How Much Do I Get Back On My Taxes For Rrsp Contributions 9 rowsCanada RRSP tax savings calculator 2023 RRSP contributions reduce your

RRSP withholding tax is charged when you withdraw funds from your RRSP before retirement The current rate of RRSP withholding tax is 10 for withdrawals up Therefore your unused contributions came to 7 000 In 2018 your contribution room was 13 000 so you can contribute a total of 20 000 this years

How Much Do I Get Back On My Taxes For Rrsp Contributions

How Much Do I Get Back On My Taxes For Rrsp Contributions

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=3200&height=1680&fit=crop

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

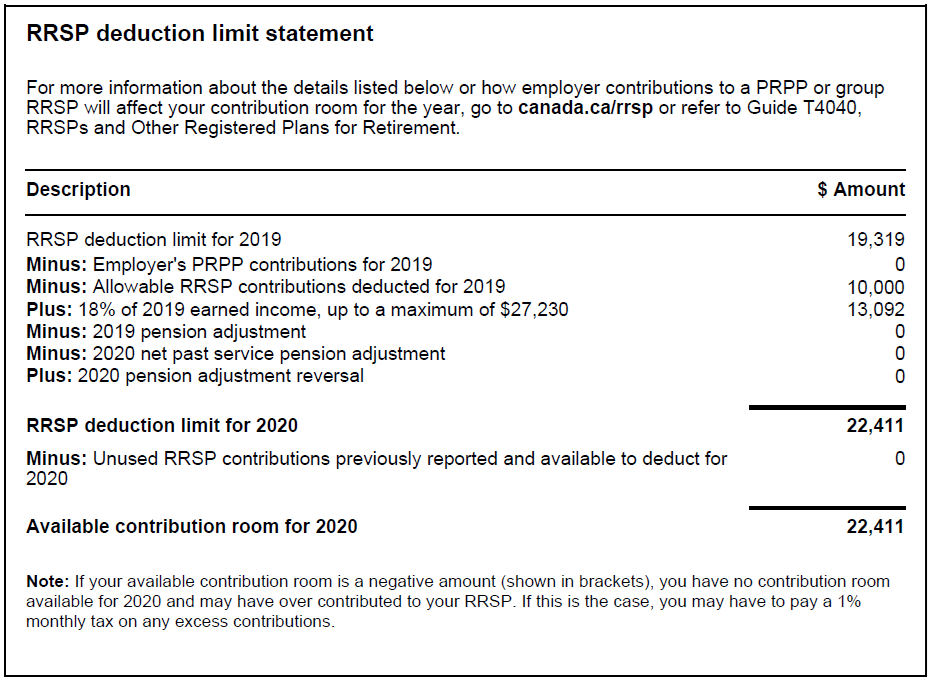

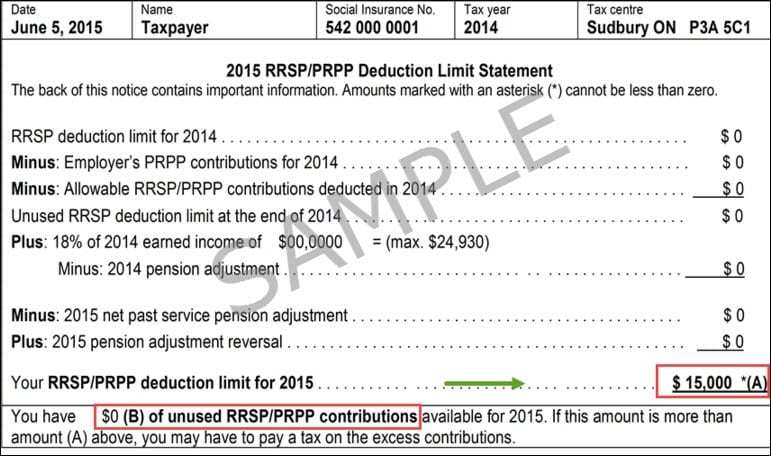

Understanding RRSP Contributions Deductions And Over Contributions

https://wellington-altus.ca/wp-content/uploads/2021/02/Picture1.png

Here is an RRSP calculator that you can use free of charge Amount in RRSP Account Max 10 000 Rate of Return While Working Max 30 Annual Issuers have until May 1 to send you your RRSP contribution receipts for the previous tax year Even if you have not received all of your RRSP contribution receipts you must file

For 2023 the RRSP contribution limit is 30 780 Contributions to an RRSP reduce the amount of income tax individuals must pay each year so the Canada Revenue Agency Savings and pension plans RRSPs and related plans Registered Retirement Savings Plan RRSP An RRSP is a retirement savings plan that you establish that we register and to

Download How Much Do I Get Back On My Taxes For Rrsp Contributions

More picture related to How Much Do I Get Back On My Taxes For Rrsp Contributions

