How Much Do Accountants Charge For Tax Returns Uk How much does an accountant cost typically for the following services Individual tax return 75 to 500 vat per annum Self employed tax return and accounts 250 to 1 000 vat per annum Limited company 60 to 250 vat per month for accounts tax returns and payroll is fairly typical

On average a typical tax accountant in the UK charges around 150 to 300 for annual tax returns like self assessment tax However the actual fee depends upon so many different factors Tax accountants are the most important part of any business It shared that 90 of accountants charge between 126 and 400 for a tax return This seems to be the sweet spot for most reflecting what accountants believe is fair for their location time and expertise The remaining accountants charge between 400 and 600 and then there s the 1 who charge more than 600 for a single tax return

How Much Do Accountants Charge For Tax Returns Uk

How Much Do Accountants Charge For Tax Returns Uk

https://disruptmagazine.com/wp-content/uploads/2023/02/o3gogpb4sru.jpg

:max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg)

Accountant Job Description Salary Skills More

https://www.liveabout.com/thmb/hozYkY-coxlo_oFrK5vKX5D9uHY=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg

How Much Accountants Charge For Limited Companies Tax Return

https://www.zooconomics.co.uk/blog/wp-content/uploads/2017/06/StockSnap_KCIU8RWM09-Medium-1024x678.jpg

An accountant will charge a one off fee for an annual self assessment tax return which will typically range from 200 to 300 and over depending on the complexity and scope of your finances Broadly speaking the higher your income and the more sources of income you have the higher the fee is likely to be For self assessment accountant fees we charge 179 for a basic return Our fixed fee schedule is based on the requirements of your business and your turnover Separate fees are charged for accounts preparation filing of tax returns VAT and PAYE You will only be charged for the services you need See a full breakdown of all of our fees below

In the UK the average hourly rate for accountants is 26 50 according to the Association of Chartered Certified Accountants ACCA In the UK a basic personal tax return costs 100 according to the Taxpayers Alliance To calculate your monthly salary multiply your gross annual salary by 12 5 to find out what your taxable income is But on average you can expect an accountant to charge around 150 300 to file your Self Assessment tax return for you While this might seem expensive you could save even more by ensuring you claim tax relief on all your eligible expenses

Download How Much Do Accountants Charge For Tax Returns Uk

More picture related to How Much Do Accountants Charge For Tax Returns Uk

How Much Do Accountants Charge UK Costs Fees In 2022 Accounting Logic

https://accountinglogic.co.uk/wp-content/uploads/2022/10/5-1.png

How Much Does It Cost To Hire An Accountant For A Small Business

https://www.pherrus.com.au/wp-content/uploads/2022/02/How-much-does-an-accountant-cost.png

How Much Does It Cost To Hire A Tax Accountant Xendoo

https://xendoo.com/wp-content/uploads/2018/09/Accounting-what-do-accountants-charge-for-small-businesses.jpg

How much do accountants charge for filing tax returns When looking for an accountant it s worth approaching a few different firms for a quote as there can be significant variations in the cost of a tax return This makes it impossible to give an exact figure but below we ll discuss several common factors which can affect the price This means monthly support so that your tax issues never become a surprise You can check out our website for our packages which range in cost from 125 VAT per month to 195 VAT per month For self assessment tax returns alone the costs vary and contacting us for a conversation is your best option For all your tax and accounting needs

The cost of hiring an accountant for a self assessment tax return typically ranges from 200 to 300 but this can vary based on several factors including the complexity of your return your income and other financial considerations Survey Reveals 90 of UK Accountants Charge Between 126 to 400 for a Tax Return Last updated May 13 2024 10 50 am IRIS Software Group Share 3 Min Read

Here s How Accountants Make Sure That Taxes Are Paid Properly

https://lh3.googleusercontent.com/OrkT9ecNFRzsVwuP0BFmOCou6O-hrFyx5VweJSVxrDWPefoIr_kvueQFXbyWkJHwbvmFzghinXh5ScENCRc1sshuHnQKojcBsA4=s1000

