How Much Can You Claim Laundry Tax If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self

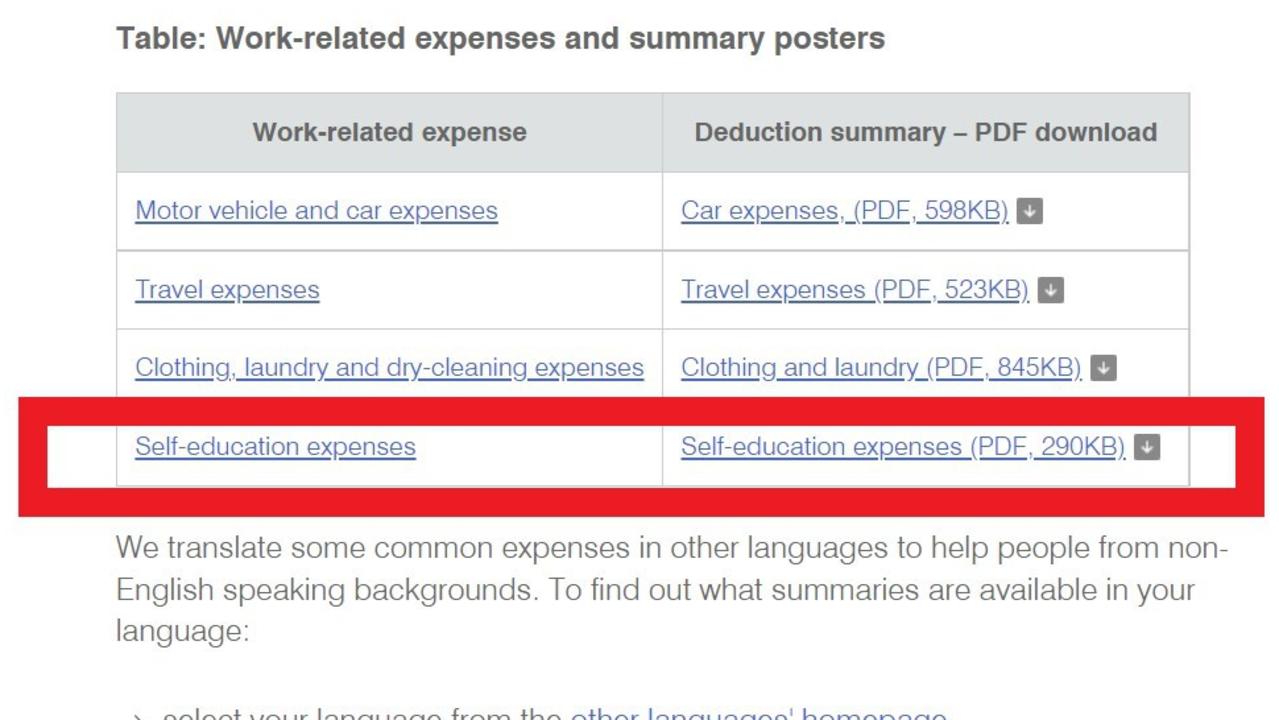

Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry QC 72119 Find out which expenses you can claim as income To claim work related clothing laundry and dry cleaning expenses you must first show income from salary and wages or foreign employment income in the

How Much Can You Claim Laundry Tax

How Much Can You Claim Laundry Tax

https://taxscouts.com/wp-content/uploads/TaxScouts-og-image-6583.png

Working From Home What Can You Claim And How Do You Claim It Public

https://www.publicaccountant.com.au/images/tax_consultant_.jpeg

Can You Claim Mortgage Interest On Taxes CountyOffice YouTube

https://i.ytimg.com/vi/IUnJn3SsPLw/maxresdefault.jpg

The maximum laundry expenses you can claim without receipt is 150 However you can have total work related expenses laundry expenses included claimed for up to 300 without receipts Bear in mind that you It s possible to claim the costs of washing drying ironing and dry cleaning eligible work clothes Written evidence for your laundry expenses such as diary entries and receipts

You can claim washing drying and ironing you do yourself using the following ATO formula 1 per load if it contains only work related clothing items 50 cents per Trump s tax cuts Trump repeated his regular claim that his signature tax cuts in the Tax Cuts and Jobs Act of 2017 were the largest tax cut ever provided Facts

Download How Much Can You Claim Laundry Tax

More picture related to How Much Can You Claim Laundry Tax

Can You Claim Clothing As A Business Expense CRUX Award Winning

http://static1.squarespace.com/static/5b4c14fe9f8770f26424fa47/t/632cd8e82db81d3724879b35/1663883498196/unsplash-image-b34E1vh1tYU.jpg?format=1500w

