How Much Ev Tax Credit 2022 Qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some other qualifications Used car must be

Step 5 The EV sticker price matters Price matters but not until January 1 New battery electric cars that cost more than 55 000 do not qualify for the EV tax The big climate and health care bill signed into law by President Biden has what at first sight looks like a big incentive for those

How Much Ev Tax Credit 2022

How Much Ev Tax Credit 2022

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

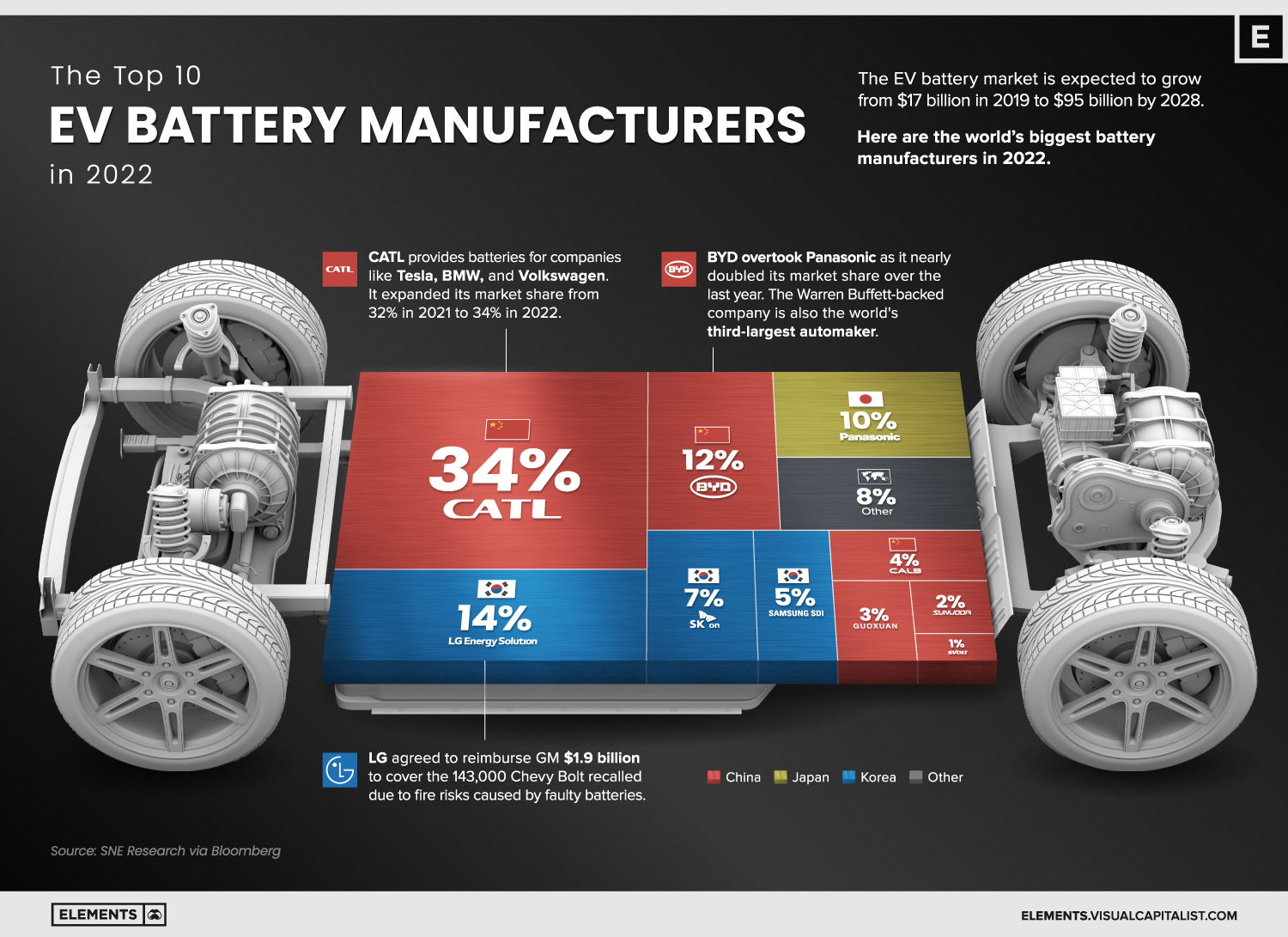

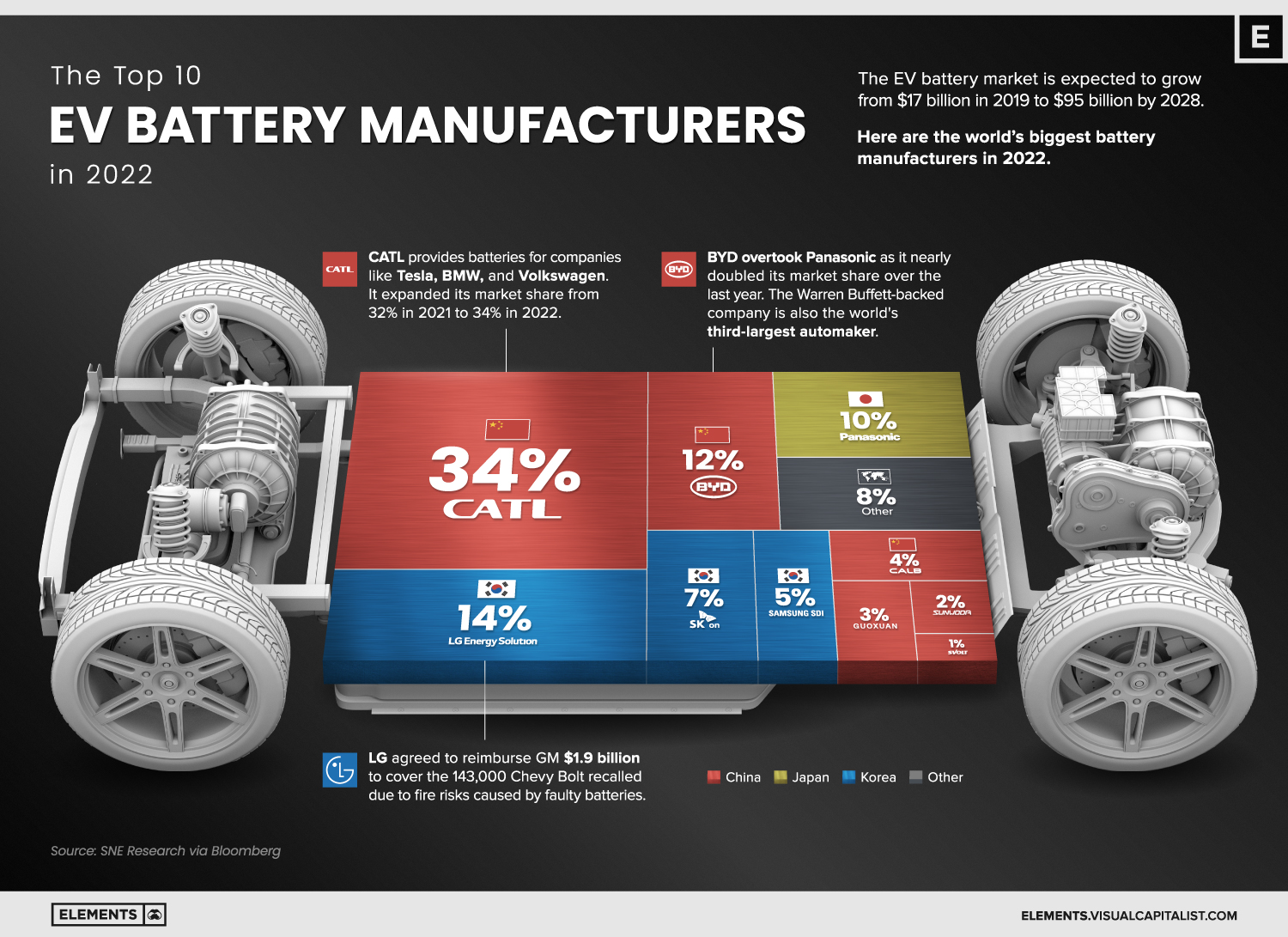

The Top 10 EV Battery Manufacturers In 2022

https://elements.visualcapitalist.com/wp-content/uploads/2022/10/Top-10-EV-Battery-Manufacturers-by-Market-Share-2022_main_Oct11.jpg

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue That number will gradually grow to 100 in 2029 Under the new credit system the MSRP of a pickup or SUV must not be over 80 000 and other vehicles like sedans must not surpass 55 000 A

Certain used previously owned EVs can qualify for a tax credit of up to 4 000 or 30 of the sales price whichever is less As of Jan 1 2024 you can take the Audi Q5 TFSI e Quattro PHEV BMW 330e sedan 2021 2023 model may have qualified for partial credit up to 5 836 due to battery size if made in North

