How Much Do You Get Back From Tax Deductible Donations The standard deduction for taxes due in April 2024 is 13 850 for single tax filers and 27 700 for married joint filers If your standard deduction is higher than your

The Charitable Giving Tax Savings Calculator demonstrates the tax savings power of your charitable giving Use our interactive tool to see how giving can help you save on Did you know you can claim a tax deduction when you donate to registered charities like World Vision Australia Use our tax donation calculator to see how much you can save

How Much Do You Get Back From Tax Deductible Donations

How Much Do You Get Back From Tax Deductible Donations

https://www.groupon.com/merchant/wp-content/uploads/2022/04/taxdeductibledonations.jpg

How To Maximize Your Tax Deductible Donations Forbes Advisor

https://www.forbes.com/advisor/wp-content/uploads/2021/12/tax-deductible-donations-before-Dec-31.jpeg

The Complete 2022 Charitable Tax Deductions Guide

https://daffy.ghost.io/content/images/2022/05/Daffy-Donor-advised-funds-Tax-Deductions-2022.png

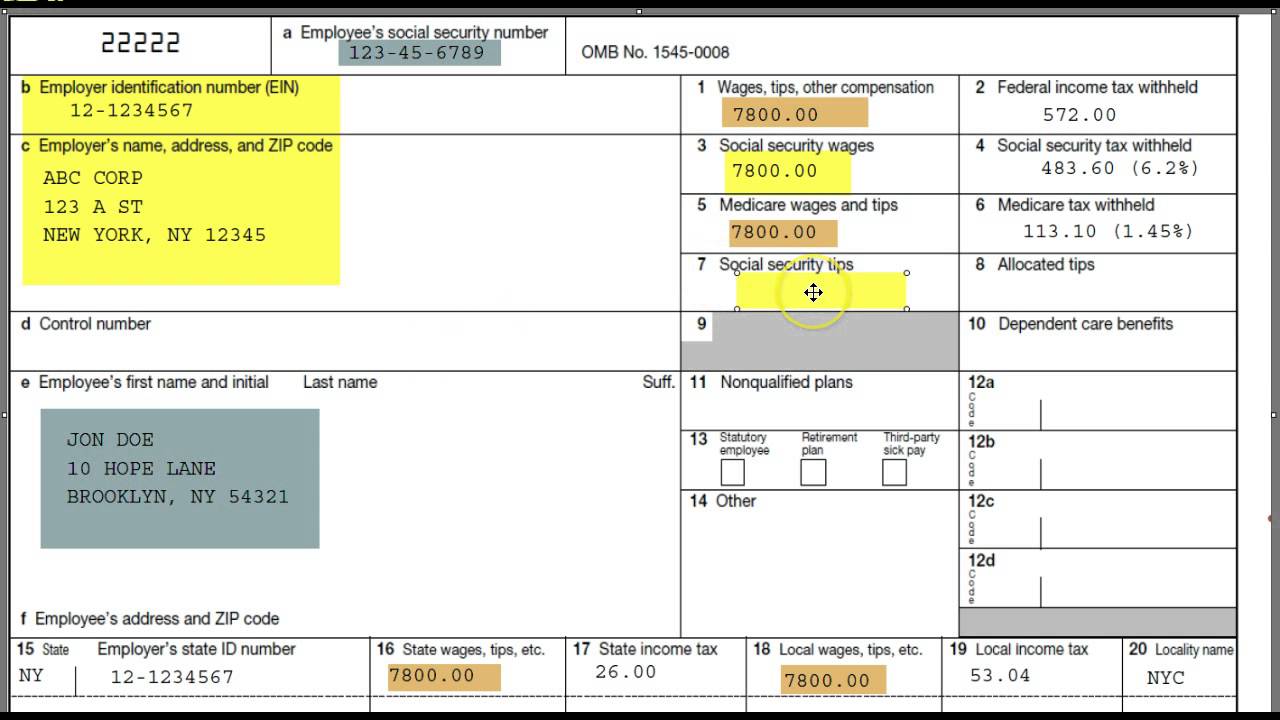

In that case you d claim charitable donations on Schedule A Form 1040 As a general rule you can deduct donations totaling up to 60 of your adjusted gross It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct It also discusses how

