How Much Do Employers Reimburse For Mileage For 2020 the federal mileage rate is 0 575 cents per mile Reimbursements based on the federal mileage rate aren t considered income making

Mileage reimbursement is typically set at a per mile rate usually below 1 per mile Some companies prefer to set a monthly flat rate for reimbursement when Employers are not required to reimburse employees for mileage unless the mileage expenses cause their wages to drop below the federal minimum wage However many businesses reimburse employees for

How Much Do Employers Reimburse For Mileage

How Much Do Employers Reimburse For Mileage

https://staminacomfort.com/uploads/t14/articles/full/2e02140e43a33b2491529b9de996869add79784f.jpg

Do California Employers Reimburse People For Mileage Aiman Smith Marcy

https://www.asmlawyers.com/wp-content/uploads/2019/11/Do-California-Employers-Reimburse-People-For-Mileage-ASM-Lawyers.jpeg

Do I Have To Reimburse My Employees For That Reasonable Not

https://organicremedies.com/e0348c3b/https/e7167b/sbshrs.adpinfo.com/hubfs/Jaime/iStock-1042650228.jpg

To find your reimbursement multiply the number of business miles driven by the IRS reimbursement rate So if you drove 1 000 miles and got reimbursed 585 cents per mile your reimbursement would be 585 The IRS sets a standard mileage reimbursement rate of 58 5 cents per business mile driven in 2022 This rate is based on an annual study of the fixed and variable costs of operating a vehicle like

For 2023 the standard mileage rate for businesses is 65 5 cents per mile an increase of 3 cents from 62 5 cents per mile in the second half of 2022 According to critics the issue with these annually fixed national rates is In this guide we cover everything you need to know about employee mileage reimbursement including the rules the current IRS rates in 2023 tax benefits and the practical tools you can use to effectively

