How Much Do Property Taxes Usually Cost A property tax is an annual or semiannual charge levied by a local government and paid by the owners of real estate within its jurisdiction Property tax is

Property taxes are calculated by multiplying your assessed home value and local tax rate Learn more about what affects your property tax bill and calculation Property Tax Definition and How to Calculate Taxes on Real Estate Your property tax bill is mostly based on your property s

How Much Do Property Taxes Usually Cost

How Much Do Property Taxes Usually Cost

https://swanwealth.com/wp-content/uploads/2020/02/State-Tax-Loss-dplic-207264826.jpg

How Do Property Taxes Work In Illinois YouTube

https://i.ytimg.com/vi/kGEQUrSqD5Y/maxresdefault.jpg

How Much Does It Cost To Get Your Taxes Done At Walmart YouTube

https://i.ytimg.com/vi/LqTG7e5Cu5s/maxresdefault.jpg

How do you find out how much your property taxes are You should receive a property tax bill or notice each year from your local tax assessor You can also calculate your property taxes by multiplying Property taxes are fees charged on a piece of real estate If you own property as a residence business or investment you re expected to pay property

Property taxes are usually based on your home s appraised value and the local millage rate Find out more about how much these taxes could cost you Understanding how property tax rates are calculated and affect your housing costs can help you make better decisions when buying a house Here s what you need

Download How Much Do Property Taxes Usually Cost

More picture related to How Much Do Property Taxes Usually Cost

Property Taxes By State County Median Property Tax Bills

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

How Do Property Taxes Work YouTube

https://i.ytimg.com/vi/-3NGrTf-hSc/maxresdefault.jpg

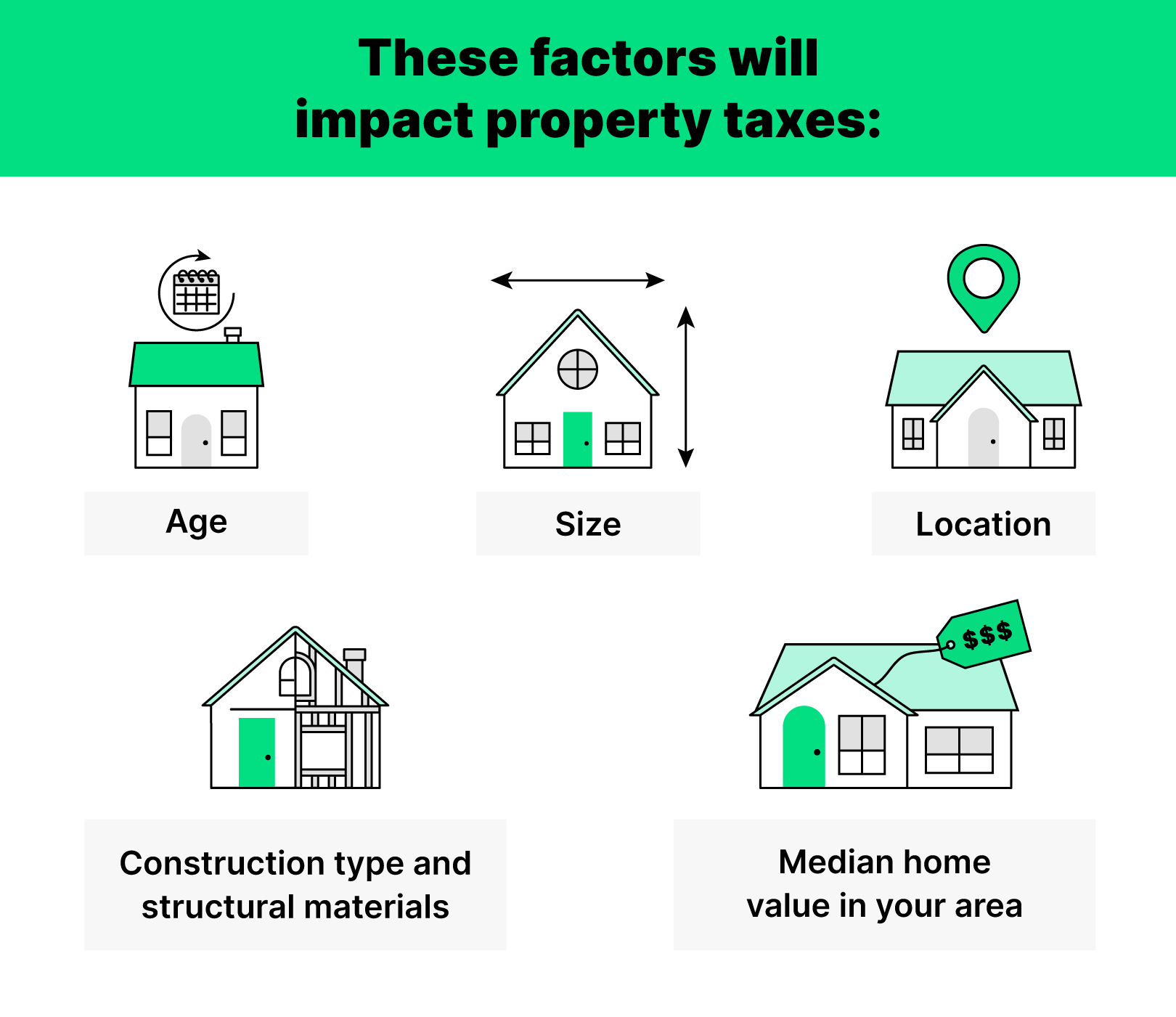

Your Guide To Property Taxes Hippo

https://www.hippo.com/sites/default/files/content/paragraphs/inline/factors-that-impact-property-taxes_0.png

Property taxes are the costs charged by local jurisdictions state county municipal township school district or special district for your house and plot of land within the Married couples need to earn over 487 450 this year to hit the top tax rate of 37 Project 2025 argues that the current tax system is too complicated and expensive

Table of Contents What is Property Tax How is Property Tax Calculated Why Do We Have Property Taxes What is the difference Between Personal Property To estimate your property tax multiply your home s assessed value by your local property tax rate How property tax rates are determined The property tax rates of

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

How Do Property Taxes Work In California

https://assets-global.website-files.com/6171747941d4147f6a7d52cd/626adb85f697e0cb8dd60243_how-do-property-taxes-work-in-california.jpg

https://www.investopedia.com/terms/p/propertytax.asp

A property tax is an annual or semiannual charge levied by a local government and paid by the owners of real estate within its jurisdiction Property tax is

https://www.investopedia.com/articles/tax/09/...

Property taxes are calculated by multiplying your assessed home value and local tax rate Learn more about what affects your property tax bill and calculation

What Do Your Property Taxes Pay For

How High Are Property Taxes In Your State American Property Owners

What You Need To Know About Property Taxes In Hawaii Hawaii Free Press

How Much Do Property Managers Charge In Los Angeles Los Angeles

How Much Are You Paying In Property Taxes Real Estate Investing Today

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

How High Are Property Taxes In Your State Tax Foundation

How Do Property Taxes Work When You Buy A House Prudential Cal

Property Taxes The Highs And Lows RISMedia s Housecall

How Much Do Property Taxes Usually Cost - How do you find out how much your property taxes are You should receive a property tax bill or notice each year from your local tax assessor You can also calculate your property taxes by multiplying