How Much Do Companies Pay For Mileage Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes Companies can choose to reimburse the exact amount an employee incurred on the trip or use a specific preset rate for each mile

For jobs that require a lot of driving mileage reimbursement is an alternative to providing an employee with a company vehicle or stipend to act as a car allowance It typically takes the form of a flat per mile rate that often but not always matches the standard mileage rate set by the Internal Revenue Service IRS each year The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like gas insurance depreciation and standard maintenance

How Much Do Companies Pay For Mileage

How Much Do Companies Pay For Mileage

https://companymileage.com/wp-content/uploads/2019/02/reimbursement-rates.jpg

15 Companies That Pay For Ideas In 2022 HearMeFolks

https://hearmefolks.com/wp-content/uploads/2021/04/companies-that-pay-for-your-ideas-1536x864.png

How Much Do Companies Pay For Health Insurance Per Employee Aspirin

https://aspirin-social-awards.org/wp-content/uploads/2022/02/80.jpg

Standard mileage rates are values the IRS sets for calculating reimbursable or deductible costs for driving a personal car for work related reasons There are three categories of travel that are eligible for mileage reimbursement Self employed and business Charities Your Estimated Mileage Deduction 1 515 00 Understanding Mileage Reimbursement If you regularly use your personal vehicle for work purposes you are permitted to deduct the vehicle expenses from your tax return You have two options available to

For 2024 the standard mileage rate for businesses is 67 cents per mile an increase of 1 5 cents from 65 5 cents per mile in 2023 According to critics the issue with these annually fixed national rates is that they do not account for variables such as location and fluctuating fuel prices Each year the Internal Revenue Service IRS sets a standard mileage reimbursement rate so contractors employees and employers can use them for tax purposes related to business travel This rate applies to both cars and trucks and fluctuates year by year

Download How Much Do Companies Pay For Mileage

More picture related to How Much Do Companies Pay For Mileage

Web Developer Salary How Much Do They Make Thinkful

https://s3.amazonaws.com/tf-nightingale/2020/04/Outcomes-Salaries_20200409_WebDevelopment_Blog_Header-1.png

How Much Do Companies Pay For Product Placement In Movies

https://www.popoptiq.com/wp-content/uploads/2022/04/Ross-Geller-04232022.jpg

What Companies Pay The Highest Dividends StocksProGuide

https://www.stocksproguide.com/wp-content/uploads/what-companies-pay-the-best-dividends-designedbyrazz-1024x957.png

For reimbursements to be tax free companies need to use standard mileage rates provided by the IRS In 2024 it means that companies can issue tax free reimbursements at the maximum rate of 67 cents per mile Small Business The Top Payroll Software for Small Businesses Employee Mileage Reimbursement What You Need to Know Updated July 15 2024 By Ryan Lasker Our Small Business Expert Many

[desc-10] [desc-11]

How Much Do Companies Spend On Advertising

https://www.creativebloggingworld.com/wp-content/uploads/2020/04/advertising-strategy.jpg

This Is How Much Celebrities Get Paid To Endorse Soda And Unhealthy

https://wp-cpr.s3.amazonaws.com/uploads/2019/07/481145162_383850009.jpg?resize=1200,600

https://www.paylocity.com/resources/resource...

Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes Companies can choose to reimburse the exact amount an employee incurred on the trip or use a specific preset rate for each mile

https://ramp.com/blog/mileage-reimbursement

For jobs that require a lot of driving mileage reimbursement is an alternative to providing an employee with a company vehicle or stipend to act as a car allowance It typically takes the form of a flat per mile rate that often but not always matches the standard mileage rate set by the Internal Revenue Service IRS each year