Download How Much Do Employers Reimburse For Mileage

More picture related to How Much Do Employers Reimburse For Mileage

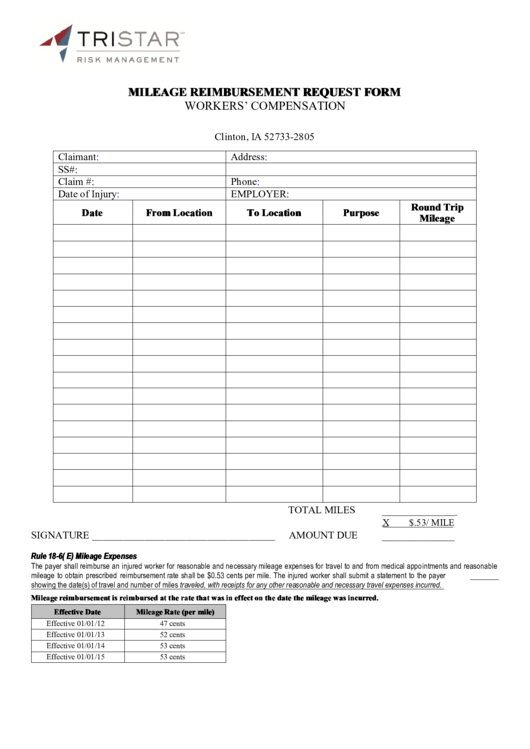

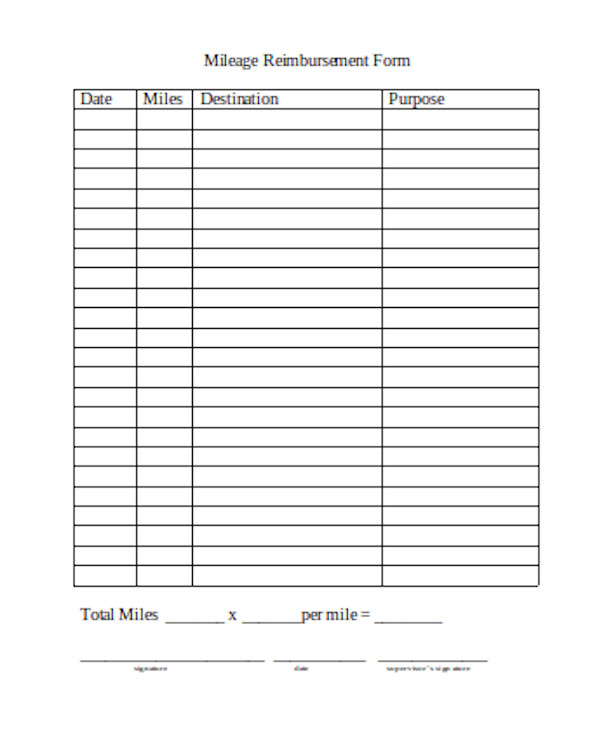

