How Much Does An Accountant Charge For Capital Gains Tax Return The fee is invoiced in two amounts A Capital Gains Tax return is due within 60 days of completion On the subsequent Tax return a further 40 is added for the required

I would usually charge not much more than 100 150 for this you don t really need a meeting usually and can ask for the information by email Lots of A capital gains tax accountant plays a critical role in accurately calculating capital gains They consider all relevant factors from acquisition and improvement costs

How Much Does An Accountant Charge For Capital Gains Tax Return

How Much Does An Accountant Charge For Capital Gains Tax Return

https://www.zooconomics.co.uk/blog/wp-content/uploads/2017/06/StockSnap_09LJGFBK1X-Medium-1024x683.jpg

Things You Need To Know About Capital Gains Tax Lumina Homes

https://www.lumina.com.ph/assets/news-and-blogs-photos/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property/4-Things-you-Need-to-Know-about-Capital-Gains-Tax-before-Buying-a-New-Property.webp

How Much Does An Accountant Charge Per Transaction Remote Books Online

https://www.remotebooksonline.com/blog/wp-content/uploads/bookkeeping-charge-4.jpg

Currently the Capital Gains Tax allowance is 12 300 This represents the total amount of gains a person can make before they are liable to pay Capital Gains Tax CGT applies Short term capital gains are taxed at ordinary income tax rates up to 37 the seven marginal tax brackets are 10 12 22 24 32 35 and 37 By contrast long term capital gains are

What Is the Capital Gains Tax A capital gains tax is a tax imposed on the sale of an asset The long term capital gains tax rates for the 2023 and 2024 tax years are 0 15 Currently in the UK the annual Capital Gains tax free allowance stands at 12 300 That s 12 300 that you can gain without having to pay a penny in tax to HMRC Once that

Download How Much Does An Accountant Charge For Capital Gains Tax Return

More picture related to How Much Does An Accountant Charge For Capital Gains Tax Return

How Much Do Accountants Charge For Small Business Taxes Accountsdept

https://accountsdept.co.nz/wp-content/uploads/2023/03/How-much-do-accountants-charge-for-small-business-taxes-featured-image-900x313.png

How Much Does An Accountant Charge For A Corporate Tax Return In Canada

https://accountantsedmonton.ca/wp-content/uploads/2023/09/How-Much-Does-an-Accountant-Charge-for-a-Corporate-Tax-Return-in-Canada-768x402.png

Budget Predictions Is Change On The Way For Capital Gains Tax BHP

https://bhp.co.uk/wp-content/uploads/2023/03/AdobeStock_386954337.jpeg

If you sold a UK residential property on or after 6 April 2020 and you have tax on gains to pay you can report and pay using a Capital Gains Tax on UK property account It s important to understand what capital gains tax is and how it s calculated and what tax rates apply

How much does a CPA cost Well that depends but you can generally expect to pay more when working with a tax accountant compared with a general tax I want to find out what is the avearage to charge a recent client for capital gains tax computations

How To Avoid Capital Gains Tax On Investment Property Pherrus

https://www.pherrus.com.au/wp-content/uploads/2022/12/01_cover_How-to-Avoid-Capital-Gains-Tax-on-Investment-Property.jpg

How To Calculate Your 2023 Taxes PELAJARAN

https://www.taxestalk.net/wp-content/uploads/how-to-disclose-capital-gains-in-your-income-tax-return.jpeg

https://comanandco.co.uk/pricing

The fee is invoiced in two amounts A Capital Gains Tax return is due within 60 days of completion On the subsequent Tax return a further 40 is added for the required

https://www.accountingweb.co.uk/any-answers/how...

