How Much Deduction Per Mile WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving You can

How Much Deduction Per Mile

How Much Deduction Per Mile

https://easy-expense.com/Scan_1.f201f8da.png

IRS Increases Mileage Deduction By Four Cents Per Mile For The Last Six

https://www.marcumllp.com/wp-content/uploads/insights-mileage-deduction-increase-960x600.jpg

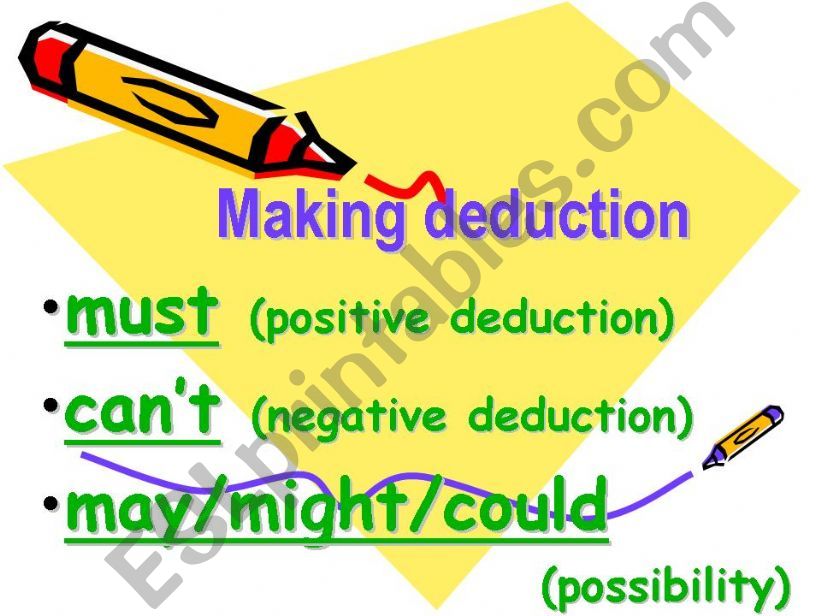

Modals Of Deduction English ESL Worksheets Pdf Doc

https://static.islcollective.com/storage/preview/201303/1532x2168/modals-of-deduction_48441_1.jpg

The standard mileage rate also known as the mileage per diem or deductible mileage is the default cost per mile set by the Internal Revenue Service How much you can deduct for mileage depends on the type of driving you did Business mileage is most common but you can also deduct mileage accrued for charitable purposes or for

The IRS mileage rate determines how much money you can write off when using your vehicle for business purposes The IRS increases the mileage reimbursement rate each The new mileage rates are up from 56 cents per mile for business purposes and 16 cents per mile for medical or moving purposes in 2021 The new

Download How Much Deduction Per Mile

More picture related to How Much Deduction Per Mile

DEDUCTION Official Trailer YouTube

https://i.ytimg.com/vi/yZ4hAg1Vg-k/maxresdefault.jpg

Deduction Administratie En Advies

https://deduction.nl/_next/image?url=%2Flogo_main.png&w=640&q=75

Deduction YouTube

https://i.ytimg.com/vi/SzdByNIA0EI/maxresdefault.jpg

The IRS has increased the standard mileage rates to 65 5 cents per miles for business purposes in 2023 up from 58 5 cents in early 2022 and 62 5 cents in the On December 14 2023 the IRS issued the standard mileage rate for 2024 which will be 67 cents per mile for business use up 1 5 cents from 2023 This rate will apply beginning

The federal mileage rate deduction informs business owners and self employed individuals how much they can deduct for business related driving only In At the end of last year the Internal Revenue Service published the new mileage rates for 2024 New standard mileage rates are 67 cents per mile for business purposes 21

Deduction YouTube

https://i.ytimg.com/vi/_ie9vK4Kvgs/maxresdefault.jpg

The manufacturers Deduction Isn t Just For Manufacturers

https://www.seilersingleton.com/wp-content/uploads/2017/02/2017-02-06-199-Deduction.jpg

https://www.irs.gov/newsroom/irs-issues-standard...