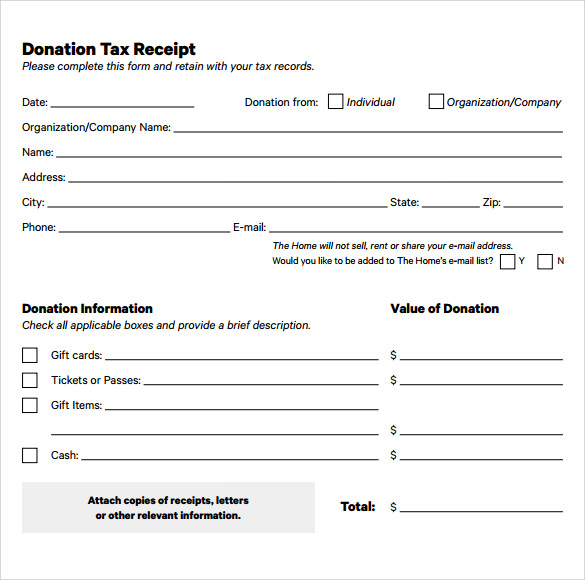

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the If you claim a deduction of more than 500 000 for a contribution of noncash property you must fill out Form 8283 Section B and also attach the qualified appraisal

Download How Much Do You Get Back From Tax Deductible Donations

More picture related to How Much Do You Get Back From Tax Deductible Donations

Tax deductible Donations Get The Most Out Of Giving Back

https://paradigmsp.com.au/wp-content/uploads/2021/09/Charity-685-1024x585.jpg

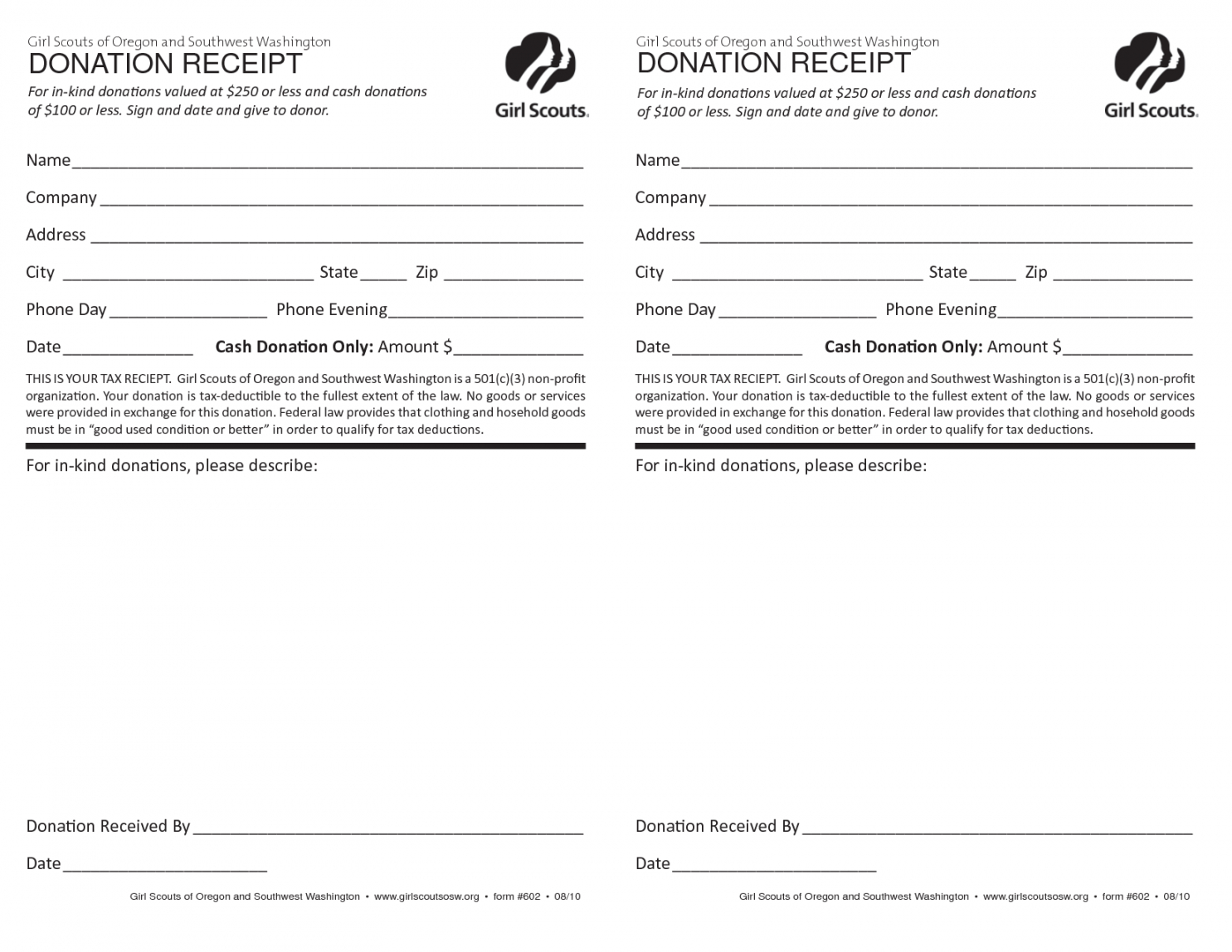

Printable Printable Church Donation Receipt Template For Religious

http://www.emetonlineblog.com/wp-content/uploads/2020/07/printable-printable-church-donation-receipt-template-for-religious-church-tax-donation-receipt-template-sample.png

Is GoFundMe Tax Deductible TL DR Accounting

https://www.tldraccounting.com/wp-content/uploads/2021/07/Are-gofundme-donations-tax-deductible.png

In 2020 you can deduct up to 300 of qualified charitable cash contributions per tax return as an adjustment to adjusted gross income without itemizing your How to write off charitable contributions Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A Form 1040 For non cash

Whether you get any benefit in return Any benefits you receive back from the organization you donated to count against your deduction For example if you pay 500 for baseball For example if you have 25 000 in taxable income this year and donate 60 of that or 15 000 to charity you will receive the deduction for the whole gift and