I would usually charge not much more than 100 150 for this you don t really need a meeting usually and can ask for the information by email Lots of

How To Apply For Capital Gains Tax Exemption In Kenya In 2024 A

How To Avoid Capital Gains Tax On Investment Property Pherrus

How Much Do Accountants Charge For Capital Gains Tax In The UK

Filing Your Capital Gains Tax Return Step by Step Guide

Capital Gains Are The Profits You Make From Selling Your Investments

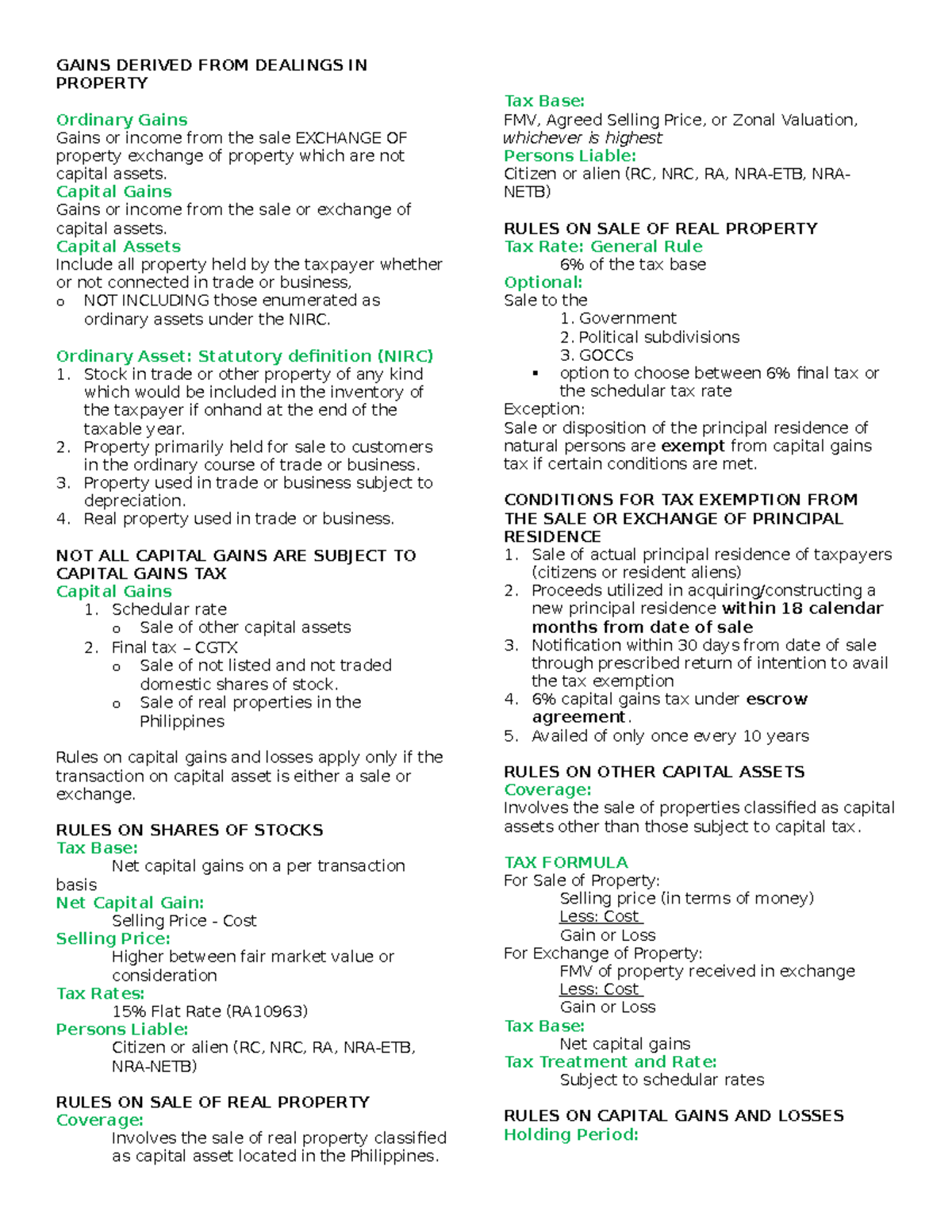

