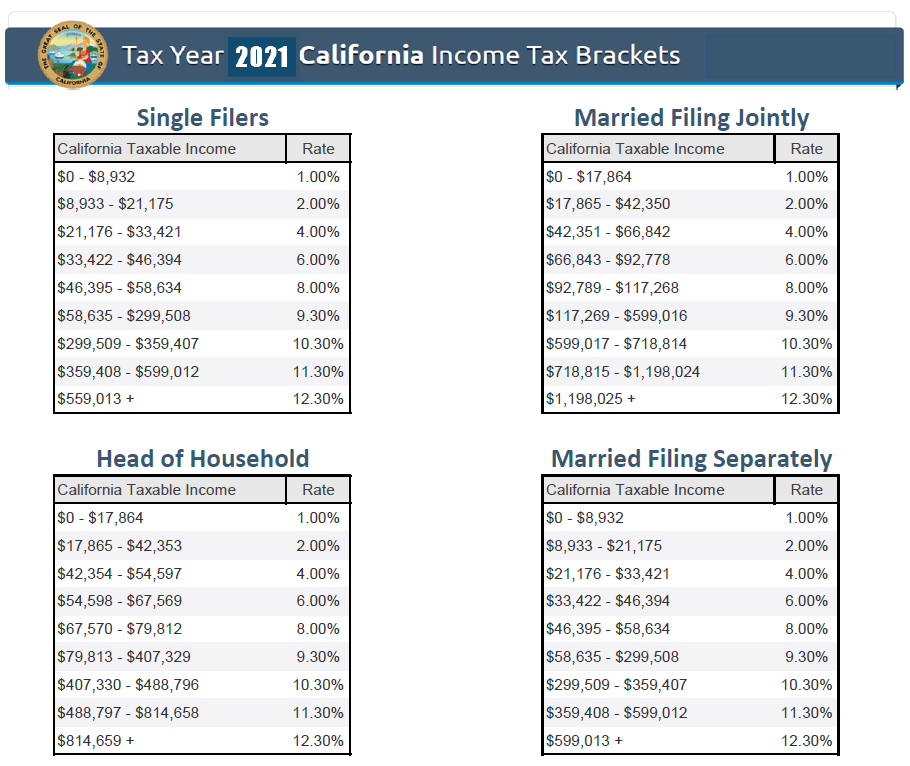

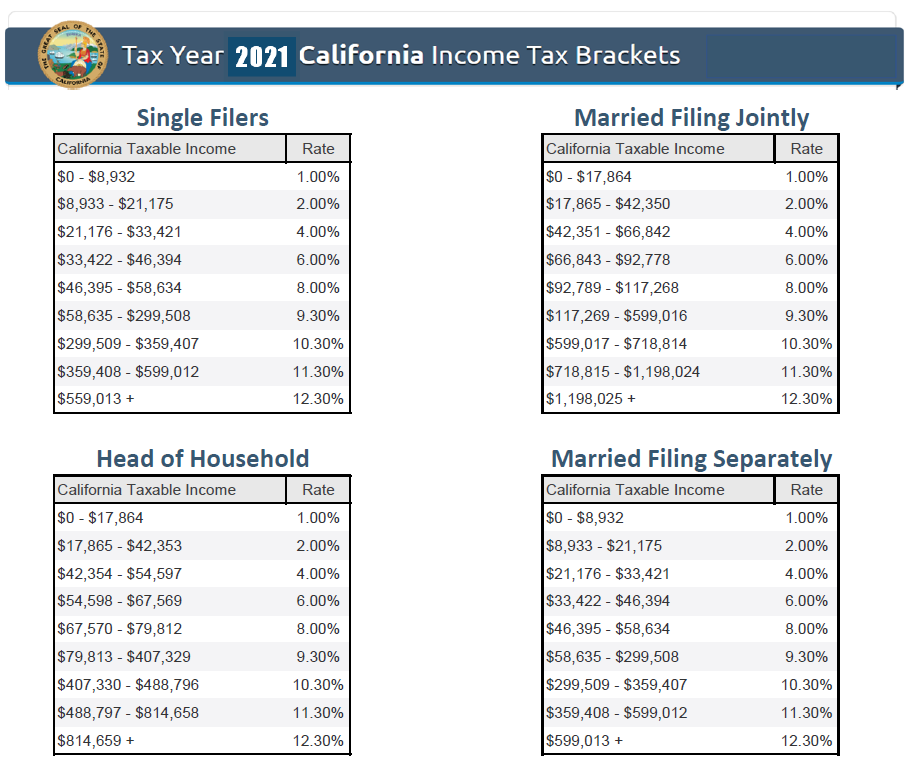

California has nine tax brackets 1 2 4 6 8 9 3 10 3 11 3 and 12 3 Here are the rates and brackets for the 2021 tax year which you ll file in 2022 via the California Franchise SmartAsset s California paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Download How Much Are State Income Tax In California

