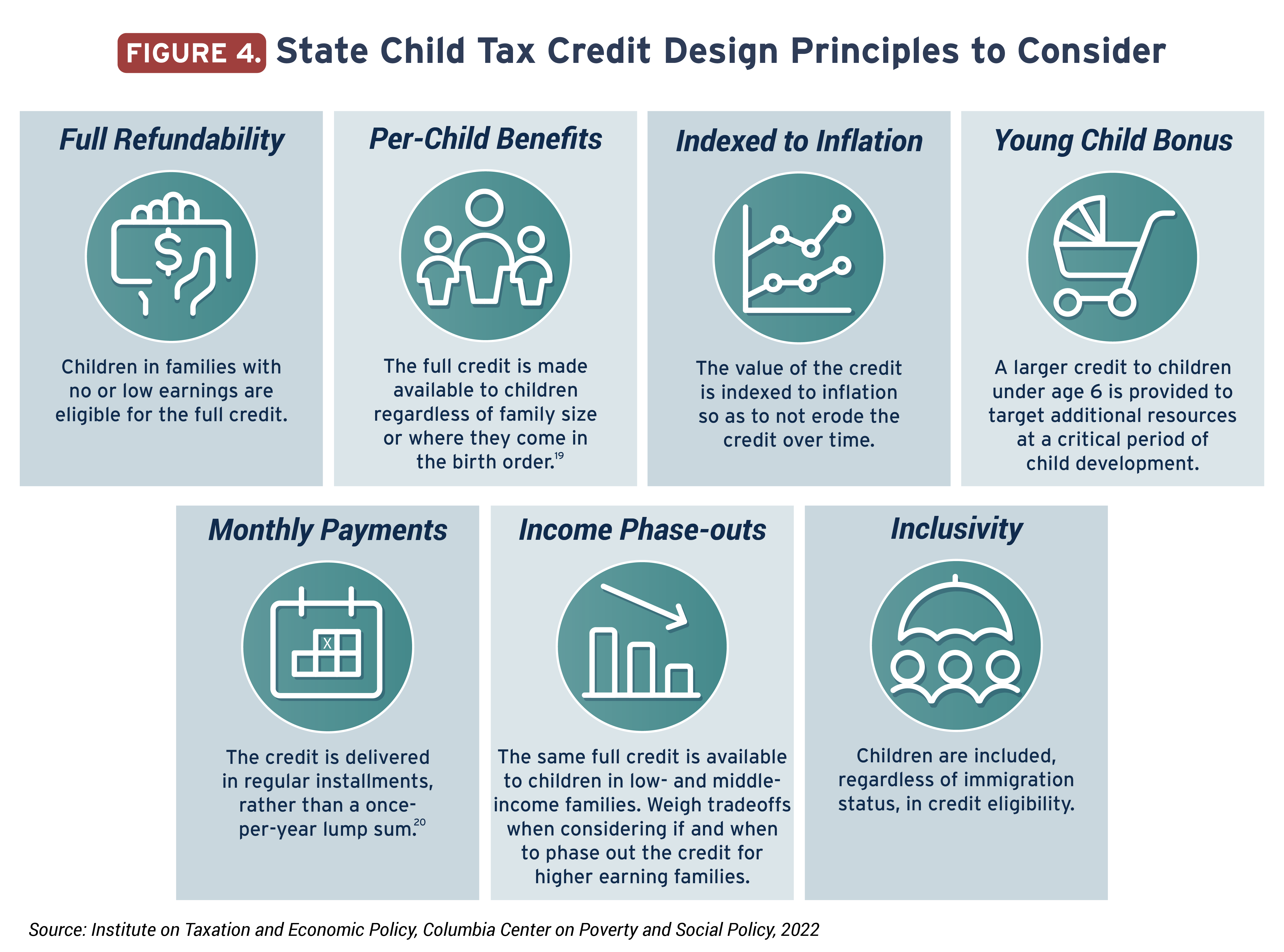

How Much For Child Tax Credit 2023 Per Child In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18

The Child Tax Credit for 2022 2023 and 2024 are non refundable 2 000 a year per child only available to taxpayers with at least 2 500 in earned income only available up to the limit of How much is the tax credit per child The maximum tax credit per child is 2 000 for tax year 2023 The maximum credit is set to increase with inflation in 2024 and 2025

How Much For Child Tax Credit 2023 Per Child

How Much For Child Tax Credit 2023 Per Child

https://mendenaccounting.com/wp-content/uploads/2012/06/child-tax-credit-1-scaled.jpg

Monthly Child Tax Credit Payments Start Thursday Here s What To Know

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

When Can You Claim The Federal Tax Credit For Electric Cars OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included The These tables show rates and allowances for tax credits Child Benefit and Guardian s Allowance by tax year 6 April to 5 April The maximum annual Working Tax Credit

The Child Tax Credit is worth up to 2 000 per qualifying child under age 17 Exactly how much you get depends on your income More specifically your modified adjusted gross income Child Tax Credits if you re responsible for one child or more how much you get eligibility claim tax credits

Download How Much For Child Tax Credit 2023 Per Child

More picture related to How Much For Child Tax Credit 2023 Per Child

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

Expanding The Child Tax Credit Budgetary Distributional And

https://images.squarespace-cdn.com/content/v1/55693d60e4b06d83cf793431/1635174298909-BVRM1BK6BUJQKSEXWQK9/AdobeStock_299187554.jpeg

Child Tax Credit Update Here s Three Reasons You Should Opt Out Of

https://www.the-sun.com/wp-content/uploads/sites/6/2021/09/kc-child-tax-credit-comp-1.jpg?w=1040

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you According to the IRS the nonrefundable 2023 child tax credit is currently 2 000 per child The refundable portion of the credit known as the additional child tax credit is worth up to

How Much is the Child Tax Credit Income Threshold The 2023 Child Tax Credit amount is worth 2 000 per qualifying dependent child for taxpayers with a modified adjusted gross income of 400 000 or less for How much is the child tax credit For the 2023 tax year you may be eligible for a child tax credit of up to 2 000 for each dependent under the age of 17 In addition 1 600

At What Income Do You No Longer Get Child Tax Credit Leia Aqui Do

https://itep.sfo2.digitaloceanspaces.com/Figure-4-State-Child-Tax-Credit-Design-Principles-to-Consider.png

Advancements In The Child Tax Credits Quality Back Office

https://goqbo.com/app/uploads/2021/07/Advancements-In-Child-Tax-Credits-1024x683.png

https://www.omnicalculator.com › finance › child-tax-credit

In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18

https://ttlc.intuit.com › ...

The Child Tax Credit for 2022 2023 and 2024 are non refundable 2 000 a year per child only available to taxpayers with at least 2 500 in earned income only available up to the limit of

Child Tax Credit Spilyay Tymoo

At What Income Do You No Longer Get Child Tax Credit Leia Aqui Do

Maximizing Tax Benefits For Parents

Child Tax Credit

What You Need To Know About The 2021 Child Tax Credit Pittman Legal

You May Be Able To Get More Money From Federal Child Tax Credits By

You May Be Able To Get More Money From Federal Child Tax Credits By

Child Tax Credit Payments 06 28 2021 News Affordable Housing

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

New Law Parents And Other Eligible Americans To Receive Direct

How Much For Child Tax Credit 2023 Per Child - The Child Tax Credit is worth up to 2 000 per qualifying child under age 17 Exactly how much you get depends on your income More specifically your modified adjusted gross income