How Much Can You Withdraw From Rrsp For First Time Home Buyer You can withdraw amounts from your RRSP under the HBP and make a qualifying withdrawal from your first home savings account FHSA for the same qualifying

The HBP allows you to pay back the amounts withdrawn within a 15 year period You can make a withdrawal from more than one RRSP as long as you are the With the Home Buyers Plan you can withdraw up to 60 000 without paying withholding tax or including the withdrawal as income to put towards your first home as long as you

How Much Can You Withdraw From Rrsp For First Time Home Buyer

How Much Can You Withdraw From Rrsp For First Time Home Buyer

https://static.twentyoverten.com/5c98ec659c4ce5673c7afaf6/ZTy7ShXdur/early-withdrawal-exceptions.png

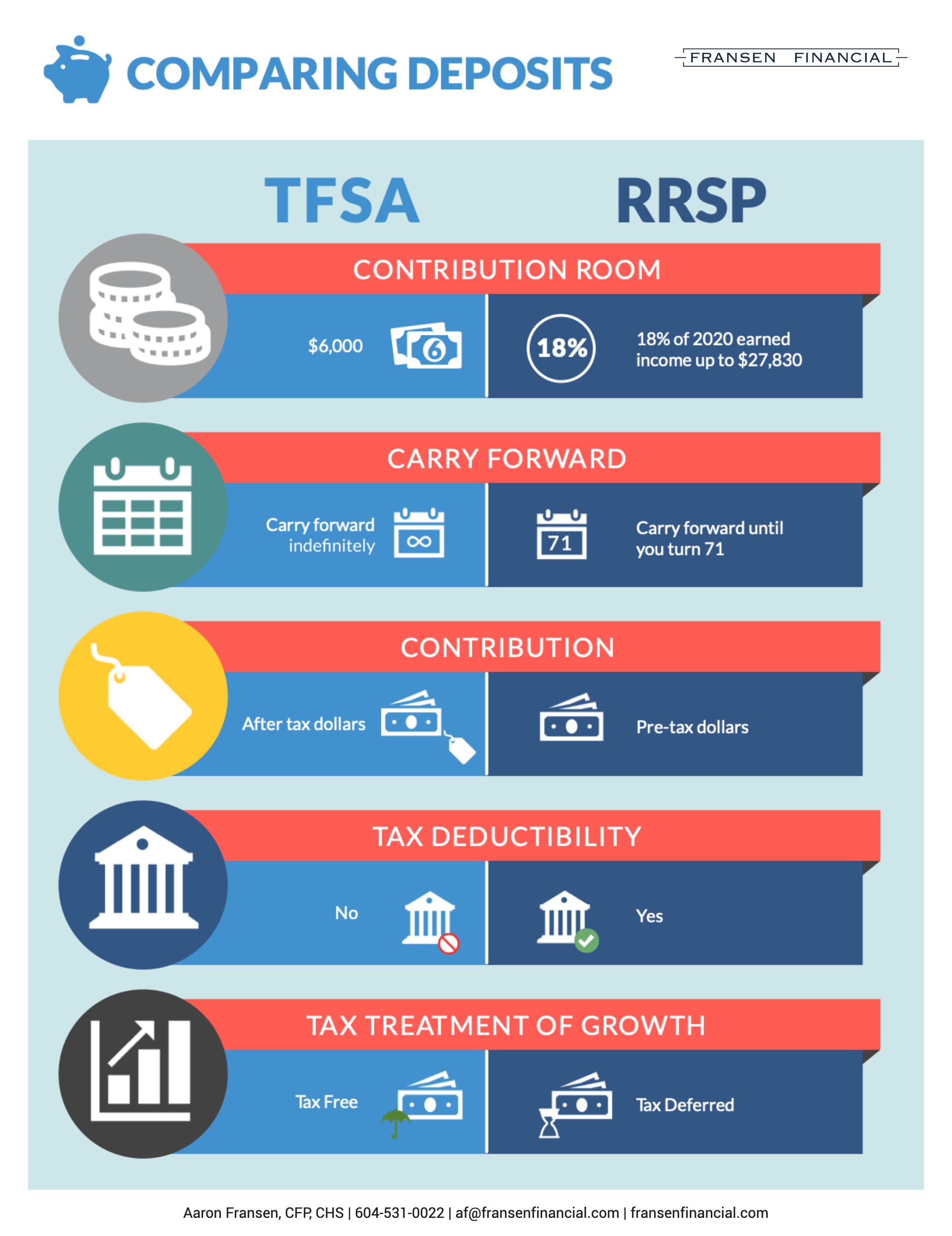

RRSP TFSA s For First Time Home Buyers

https://static.wixstatic.com/media/fcb657_c3eadd36edf64d45b72cb23b3997d527~mv2.jpg/v1/fill/w_960,h_498,al_c,lg_1,q_85/fcb657_c3eadd36edf64d45b72cb23b3997d527~mv2.jpg

TFSA Vs RRSP What You Need To Know To Make The Most Of Them In 2021

https://www.appsforadvisors.com/ufs/advisorBrandedContent/k5JCSt3PXDeFyoo48/FTT_2021_TFSA-vs-RRSP_Deposits@144ppi-Aaron -Fransen.png

How much can I withdraw from my RRSP You can withdraw up to 35 000 from your RRSP per calendar year Spouses or partners may also each withdraw up to 35 000 You can maximize your RRSP contributions by buying or building your first home You receive a two year grace period before you begin repaying the amount withdrawn

With the federal government s Home Buyers Plan you can use up to 60 000 of your RRSP savings 120 000 for a couple to help finance your down payment on a home Recent changes to the HBP also extend the amount of time first time home buyers have to start repaying their RRSP from two to five years for those who make withdrawals

Download How Much Can You Withdraw From Rrsp For First Time Home Buyer

More picture related to How Much Can You Withdraw From Rrsp For First Time Home Buyer

Withdrawing From Your RRSP From The First Time Home Buyer Plan To