More picture related to How Much Are State Income Tax In California

States With The Lowest Corporate Income Tax Rates Infographic

https://assets.entrepreneur.com/article/1398974418-states-lowest-corporate-income-tax-rates-infographic.jpg

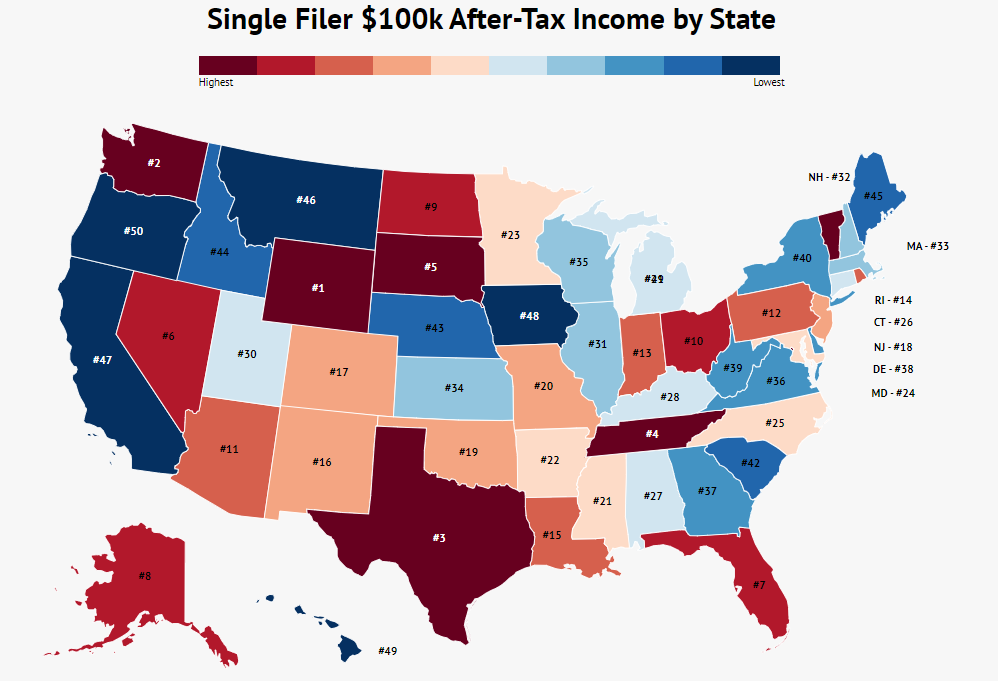

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

Taxes Scolaires Granby

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

Income tax 1 percent to 12 3 percent California has nine tax brackets ranging from 1 percent to 12 3 percent Those who make over 1 million also pay an additional 1 percent income tax Property tax 0 75 percent of California employs a progressive state income tax system ranging from 1 to 13 3 The tax brackets are different for single and married filers but the percentage rates remain the same There is also a 1 2 State Disability Insurance SDI