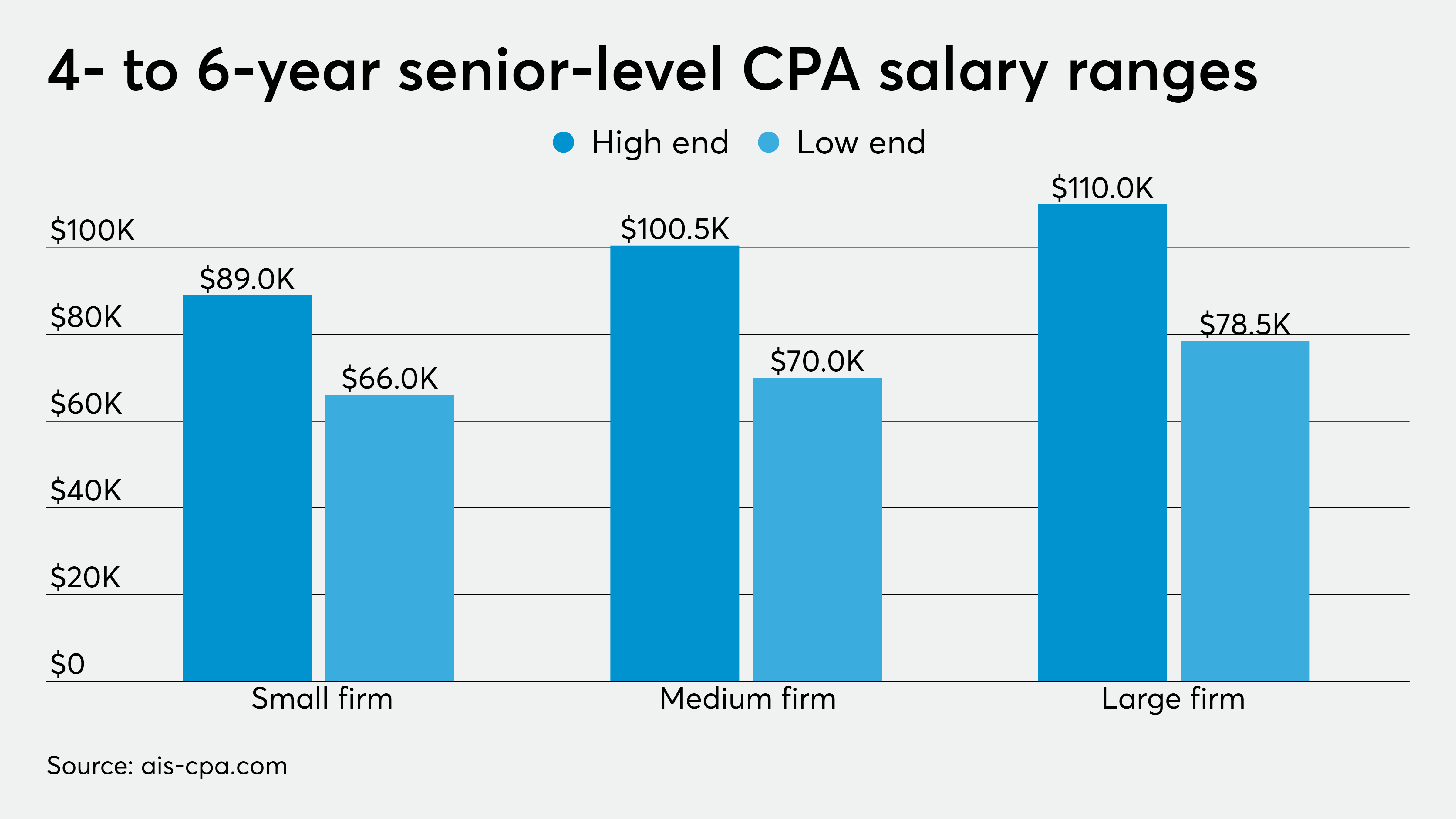

How Much Do Accountants And CPAs Really Earn Accounting Today

https://arizent.brightspotcdn.com/a5/ad/eef6eee44199ad996cac56574dcd/at-082719-senior-levelcpasalarieschart.png

https://www. cheltenham-tax-accountants.co.uk /blog/...

How much does an accountant cost typically for the following services Individual tax return 75 to 500 vat per annum Self employed tax return and accounts 250 to 1 000 vat per annum Limited company 60 to 250 vat per month for accounts tax returns and payroll is fairly typical

:max_bytes(150000):strip_icc()/accountant-job-description-4178425-edit-01-fe86b64141eb44498c11502dcb2440c0.jpg?w=186)

https://www. protaxaccountant.co.uk /post/how-much...

On average a typical tax accountant in the UK charges around 150 to 300 for annual tax returns like self assessment tax However the actual fee depends upon so many different factors Tax accountants are the most important part of any business

How Much Do Accountants Charge For Small Business Taxes Accountsdept

Here s How Accountants Make Sure That Taxes Are Paid Properly

How Much Do Accountants Charge For Tax Returns Learn The Average

How Much Do Accountants Charge For Small Business Taxes Smart Tax

How Much Do Accountants Charge For A Small Business It Depends On Your

What Fees Are Accountants Charging ICBA Accounting Income Tax

What Fees Are Accountants Charging ICBA Accounting Income Tax

Importance Of Accountants Why You Should Hire One For Your Business

:max_bytes(150000):strip_icc()/list-of-accounting-skills-2062348-9cc894888b7b418789af0b62ef3c68b1.png)

Important Accounting Skills For Workplace Success

Choosing The Best Accountants For Tax Returns In The UK

How Much Do Accountants Charge For Tax Returns Uk - But on average you can expect an accountant to charge around 150 300 to file your Self Assessment tax return for you While this might seem expensive you could save even more by ensuring you claim tax relief on all your eligible expenses