How Much Can You Claim For Laundry On Tax Return If your laundry expenses washing drying and ironing but not dry cleaning expenses are 150 or less you can claim the amount you incur on laundry without providing written evidence of your laundry expenses This is the case even if your total claim for work related expenses is more than 300 including your laundry expenses

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat rate expense for uniform is 60 so If you earn up to 50 270 you can claim 20 of that 60 back If you earn over 50 270 you can However you can claim for laundry expenses up to 150 without written evidence This doesn t increase the 300 work related expenses limit to 450 If you launder dry or iron your work related clothing you can use a reasonable basis to calculate the amount that is

How Much Can You Claim For Laundry On Tax Return

How Much Can You Claim For Laundry On Tax Return

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

How Much Can You Inherit Without Paying Tax UK YouTube

https://i.ytimg.com/vi/SD7UOYyELRU/maxresdefault.jpg

How Much Can You Claim For Laundry And Clothing Visory

https://www.visory.com.au/wp-content/uploads/2022/08/how-much-can-you-claim-for-laundry.jpg

If you did washing drying or ironing yourself you can use a reasonable basis to calculate the amount such as 1 per load for work related clothing or 50 cents per load if other laundry items were included We pre fill your tax return with work related clothing laundry and dry cleaning expense information you uploaded from myDeductions It s possible to claim the costs of washing drying ironing and dry cleaning eligible work clothes Written evidence for your laundry expenses such as diary entries and receipts must be kept if both the amount of your claim is greater than 150 and your total claim for work related expenses exceeds 300

How much you can claim You can either claim the actual amount you ve spent you ll need to keep receipts an agreed fixed amount a flat rate expense or flat rate deduction Check if One of the most common mistakes taxpayers make in claiming deductions on their tax return are uniform and laundry expenses You can claim a deduction for the cost you incur to buy and clean your work clothes if it is one of these categories Occupation specific clothing Protective clothing Compulsory uniforms

Download How Much Can You Claim For Laundry On Tax Return

More picture related to How Much Can You Claim For Laundry On Tax Return

How Much Can You Save With R D Tax Credit YouTube

https://i.ytimg.com/vi/el17XjQ0ngg/maxresdefault.jpg

How Much Can You Purchase With 50K Income Using A FHA Loan YouTube

https://i.ytimg.com/vi/PzgY-KkL2FM/maxresdefault.jpg

How Much Can I Claim For Laundry Expenses self employed TaxScouts

https://taxscouts.com/wp-content/uploads/TaxScouts-og-image-6583.png

If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully uniformed pilot police officer or nurse As of the latest update this rate is set at 60 per year How much can be claimed The amount you can claim as part of the laundry expense tax rebate depends on the type of clothing you re seeking to claim for and your industry s norms

Certain business and work related expenses such as the costs of laundering clothes may qualify for a tax deduction Tax deductions reduce your overall liability which can reduce the amount of taxes you owe to the federal government Clothing expenses You can claim allowable business expenses for uniforms protective clothing needed for your work costumes for actors or entertainers You cannot claim for everyday clothing