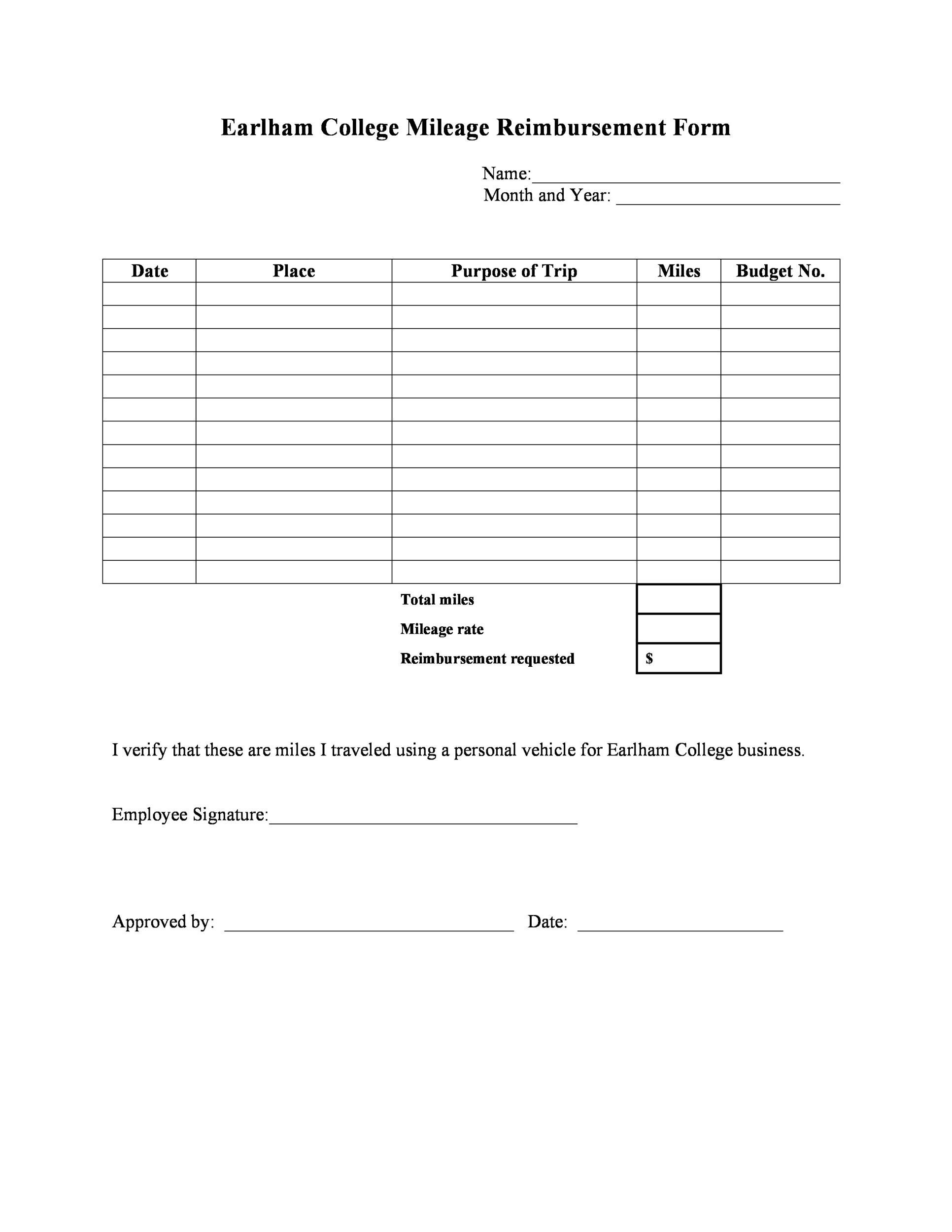

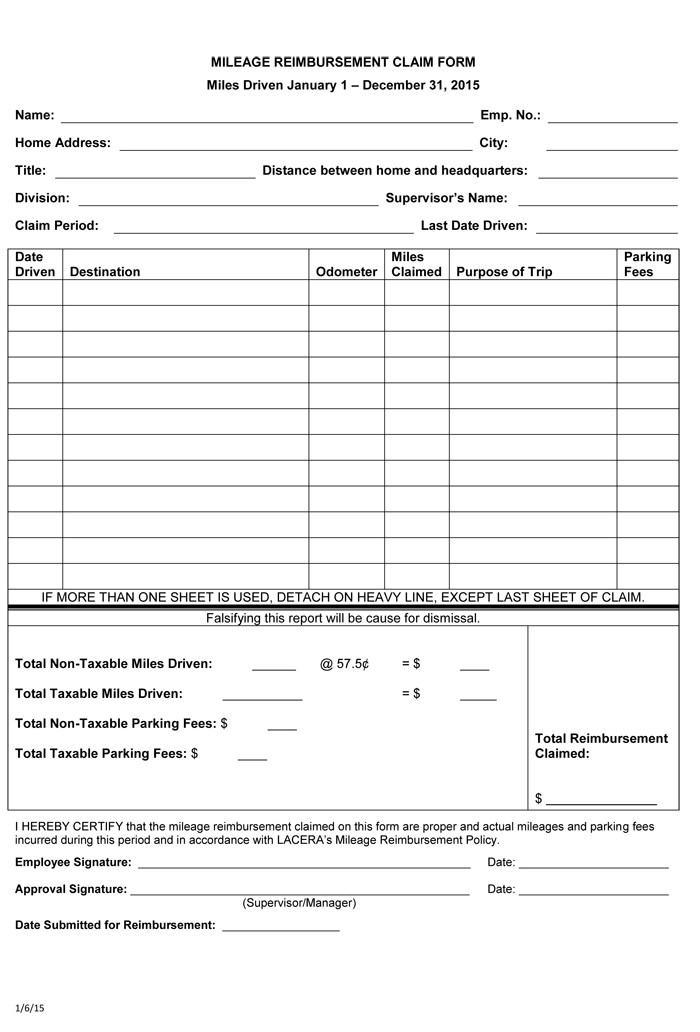

Fillable Mileage Reimbursement Form IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/fillable-mileage-reimbursement-request-form-printable-pdf.png

