How Much Can You Claim For Child Care Expenses In Canada How Much of Your Child Care Expenses Can You Claim Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year

How do I claim child care expenses The most common method is by using the Child Care Expense Deduction Form to figure out your permitted amount of child care expenses You must get a receipt from the individual or You can claim the cost of the following child care services Child care services provided by caregivers including babysitters and nannies Nursery schools and daycare centres Child

How Much Can You Claim For Child Care Expenses In Canada

How Much Can You Claim For Child Care Expenses In Canada

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

How To Use Tax Credits For Child Care Expenses The Money Coach

https://askthemoneycoach.com/wp-content/uploads/2014/01/iStock_000001230665Small.jpg

When Can You Claim Business Expenses And How To Calculate Them

https://www.olympiabenefits.com/hubfs/Vega/Blog Pages/Tax/when to claim business expenses in Canada.png

The claim for child care expenses cannot exceed two thirds of your earned income for the year The above limits can be found in the Canada Revenue Agency CRA form T778 Child Care Expenses which is filed with You can claim child care expenses for a child under 16 at the beginning of the year unless your child qualifies for the disability tax credit in which case there is no age limit

Eligible taxpayers can claim up to 8 000 per eligible child under the age of 7 at the end of the year and 5 000 per eligible child aged 7 to 16 at the end of the year More details about the totals you can claim are available on To claim the child care expenses deduction you need to report the total amount of eligible child care expenses on line 21400 of your tax return This deduction will reduce your taxable income potentially lowering your tax

Download How Much Can You Claim For Child Care Expenses In Canada

More picture related to How Much Can You Claim For Child Care Expenses In Canada

How Much Can You Purchase With 50K Income Using A FHA Loan YouTube

https://i.ytimg.com/vi/PzgY-KkL2FM/maxresdefault.jpg

Claiming Child Care Expenses In Canada 2022 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/credits-families-720x370.jpg

Claiming Childcare Expenses In Canada Blueprint Accounting

https://www.experienceyourblueprint.com/wp-content/uploads/Claiming-Childcare-expenses-on-Your-Personal-Tax-Return-Blog-Feature-Img.png

Make sure to get a receipt from your nanny babysitter nursery school and or daycare as you may be able to claim child care expenses If your child is under seven you may claim up to 8 000 For a child between seven and 15 you In Canada the tax rules for claiming childcare expenses deduction are as follows Eligibility You or another person may claim childcare expenses if the child is under 16 years

As of 2022 the most you can claim for childcare costs is 8 000 for each child under 7 years old 5 000 for each child 7 to 16 years old and 11 000 for each child who is The maximum child care expenses that can be claimed per child each year is limited to 5 000 8 000 or 11 000 depending on the circumstances This Chapter discusses the meaning of

How Does The Medical Expense Tax Credit Work In Canada

https://www.olympiabenefits.com/hubfs/How does the Medical Expense Tax Credit work in Canada.png

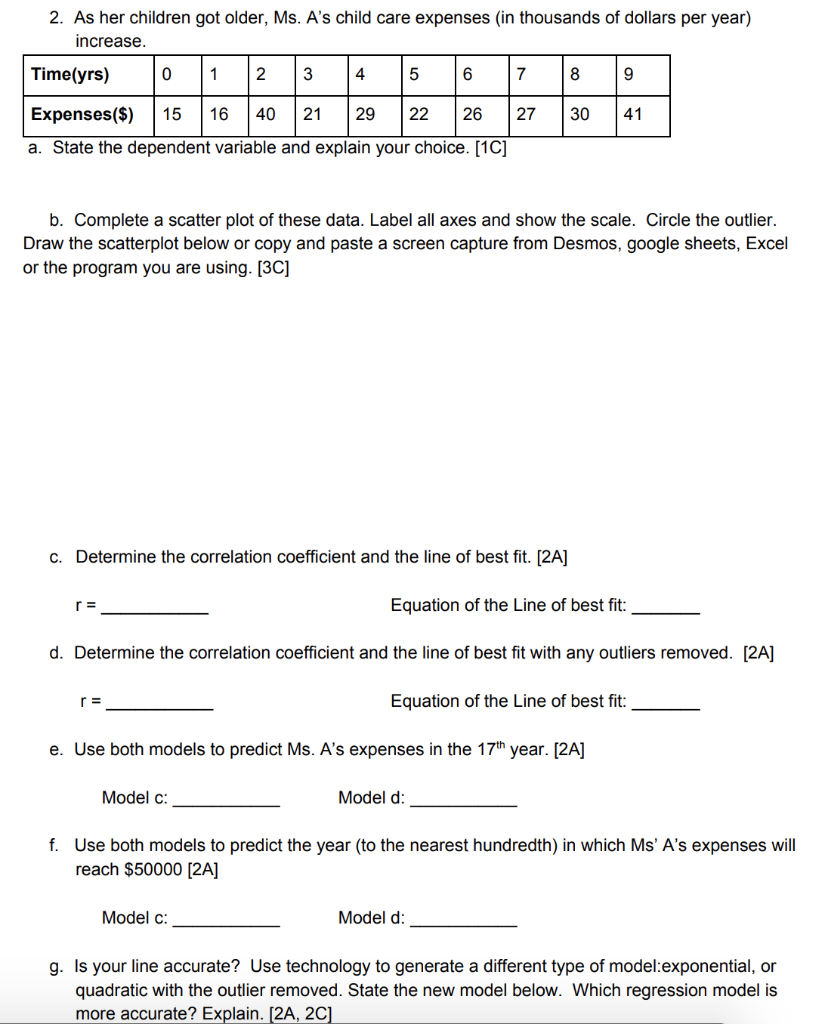

Solved Complete Each Of The Questions Below Using Chegg

https://media.cheggcdn.com/media/0ea/0eab9c65-c8ee-44fa-90f9-d3b3ced72c21/php5ZF861

https://turbotax.intuit.ca › tips

How Much of Your Child Care Expenses Can You Claim Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year

https://go.truenorthaccounting.com › blog › t…

How do I claim child care expenses The most common method is by using the Child Care Expense Deduction Form to figure out your permitted amount of child care expenses You must get a receipt from the individual or