WASHINGTON The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for

https://www.thebalancemoney.com/how-to-cal…

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also

Modals Deductions About The Present Listening To You Keep Up Men

Deduction YouTube

Surprise The Mortgage Interest Deduction Is Now Even More Of A Handout

ESL English PowerPoints Making Deduction

Can Your Business Claim A Super Deduction North Devon Accounts

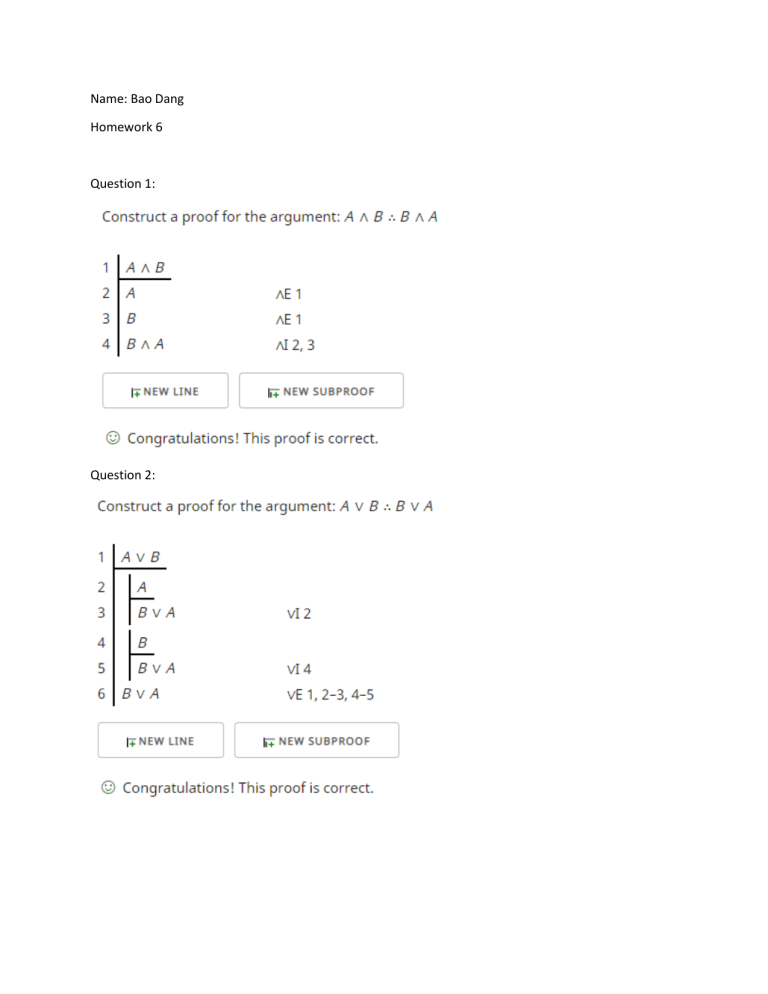

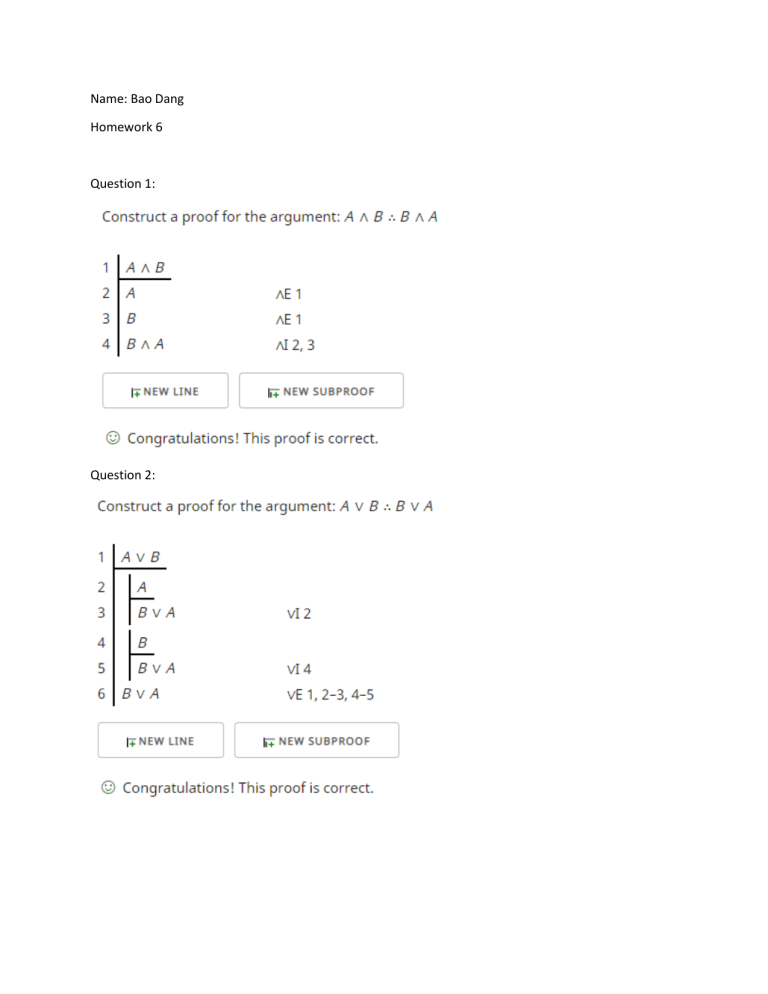

Cs270 Deduction

Cs270 Deduction

AGIKgqNNMaXAqjNX6CnyOotH0wAO62 V0cK25Cv4Cspc s900 c k c0x00ffffff no rj

.png)

What Is The RRSP Deduction Limit

Increase Deduction Limit On Interest On Home Loans Bhairav Dalal PwC

How Much Deduction Per Mile - For the 2022 tax year taxes filed in 2023 the IRS standard mileage rates are 65 5 cents per mile for business 14 cents per mile for charity 22 cents per mile for medical