How Much Child Care Can You Claim On Taxes 2022 The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents This means that the

How Much Child Care Can You Claim On Taxes 2022

How Much Child Care Can You Claim On Taxes 2022

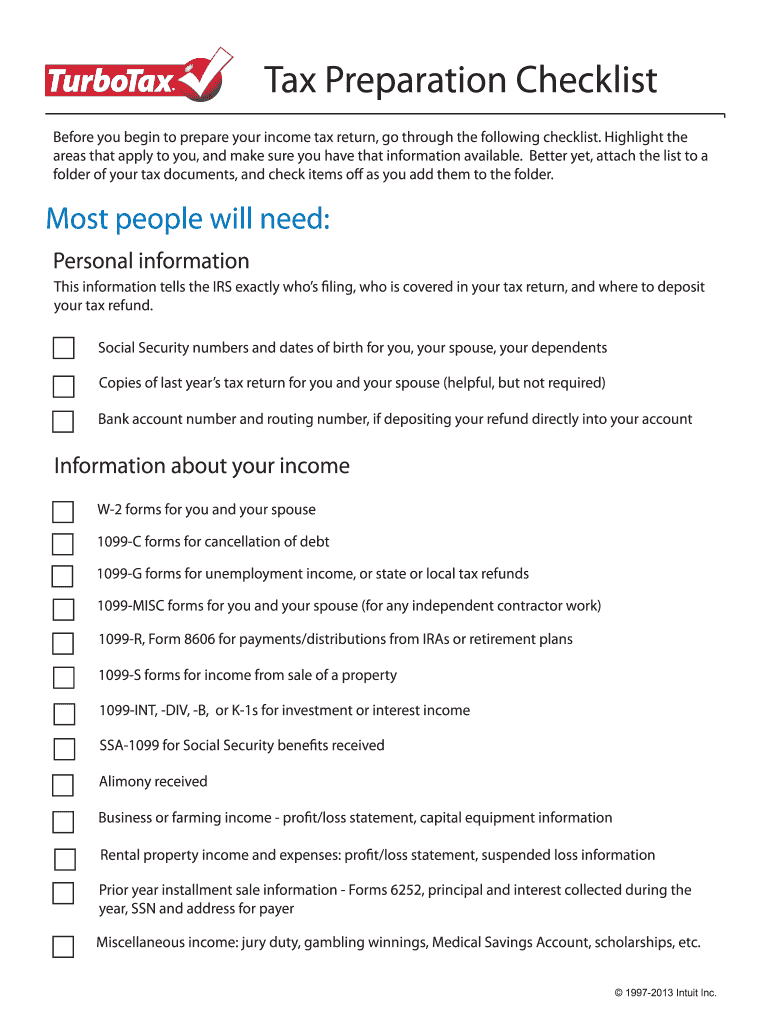

https://www.signnow.com/preview/100/93/100093528/large.png

How Many Kids Can You Claim On Taxes YouTube

https://i.ytimg.com/vi/5ZlHu2_Btog/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBlKGUwDw==&rs=AOn4CLAUVfOUGX38VyHK3nGlEwomCKi1-g

2020 V A Disability Pay Chart

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

Your 2022 Child and Dependent Care Tax Credit ranges from 20 to 35 of what you spent on daycare up to 3 000 for one dependent or up to 6 000 for two or more dependents Your applicable percentage depends Key Points For your 2021 tax return the cap on expenses eligible for the child and dependent care tax credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2024 Benefits of the tax Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the

Download How Much Child Care Can You Claim On Taxes 2022

More picture related to How Much Child Care Can You Claim On Taxes 2022

6 Self Employed Expenses The HMRC Lets You Claim On Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110ca7e818bb7f9b063bd76_60d828f4f239013f07a58dda_self-employed-expenses-2.jpeg

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-hanfincal.jpg

How Many Kids Can You Claim On Taxes Hanfincal

https://hanfincal.com/wp-content/uploads/2022/01/how-many-kids-can-you-claim-on-taxes-01.jpg

If you paid a day care center homecare aide or other person or organization to care for your child or a relative so that you and or your spouse could work or look for How much you receive depends on how much you spent during the year on work related child care Taxpayers with one child can submit up to 8 000 of qualifying expenses while U S

