How Much Fixed Deposit Is Tax Free Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in period of 5 years Interest earned is taxable The rate of interest ranges from 5 5 7 75

Accrual basis Paying tax every year In this method you pay tax on your interest income as it accrues to you i e every year You can find the interest earned every year pretty easily from your Form 26AS which reflects the interest credit the tax If your interest income from all FDs is less than Rs 40 000 in a year the income is TDS exempt On the other hand if your interest income is over Rs 40 000 the TDS would be 10 Besides if you do not have a PAN card the bank can deduct 20 of TDS

How Much Fixed Deposit Is Tax Free

How Much Fixed Deposit Is Tax Free

https://everestbankltd.com/wp-content/uploads/2019/06/FD.png

Fixed Deposit Rate 2023 Best Bank FD Promotion Malaysia

https://mypt3.com/wp-content/uploads/fixed-deposit-rate.jpg

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

The term or period for a fixed deposit can vary between 30 days and 10 years with interest rates ranging between 3 and 11 Although the interest rates on fixed deposits are low compared to most investment vehicles the returns are almost risk free Impact of Tax on Fixed Deposit Returns Taxes have a significant impact on the overall returns generated from fixed deposits The taxation on fixed deposit interest can reduce the net returns earned by investors Let s explore the impact of taxes on

Individuals can claim income tax deductions of up to Rs 1 5 lakh under Section 80C of the Income tax Act 1961 for booking tax saving fixed deposits The interest earned on these tax saving fixed deposits however is taxable except when The FD interest rate is lower at post offices but you can save on taxes You can deposit money in FDs under your spouse parents and kids name The income tax on interest on fixed deposit income is calculated for

Download How Much Fixed Deposit Is Tax Free

More picture related to How Much Fixed Deposit Is Tax Free

Company Fixed Deposits Interest Rates And Other Factors To Consider

http://www.komku.org/wp-content/uploads/2019/11/Fixed-Deposits.jpg

Whats Is Savings Account And Zero Balance Interest Rate Benefit

https://1.bp.blogspot.com/-KYMRzf7r8Js/XzX7MEIGibI/AAAAAAAACoE/Q__sIPsePV49NpAAyoa5FzgK66nYujvfACLcBGAsYHQ/w1600/Saving-Account.jpg

Want A Pile Of Tax Free Money Thanks To A Cash Out Refinance Who Doesn

https://i.pinimg.com/originals/c5/a8/28/c5a8283aaf2e717e58a6d33ce6fa6182.png

The Role of Tax Saver FDs in Tax Planning Tax planning helps reduce tax liability One way is to invest in tax saving fixed deposits and offer deductions under Section 80C Individuals and HUFs Your starting rate for savings is a maximum of 5 000 Every 1 of other income above your Personal Allowance reduces your starting rate for savings by 1 You earn 16 000 of wages and get

Tax saving deposits are a type of deposit scheme that allows you to enjoy a deduction of up to 1 5 lakh under Section 80C of the Income Tax Act They come with a lock in period of 5 years Just like other fixed deposits returns on a tax saving FD are Generally fixed deposits aren t tax free However Section 80C of the Income Tax Act allows a deduction of up to Rs 1 5 lakh against your taxable income if you invest in a tax saving

FD RD PPF Tax Hello Maharashtra

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

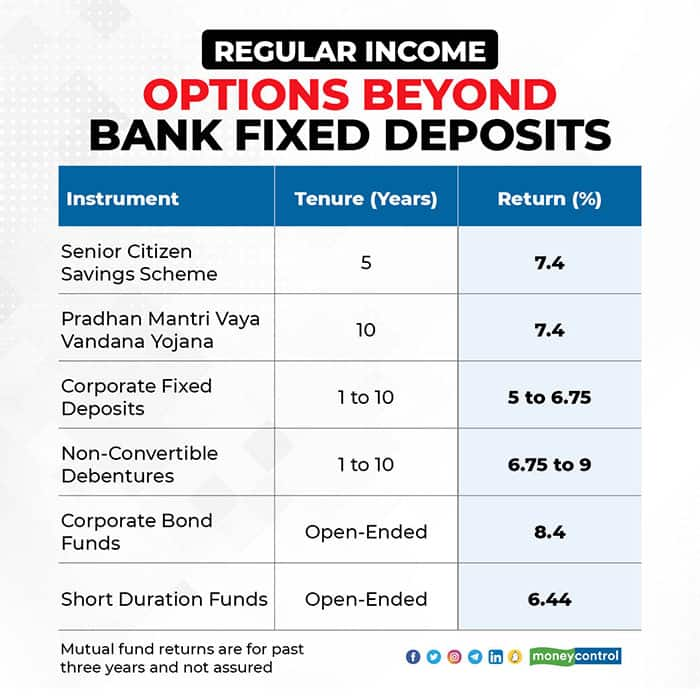

Fixed Deposit Rates Are At All time Lows Here Are Some Better

https://images.moneycontrol.com/static-mcnews/2021/09/Regular-Income-Options-beyond-bank-fixed-deposits-R.jpg

https://cleartax.in/s/tax-saving-fd-fixed-deposits

Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account Some of its features are A lock in period of 5 years Interest earned is taxable The rate of interest ranges from 5 5 7 75

https://freefincal.com/tax-on-fixed-deposits

Accrual basis Paying tax every year In this method you pay tax on your interest income as it accrues to you i e every year You can find the interest earned every year pretty easily from your Form 26AS which reflects the interest credit the tax

SBI Tax Saving Fixed Deposit Scheme IndiaFilings

FD RD PPF Tax Hello Maharashtra

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

The Safest Way To Invest Fixed Deposits Banking24Seven

Interest Rates Archives BANKPEDIA

What Is The Cost Of Withdrawing Your Super Early

What Is The Cost Of Withdrawing Your Super Early

What Can You Buy During Tax free Weekend Here s A Complete List The

Fixed Deposit Vs Savings Account Where Should You Invest

Get Higher Returns Up To 2 30 Pa With CIMB EFixed Return Income

How Much Fixed Deposit Is Tax Free - Invest in Tax Free Bonds Tax free bonds are another great way to save tax on FD interest These bonds are issued by the government and come with a lock in period of 5 years or more These bonds interest payments are tax free Invest in Tax Free Mutual Funds