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

https://www.fidelitycharitable.org/content/dam/fc-public/shared/infographics/tax-strategies-cash-securities-example.png.transform/viewport-max/image.20190621.png

Donation Letter For Taxes Template In PDF Word

https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1

https://www.businessinsider.com/personal-finance/...

The standard deduction for taxes due in April 2024 is 13 850 for single tax filers and 27 700 for married joint filers If your standard deduction is higher than your

https://www.fidelitycharitable.org/tools/...

The Charitable Giving Tax Savings Calculator demonstrates the tax savings power of your charitable giving Use our interactive tool to see how giving can help you save on

Tax Return 6 Ways To Get The Most Money Back From Your Tax Return

How Can I Reduce My Income Tax Leia Aqui How Can I Lower My Income Tax

Tips On Tax Deductions For Donations

7 Donation Receipt Templates And Their Uses NeuFutur Magazine

How To Maximize Your Charity Tax Deductible Donation WealthFit

Non Profit Letter For Donations Database Letter Template Collection

Non Profit Letter For Donations Database Letter Template Collection

When Is The Last Day To Donate For Taxes Find Out Now

How To Maximize Your Charity Tax Deductible Donation WealthFit

How To Figure Out How Much You Get Back In Taxes 3 Ways To Calculate

How Much Do You Get Back From Tax Deductible Donations - In that case you d claim charitable donations on Schedule A Form 1040 As a general rule you can deduct donations totaling up to 60 of your adjusted gross