How Much Can You Deduct For Food On Taxes 2023 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27 2020 the deductibility of meals is changing Food and beverages were 100 deductible if

WASHINGTON The Treasury Department and the Internal Revenue Service today issued Notice 2021 25 PDF providing guidance under the Taxpayer Certainty and The deduction for unreimbursed non entertainment related business meals is generally subject to a 50 limitation You generally can t deduct meal expenses unless

How Much Can You Deduct For Food On Taxes

How Much Can You Deduct For Food On Taxes

https://www.realized1031.com/hubfs/propertytaxes-1295797018.jpg#keepProtocol

Can You Deduct Gas On Taxes

https://taxsaversonline.com/wp-content/uploads/2022/07/Can-You-Deduct-Gas-On-Taxes-1-850x567.jpg

How Much Can You Deduct For Business Mileage In 2023

https://venicecpa.com/images/business-mileage-deduction-2023.jpg

April 8 2021 Related TOPICS The IRS released guidance on Thursday explaining when the temporary 100 deduction for restaurant meals is available and when the 50 limitation on the deduction for food and Your deduction is usually limited to 50 of the expenses You can fully deduct the cost of business gifts up to a maximum of 25 per client per year if they re Ordinary and

For many years meal expenses incurred while traveling for business were only 50 deductible However during 2021 and 2022 business meals in restaurants are 100 42 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3 Cash App Taxes

Download How Much Can You Deduct For Food On Taxes

More picture related to How Much Can You Deduct For Food On Taxes

What I Have Learned Mr Mangindo Has An Income Of P 20 000 00 Per Month

https://ph-static.z-dn.net/files/de1/604e4594c1ae81a7b99beae2db783015.jpg

The Medical Expense Deduction What You Can Deduct And How Much Nursa

https://nurscdn.nursa.org/how_much_can_you_deduct_for_medical_expenses_.jpg

Deducting Meals And Entertainment In 2021 2022 Lifetime Paradigm

https://lifetimeparadigm.com/wp-content/uploads/2022/02/Deducting-Meals-Entertainment-1.png

If you re self employed and have health insurance you can deduct the cost of your premiums from your taxes This deduction is available even if you don t claim itemized Generally you can either take a Standard Deduction such as 6 350 if you re filing 2017 taxes as a single person or you can list each of your deductions

Feb 4 2022 0 comments Donating food to a food bank can be deducted from your taxable income as a charitable donation Donating food can help more than feeding the In 2021 the Consolidated Appropriations Act CAA allowed businesses to deduct 100 of certain business meal expenses in 2021 and 2022 But the deduction

Can I Deduct Expenses For Growing Food That I Donate Nj

https://www.nj.com/resizer/uTo2vb_wa7xHMXZkj4iUCHfor2M=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/CYUSSK7UVVCDZNWJYYBOXEGCXQ.jpg

Solved How Much Can She Deduct Were You Being A Tax Professional

https://www.coursehero.com/qa/attachment/38368717/

https://www.bench.co/blog/tax-tips/deduct-m…

2023 meals and entertainment deduction As part of the Consolidated Appropriations Act signed into law on December 27 2020 the deductibility of meals is changing Food and beverages were 100 deductible if

https://www.irs.gov/newsroom/treasury-irs-provide...

WASHINGTON The Treasury Department and the Internal Revenue Service today issued Notice 2021 25 PDF providing guidance under the Taxpayer Certainty and

What Expenses Can You Deduct For A Second Property In Canada

Can I Deduct Expenses For Growing Food That I Donate Nj

Can I Deduct My Tax prep Fees Fox Business

What You Can t Deduct On Your Taxes

What Can I Deduct As A Business Expense

How To Deduct Your Car And Rent On Your Tax Return YouTube

How To Deduct Your Car And Rent On Your Tax Return YouTube

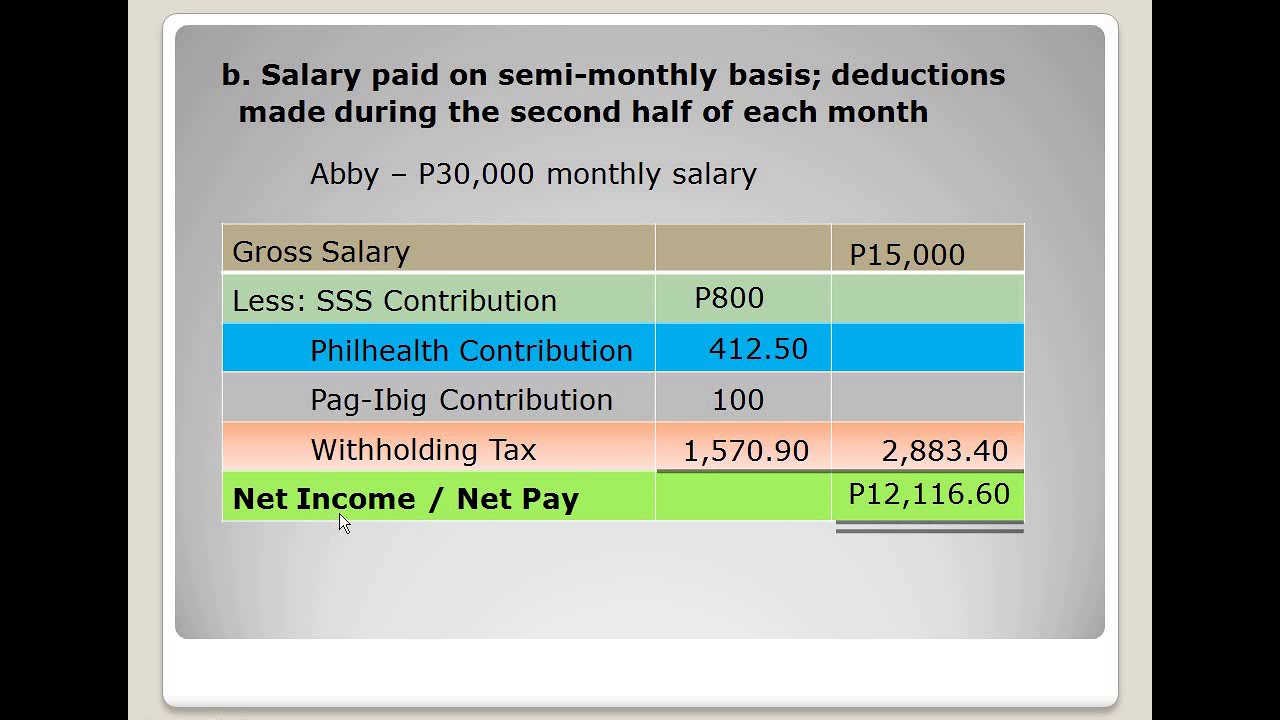

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

List Of Tax Deductions Here s What You Can Deduct

Learn Which Donations You Can Deduct From Your Tax Return In 2020

How Much Can You Deduct For Food On Taxes - 42 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3 Cash App Taxes