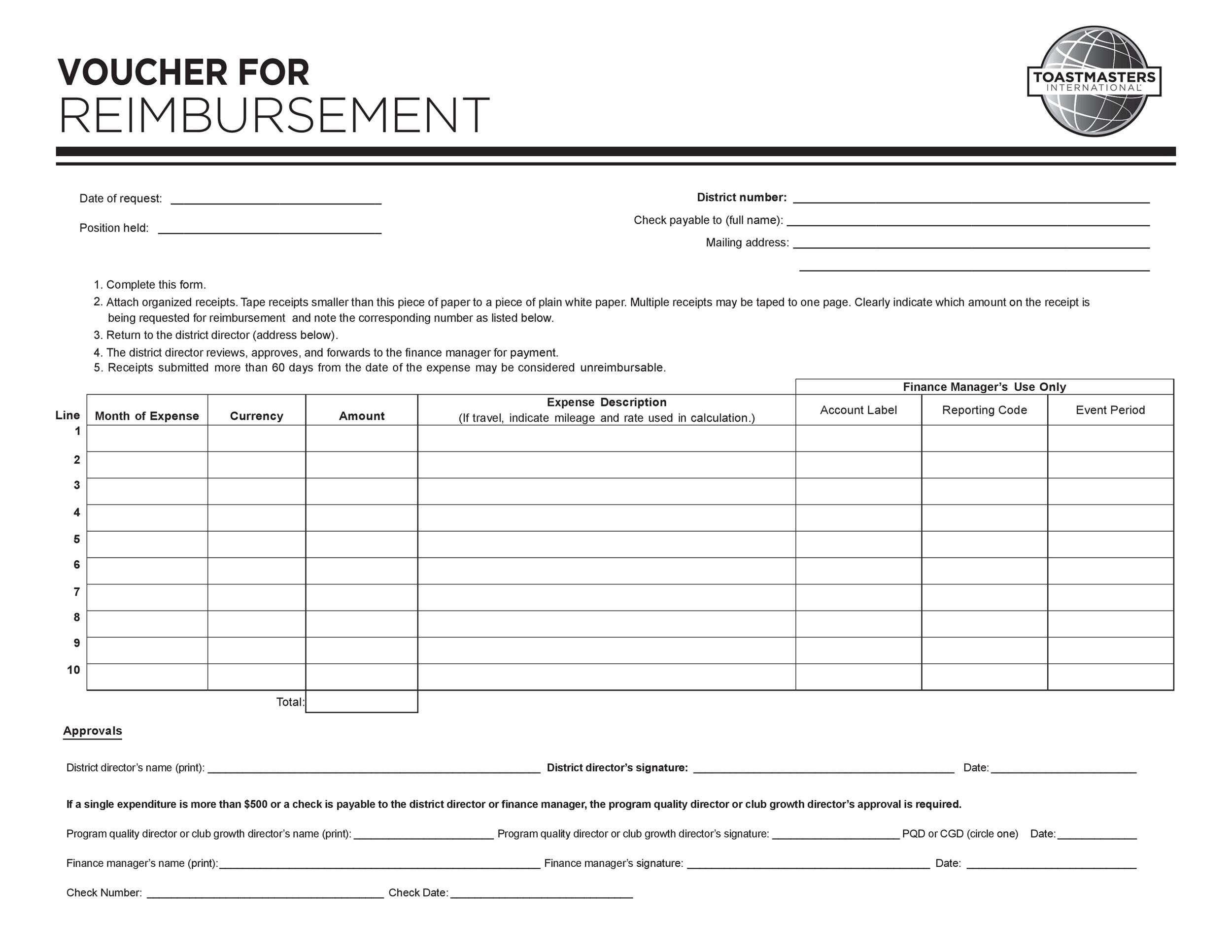

Reimbursement Form Template IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/47-reimbursement-form-templates-mileage-expense-vsp-1.jpg

Can Employers Reimburse Employees For Health Insurance Plans

https://www.patriotsoftware.com/wp-content/uploads/2021/03/health-insurance-reimbursments-1024x576.jpg

Related 11 Popular Travel Jobs Example of mileage reimbursement Company ABC pays its sales staff 58 cents per mile driven to and from customer locations As an employee you are sent to meet For 2021 the standard mileage rate for the use of a car as well as vans pickups or panel trucks is 56 cents per mile a decrease of 1 5 cents from the rate for 2020 The IRS didn t explain why the

The allowance must be based on and not more than the IRS standard mileage rate For example you could give a mileage allowance of 1 120 for that month 2 000 x the 2021 standard mileage Medical or moving work 22 cents per mile Charity related work 14 cents per mile

Car Allowance Vs Mileage Reimbursement

https://falconexpenses.com/blog/wp-content/uploads/2020/03/HowToReimburseEmployeesForMileageExpenses-768x510.jpg

Simple Expense Reimbursement Form 1 Excelxo

https://excelxo.com/wp-content/uploads/2018/02/simple-expense-reimbursement-form-1-601x466.png

https://www.fool.com/the-ascent/small-business/...

For 2020 the federal mileage rate is 0 575 cents per mile Reimbursements based on the federal mileage rate aren t considered income making

https://www.businessnewsdaily.com/15891-mileage...

Mileage reimbursement is typically set at a per mile rate usually below 1 per mile Some companies prefer to set a monthly flat rate for reimbursement when

