How Much Cpp Is Deducted From My Paycheck 2023 This guide contains the most common pay periods weekly biweekly every two weeks semi monthly and monthly If you have unusual pay periods such as daily

The maximum pensionable earnings under the Canada Pension Plan CPP for 2023 will be 66 600 up from 64 900 in 2022 The basic exemption amount for For 2024 the maximum CPP payout is 1 364 60 per month for new beneficiaries who start receiving CPP at 65 while the average CPP in October 2023

How Much Cpp Is Deducted From My Paycheck 2023

How Much Cpp Is Deducted From My Paycheck 2023

https://www.coursehero.com/qa/attachment/18920165/

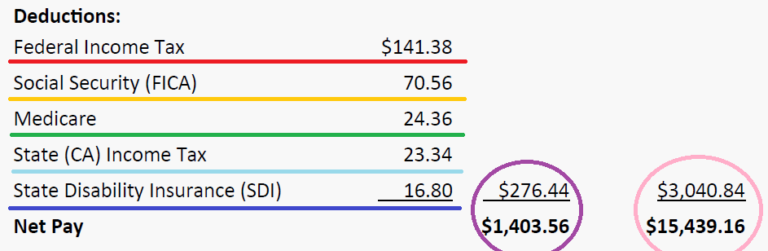

Anatomy Of A Paycheck Understanding Your Deductions Fidelity

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/LC/infographic/Anatomy_of_a_paycheck_Desktop_Image_Module_1_Hero_Image.png

How Much Money Is Deducted From My Paycheck In CA Allman Allman

https://allmancpa.com/wp-content/uploads/2020/08/pexels-karolina-grabowska-4386367.jpg

The Cpp deduction calculator takes into account your income age and other factors to determine the amount of Cpp deductions you need to pay The If you are an employee your CPP contributions are deducted at source from your payroll until the maximum annual amount is reached Once this maximum is

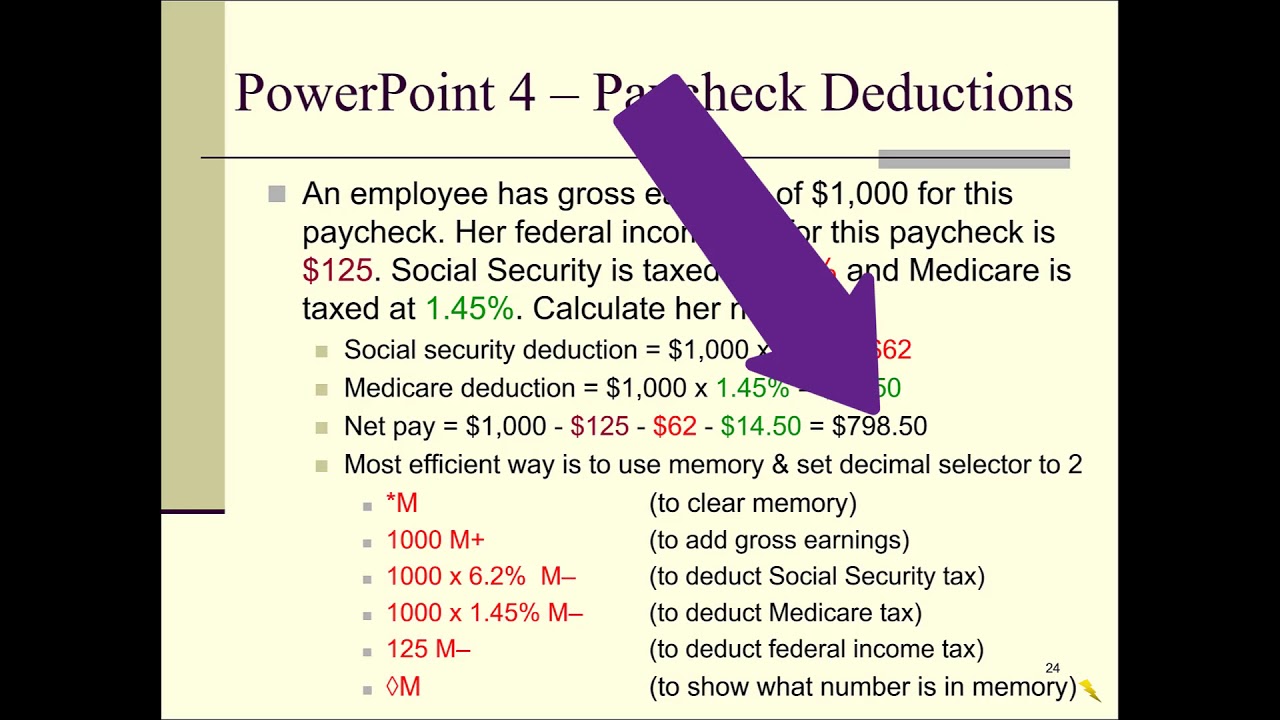

Use this calculator to estimate whether you need a change in your withholding tax percentage rate You may require a new with holding rate because you Payroll Deductions Tables CPP EI and income tax deductions British Columbia T4032 BC E Rev 24 This guide uses plain language to explain the most

