How Much Do You Get Paid For Family Tax Benefit You may get the maximum rate of FTB Part A if your family s adjusted taxable income is 62 634 or less Income between 62 634 and 111 398 We use an income test if your

The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A will How much do you get paid for the family tax benefit Family Tax Benefit payment rates may vary The base rate for Family Tax Benefit Part A is 63 56 for each

How Much Do You Get Paid For Family Tax Benefit

How Much Do You Get Paid For Family Tax Benefit

https://flast.com.au/s/bx_posts_photos_resized/qzcn8hzfsz5nrttexf4rngmdepayyzfb.png

Lodgment Reminder Family Tax Benefit Recipients Crest Accountants

https://www.crestaccountants.com.au/wp-content/uploads/2022/06/Lodgment-Reminder-Family-Tax-Benefit-Recipients-1060x628.png

New App WageSpot Exposes Salary Data Across The Country

https://www.gannett-cdn.com/-mm-/389f33b6050a2664d0a5c4c7964c4fab0747cd63/c=0-38-2024-1181/local/-/media/2015/10/26/USATODAY/USATODAY/635814567737908846-salary.jpg?width=2024&height=1143&fit=crop&format=pjpg&auto=webp

Aged 0 to 15 years aged 16 to 19 years and meet certain study requirements The child must be in your care for at least 35 of the time Your child must not be receiving other Less than 31 096 from 1 July 2021 less than 32 864 from 1 April 2022 less than 34 216 from 1 April 2023 It tops up your family s after tax weekly income to at least 658 from

Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid To receive the FTB Part A your family s combined income must be 80 000 or less How much Family Tax Benefit Part A can I receive Your FTB A payment rate

Download How Much Do You Get Paid For Family Tax Benefit

More picture related to How Much Do You Get Paid For Family Tax Benefit

The Best And Easiest Ways To Make Money Overseas

https://www.liveandinvestoverseas.com/wp-content/uploads/2018/08/man-getting-paid.jpg

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

How To Find Out If You Owe Irs Informationwave17

https://i.insider.com/5f721b9074fe5b0018a8dc86?width=1000&format=jpeg&auto=webp

The limit ranges from 99 536 for one child under 12 to 221 373 for three children under 19 To be eligible for Family Tax Benefit Part B you must be a single If your income is 56 000 and you have one child you will be paid 21 80 a week or 1 133 60 a year Your income over 50 000 is 6 000 so you will be required to pay tax of 1 for every 100 over

Family Tax Benefit Part A eligibility Family Tax Benefit FTB Part A is paid per child The amount you will receive depends on your family s circumstances By claiming Child Benefit you can get an allowance paid to you for each child you ll usually get it every 4 weeks National Insurance credits which count towards your State

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

https://www.pitcher.com.au/wp-content/uploads/2023/05/FedBudget_FullReport_230510_table.jpg

https://www.servicesaustralia.gov.au/income-test...

You may get the maximum rate of FTB Part A if your family s adjusted taxable income is 62 634 or less Income between 62 634 and 111 398 We use an income test if your

https://www.bigdream.com.au/family-tax-benefit-calculator

The max FTB part A payment you can get is 6 380 when your salary is no more than 62 634 If your taxable income is between 62 634 and 111 398 the FTB part A will