Parents with one child can claim 50 of their child care expenses up to 8 000 That means parents with one child can get a maximum tax credit of 4 000 on their taxes this It s called the Child and Dependent Care Tax Credit CDCC and you might be able to get back some of the money you spent on these expenses by claiming it Learn more about this

How Many Children Can You Claim On Your Taxes

https://theinsiderr.com/wp-content/uploads/2022/12/How-Many-Children-Can-You-Claim-On-Your-Taxes.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://help.taxreliefcenter.org/wp-content/uploads/2018/08/Tax-Relief-Center-10-Taxes-You-Can-Write-Off-When-You-Work-From-Home-20180725.jpg

https://www.irs.gov/newsroom/child-and-dependent...

The following FAQs can help you learn if you are eligible and if eligible how to calculate your credit Further information is found below and in IRS Publication 503 Child and

https://www.irs.gov/publications/p503

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next

5 Ways To Make Your Tax Refund Bigger The Motley Fool

How Many Children Can You Claim On Your Taxes

What Can You Claim On Taxes In 2020 Perth Mobile Tax

How Many Kids Can You Claim RT Jan16 RapidTax Blog

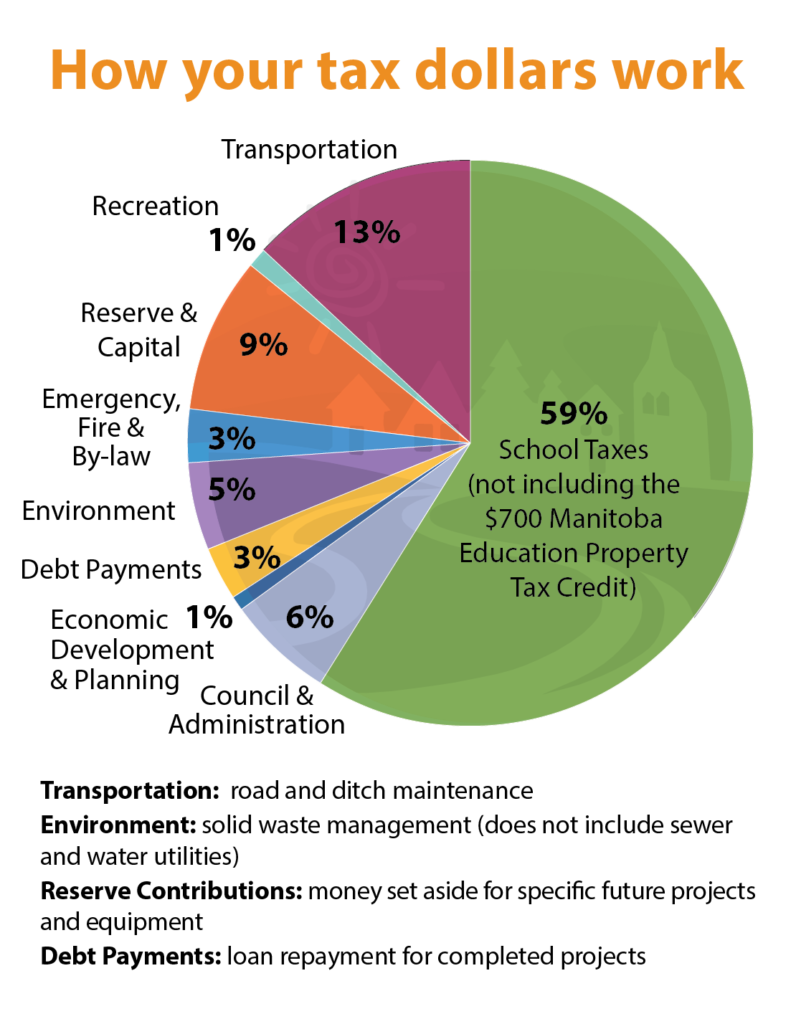

Tax Dollars Pie Chart 2x Rural Municipality Of St Clements

How Much Medical Expense Can You Claim On Taxes 27F Chilean Way

How Much Medical Expense Can You Claim On Taxes 27F Chilean Way

Can I Write Off Medical Expenses Canada 27F Chilean Way

Fillable Online What Receipts Can You Claim On Taxes Fax Email Print

Tax Deductions Write Offs To Save You Money Financial Gym

How Much Child Care Can You Claim On Taxes 2022 - Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the