Download How Much Cpp Is Deducted From My Paycheck 2023

More picture related to How Much Cpp Is Deducted From My Paycheck 2023

How Much Taxes Deducted From Paycheck In Ga Georgia

https://www.allaboutcareers.com/wp-content/uploads/2022/05/Taxes-Deducted-From-Paycheck-in-Ga.jpg

Visualizing Taxes Deducted From Your Paycheck In Every State

https://cdn.howmuch.net/articles/how-much-money-gets-taken-out-paychecks-1542.jpg

How To Calculate Net Income California Haiper

https://i.ytimg.com/vi/Omxh157P-8U/maxresdefault.jpg

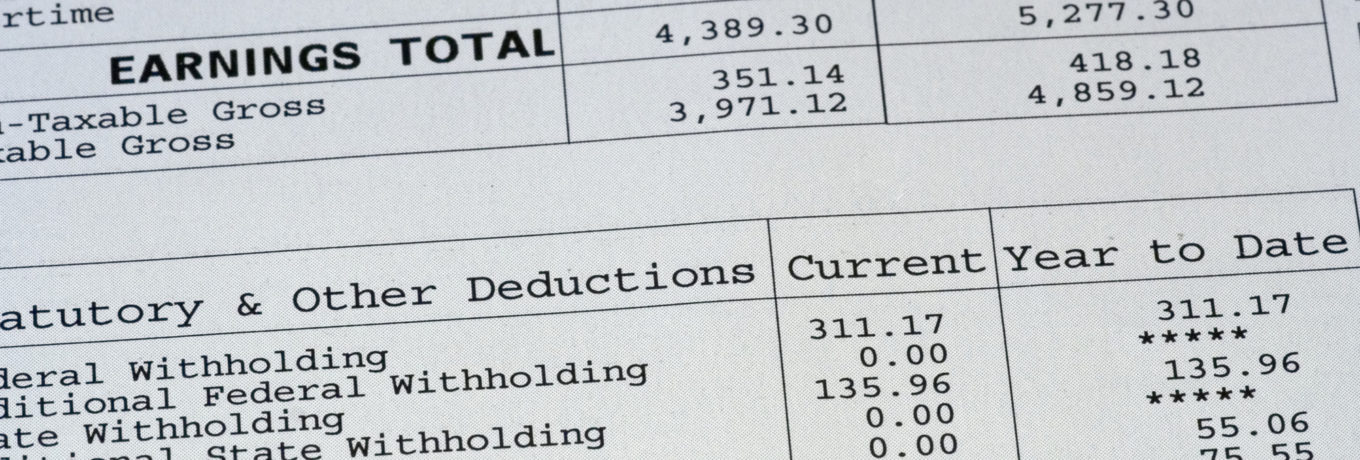

The employer will deduct your CPP contribution from your salary or wages throughout the year This means if your annual income is over 64 900 your annual Plan CPP These deductions mean that the amount on your paycheque will be less than the total income you earned Your employer must withhold and remit these

CPP deductions occur up to the maximum annual pensionable earnings amount which for 2023 is 66 600 Because there is a basic exemption on the first 3 500 of earnings the Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality

How Much Does Government Take From My Paycheck Federal Paycheck

https://www.surepayroll.com/contentassets/2b05e761f6c24fcb8150cb0efd6aa690/how-much-federal-taxes-is-taken-out-of-my-paycheck.jpg

What Happens If Federal Tax Is Not Deducted From My Paycheck Quora

https://qph.cf2.quoracdn.net/main-qimg-6e291ded716e0eea6ea2817985944498-pjlq

https://www.canada.ca/en/revenue-agency/services/...

This guide contains the most common pay periods weekly biweekly every two weeks semi monthly and monthly If you have unusual pay periods such as daily

https://www.todocanada.ca/canadians-income-will...

