How Much Do You Get Back In Taxes For Child Care 2022 The majority of families can expect to save up to 600 if they have one child and up to 1 200 if they have two or more children Curious about the difference between a tax deduction and a tax credit According to the IRS website A tax deduction will reduce your taxable income and is calculated based on a percentage of your tax bracket

Parents with one child can claim 50 of their child care expenses up to 8 000 That means parents with one child can get a maximum tax credit of 4 000 on their taxes this year If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2023 or 2024 taxes of up to 35 of Up to 3 000 of qualifying expenses for a maximum credit of 1 050 for one child or dependent or

How Much Do You Get Back In Taxes For Child Care 2022

How Much Do You Get Back In Taxes For Child Care 2022

https://static01.nyt.com/images/2023/02/25/business/002023-taxes/002023-taxes-superJumbo.jpg

How Much Do You Get Back In Taxes For A Child In 2023

https://media.marketrealist.com/brand-img/TSudLWpx6/1280x670/how-much-per-child-on-taxes-2023-1674839017377.jpg?position=top

How Much Do You Get Back In Taxes For A Child In 2023

https://media.marketrealist.com/brand-img/51B_kReoo/1024x536/dependent-care-credit-1674837056376.jpg

For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4 000 for one qualifying person and 8 000 for two or more qualifying persons and potentially refundable so you might not have to owe taxes to claim the credit so long as you meet the other requirements How much of the Child Tax Credit can I claim on my 2021 tax return added January 31 2022 Q A4 How did the IRS determine the amount of my advance Child Tax Credit payments added January 31 2022 Q A5 Will the amount of my Child Tax Credit be reduced if my 2021 income is too high added January 31 2022 Q A6

If you paid for babysitting day care or even a summer camp you might be eligible to receive up to 8 000 in credits during this year s tax season depending on how many dependents you have Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for

Download How Much Do You Get Back In Taxes For Child Care 2022

More picture related to How Much Do You Get Back In Taxes For Child Care 2022

How Much Money Do You Get Back In Taxes For Buying A House Home Money

https://cdn.homeandmoney.com/wp-content/uploads/2021/07/29121248/HAM_HouseTaxRefund_FeaturedImg.jpg

Social Security Cost Of Living Adjustments 2023

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/10/wage-and-tax-statement.png

What Families Need To Know About The CTC In 2022 CLASP

https://www.clasp.org/wp-content/uploads/2022/04/CTC20_f202220Infographic_final_crop.png

Taxpayers can now claim up to 8 000 in expenses for one child or up to 16 000 for two or more dependents The American Rescue Act also increased the rate of return on the child You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return

For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional child tax What is your adjusted gross income How many dependents are you claiming Under age 6 as of Dec 31 2021 Ages 6 through 16 17 years old 18 or older Calculate Half of the tax credit

Live In N J You ll Pay More In Taxes Over A Lifetime Than Anywhere

https://www.nj.com/resizer/3002Ih90r6BDrXqjjIph_w4A_Ec=/700x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/GLZ6DCHYWZBQPLR6K7FIKPZCTI.png

How Much Is 2 Kids Worth On Taxes Leia Aqui How Much Do You Get Back

https://www.fidelity.com/bin-public/600_Fidelity_Com_English/images/migration/kiddie tax example 2023 update.png

https://www.care.com/c/daycare-tax-credit-what-is-it-benefits

The majority of families can expect to save up to 600 if they have one child and up to 1 200 if they have two or more children Curious about the difference between a tax deduction and a tax credit According to the IRS website A tax deduction will reduce your taxable income and is calculated based on a percentage of your tax bracket

https://www.cbsnews.com/news/child-dependent-care...