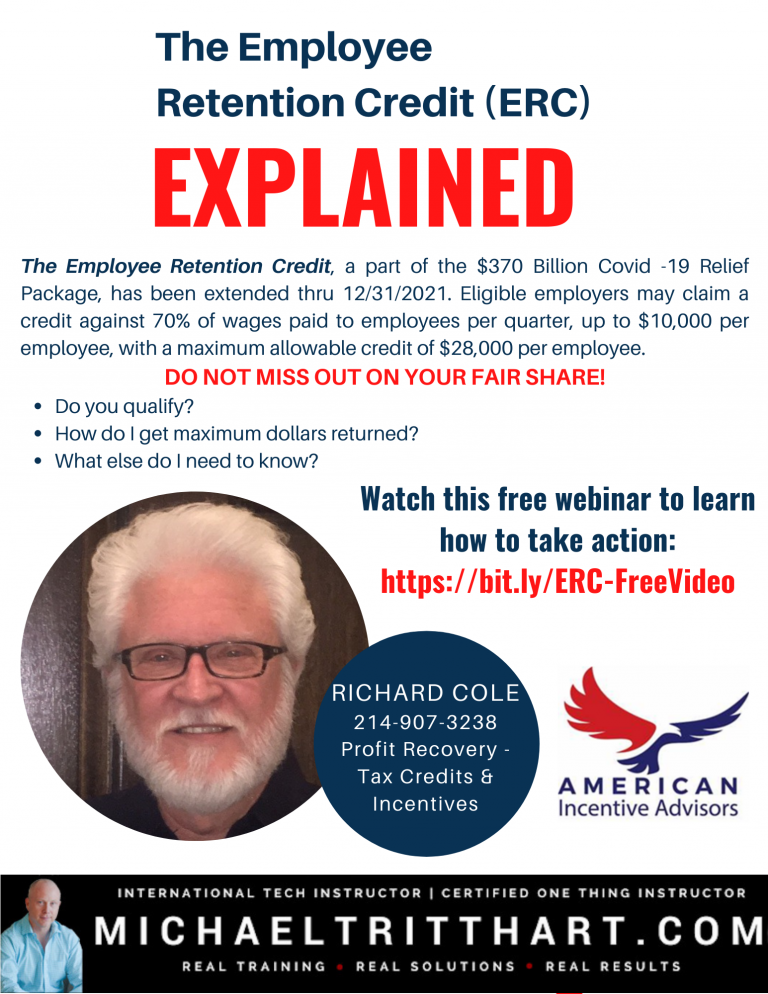

Can You Claim The Employee Retention Credit MichaelTritthart

https://michaeltritthart.com/wp-content/uploads/2021/08/RichardCole-v2-768x994.png

Claim Laundry Dry Cleaning Expenses In Tax Return 2021 MyTax Mygov

https://i.ytimg.com/vi/yHJtKlvuvaY/maxresdefault.jpg

If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 100s of tax for up to five years of expenses You can reclaim whether it s just a branded T shirt or if you re a fully Uniforms work clothing and tools You may be able to claim tax relief on the cost of repairing or replacing small tools you need to do your job for example scissors or an

The Fed could still get the soft landing it has been hoping for weekly jobless claims fell more than expected in fresh data released on Thursday a minor but positive We ve created the following table which lists some of the possible methods for laundering your work clothes as well as how to calculate your deduction Means of cleaning

Can You Claim Clothing As A Business Expense NH Associates

https://www.nh-a.co.nz/wp-content/uploads/2022/07/BLOG-Covers-2.png

Tax Return How To Save Almost 2000 In Deductions News au

https://content.api.news/v3/images/bin/fedf6fcb9e426601151fd683840e3f62

https://taxscouts.com/expenses/how-much-can-i...

If your laundry expenses pass the wholly exclusively and necessarily test you can claim self employed expenses You do this when you do your Self

https://www.ato.gov.au/.../deductions-you-can-claim

Income and allowances to declare and the expenses you can claim a deduction for in your occupation or industry QC 72119 Find out which expenses you can claim as income

Doola On Twitter Are You Ready For Tax Season Join Us On 3 1 For

Can You Claim Clothing As A Business Expense NH Associates

Donations What Can You Claim As A Tax Deduction Queensland Country

Who Can You Claim As A Tax Dependent

How Much Will It Cost To Buy A House RE MAX Canada

Know Whether You Can Claim Input Tax Credit On Food

Know Whether You Can Claim Input Tax Credit On Food

.png)

General 1 EC ACCOUNTING SOLUTIONS CPA

Should I Lie To My Accountant

How Much Can You Make As A Tax Preparer

How Much Can You Claim Laundry Tax - The maximum laundry expenses you can claim without receipt is 150 However you can have total work related expenses laundry expenses included claimed for up to 300 without receipts Bear in mind that you