https://cms.howtosavemoney.ca/wp-content/uploads/2020/02/rrsp-withdraw-first-time-home-buyers.jpg

Time To Get Aggressive With Your TFSA The Globe And Mail

https://www.theglobeandmail.com/resizer/bZH5sn2IgleJy9Mws6su3AYomr4=/1200x0/filters:quality(80)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/TOWG4V2ARJBY7K57Y3W7FDEXDU

Best Way To Withdraw Money From RRSP A Full Up to date Guide

https://income.ca/wp-content/uploads/Tax-Free-sign.jpg

As of April 16 2024 first time home buyers can withdraw up to 60 000 from their RRSP via the HBP 1 Previously the HBP withdrawal limit was 35 000 The The RRSP Home Buyers Plan HBP lets you withdraw up to 35 000 tax free from your RRSP in order to fund the purchase of your first home You have to start

[desc-10] [desc-11]

Sample Withdrawal Letter From Attorney

https://s2.studylib.net/store/data/015533242_1-dbf7d7ce811f1b9e4cfa7ca96a1034bb-768x994.png

Advisorsavvy How To Withdraw Money From RRSP

https://advisorsavvy.com/wp-content/uploads/2022/08/How-to-Withdraw-Money-from-RRSP.jpg

https://www.canada.ca/en/revenue-agency/services/tax/individuals...

You can withdraw amounts from your RRSP under the HBP and make a qualifying withdrawal from your first home savings account FHSA for the same qualifying

https://www.canada.ca/en/revenue-agency/services/tax/individuals...

The HBP allows you to pay back the amounts withdrawn within a 15 year period You can make a withdrawal from more than one RRSP as long as you are the

Should You Make An RRSP Withdrawal For Renovation Costs

Sample Withdrawal Letter From Attorney

How To Withdraw Tax Free From Your RRSP CanadianPreferredShares

Retirement Planning Test Assessment Sample Examination Assessment

Withdrawing From Your RRSP YouTube

It s RRSP Time What You Should Know Before The Deadline

It s RRSP Time What You Should Know Before The Deadline

RRSP First Time Home Buyer Guide 2021 Get Up To 70 000

Should You Use Your RRSP To Buy A Home

RRSP Withdrawal Rules And Taxes Explained PiggyBank

How Much Can You Withdraw From Rrsp For First Time Home Buyer - [desc-14]

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/TOWG4V2ARJBY7K57Y3W7FDEXDU)