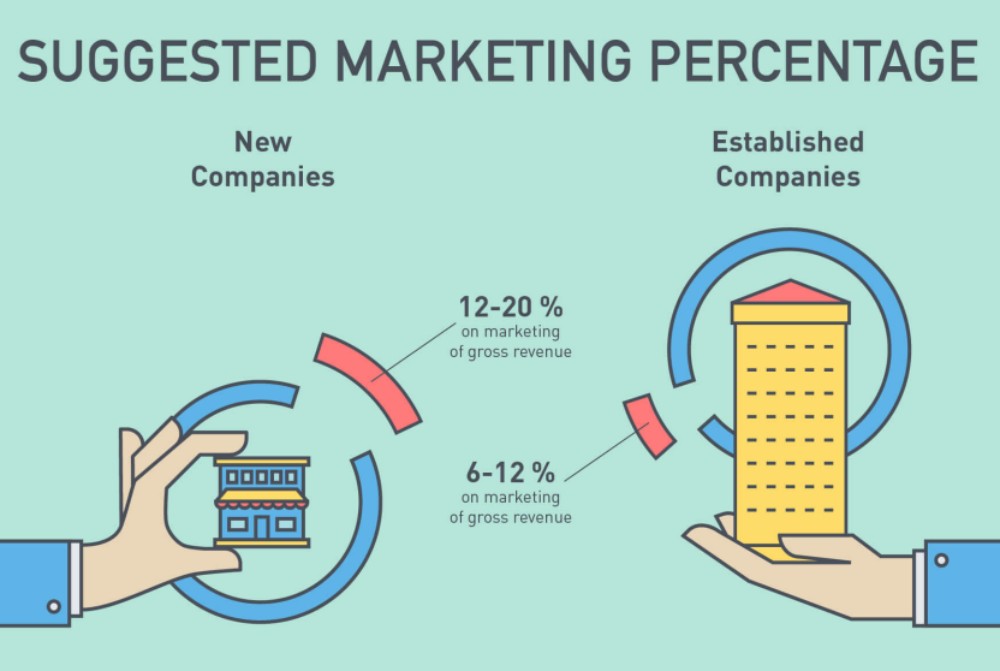

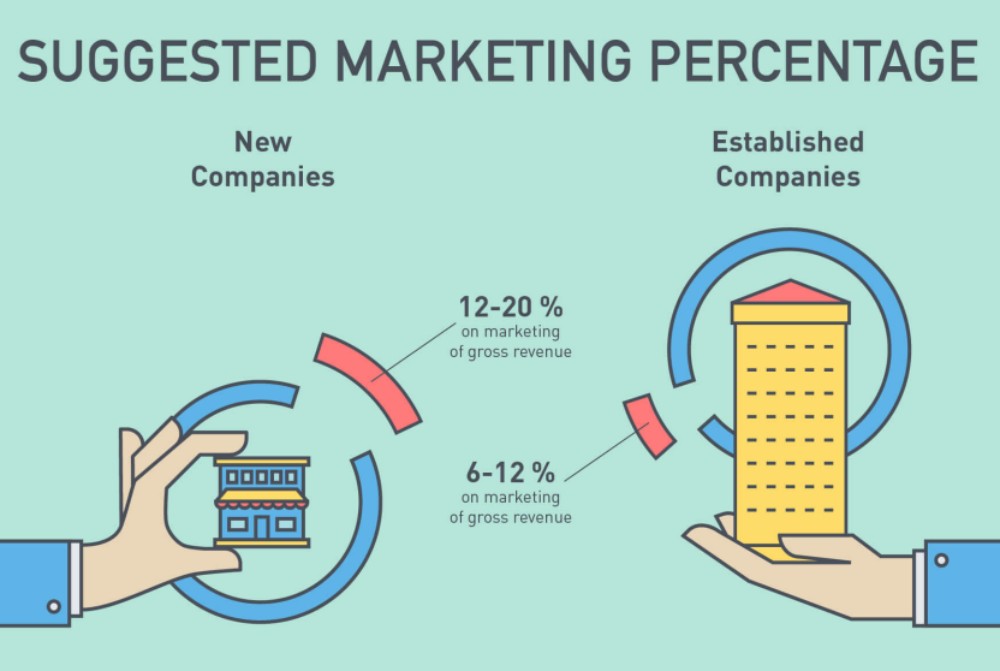

Content Marketing Content Marketing Infographic Marketing Budget

How Much Do Companies Spend On Advertising

Why And How Companies Pay A Dividend YouTube

Oncall Compensation For Software Engineers The Pragmatic Engineer

Do Businesses Pay Ransomware Icsid

How Much Companies Spend On Employee Training LearnExperts

How Much Companies Spend On Employee Training LearnExperts

How Much Do Companies Pay For Product Placement In Movies

Why Some Companies Pay Dividends And Some Don t The Reasons You Need

How Much Regular Employee Will Spend Money For Gas Icsid

How Much Do Companies Pay For Mileage - [desc-12]