Download How Much Ev Tax Credit 2022

More picture related to How Much Ev Tax Credit 2022

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

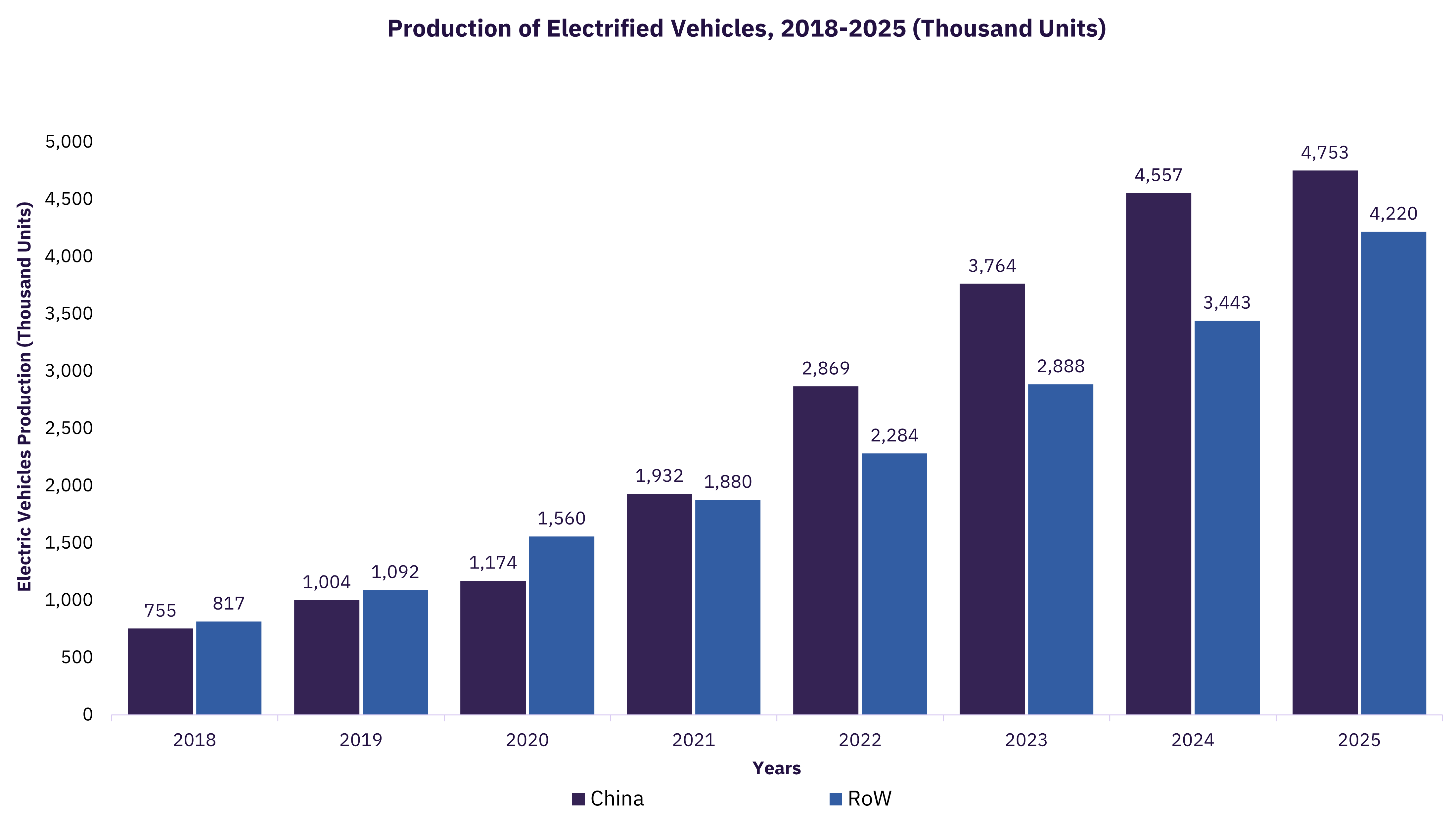

China To End EV Subsidies After 30 Cut In 2022 GlobalData

https://www.globaldata.com/Uploads/Statistics/d60cdb76-8689-4e53-bb98-90c285689569.png

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only

Calculate See how much you could get back buying a new EV or plug in hybrid Federal EV tax credits of 2 500 7 500 are available for new EVs and plug in Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new

Ev Tax Credit 2022 Cap Clement Wesley

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

EV Tax Credit 20 EVs That Still Qualify For 2023 Tax Breaks

https://evlife.co/blog/wp-content/uploads/2023/04/Model-Y-900w-768x357.jpg

https://www.nerdwallet.com/article/taxes/ev-tax...

Qualifying used EV purchases can fetch taxpayers a credit of up to 4 000 limited to 30 of the car s purchase price Some other qualifications Used car must be

https://techcrunch.com/2022/09/02/a-complete-guide...

Step 5 The EV sticker price matters Price matters but not until January 1 New battery electric cars that cost more than 55 000 do not qualify for the EV tax

What Is The ERC Tax Credit 2022 Updated For 2023 Qualifications For

Ev Tax Credit 2022 Cap Clement Wesley

EV Tax Credit 2022 Updates Shared Economy Tax

Orange Charger Inc

EV Tax Credit 2022 NEW Dates Pass Or Fail YouTube

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Ev Tax Credit 2022 Retroactive Shemika Wheatley

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

EV Tax Credit 2023 What s Changing With Biden s IRA The Week

How Much Ev Tax Credit 2022 - When buying a used electric vehicle costing up to 25 000 drivers can receive a tax credit of up to 30 percent of the purchase price with a 4 000 cap Liz