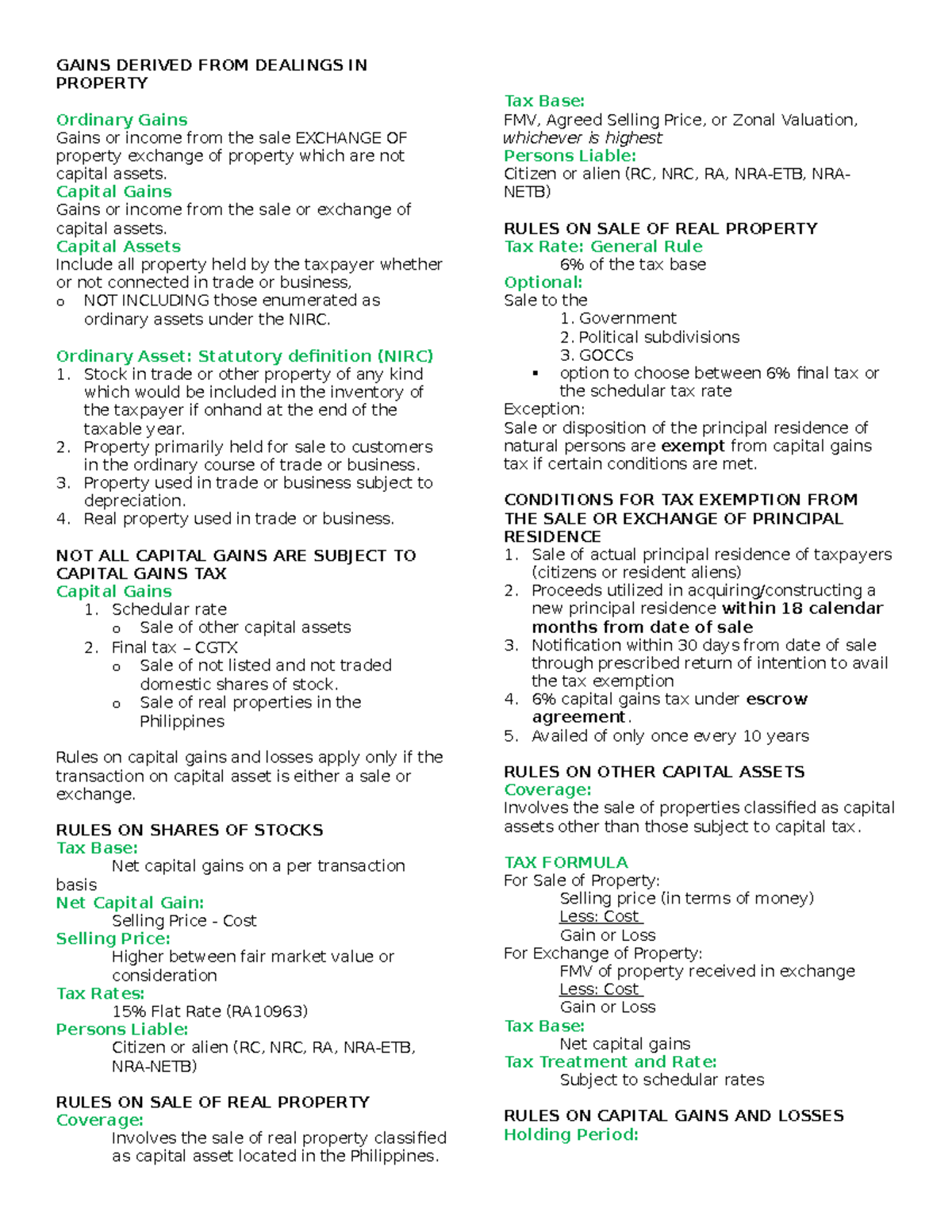

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Tax Consequence As Such He Shall File His Capital Gains Tax Return

Simplified Income Tax Return Online TaxNodes

What Does An Accountant Charge Per Hour Remote Books Online

How Much Does An Accountant Charge For Capital Gains Tax Return - How much Capital Gains Tax will I pay The rate of Capital Gains Tax you pay on the gains you make above the allowance depends on what the asset is and the