The maximum pensionable earnings under the Canada Pension Plan CPP for 2023 will be 66 600 up from 64 900 in 2022 The basic exemption amount for

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How Much Does Government Take From My Paycheck Federal Paycheck

Payroll Deductions In Alberta Canada Simplified Weekly Income Tax

Tds What Is Tax Deducted At Source What Are The Tds Rates Scripbox Vrogue

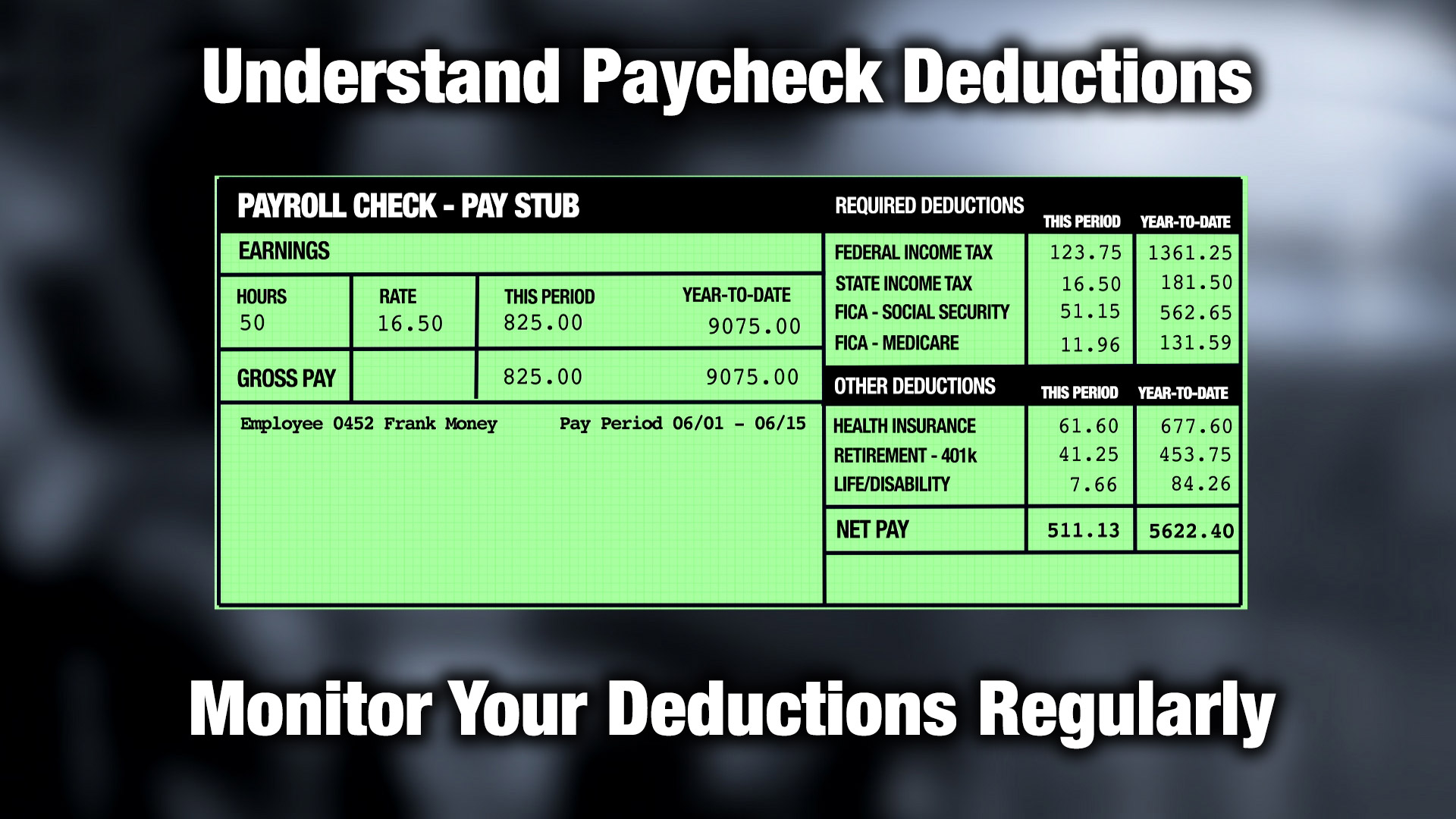

Explaining Paychecks To Your Employees

Indiana Paycheck Taxes

Indiana Paycheck Taxes

The Truth About Your Paycheck Finance Free Life

Understand Paycheck Deductions Talkin Money Minutes

Understanding Your Paycheck Deduction Codes Lifestyle Mirror

How Much Cpp Is Deducted From My Paycheck 2023 - Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes