How Much Do You Get Back From Deductions Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate A is a dollar for dollar discount on your tax bill So if you owe 1 000 but

Tax deductions aren t a refund At best if you earn more than 180 000 you will save 45 cents per dollar and if you earn less than 180 000 then your tax Estimate your 2023 2024 federal taxes with our free income tax calculator and refund estimator Input your income deductions and credits to determine your potential

How Much Do You Get Back From Deductions

How Much Do You Get Back From Deductions

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-scaled.jpg

When You Get Back From A Music Festival And All You Want To Do Is Lay

https://i.pinimg.com/originals/6e/75/6d/6e756dfc3c675dd3d1c6d73892541ab7.jpg

How Much Money Do You Get Back From Bail In Nevada

https://lightningbail.com/wp-content/uploads/2022/06/how-much-money-do-you-get-back-from-bail-scaled.jpg

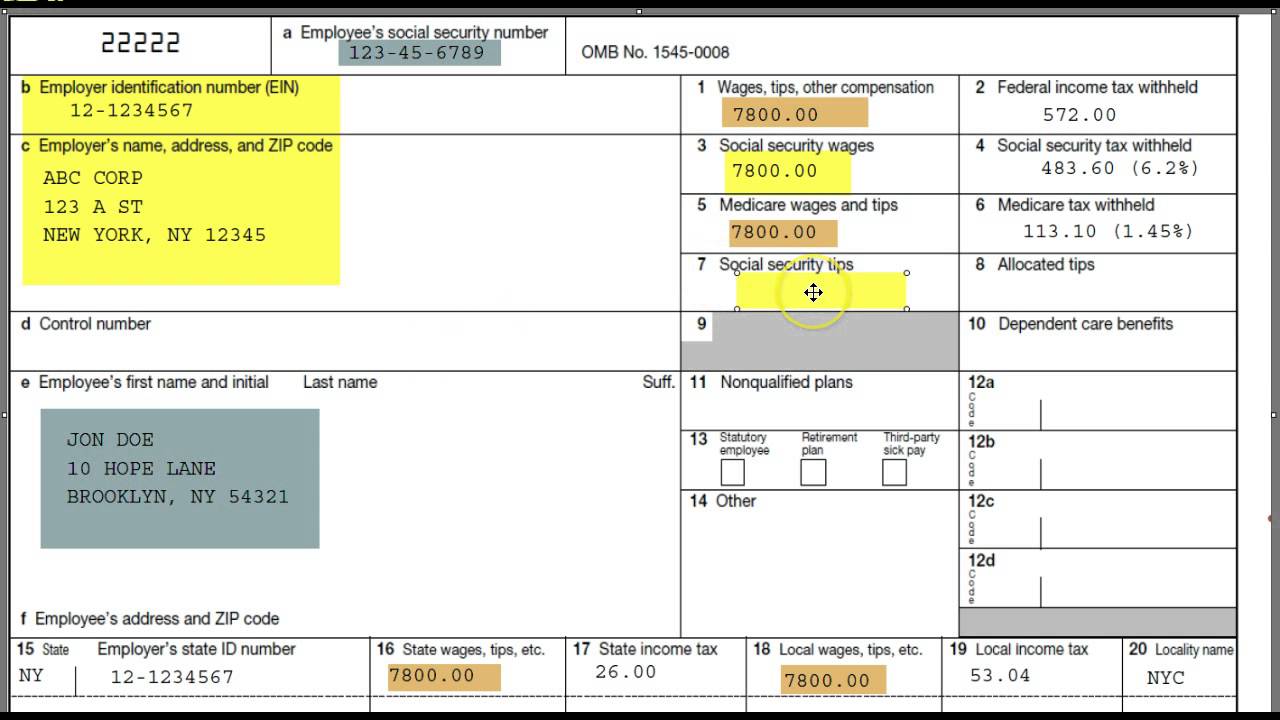

For the 2023 tax year which we filed in early 2024 the federal standard deduction for single filers and married folks filing separately was 14 600 It s 29 200 if By using a tax refund calculator you ll get an idea of how much you might get back or owe This can help you plan your finances better whether it s setting aside money if you owe taxes or planning how

