How Much Do You Get Back In Taxes For Daycare Canada Reddit Yes you get a child credit for every dependent you claim You get tax deductions on any child care and some school expenses as well if not regardless of income definitely

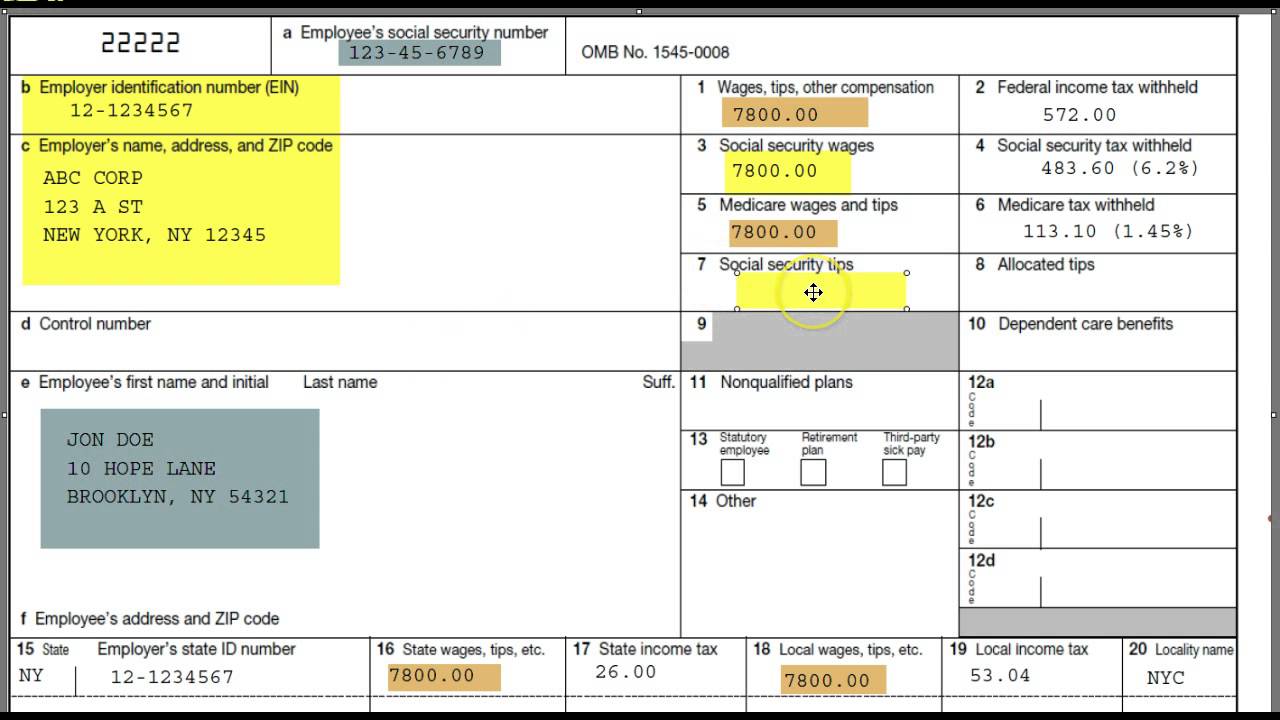

If you make more then 150k as a household you get nothing You will receive 2 of your childcare expenses max 8k per 3600 you are under 150k gross income 7 yr ago As a fairly normal dude without kids and before entering any specific deductions my withholding had my refund at about 2 50 But since many people have children or tuiton

How Much Do You Get Back In Taxes For Daycare Canada Reddit

How Much Do You Get Back In Taxes For Daycare Canada Reddit

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

What Is Small Employers Relief 2023 2023 Leia Aqui What Is The Small

https://static01.nyt.com/images/2023/02/25/business/002023-taxes/002023-taxes-superJumbo.jpg

BuzzCanada New Study Shows Canadians Spend More On Taxes Than Food And

http://1.bp.blogspot.com/-HaCPocuqiXg/U_KNdyDL0pI/AAAAAAAAEnY/5Y2wOFGzOwc/s1600/TaxBurden.jpg

So if you had 25k of daycare costs used 5k of a dependent care FSA and have two kids the eligible expenses that are used for the credit starts at 25k what you paid then capped So 5000 tuition will result in a tax reduction of 750 for federal income tax The amount it is worth for provincial tax depends on the provincial tax rate and whether the province still has a

Trying to add my 2018 RRSP to my taxes to lower it a bit more I ll figure out how to increase what my RH takes on my pay so that I get money back next year Finding a 500 laying Income Tax Package Form T778 Child Care Expenses Deduction for 2023 Income Tax Folio S1 F3 C1 Child Care Expense Deduction Date modified 2024 01 23 Information to help

Download How Much Do You Get Back In Taxes For Daycare Canada Reddit

More picture related to How Much Do You Get Back In Taxes For Daycare Canada Reddit

How Much Do You Get Back In Taxes For Daycare Canada YouTube

https://i.ytimg.com/vi/NVSqCwCWIIk/maxresdefault.jpg

How Much Money Do You Get Back In Taxes For Buying A House Home Money

https://cdn.homeandmoney.com/wp-content/uploads/2021/07/29121248/HAM_HouseTaxRefund_FeaturedImg.jpg

How Much Is 2 Kids Worth On Taxes Leia Aqui How Much Do You Get Back

https://www.fidelity.com/bin-public/600_Fidelity_Com_English/images/migration/kiddie tax example 2023 update.png

Child care expenses 101 Daycare summer camp nurseries and nanny services are all deductible expenses for parents but the tax deduction must be claimed by the parent in Find a list of all deductions credits and expenses you may be able to claim on your income tax and benefit return Date modified 2024 01 23 Find some of the deductions and credits you

3 750 per child between the ages of seven and 16 plus a top up of up to 750 for 2021 8 250 per child with a severe disability plus a top up of up to 1 650 for 2021 The Ontario Child Canadian taxpayers can claim up to 8 000 per child for children under the age of 7 years at the end of the year 5 000 per child for children aged 7 to 16 years For

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Australia

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Amazon Flex Take Out Taxes Augustine Register

https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/61e9b83fd4bedd77a0b98f76_form-1040.png

https://www.reddit.com/r/personalfinance/comments/...

Yes you get a child credit for every dependent you claim You get tax deductions on any child care and some school expenses as well if not regardless of income definitely

https://www.reddit.com/r/PersonalFinanceCanada/...

If you make more then 150k as a household you get nothing You will receive 2 of your childcare expenses max 8k per 3600 you are under 150k gross income

29000 A Year Is How Much A Month After Taxes New Update

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Australia

Here s Where Your Federal Income Tax Dollars Go NBC News

Social Security Cost Of Living Adjustments 2023

How To File Back Taxes SDG Accountants

How Much Do You Get Back In Taxes For 1098 T A Guide To Maximizing

How Much Do You Get Back In Taxes For 1098 T A Guide To Maximizing

How To Calculate How Much Youll Get Back In Taxes Reverasite

Live In N J You ll Pay More In Taxes Over A Lifetime Than Anywhere

CI Post 2 Do Immigrants Pay Taxes

How Much Do You Get Back In Taxes For Daycare Canada Reddit - Income Tax Package Form T778 Child Care Expenses Deduction for 2023 Income Tax Folio S1 F3 C1 Child Care Expense Deduction Date modified 2024 01 23 Information to help