How Much Does Rrsp Reduce Income Tax Calculator Canada Web You may get anywhere from 20 per cent to 50 per cent of your RRSP contributions back as an income tax refund based on your marginal tax rate Use the RRSP Tax Savings

Web The 2021 deduction limit is 18 of your pre taxed income from the previous year or 27 830 The limit is whichever amount is less For example if you earned 50 000 in Web 2022 RRSP savings calculator Calculate the tax savings your RRSP contribution generates in each province and territory Reflects known rates as of December 1 2022

How Much Does Rrsp Reduce Income Tax Calculator Canada

How Much Does Rrsp Reduce Income Tax Calculator Canada

https://uploads-ssl.webflow.com/61e09d67f0dcf4552c951a3a/62e1621b537ab7b4f97a56f2_hkSryA9HKu07Z-nZV4n2BbPt2ihL1tH1Q_5muUOseKJpzbS5QJ1wu37KofBZwJPEL2qoQM1WPPi5U0hXTkPtsYjnyenTOrBbnLzQYkktsv5UiEqO3dNelYilf6LLuVw9A1VgIplSsK56dCoPVgMgIA.png

How Much Should I Contribute To My RRSP To Reduce Income Tax In Canada

https://ratemasters.ca/wp-content/uploads/2023/12/Designer-2023-11-06T230210.996.png

2023 Federal Tax Rates Cra Printable Forms Free Online

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

Web 23 Juni 2023 nbsp 0183 32 RRSPs come with advantages and disadvantages The 3 main advantages of RRSPs are Contributions result in a tax deduction that reduces your taxable income and saves you money Invested Web 2023 12 01 How to set up and contribute to an RRSP transferring funds making withdrawals receiving income death of an RRSP annuitant RRSP tax free withdrawal

Web 1 M 228 rz 2023 nbsp 0183 32 How is your RRSP deduction limit determined The Canada Revenue Agency generally calculates your RRSP deduction limit as follows your unused RRSP Web Therefore the tax saving benefits when contributing to a RRSP in January and February are applied on the previous fiscal year Try this calculator to evaluate your potential tax savings and compare it with other Canadian

Download How Much Does Rrsp Reduce Income Tax Calculator Canada

More picture related to How Much Does Rrsp Reduce Income Tax Calculator Canada

How To Use Our Income Tax Calculator TaxCal

https://taxcal.in/wp-content/uploads/2020/12/screenshot.png

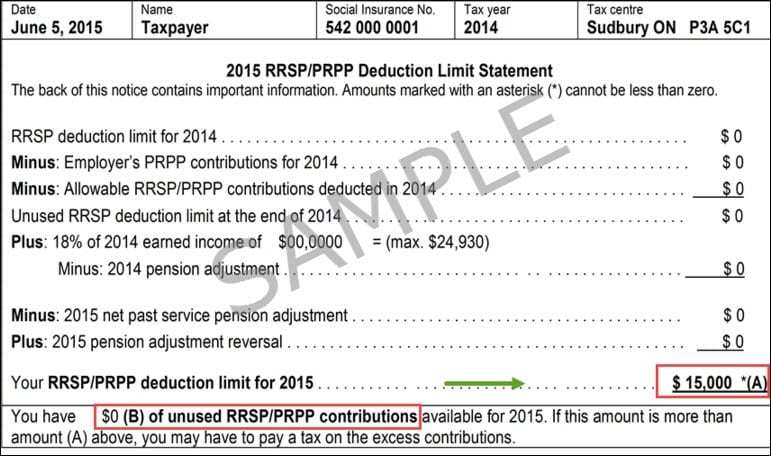

How Much Can I Contribute To My RRSP Common Wealth

https://www.commonwealthretirement.com/wp-content/uploads/2022/02/Sample-notice-of-assessment-RRSP-limit.jpeg

Tax Changes In Canada For 2023 RRSP TFSA FHSA And More Blog

https://uploads-ssl.webflow.com/61e09d67f0dcf4552c951a3a/63a201c12430f36914b49f2b_y_vSneqOQZQkpGs2jR0MBP7jI1NN9_ksbSSmwRJ1bDBpUhAFVKpyIZPzP0rZXhTg9ANDQdMeFJbsfOHzzXbwJst75qZAQ5D9L4NIzTErPKlgfQ3ICR0LxP2RO60GSMZIEsID423ZJ_cHj1SHIISFNf7mce9k7yvY7h0MSCs0Y_FTbkGXksz_VU9DRIaXJQ.png

Web You can contribute to an RRSP up until December 31 of the year you turn 71 Please enter a number between 1 and 50 Ongoing contribution amount This is the amount you plan to Web This calculator will tell you how much your RRSP will reduce your income tax and it s easy to use The calculator will give you a graph and a table which will tell you how much your RRSP will reduce your income tax It

Web It will also provide an estimate of how much your RRSP will be worth in the future The calculator takes into account your age income and RRSP savings Here are some Web 17 Dez 2021 nbsp 0183 32 For non residents of Canada withholding is 25 unless reduced by a treaty See Information Circular IC76 12 Applicable rate of part XIII tax on amounts paid

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

https://bi.icalculator.com/img/og/BI/100.png

How High Income Earners Can Legally Reduce Their Tax Rates Buying RRSPs

https://www.cwcga.com/wp-content/uploads/2018/02/rrsp-txt.jpg

https://www.theglobeandmail.com/.../tools/rrsp-tax-savings

Web You may get anywhere from 20 per cent to 50 per cent of your RRSP contributions back as an income tax refund based on your marginal tax rate Use the RRSP Tax Savings

https://income.ca/investing/how-much-rrsp-should-i-contribute-to-avoi…

Web The 2021 deduction limit is 18 of your pre taxed income from the previous year or 27 830 The limit is whichever amount is less For example if you earned 50 000 in

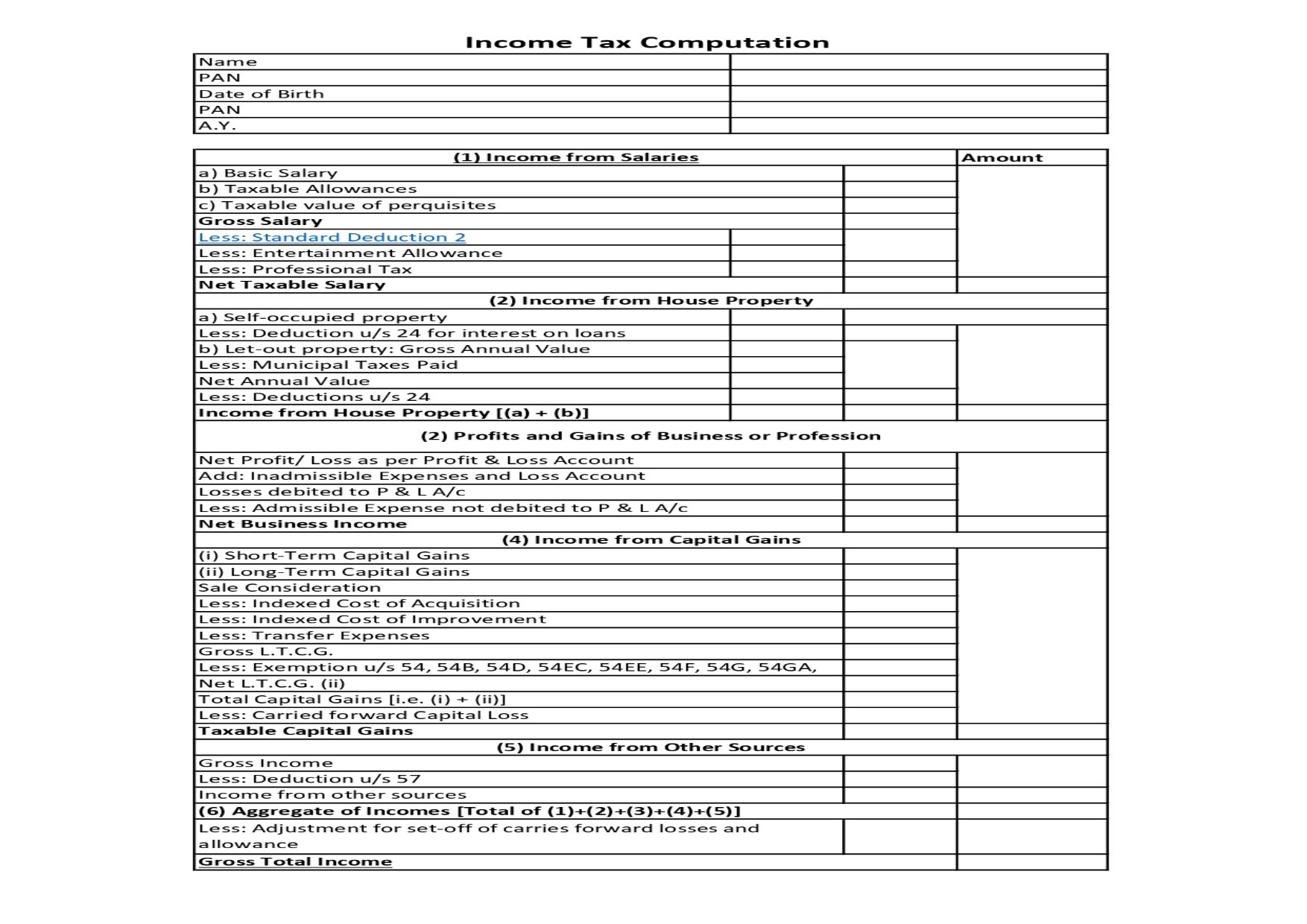

Income Tax Computation Format PDF A Comprehensive Guide

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

How Much RRSP Should I Contribute To Avoid Paying Taxes

Indian Corporate Income Tax Calculator 2022 ODINT Consulting

How To Save More Taxes Using An Income Tax Calculator

Canadian Income Tax Calculator Amazon es Appstore For Android

Canadian Income Tax Calculator Amazon es Appstore For Android

Singapore Corporate Income Tax Calculator 2022 ODINT Consulting

How To Reduce Income Tax In Canada By Ken Donaldson Issuu

Overview What Is Personal Income Tax Calculator BBNC

How Much Does Rrsp Reduce Income Tax Calculator Canada - Web 23 Juni 2023 nbsp 0183 32 RRSPs come with advantages and disadvantages The 3 main advantages of RRSPs are Contributions result in a tax deduction that reduces your taxable income and saves you money Invested