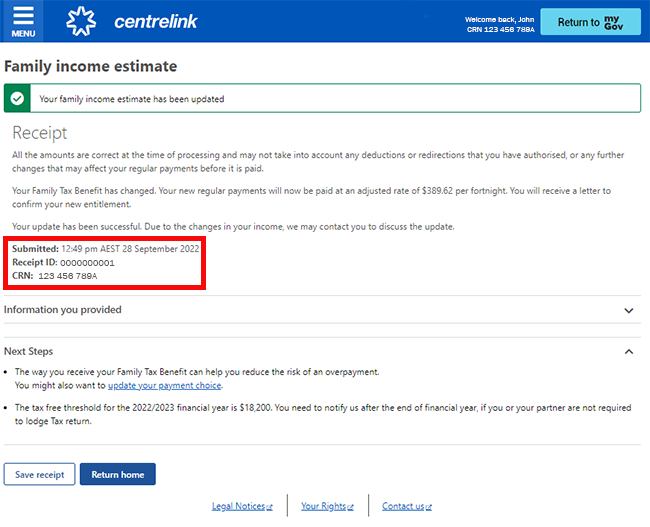

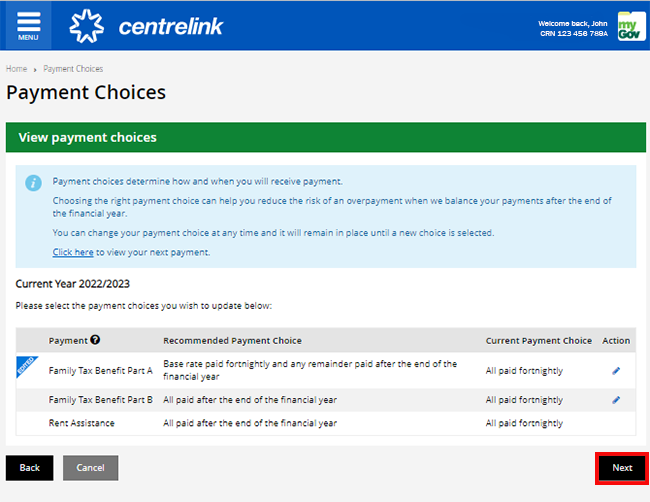

Centrelink Online Account Help Update Your Family Income Estimate And

Family Tax Benefit PART A PART B Care For Kids

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

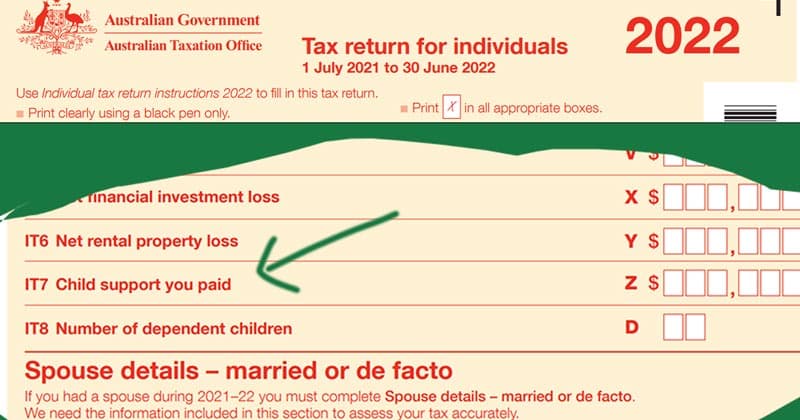

Is Child Support Taxable Income Child Support Australia

3 Best Ways To Get Paid By WALMART Working From Home YouTube

How Much Do You Get Paid For Subscribers On Youtube YouTube

How Much Do You Get Paid For Subscribers On Youtube YouTube

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

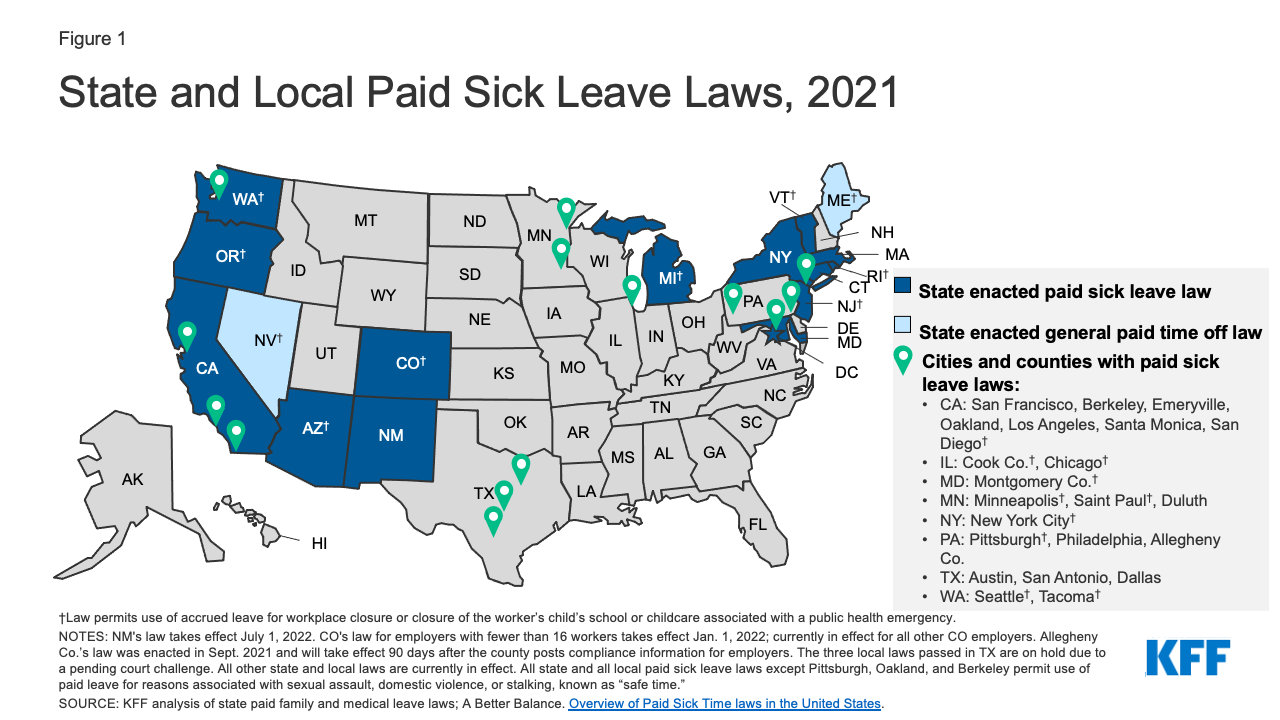

Paid Leave In The U S KFF

Centrelink Online Account Help Update Your Family Income Estimate And

How Much Do You Get Paid For Family Tax Benefit - Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid