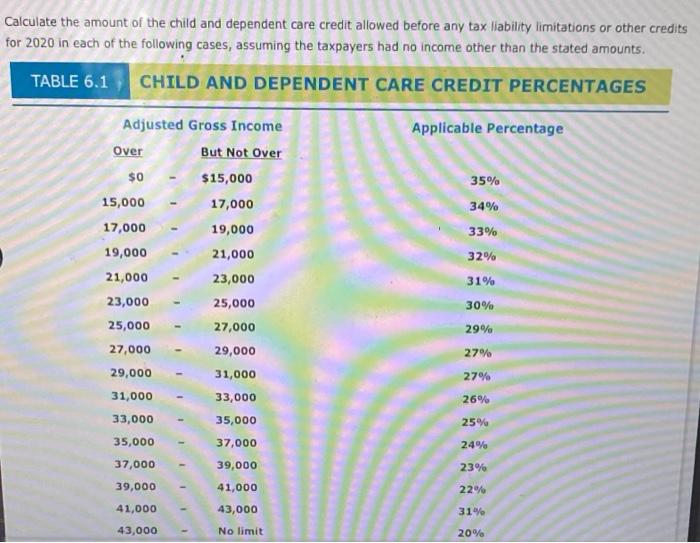

How Much Credit For Child Care The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit How Much Can I Claim for the Child and Dependent Care Credit For 2021 you can claim the credit for up to 8 000 of expenses

How Much Credit For Child Care

How Much Credit For Child Care

https://policyoptions.irpp.org/wp-content/uploads/sites/2/2021/07/How-better-data-can-help-parents-looking-for-child-care.jpg

/cloudfront-us-east-1.images.arcpublishing.com/tgam/RQATUQPGQRKATOXJFA2SFYRFCM.jpg)

Ottawa Quietly Probes Expanded Role For Child Care In Post pandemic

https://www.theglobeandmail.com/resizer/xczGU7gD3r7xzuR3gBAxq8S1ggQ=/1200x882/filters:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/tgam/RQATUQPGQRKATOXJFA2SFYRFCM.jpg

Pin On Training For Child Care Center Directors

https://i.pinimg.com/originals/f3/d4/1e/f3d41e304e2ad5eebc4f0cb56d17ae9e.jpg

How much is the Child and Dependent Care Credit worth Currently the Child and Dependent Care Credit is 20 to 35 of qualified expenses The percentage depends on your adjusted gross income AGI The Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out

This credit allows taxpayers to reduce their tax by a portion of their child and dependent care expenses The credit may be claimed by taxpayers who in order to work or look How much you receive depends on how much you spent during the year on work related child care Taxpayers with one child can submit up to 8 000 of qualifying expenses while U S

Download How Much Credit For Child Care

More picture related to How Much Credit For Child Care

Solved Calculate The Amount Of The Child And Dependent Care Chegg

https://media.cheggcdn.com/study/c1e/c1e6c6b2-2420-432b-bc09-0a6b45cd2a4c/image

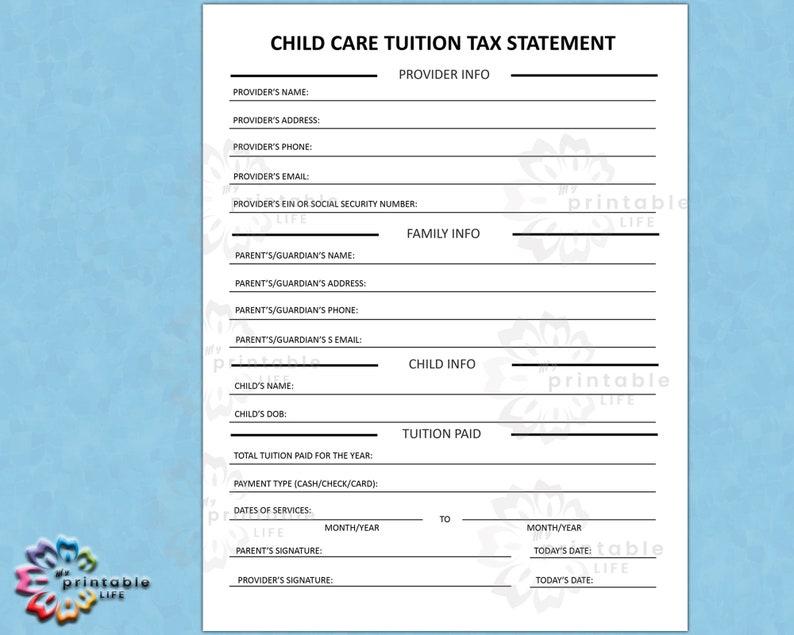

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_794xN.3736849859_31z4.jpg

Child Nutrition Nourish California

https://nourishca.org/wp-content/uploads/2021/09/KidsLunch.jpg

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the The child tax credit is a tax benefit for people with qualifying children For the 2024 tax year taxpayers are eligible for a credit of up to 2 000 and 1 700 of that will be potentially

Make permanent the American Rescue Plan s expansion of the Child and Dependent Care Tax Credit so that families can continue to get back up to 8 000 of The amount of the credit is a percentage of child care expenses up to 3 000 per child with a max of 6 000 for two or more children that you paid to a

Child Care Stabilization Grant Overview For Child Care Providers YouTube

https://i.ytimg.com/vi/9KLukKxRido/maxresdefault.jpg

Choosing Quality Child Care Seminar Child Care Services Association

https://18.235.122.25/wp-content/uploads/WMC-Event-Image-Choosing-Quality-Child-Care-Seminar.jpg

https://www.nerdwallet.com/article/taxe…

The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or

/cloudfront-us-east-1.images.arcpublishing.com/tgam/RQATUQPGQRKATOXJFA2SFYRFCM.jpg?w=186)

https://www.irs.gov/newsroom/understanding-the...

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit

Why Do Parents Pay So Much For Child Care When Early Educators Earn So

Child Care Stabilization Grant Overview For Child Care Providers YouTube

A childcare Cliff Looms Leaders Must Address High Cost Of Child Care

Find Child Care Childcare Children Care

What The New Child Tax Credit Could Mean For You Now And For Your 2021

How To Find And Pay For Child Care Today s Parent

How To Find And Pay For Child Care Today s Parent

Posters Handouts Child Care Health Consultation

Shoreline Area News Application For Child Care Subsidy Now Open To

Nevada Strong Start Child Care Services Center Nevada Child Care

How Much Credit For Child Care - Financial help if you have children Check what help you might be able to get with childcare schemes like tax credits Tax Free Childcare childcare vouchers and free childcare or