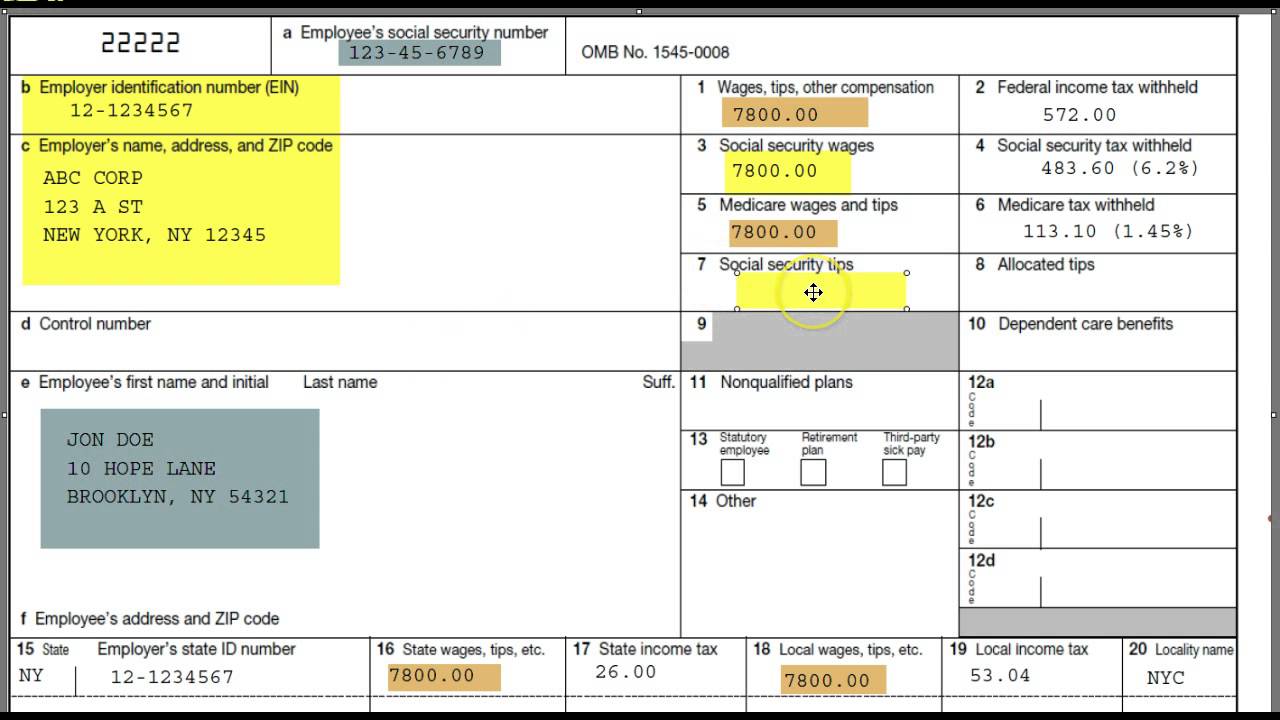

How Much Did I Get Back On My Taxes What And How Much Did I Claim

https://i.ytimg.com/vi/R6pt4SPfrYg/maxresdefault.jpg

How Much Can I Contribute To My RRSP Common Wealth

https://www.commonwealthretirement.com/wp-content/uploads/2022/02/Sample-notice-of-assessment-RRSP-limit.jpeg

29000 A Year Is How Much A Month After Taxes New Update

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

As outlined by the Canada Revenue Agency page the RRSP dollar limit for 2024 is 31 560 Click here to view RRSP dollar limits of previous years What happens if I You can expect to get 20 to 50 of your RRSP contributions back as an income tax refund So if you put 1 000 in an RRSP you ll get an income tax refund of

It is a way to reduce your income tax payments as long as you keep the funds in the plan If however you cash out a portion or the totality of your RRSP you will then need to The Canada Revenue Agency generally calculates your RRSP deduction limit as follows your unused RRSP deduction room at the end of the preceding year Plus The lesser of

What Happens If You Don t File A Tax Return CBS News

https://cbsnews1.cbsistatic.com/hub/i/r/2020/01/06/c172a0fa-425d-44ed-969e-0bb66d76e421/thumbnail/1200x630/4642c970465cd0721201093324b9169b/gettyimages-1082680096.jpg

How To Calculate How Much Money You Will Get Back In Taxes Reverasite

https://neprisstore.blob.core.windows.net/sessiondocs/doc_e7229a0d-cc97-4d86-8113-cad4716bcb00.jpg

https://turbotax.intuit.ca/tax-resources/canada-rrsp-calculator.jsp

9 rowsCanada RRSP tax savings calculator 2023 RRSP contributions reduce your

https://www.wealthsimple.com/en-ca/learn/rrsp-withholding-tax

RRSP withholding tax is charged when you withdraw funds from your RRSP before retirement The current rate of RRSP withholding tax is 10 for withdrawals up