Who Can Claim Child Care Expenses Family Lawyer Winnipeg

How Does The Medical Expense Tax Credit Work In Canada

How Much Can You Borrow Check Out Our Calcu Fi Loan Calculator On

Here s How Parents Can Claim 16 000 Back For Child Care Expenses

Daycare Expenses Child Support In CA SupportPay

How Much Can You Earn Before Paying Income Tax Earnr

How Much Can You Earn Before Paying Income Tax Earnr

Average Salary In UK My Salary In UK My Job In UK How Much Can

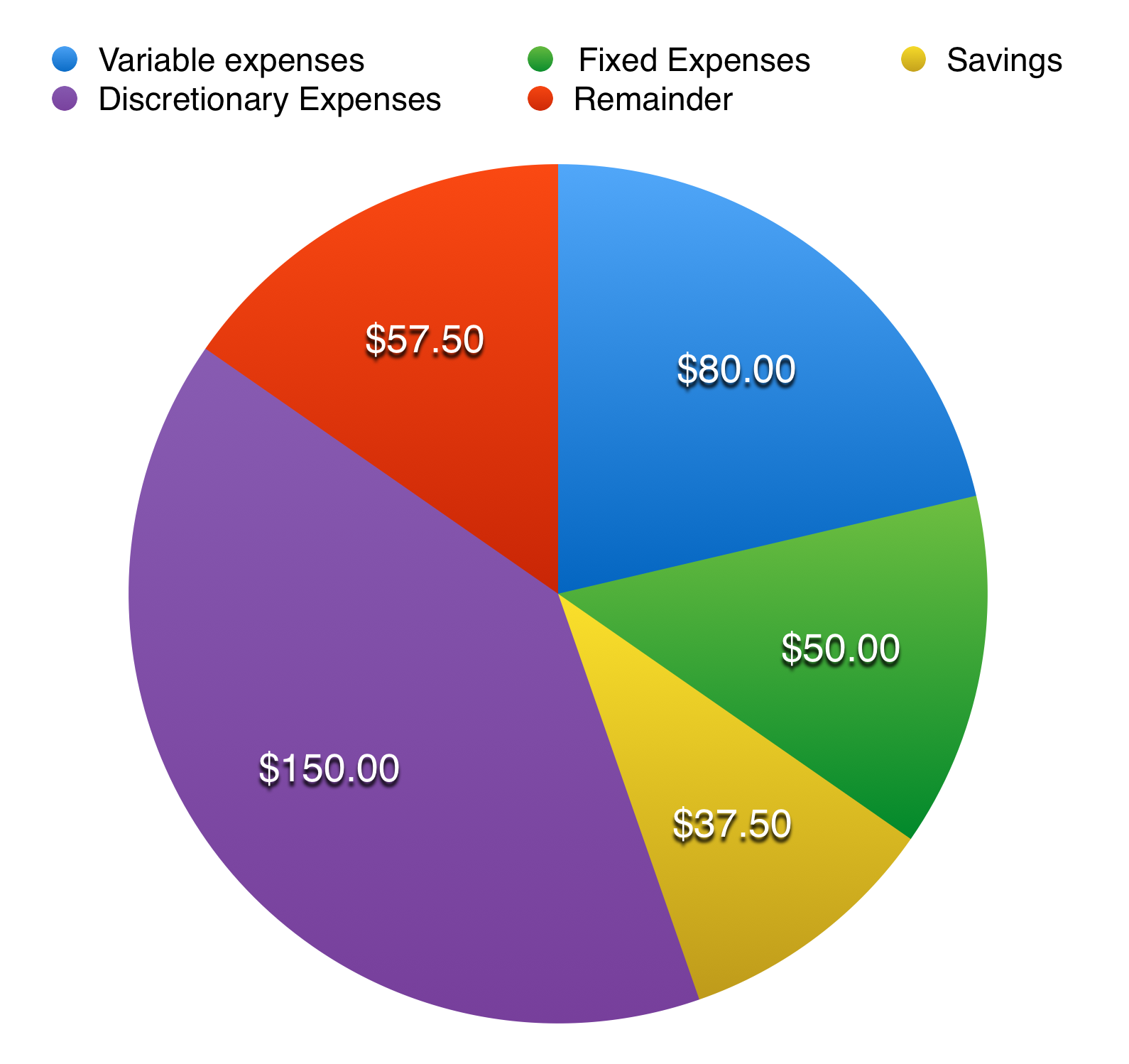

Budgeting Financial Literacy

Mileage Claim Form Template

How Much Can You Claim For Child Care Expenses In Canada - You can claim child care expenses for a child under 16 at the beginning of the year unless your child qualifies for the disability tax credit in which case there is no age limit