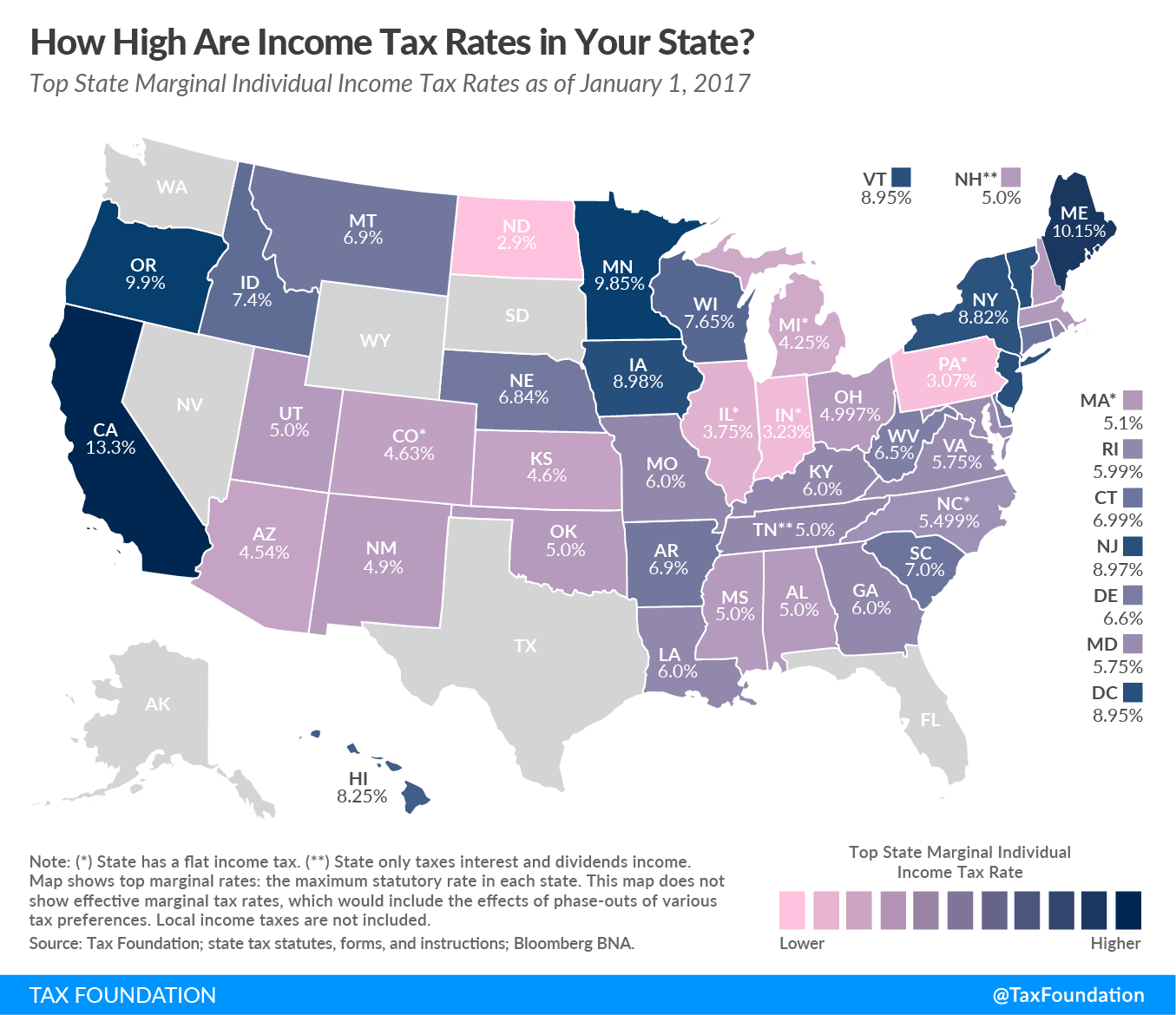

You are able to use our California State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates Californians pay the highest marginal state income tax rate in the country 13 3 according to Tax Foundation data But California has a graduated tax rate which means your rate increases with your income The

2019 State Individual Income Tax Rates And Brackets Tax Foundation

https://files.taxfoundation.org/20190320120532/PIT-2019-FINAL.F-01.png

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

https://i2.wp.com/www.westernstatesfinancial.com/uploads/1/8/7/0/18703714/2020-ca-tax-brackets-pic_orig.png

https://www.forbes.com/advisor/income-tax-calculator/california

Use our income tax calculator to find out what your take home pay will be in California for the tax year Enter your details to estimate your salary after tax

https://smartasset.com/taxes/california-tax-calculator

Find out how much you ll pay in California state income taxes given your annual income Customize using your filing status deductions exemptions and more

Tax Payment Which States Have No Income Tax Marca

2019 State Individual Income Tax Rates And Brackets Tax Foundation

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

Which States Have The Highest And Lowest Income Tax USAFacts

How To Calculate Salary After Taxes In California Tax Walls

Top State Income Tax Rates For All 50 States Chris Banescu

Top State Income Tax Rates For All 50 States Chris Banescu

California State Income Tax Fill Out Sign Online DocHub

California Sales Tax Exempt Form 2023 ExemptForm

Taxes Are Surprisingly Similar In Texas And California Mother Jones

How Much Are State Income Tax In California - The lowest California income tax rate of 1 applies on income up to 10 099 for single filers up to 20 198 for joint filers