How To File Back Taxes SDG Accountants

What Happens If You Don t File A Tax Return CBS News

The Deductions You Can Claim Hra Tax Vrogue

Deadline For 2018 RRSP Contributions Is March 1st Toronto Caribbean

Social Security Cost Of Living Adjustments 2023

Are You In Trouble With The IRS Here s How To Get Out

Are You In Trouble With The IRS Here s How To Get Out

The Importance Of Paying Your Taxes University Herald

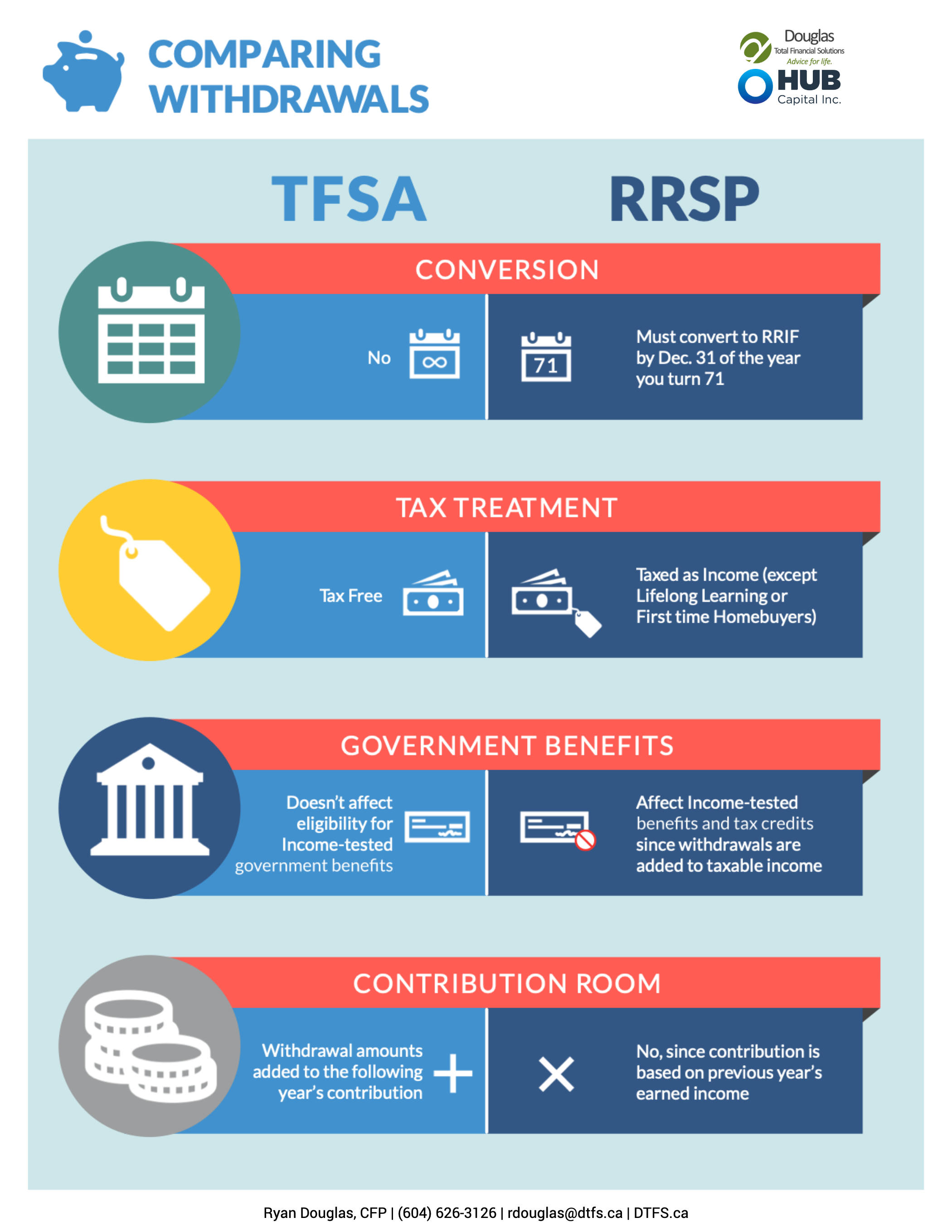

TFSA Vs RRSP What You Need To Know To Make The Most Of Them In 2021

A User s Guide To RRSPs Business Tax Season CBC News

How Much Do I Get Back On My Taxes For Rrsp Contributions - Contributions are tax deductible for the higher earner but at retirement withdrawals are taxed in the hands of the account holder presumably the lower income