The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a higher For most people tax is collected by an employer at a rate that estimates your tax for the year Your actual earnings and the deductions that you re allowed to claim

Download How Much Do You Get Back From Deductions

More picture related to How Much Do You Get Back From Deductions

How To Calculate How Much Money You Will Get Back In Taxes Reverasite

https://neprisstore.blob.core.windows.net/sessiondocs/doc_e7229a0d-cc97-4d86-8113-cad4716bcb00.jpg

When You Get Back From Doing Nothing TO DO List Make A Meme

https://media.makeameme.org/created/when-you-get-333ba41aea.jpg

How Do You Get Back Into Routine Q4fit

https://www.q4fit.com/wp-content/uploads/2016/05/How-Do-You-Get-Back-into-Routine-Q4fit.com_.jpg

So a 1 000 tax credit cuts your final tax bill by exactly 1 000 A tax deduction isn t as simple If you get a 1 000 tax deduction and you re in the 22 tax bracket that deduction reduces your taxable 7 Earned income tax credit This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges

Claim credits A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable Taxable income Your taxable income is your adjusted gross income minus deductions standard or itemized Federal withholdings This is the total amount withheld from your

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

https://www.fidelitycharitable.org/content/dam/fc-public/shared/infographics/tax-strategies-cash-securities-example.png.transform/viewport-max/image.20190621.png

Medical Expense Deduction AGI Threshold To Be 10 In 2019 Deductions TAX

https://i1.wp.com/deductions.tax/wp-content/uploads/2017/07/tax-deduction-hand-written.jpg?fit=864%2C555&ssl=1

https://smartasset.com/taxes/tax-return-calcul…

Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate A is a dollar for dollar discount on your tax bill So if you owe 1 000 but

https://www.myob.com/au/blog/understanding-tax-deductions

Tax deductions aren t a refund At best if you earn more than 180 000 you will save 45 cents per dollar and if you earn less than 180 000 then your tax