Parents with one child can claim 50 of their child care expenses up to 8 000 That means parents with one child can get a maximum tax credit of 4 000 on their taxes this year

How To Calculate How Much Money You Will Get Back In Taxes Reverasite

Live In N J You ll Pay More In Taxes Over A Lifetime Than Anywhere

29000 A Year Is How Much A Month After Taxes New Update

Amazon Flex Take Out Taxes Augustine Register

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

How To Figure Out How Much You Get Back In Taxes How Much Tax Do I

How To Figure Out How Much You Get Back In Taxes How Much Tax Do I

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

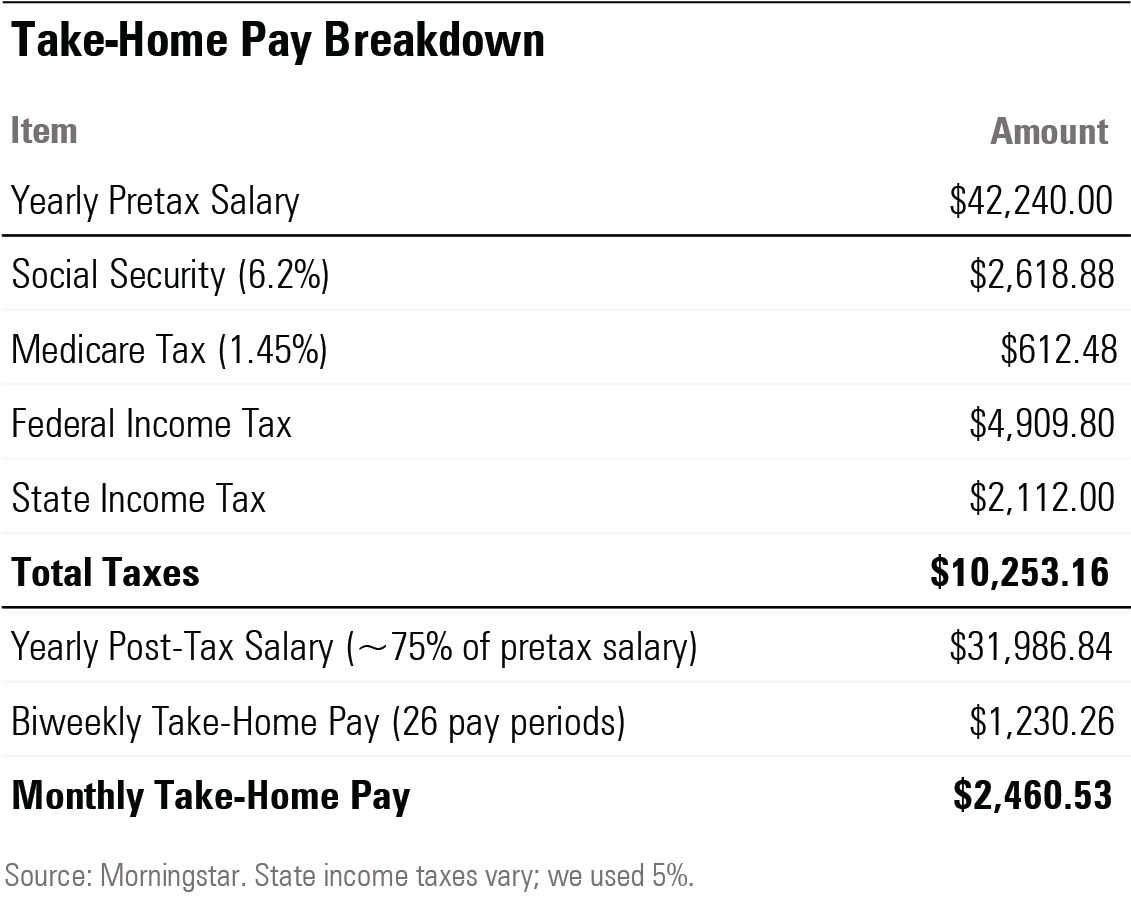

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Total Percentage Of Taxes Taken Out Of Paycheck ZahibTemilade

How Much Do You Get Back In Taxes For Child Care 2022 - If you paid for babysitting day care or even a summer camp you might be eligible to receive up to 8 000 in credits during this year s tax season depending on how many dependents you have