How Much To Reimburse For Mileage REVOLUTION REPORTS

Car Allowance Vs Mileage Reimbursement

Mileage Reimbursement Form Excel Excel Templates

Employee Mileage Reimbursement Rules For Companies Everlance

How Can My Limited Company Reimburse Me For Using My Own Car For

Travel Reimbursement Policy Sections To Include More

Travel Reimbursement Policy Sections To Include More

Mileage Reimbursement Form Template Excel Templates

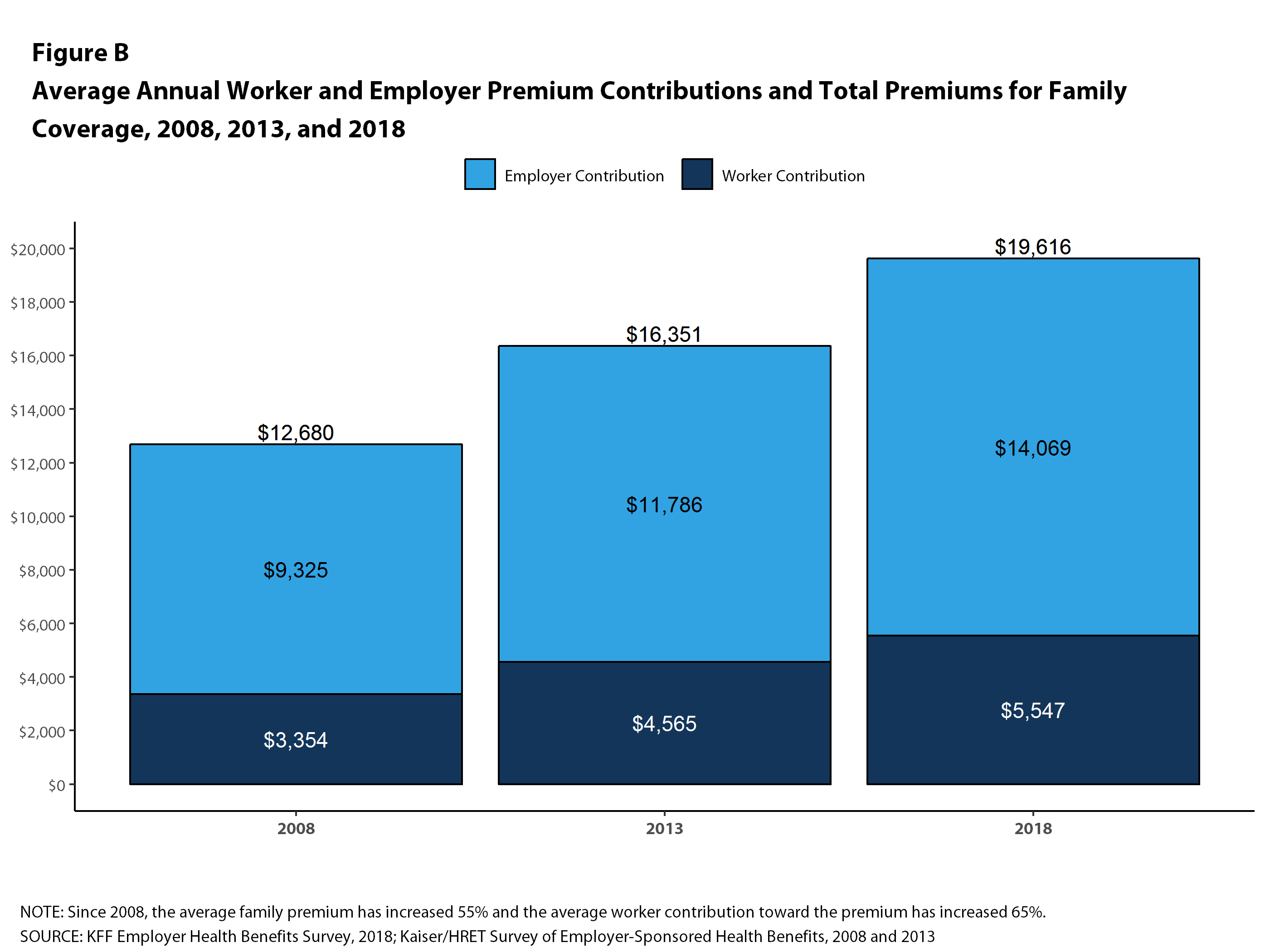

Average Annual Worker And Employer Premium Contributions And Total

Mileage Reimbursement Form Excel Excel Templates

How Much Do Employers Reimburse For Mileage - To find your reimbursement multiply the number of business miles driven by the IRS reimbursement rate So if you drove 1 000 miles and got reimbursed 585 cents per mile your reimbursement would be 585