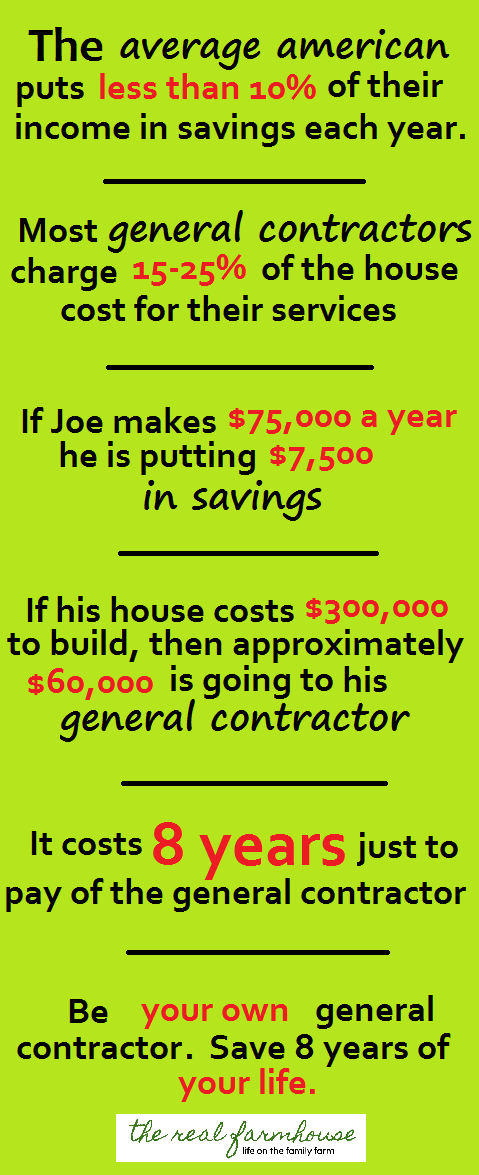

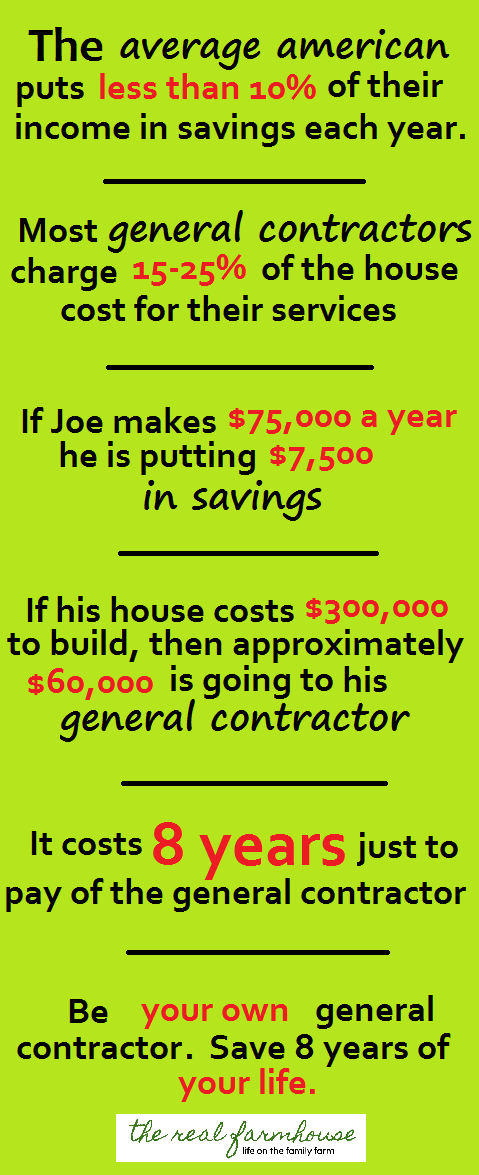

How Much Can You Save By Contracting Your Own House

https://www.therealfarmhouse.com/wp-content/uploads/2016/07/be-your-own-general-contractor-4.png

Do You Have A 10 Zloty Note You Can Get Rich Check Its Serial Number

https://d-art.ppstatic.pl/kadry/k/r/1/2f/28/6377af5a294fc_o_original.jpg

https://www.ato.gov.au/.../clothing-laundry-and-dry-cleaning-expenses

If your laundry expenses washing drying and ironing but not dry cleaning expenses are 150 or less you can claim the amount you incur on laundry without providing written evidence of your laundry expenses This is the case even if your total claim for work related expenses is more than 300 including your laundry expenses

https://taxscouts.com/expenses/how-much-can-i...

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self Assessment tax return In the 2024 25 tax year the flat rate expense for uniform is 60 so If you earn up to 50 270 you can claim 20 of that 60 back If you earn over 50 270 you can

How Much Can You Save With An Adjustable Rate Mortgage YouTube

How Much Can You Save By Contracting Your Own House

HOW MUCH MONEY DO TRADERS MAKE HOW MUCH MONEY CAN YOU MAKE TRADING

How Much Can You Earn Before Paying Income Tax

Financial Services Register How Does The FCA Keep You Safe In 2024

General Information Omokoroa Property Management Limited

General Information Omokoroa Property Management Limited

Standard Deduction How Much Can You Claim On Your Declarations For

How Much Can You Earn From Surveys En Bangnovan

How Much Can You Make As A Tax Preparer

How Much Can You Claim For Laundry On Tax Return - How much you can claim You can either claim the actual amount you ve spent you ll need to keep receipts an agreed fixed amount a flat rate expense or flat rate deduction Check if