I Believe That What You Put Out Into The Universe You Will Get Back If

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

Small Hate My Job dump When You Get Back From Vacation And Have To

How Much Do You Get From Amazon Flex The Future Warehouse

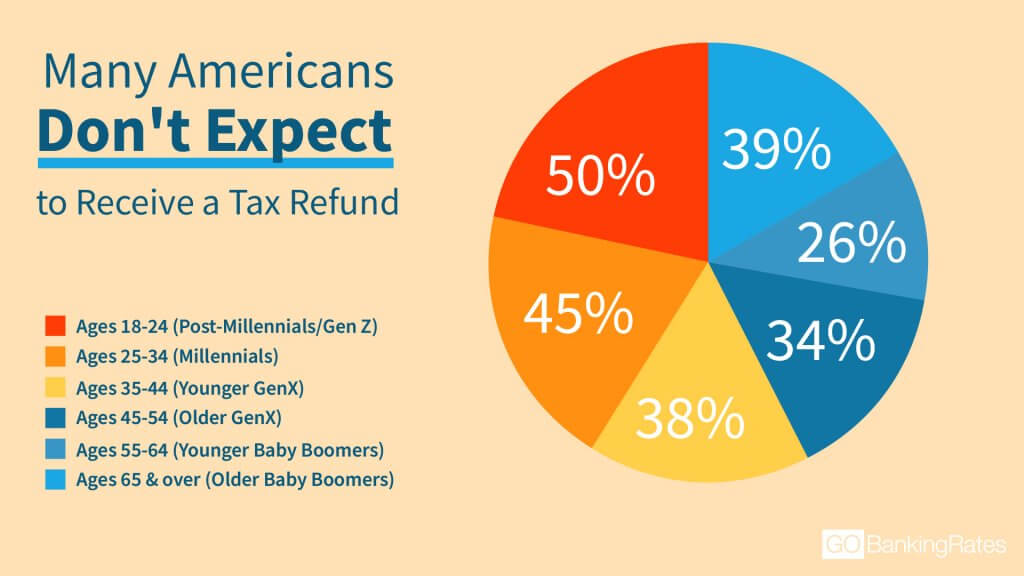

Here s The No 1 Thing Americans Do With Their Tax Refund GOBankingRates

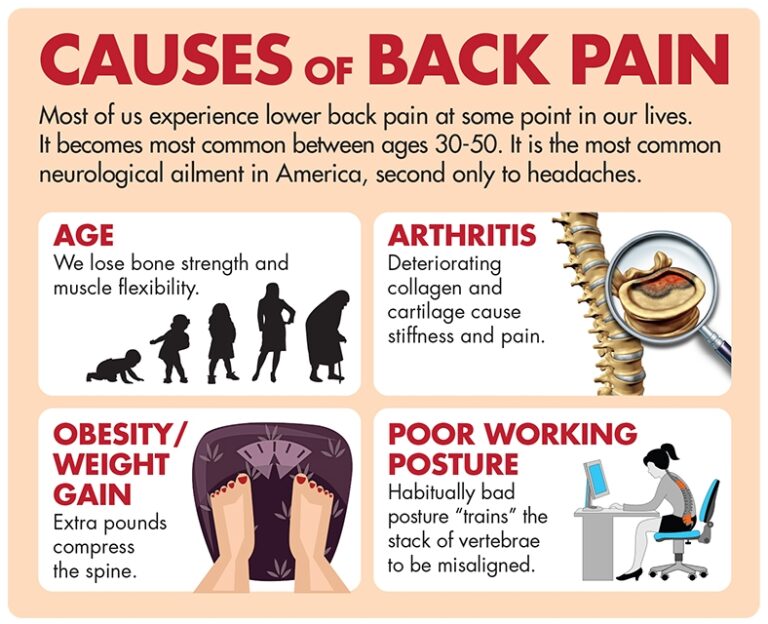

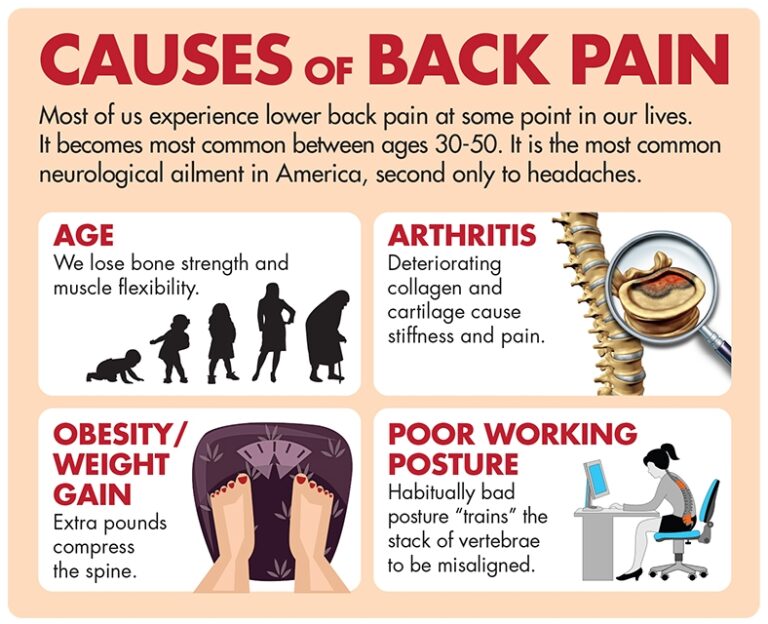

Treat Your CHRONIC BACK PROBLEMS Without Surgery AISClinic

Treat Your CHRONIC BACK PROBLEMS Without Surgery AISClinic

Back To Work After Vacation

I m Back And Recovered From My Vacation It s Amazing How Much Work

Do You Get Back Pain From Running YouTube

How Much Do You Get Back From Deductions - The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a higher